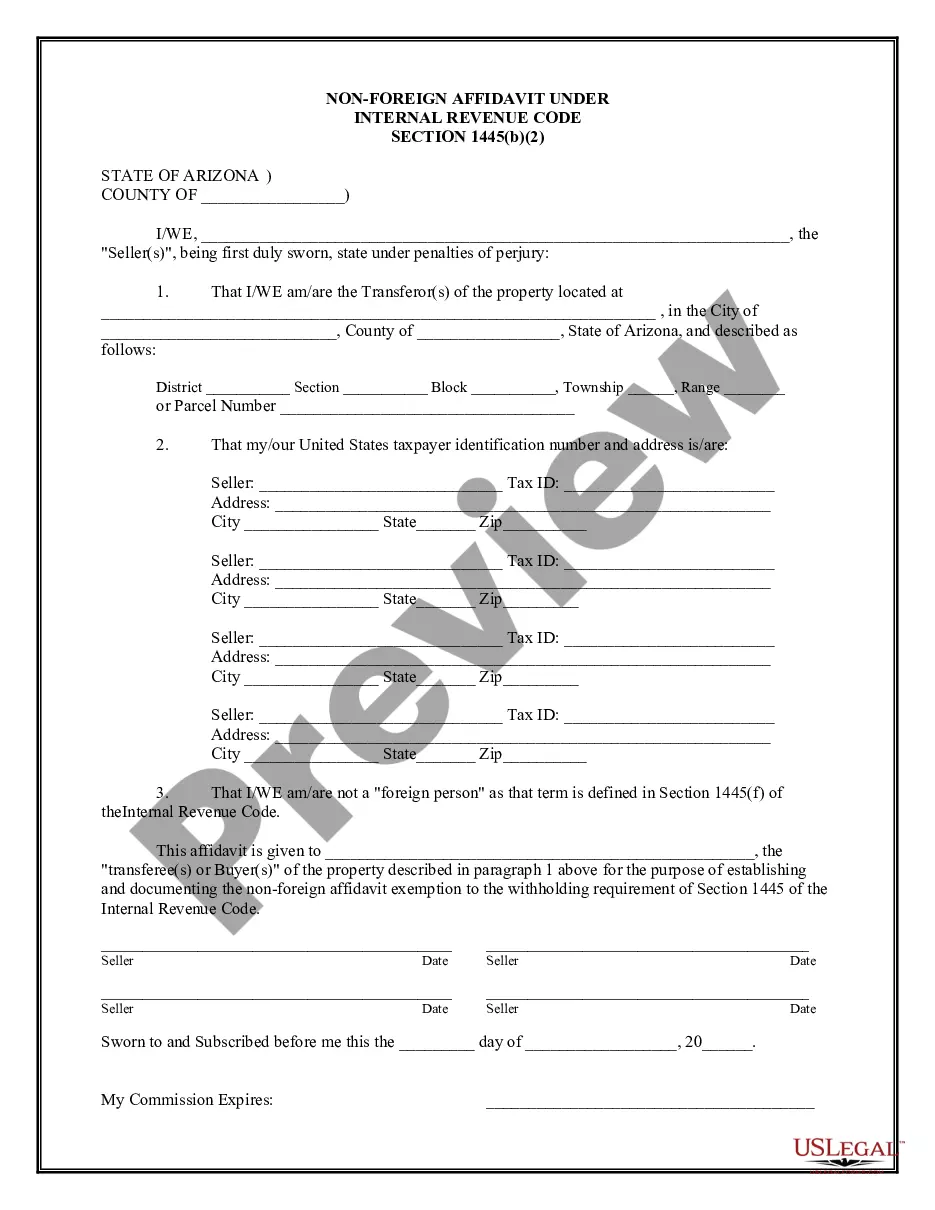

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document that helps determine the tax withholding requirements when a foreign person is selling U.S. real property interests. This affidavit is specifically designed to comply with the Internal Revenue Code (IRC) 1445 regulations, which outline the responsibilities of buyers and settlement agents regarding tax withholding for foreign sellers. The purpose of the Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 is to declare that the seller of the property is not a foreign person, as defined by the IRS. By completing this affidavit, the seller confirms their status as a U.S. citizen, resident alien, domestic corporation, partnership, trust, or estate. This serves to exempt the buyer from the obligation to withhold a portion of the sale proceeds as a tax payment to the IRS. It is essential to accurately complete the Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 to avoid any unnecessary tax withholding or delays in the closing process. If the seller does not qualify to complete this affidavit due to their foreign status, other forms and requirements may apply, such as the Foreign Investment in Real Property Tax Act (FIR PTA). Different types of Maricopa Arizona Non-Foreign Affidavits Under IRC 1445 can include variations based on the type of seller entity. For example: 1. Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 — Individual: This affidavit is used when the seller is an individual who is a U.S. citizen or resident alien. It confirms that the individual meets the qualifications under the IRC 1445 regulations and is not subject to tax withholding. 2. Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 — Business Entity: This affidavit is applicable when the seller is a domestic corporation, partnership, trust, or estate. It certifies that the business entity is eligible for non-foreign status and exempts the buyer from withholding taxes. In conclusion, the Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 is a crucial document used in real estate transactions involving foreign sellers. It verifies the seller's eligibility for non-foreign status and ensures compliance with the IRS regulations related to tax withholding. It is essential to consult with a qualified professional, such as a real estate attorney or tax advisor, to accurately complete the affidavit and navigate the complex requirements under IRC 1445.The Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document that helps determine the tax withholding requirements when a foreign person is selling U.S. real property interests. This affidavit is specifically designed to comply with the Internal Revenue Code (IRC) 1445 regulations, which outline the responsibilities of buyers and settlement agents regarding tax withholding for foreign sellers. The purpose of the Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 is to declare that the seller of the property is not a foreign person, as defined by the IRS. By completing this affidavit, the seller confirms their status as a U.S. citizen, resident alien, domestic corporation, partnership, trust, or estate. This serves to exempt the buyer from the obligation to withhold a portion of the sale proceeds as a tax payment to the IRS. It is essential to accurately complete the Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 to avoid any unnecessary tax withholding or delays in the closing process. If the seller does not qualify to complete this affidavit due to their foreign status, other forms and requirements may apply, such as the Foreign Investment in Real Property Tax Act (FIR PTA). Different types of Maricopa Arizona Non-Foreign Affidavits Under IRC 1445 can include variations based on the type of seller entity. For example: 1. Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 — Individual: This affidavit is used when the seller is an individual who is a U.S. citizen or resident alien. It confirms that the individual meets the qualifications under the IRC 1445 regulations and is not subject to tax withholding. 2. Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 — Business Entity: This affidavit is applicable when the seller is a domestic corporation, partnership, trust, or estate. It certifies that the business entity is eligible for non-foreign status and exempts the buyer from withholding taxes. In conclusion, the Maricopa Arizona Non-Foreign Affidavit Under IRC 1445 is a crucial document used in real estate transactions involving foreign sellers. It verifies the seller's eligibility for non-foreign status and ensures compliance with the IRS regulations related to tax withholding. It is essential to consult with a qualified professional, such as a real estate attorney or tax advisor, to accurately complete the affidavit and navigate the complex requirements under IRC 1445.