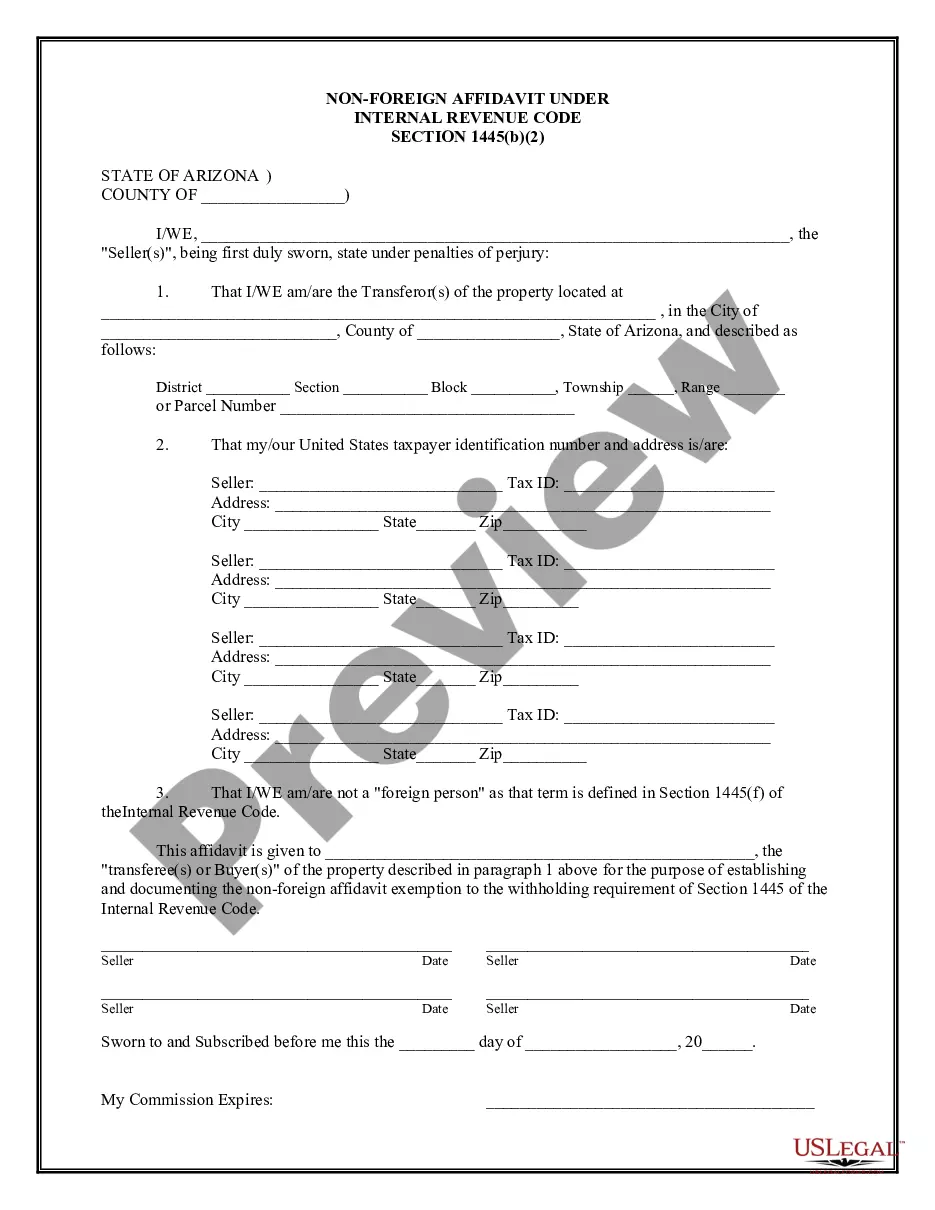

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

The Phoenix Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document used to establish the tax status of a real estate transaction involving a non-foreign individual. This affidavit is required by the Internal Revenue Code (IRC) section 1445, which governs the withholding of tax on dispositions of the United States real property interests by foreign persons. The purpose of this affidavit is to confirm that the seller of the property is not a foreign person, meaning they are a U.S. citizen, resident alien, domestic corporation, or any other entity that is not classified as a foreign person under the IRC. The affidavit acts as a declaration made under penalties of perjury stating the seller's non-foreign status. It is important to note that the specific requirements and regulations regarding this affidavit may vary depending on the jurisdiction. In the case of Phoenix, Arizona, there may be specific forms or formats prescribed by the local authorities or the state government. Some variations or types of Phoenix Arizona Non-Foreign Affidavit Under IRC 1445 may include: 1. Individual Non-Foreign Affidavit: This affidavit is used when an individual is selling the property. The individual declares their U.S. citizenship or resident alien status to confirm their non-foreign status. 2. Corporate Non-Foreign Affidavit: This affidavit is used when the seller is a domestic corporation. It establishes that the corporation is not considered a foreign person under the IRC. 3. Partnership/LLC Non-Foreign Affidavit: This affidavit is used when the seller is a partnership or limited liability company (LLC). The partners or members of the partnership or LLC declare their non-foreign status in the affidavit. 4. Trust Non-Foreign Affidavit: This affidavit is used when the property is held in a trust. The trustee or the beneficiaries of the trust declare their non-foreign status to establish the tax exemption. 5. Government Agency Non-Foreign Affidavit: This affidavit is used when the seller is a government agency or a department of the state or federal government. It confirms its non-foreign status under IRC 1445. In conclusion, the Phoenix Arizona Non-Foreign Affidavit Under IRC 1445 is a crucial legal document that ensures compliance with tax regulations and confirms the non-foreign status of the seller in a real estate transaction. Different variations of this affidavit may apply depending on the type of seller (individual, corporation, partnership, LLC, trust, or government agency).The Phoenix Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document used to establish the tax status of a real estate transaction involving a non-foreign individual. This affidavit is required by the Internal Revenue Code (IRC) section 1445, which governs the withholding of tax on dispositions of the United States real property interests by foreign persons. The purpose of this affidavit is to confirm that the seller of the property is not a foreign person, meaning they are a U.S. citizen, resident alien, domestic corporation, or any other entity that is not classified as a foreign person under the IRC. The affidavit acts as a declaration made under penalties of perjury stating the seller's non-foreign status. It is important to note that the specific requirements and regulations regarding this affidavit may vary depending on the jurisdiction. In the case of Phoenix, Arizona, there may be specific forms or formats prescribed by the local authorities or the state government. Some variations or types of Phoenix Arizona Non-Foreign Affidavit Under IRC 1445 may include: 1. Individual Non-Foreign Affidavit: This affidavit is used when an individual is selling the property. The individual declares their U.S. citizenship or resident alien status to confirm their non-foreign status. 2. Corporate Non-Foreign Affidavit: This affidavit is used when the seller is a domestic corporation. It establishes that the corporation is not considered a foreign person under the IRC. 3. Partnership/LLC Non-Foreign Affidavit: This affidavit is used when the seller is a partnership or limited liability company (LLC). The partners or members of the partnership or LLC declare their non-foreign status in the affidavit. 4. Trust Non-Foreign Affidavit: This affidavit is used when the property is held in a trust. The trustee or the beneficiaries of the trust declare their non-foreign status to establish the tax exemption. 5. Government Agency Non-Foreign Affidavit: This affidavit is used when the seller is a government agency or a department of the state or federal government. It confirms its non-foreign status under IRC 1445. In conclusion, the Phoenix Arizona Non-Foreign Affidavit Under IRC 1445 is a crucial legal document that ensures compliance with tax regulations and confirms the non-foreign status of the seller in a real estate transaction. Different variations of this affidavit may apply depending on the type of seller (individual, corporation, partnership, LLC, trust, or government agency).