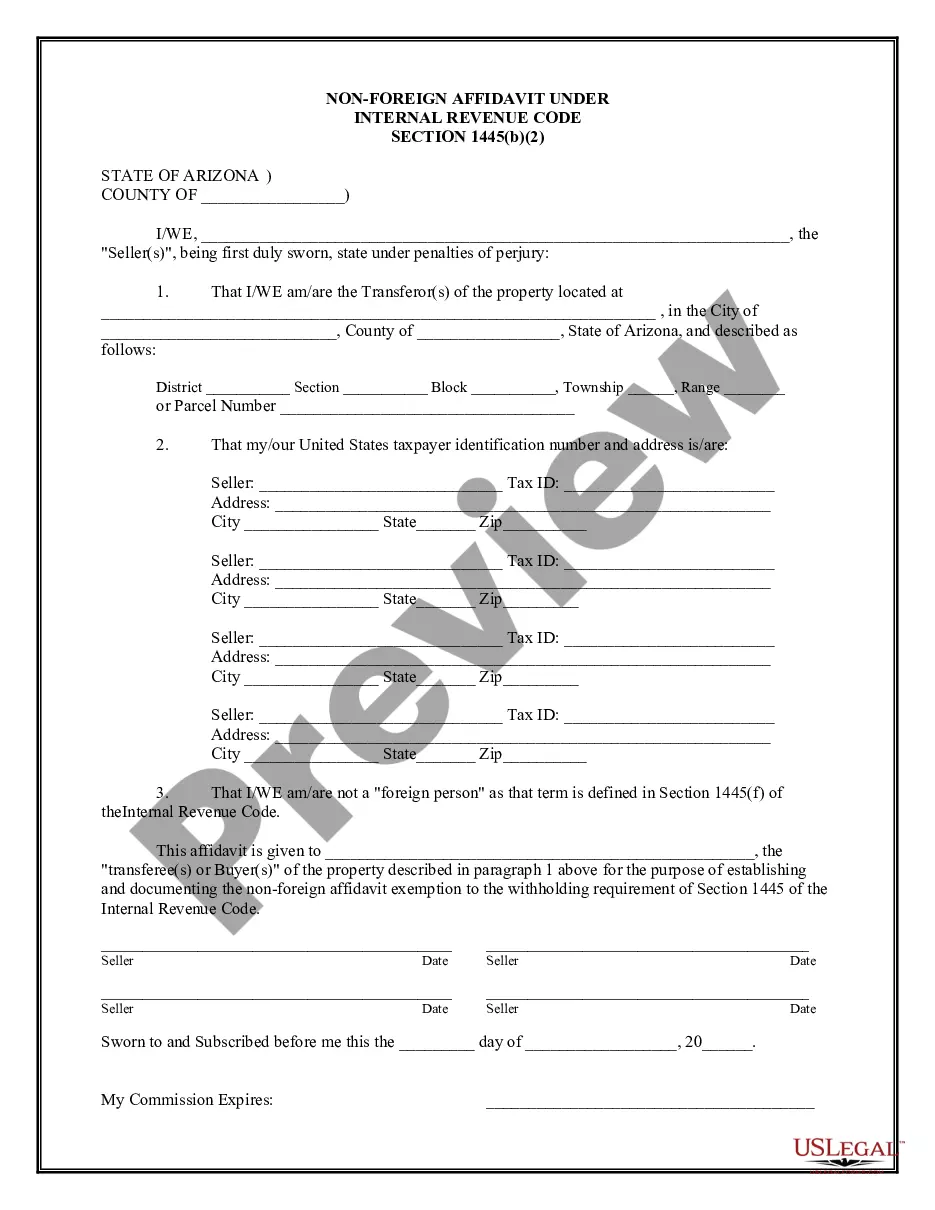

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

Lima Arizona Non-Foreign Affidavit Under IRC 1445: A Detailed Description The Lima Arizona Non-Foreign Affidavit Under IRC 1445 is an important legal document in real estate transactions. It is primarily used to comply with the provisions of the Internal Revenue Code (IRC) Section 1445, which requires certain foreign individuals or entities to pay taxes on the sale or disposition of U.S. real property interests. This affidavit serves as a sworn statement, declaring that the seller of the property in Lima Arizona is not a foreign person as defined by the IRC. By completing this affidavit, the seller attests that they are either a U.S. citizen, a U.S. resident alien, a U.S. corporation, or a domestic partnership/estate/trust. It allows the buyer to withhold a specific amount of the purchase price to ensure that any potential tax liability of the seller is fulfilled. Keywords: Lima Arizona, Non-Foreign Affidavit, IRC 1445, real estate transactions, compliance, Internal Revenue Code, U.S. real property interests, taxes, sworn statement, seller, foreign person, U.S. citizen, U.S. resident alien, U.S. corporation, domestic partnership, domestic estate, domestic trust, purchase price, tax liability. Different Types of Lima Arizona Non-Foreign Affidavit Under IRC 1445: 1. Individual Seller Affidavit: This type of affidavit is used when the seller of the property is an individual, either a U.S. citizen or a U.S. resident alien. It verifies their status as a non-foreign person and ensures compliance with IRC 1445. 2. Corporate Seller Affidavit: When the seller is a U.S. corporation, this affidavit is completed to establish their status as a domestic entity. It guarantees that the corporation is not classified as a foreign person as per the IRC. 3. Partnership/Estate/Trust Seller Affidavit: In cases where the seller is a domestic partnership, estate, or trust, this affidavit is utilized to declare that these entities are not considered foreign persons under IRC 1445. It safeguards compliance with the tax provisions. Keywords: Individual Seller Affidavit, Corporate Seller Affidavit, Partnership Seller Affidavit, Estate Seller Affidavit, Trust Seller Affidavit, U.S. corporation, U.S. citizen, U.S. resident alien, domestic partnership, domestic estate, domestic trust, compliance, tax provisions. Note: It is essential to consult with a qualified attorney or tax professional to ensure accurate completion and submission of the Lima Arizona Non-Foreign Affidavit Under IRC 1445, as tax laws and regulations can vary.Lima Arizona Non-Foreign Affidavit Under IRC 1445: A Detailed Description The Lima Arizona Non-Foreign Affidavit Under IRC 1445 is an important legal document in real estate transactions. It is primarily used to comply with the provisions of the Internal Revenue Code (IRC) Section 1445, which requires certain foreign individuals or entities to pay taxes on the sale or disposition of U.S. real property interests. This affidavit serves as a sworn statement, declaring that the seller of the property in Lima Arizona is not a foreign person as defined by the IRC. By completing this affidavit, the seller attests that they are either a U.S. citizen, a U.S. resident alien, a U.S. corporation, or a domestic partnership/estate/trust. It allows the buyer to withhold a specific amount of the purchase price to ensure that any potential tax liability of the seller is fulfilled. Keywords: Lima Arizona, Non-Foreign Affidavit, IRC 1445, real estate transactions, compliance, Internal Revenue Code, U.S. real property interests, taxes, sworn statement, seller, foreign person, U.S. citizen, U.S. resident alien, U.S. corporation, domestic partnership, domestic estate, domestic trust, purchase price, tax liability. Different Types of Lima Arizona Non-Foreign Affidavit Under IRC 1445: 1. Individual Seller Affidavit: This type of affidavit is used when the seller of the property is an individual, either a U.S. citizen or a U.S. resident alien. It verifies their status as a non-foreign person and ensures compliance with IRC 1445. 2. Corporate Seller Affidavit: When the seller is a U.S. corporation, this affidavit is completed to establish their status as a domestic entity. It guarantees that the corporation is not classified as a foreign person as per the IRC. 3. Partnership/Estate/Trust Seller Affidavit: In cases where the seller is a domestic partnership, estate, or trust, this affidavit is utilized to declare that these entities are not considered foreign persons under IRC 1445. It safeguards compliance with the tax provisions. Keywords: Individual Seller Affidavit, Corporate Seller Affidavit, Partnership Seller Affidavit, Estate Seller Affidavit, Trust Seller Affidavit, U.S. corporation, U.S. citizen, U.S. resident alien, domestic partnership, domestic estate, domestic trust, compliance, tax provisions. Note: It is essential to consult with a qualified attorney or tax professional to ensure accurate completion and submission of the Lima Arizona Non-Foreign Affidavit Under IRC 1445, as tax laws and regulations can vary.