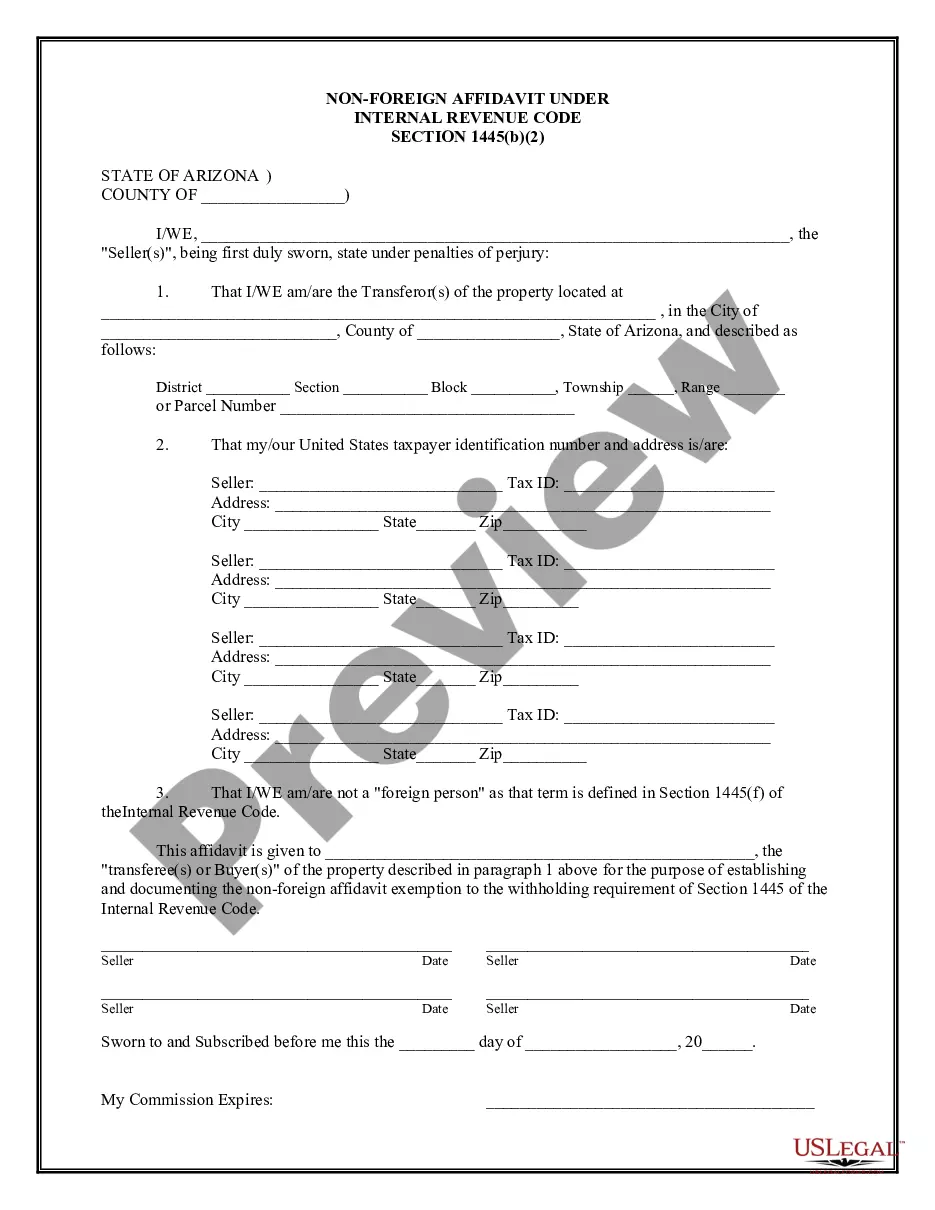

This Non-Foreign Affdavit Under Internal Revenue Code 1445 is for a seller of real property to sign stating that he or she is not a foreign person as defined by the Internal Revenue Code Section 26 USC 1445. This document must be signed and notarized.

A Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. persons. This affidavit serves as proof that the seller of the property is not a foreign individual or entity and is subject to withholding taxes under the Internal Revenue Code (IRC) Section 1445. The non-foreign affidavit is an essential part of the closing process when a non-U.S. person sells a property located in the United States. It is intended to protect the buyer from potential tax liability by ensuring that proper withholding taxes are withheld and remitted to the IRS. The affidavit is typically prepared by the seller or their representative and includes essential details such as the seller's name, address, taxpayer identification number (such as an Individual Taxpayer Identification Number), and country of residence. Additionally, the affidavit may require additional supporting documentation, such as a copy of the seller's passport or visa. Different types of Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 may include variations in formatting or specific requirements based on the nature of the transaction or the parties involved. For example, there might be separate versions for individual sellers, foreign corporations, or foreign partnerships, each necessitating specific information relevant to their tax status. It is crucial to ensure that the non-foreign affidavit is accurately completed, as any false or misleading information can have serious legal and financial consequences for both the buyer and the seller. An experienced real estate attorney or a qualified tax professional should be consulted to properly navigate the complexities of completing this document. In conclusion, a Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 is a legally binding document that verifies the non-foreign status of a seller in a real estate transaction to meet the requirements outlined in IRC Section 1445. Adhering to the proper completion of this affidavit protects both the buyer and the seller from potential tax liabilities.A Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 is a legal document that is required in certain real estate transactions involving non-U.S. persons. This affidavit serves as proof that the seller of the property is not a foreign individual or entity and is subject to withholding taxes under the Internal Revenue Code (IRC) Section 1445. The non-foreign affidavit is an essential part of the closing process when a non-U.S. person sells a property located in the United States. It is intended to protect the buyer from potential tax liability by ensuring that proper withholding taxes are withheld and remitted to the IRS. The affidavit is typically prepared by the seller or their representative and includes essential details such as the seller's name, address, taxpayer identification number (such as an Individual Taxpayer Identification Number), and country of residence. Additionally, the affidavit may require additional supporting documentation, such as a copy of the seller's passport or visa. Different types of Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 may include variations in formatting or specific requirements based on the nature of the transaction or the parties involved. For example, there might be separate versions for individual sellers, foreign corporations, or foreign partnerships, each necessitating specific information relevant to their tax status. It is crucial to ensure that the non-foreign affidavit is accurately completed, as any false or misleading information can have serious legal and financial consequences for both the buyer and the seller. An experienced real estate attorney or a qualified tax professional should be consulted to properly navigate the complexities of completing this document. In conclusion, a Scottsdale Arizona Non-Foreign Affidavit Under IRC 1445 is a legally binding document that verifies the non-foreign status of a seller in a real estate transaction to meet the requirements outlined in IRC Section 1445. Adhering to the proper completion of this affidavit protects both the buyer and the seller from potential tax liabilities.