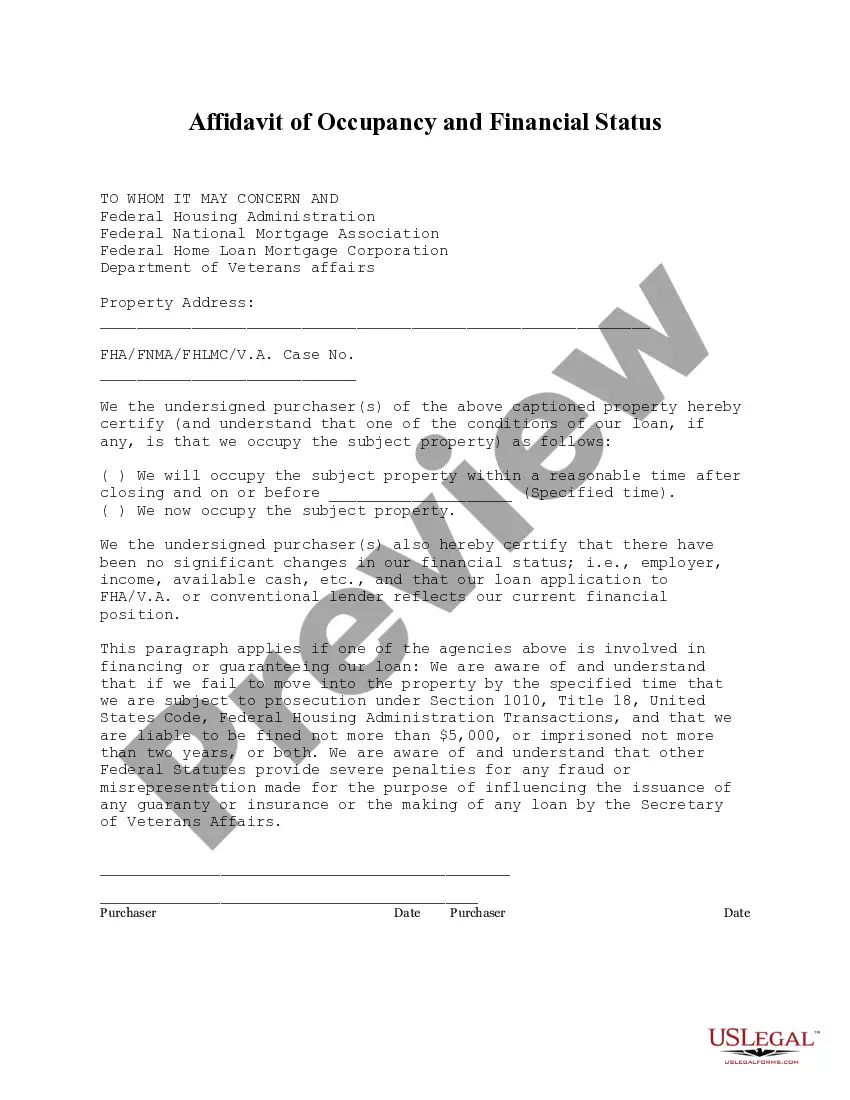

This Affidavit of Occupancy and Financial Status form is for buyer(s) to certify at the time of closing that he/she/they will occupy the property as his/her/their primary residence and that there has been no change in his/her/their financial status since the time the loan application was made.

The Phoenix Arizona Affidavit of Occupancy and Financial Status is a legal document that is typically used in real estate transactions or as a part of the loan application process. This affidavit is required to be completed by the borrower or homeowner, declaring their occupancy status and providing financial information related to the property in question. The purpose of this affidavit is to verify and establish the current occupancy status of the property, ensuring that it is being used in accordance with the terms of the loan or related regulations. It also serves as a means to gather financial information about the property, allowing lenders or relevant parties to assess the borrower's financial stability and ability to maintain the property. The Phoenix Arizona Affidavit of Occupancy and Financial Status usually includes several key elements. These may include, but are not limited to: 1. Identifying information: This section requires the borrower to provide their full name, contact details, and any other relevant identification information. 2. Property information: Here, the borrower is required to provide details about the property being financed, including its address, legal description, and any other specific identifiers. 3. Occupancy declaration: The borrower must declare their occupancy status of the property as either a primary residence, second home, or investment property. This section helps lenders determine the loan terms and eligibility criteria based on the intended use of the property. 4. Income and debt information: The affidavit typically requires the borrower to disclose their income, including sources such as employment, investments, or rental income. They may also need to disclose their outstanding debts, including mortgages, loans, or credit card balances. 5. Financial statement: This section includes an overview of the borrower's financial situation, including assets and liabilities, such as bank accounts, retirement savings, or other valuable possessions. 6. Certification and signature: The affidavit concludes with a statement certifying the accuracy of the information provided, typically requiring the borrower's signature and date. It is important to note that while the general structure of the Phoenix Arizona Affidavit of Occupancy and Financial Status remains consistent, there may be variations or additional sections depending on the specific requirements of different lenders or loan programs. These variations could include specialized affidavits for specific loan types, such as FHA, VA, or USDA loans, each designed to cater to the unique guidelines and regulations associated with those loan programs.The Phoenix Arizona Affidavit of Occupancy and Financial Status is a legal document that is typically used in real estate transactions or as a part of the loan application process. This affidavit is required to be completed by the borrower or homeowner, declaring their occupancy status and providing financial information related to the property in question. The purpose of this affidavit is to verify and establish the current occupancy status of the property, ensuring that it is being used in accordance with the terms of the loan or related regulations. It also serves as a means to gather financial information about the property, allowing lenders or relevant parties to assess the borrower's financial stability and ability to maintain the property. The Phoenix Arizona Affidavit of Occupancy and Financial Status usually includes several key elements. These may include, but are not limited to: 1. Identifying information: This section requires the borrower to provide their full name, contact details, and any other relevant identification information. 2. Property information: Here, the borrower is required to provide details about the property being financed, including its address, legal description, and any other specific identifiers. 3. Occupancy declaration: The borrower must declare their occupancy status of the property as either a primary residence, second home, or investment property. This section helps lenders determine the loan terms and eligibility criteria based on the intended use of the property. 4. Income and debt information: The affidavit typically requires the borrower to disclose their income, including sources such as employment, investments, or rental income. They may also need to disclose their outstanding debts, including mortgages, loans, or credit card balances. 5. Financial statement: This section includes an overview of the borrower's financial situation, including assets and liabilities, such as bank accounts, retirement savings, or other valuable possessions. 6. Certification and signature: The affidavit concludes with a statement certifying the accuracy of the information provided, typically requiring the borrower's signature and date. It is important to note that while the general structure of the Phoenix Arizona Affidavit of Occupancy and Financial Status remains consistent, there may be variations or additional sections depending on the specific requirements of different lenders or loan programs. These variations could include specialized affidavits for specific loan types, such as FHA, VA, or USDA loans, each designed to cater to the unique guidelines and regulations associated with those loan programs.