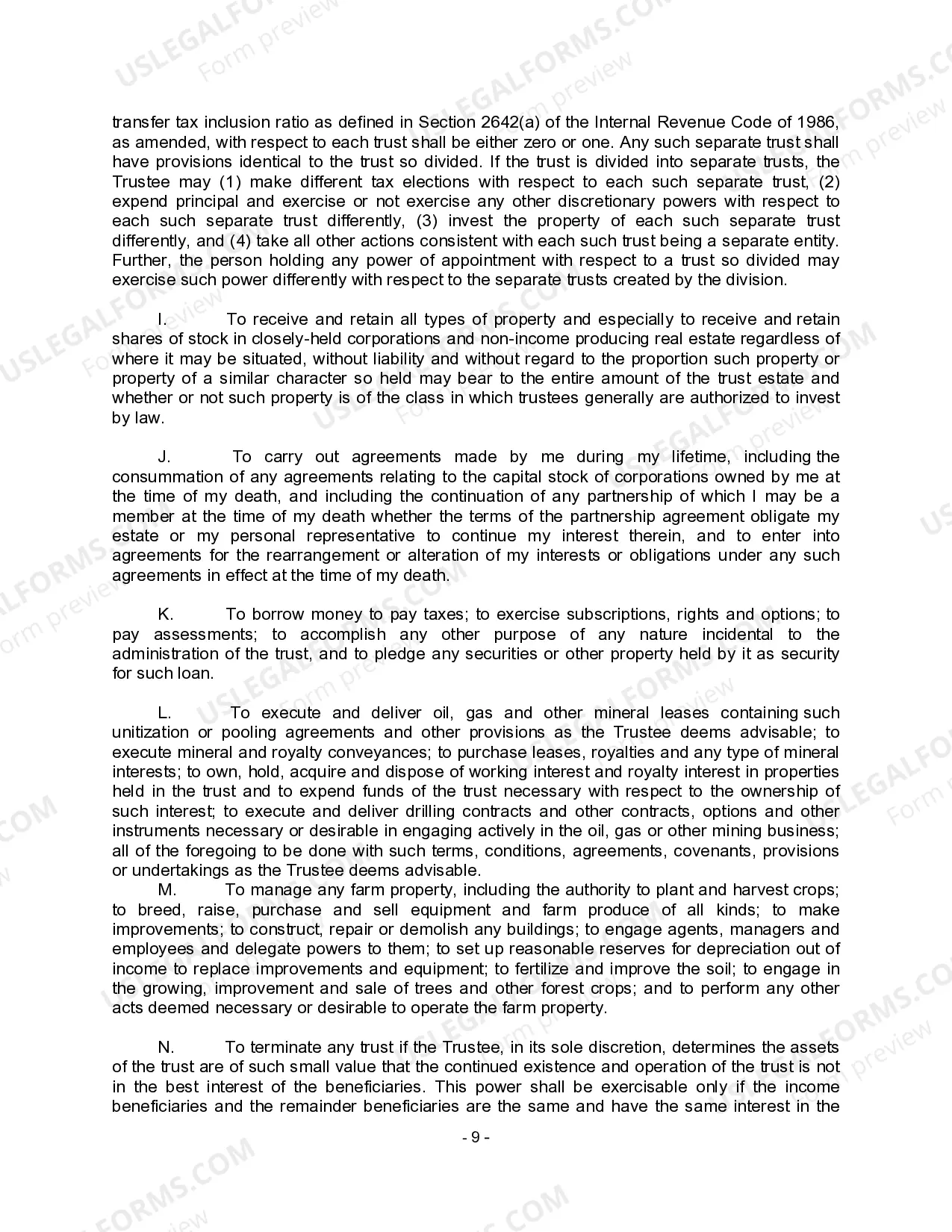

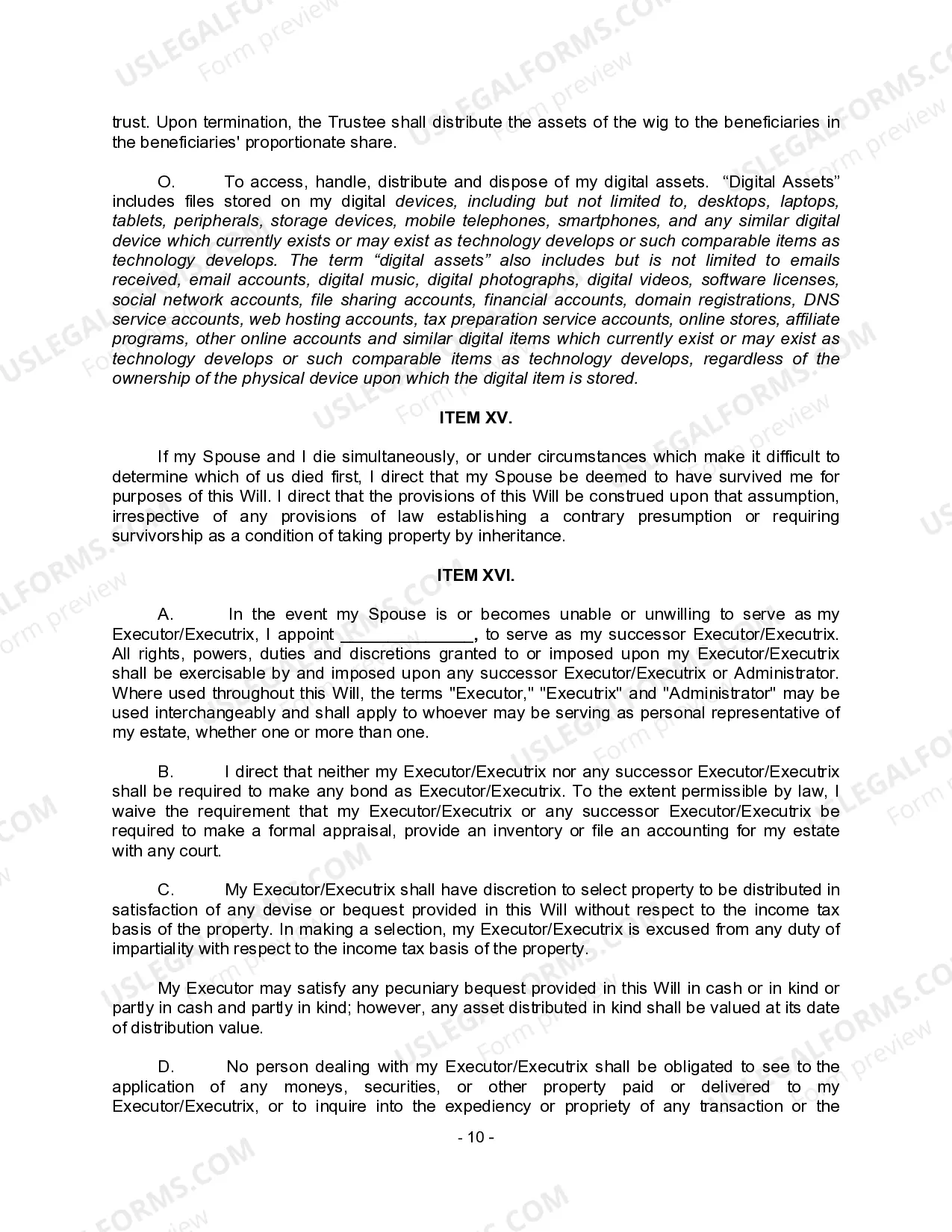

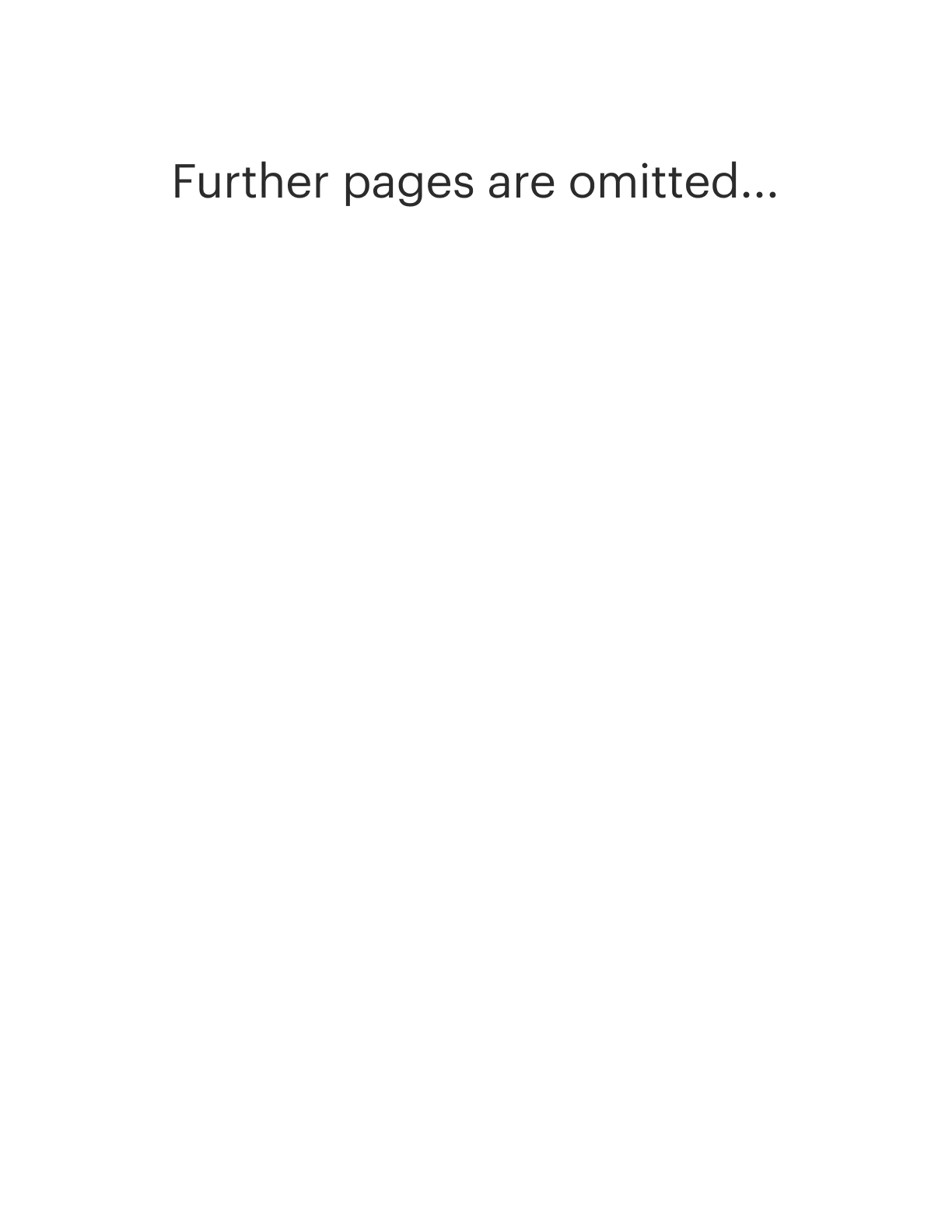

This Complex Will with Credit Shelter Trust for Large Estates form is a complex Will designed to enable a couple to maximize the amount of property that can pass free of estate taxes. The Will leaves the maximum tax free amount allowed (i.e. 1,000,000.00 as of 2001) to a trust and the remainder of property to the surviving spouse. All of the property passing to the Spouse is estate tax free. Therefore, no estate taxes are due at the death of the first Spouse. Since the trust has 1 million dollars that can pass to the children tax free, the surviving spouse can also leave 1 million to a similar trust or children and thereby enable 2 million dollars instead of 1 to pass to the children estate tax free. Income from the trust can be disbursed to the surviving spouse and children.

A Phoenix Arizona Complex Will with Credit Shelter Marital Trust for Large Estates is a legal document that combines elements of a complex will and a credit shelter marital trust to effectively manage and distribute assets in a large estate. This type of estate planning strategy is particularly beneficial for individuals or families with significant wealth or assets. The primary purpose of a Complex Will with Credit Shelter Marital Trust is to minimize the impact of estate taxes upon the death of the granter, while also ensuring a smooth transfer of wealth to the intended beneficiaries, such as a surviving spouse and children. The credit shelter trust, also known as a bypass trust or a family trust, is created upon the death of the granter to hold a portion of the estate's assets. This trust takes advantage of the estate tax exemption limit, thereby reducing or eliminating the estate tax liability. The surviving spouse is usually the primary beneficiary of the credit shelter trust, ensuring their financial security and providing income throughout their lifetime. Upon the death of the surviving spouse, the remaining trust assets are typically passed on to the specified beneficiaries, often children or other family members, while bypassing further estate taxation. In a large estate plan, various types of Complex Wills with Credit Shelter Marital Trusts may be utilized to cater to specific needs and objectives. Some different types include: 1. Irrevocable Credit Shelter Trust: This type of trust cannot be modified or revoked once it is established. It allows for maximum estate tax savings by transferring assets out of the taxable estate. 2. Revocable Credit Shelter Trust: As opposed to the irrevocable trust, the revocable credit shelter trust can be modified or revoked during the granter's lifetime. This type of trust provides more flexibility in managing and distributing assets. 3. TIP Trust: The Qualified Terminable Interest Property (TIP) trust is a special type of marital trust that ensures the surviving spouse has access to income from the trust assets while preserving the ultimate distribution of the assets to named beneficiaries, such as children or other family members. 4. Dynasty Trust: A dynasty trust is established to provide for multiple generations while minimizing estate taxes. It allows the assets to grow and benefit future generations indefinitely. Overall, a Phoenix Arizona Complex Will with Credit Shelter Marital Trust for Large Estates provides a comprehensive and strategic approach to estate planning, aiming to protect and preserve the wealth of the granter and provide for their loved ones in a tax-efficient manner. It is essential to consult with an experienced estate planning attorney to determine the most suitable type of credit shelter trust based on individual circumstances and goals.A Phoenix Arizona Complex Will with Credit Shelter Marital Trust for Large Estates is a legal document that combines elements of a complex will and a credit shelter marital trust to effectively manage and distribute assets in a large estate. This type of estate planning strategy is particularly beneficial for individuals or families with significant wealth or assets. The primary purpose of a Complex Will with Credit Shelter Marital Trust is to minimize the impact of estate taxes upon the death of the granter, while also ensuring a smooth transfer of wealth to the intended beneficiaries, such as a surviving spouse and children. The credit shelter trust, also known as a bypass trust or a family trust, is created upon the death of the granter to hold a portion of the estate's assets. This trust takes advantage of the estate tax exemption limit, thereby reducing or eliminating the estate tax liability. The surviving spouse is usually the primary beneficiary of the credit shelter trust, ensuring their financial security and providing income throughout their lifetime. Upon the death of the surviving spouse, the remaining trust assets are typically passed on to the specified beneficiaries, often children or other family members, while bypassing further estate taxation. In a large estate plan, various types of Complex Wills with Credit Shelter Marital Trusts may be utilized to cater to specific needs and objectives. Some different types include: 1. Irrevocable Credit Shelter Trust: This type of trust cannot be modified or revoked once it is established. It allows for maximum estate tax savings by transferring assets out of the taxable estate. 2. Revocable Credit Shelter Trust: As opposed to the irrevocable trust, the revocable credit shelter trust can be modified or revoked during the granter's lifetime. This type of trust provides more flexibility in managing and distributing assets. 3. TIP Trust: The Qualified Terminable Interest Property (TIP) trust is a special type of marital trust that ensures the surviving spouse has access to income from the trust assets while preserving the ultimate distribution of the assets to named beneficiaries, such as children or other family members. 4. Dynasty Trust: A dynasty trust is established to provide for multiple generations while minimizing estate taxes. It allows the assets to grow and benefit future generations indefinitely. Overall, a Phoenix Arizona Complex Will with Credit Shelter Marital Trust for Large Estates provides a comprehensive and strategic approach to estate planning, aiming to protect and preserve the wealth of the granter and provide for their loved ones in a tax-efficient manner. It is essential to consult with an experienced estate planning attorney to determine the most suitable type of credit shelter trust based on individual circumstances and goals.