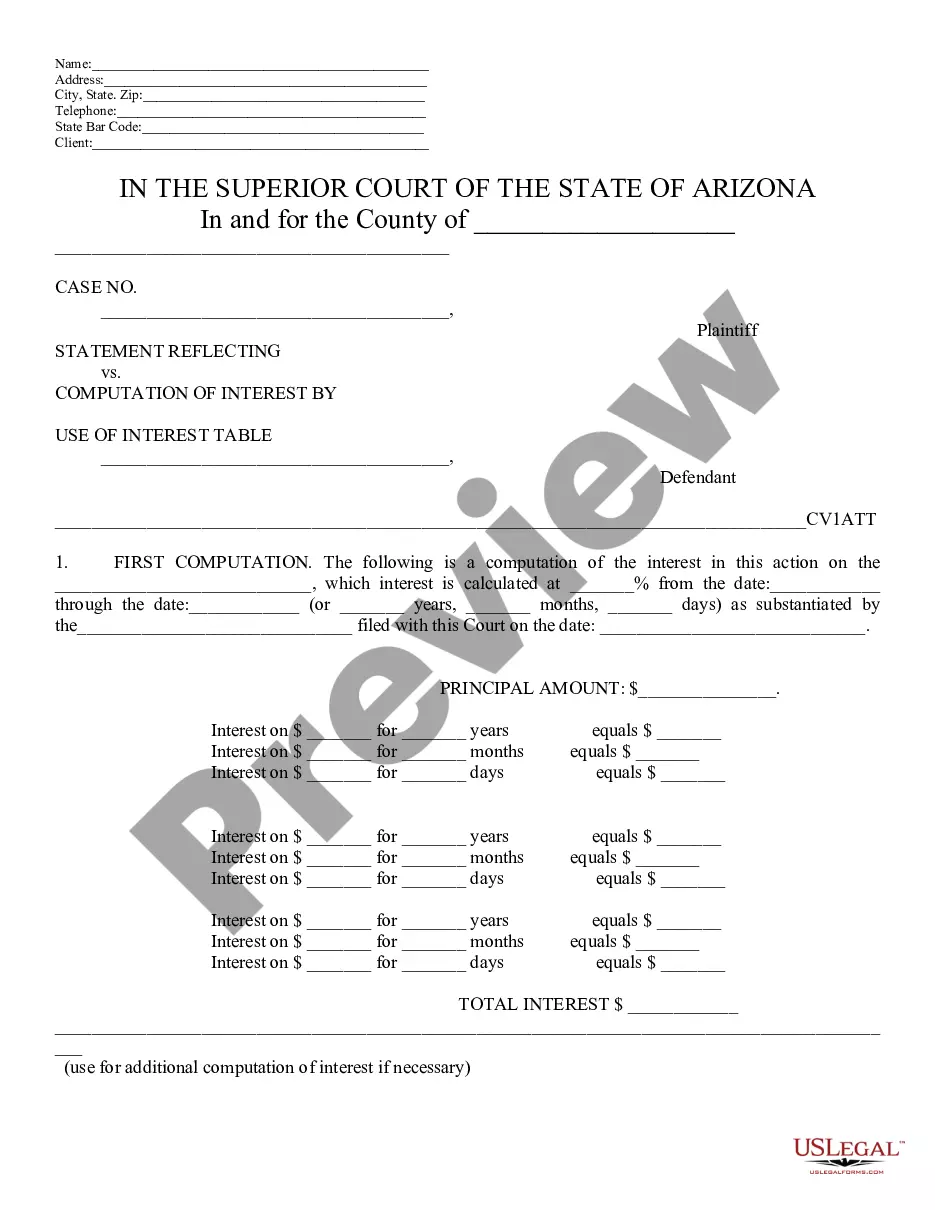

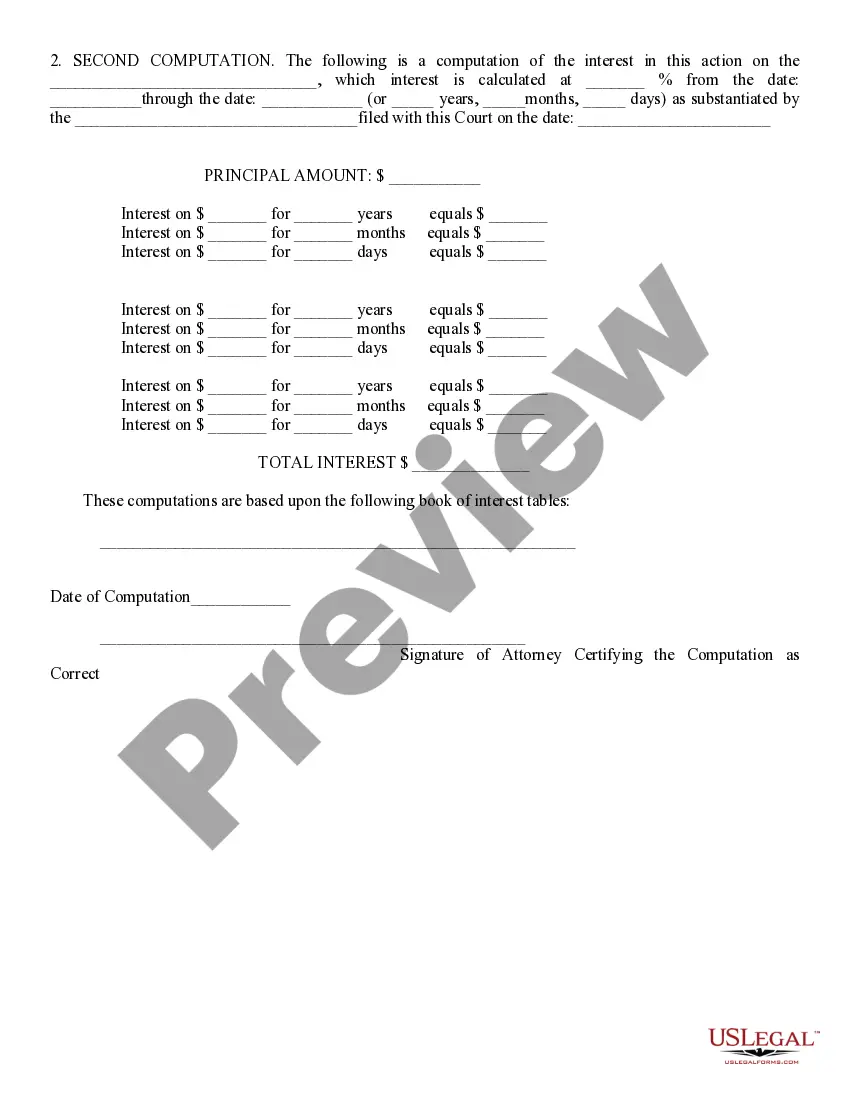

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Mesa, Arizona Statement Reflecting Computation of Interest Using Interest Table: Detailed Description and Types In Mesa, Arizona, the Statement Reflecting Computation of Interest Using Interest Table serves as a comprehensive document detailing the calculations and breakdowns of interest charges or earnings on various financial transactions. This statement is highly important in several financial and business scenarios, enabling individuals, organizations, and financial institutions to accurately determine and understand the interest amounts involved in specific transactions. The Mesa, Arizona Statement Reflecting Computation of Interest Using Interest Table typically includes a range of relevant information to provide a clear picture of the interest calculations. Such information may consist of the principal amount, interest rate, calculation period, compounding frequency, and the final interest amount. This statement ensures transparency and facilitates accurate financial decision-making by clearly illustrating the costs or earnings associated with interest in an easily understandable format. There are several types of Mesa, Arizona Statements Reflecting Computation of Interest Using Interest Table, each tailored to different financial scenarios. Here are some common types to consider: 1. Loan Interest Statement: This type of statement is commonly issued by lenders to borrowers, detailing the interest accrued on a loan over a specific period. It provides borrowers with a clear breakdown of their repayment obligations and assists them in managing their loan payments effectively. 2. Mortgage Interest Statement: Specifically designed for mortgage borrowers, this statement reflects the computation of interest in relation to their mortgage loans. It assists homeowners in understanding the interest portion of their monthly mortgage payments, aiding in budgeting and long-term financial planning. 3. Savings Account Interest Statement: Financial institutions often issue this statement to their customers, elucidating the interest earned on savings account balances. It allows individuals to track the growth of their savings over time, encouraging effective savings habits and assisting with personal finance goals. 4. Investment Interest Statement: Investors receive this type of statement, detailing the interest earned on investments such as bonds, certificates of deposit (CDs), and other interest-bearing securities. It helps investors gain a comprehensive understanding of their investment earnings and evaluate the performance of their portfolios. 5. Credit Card Interest Statement: This statement is provided by credit card companies to their customers, showing the interest charges applied to outstanding balances within a billing cycle. It allows individuals to monitor their credit card usage and make informed decisions regarding debt management and repayment strategies. These different types of Mesa, Arizona Statements Reflecting Computation of Interest Using Interest Table are crucial components in various financial interactions, ensuring transparency and assisting individuals and businesses in making informed decisions. By accurately computing and displaying interest charges or earnings, they play a vital role in maintaining financial stability and promoting responsible money management.Mesa, Arizona Statement Reflecting Computation of Interest Using Interest Table: Detailed Description and Types In Mesa, Arizona, the Statement Reflecting Computation of Interest Using Interest Table serves as a comprehensive document detailing the calculations and breakdowns of interest charges or earnings on various financial transactions. This statement is highly important in several financial and business scenarios, enabling individuals, organizations, and financial institutions to accurately determine and understand the interest amounts involved in specific transactions. The Mesa, Arizona Statement Reflecting Computation of Interest Using Interest Table typically includes a range of relevant information to provide a clear picture of the interest calculations. Such information may consist of the principal amount, interest rate, calculation period, compounding frequency, and the final interest amount. This statement ensures transparency and facilitates accurate financial decision-making by clearly illustrating the costs or earnings associated with interest in an easily understandable format. There are several types of Mesa, Arizona Statements Reflecting Computation of Interest Using Interest Table, each tailored to different financial scenarios. Here are some common types to consider: 1. Loan Interest Statement: This type of statement is commonly issued by lenders to borrowers, detailing the interest accrued on a loan over a specific period. It provides borrowers with a clear breakdown of their repayment obligations and assists them in managing their loan payments effectively. 2. Mortgage Interest Statement: Specifically designed for mortgage borrowers, this statement reflects the computation of interest in relation to their mortgage loans. It assists homeowners in understanding the interest portion of their monthly mortgage payments, aiding in budgeting and long-term financial planning. 3. Savings Account Interest Statement: Financial institutions often issue this statement to their customers, elucidating the interest earned on savings account balances. It allows individuals to track the growth of their savings over time, encouraging effective savings habits and assisting with personal finance goals. 4. Investment Interest Statement: Investors receive this type of statement, detailing the interest earned on investments such as bonds, certificates of deposit (CDs), and other interest-bearing securities. It helps investors gain a comprehensive understanding of their investment earnings and evaluate the performance of their portfolios. 5. Credit Card Interest Statement: This statement is provided by credit card companies to their customers, showing the interest charges applied to outstanding balances within a billing cycle. It allows individuals to monitor their credit card usage and make informed decisions regarding debt management and repayment strategies. These different types of Mesa, Arizona Statements Reflecting Computation of Interest Using Interest Table are crucial components in various financial interactions, ensuring transparency and assisting individuals and businesses in making informed decisions. By accurately computing and displaying interest charges or earnings, they play a vital role in maintaining financial stability and promoting responsible money management.