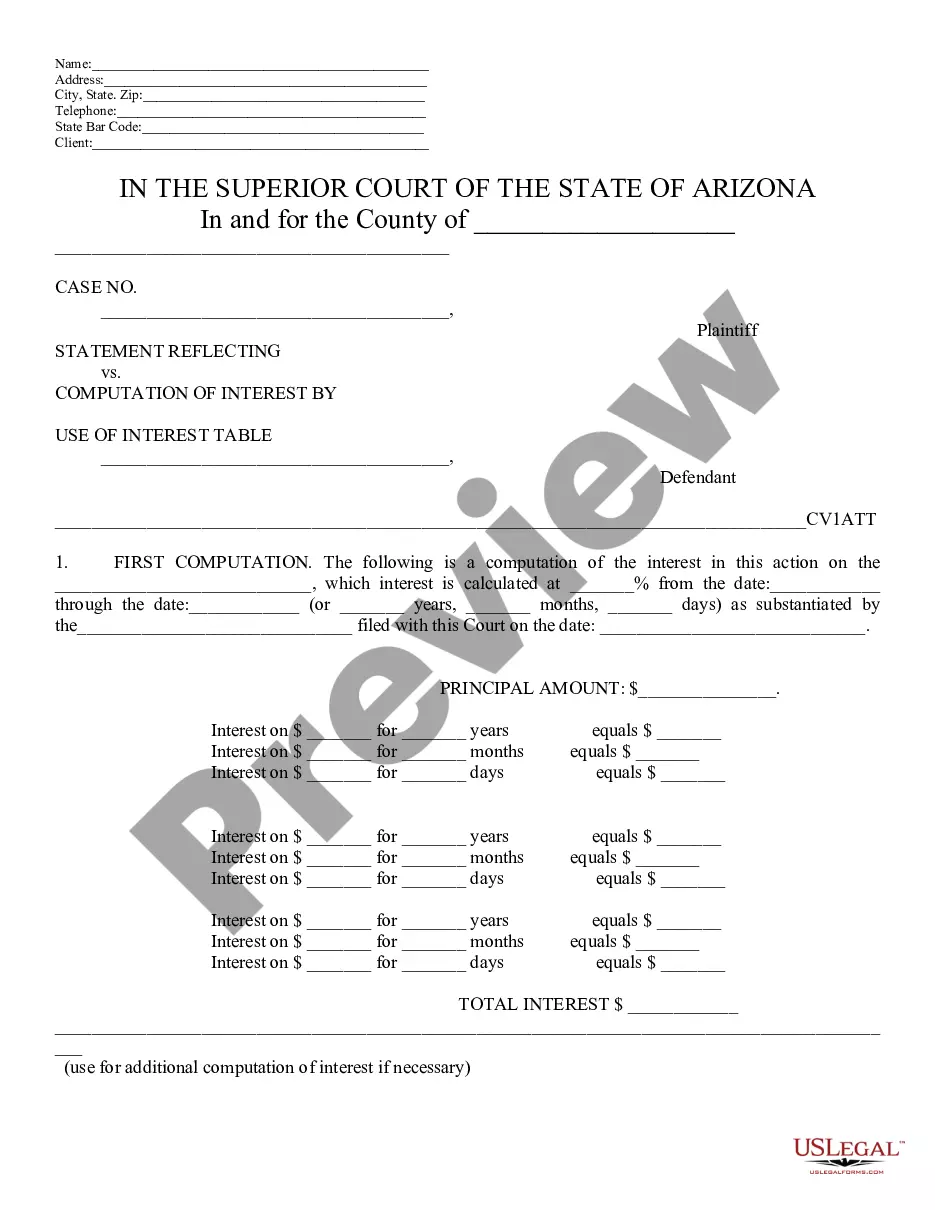

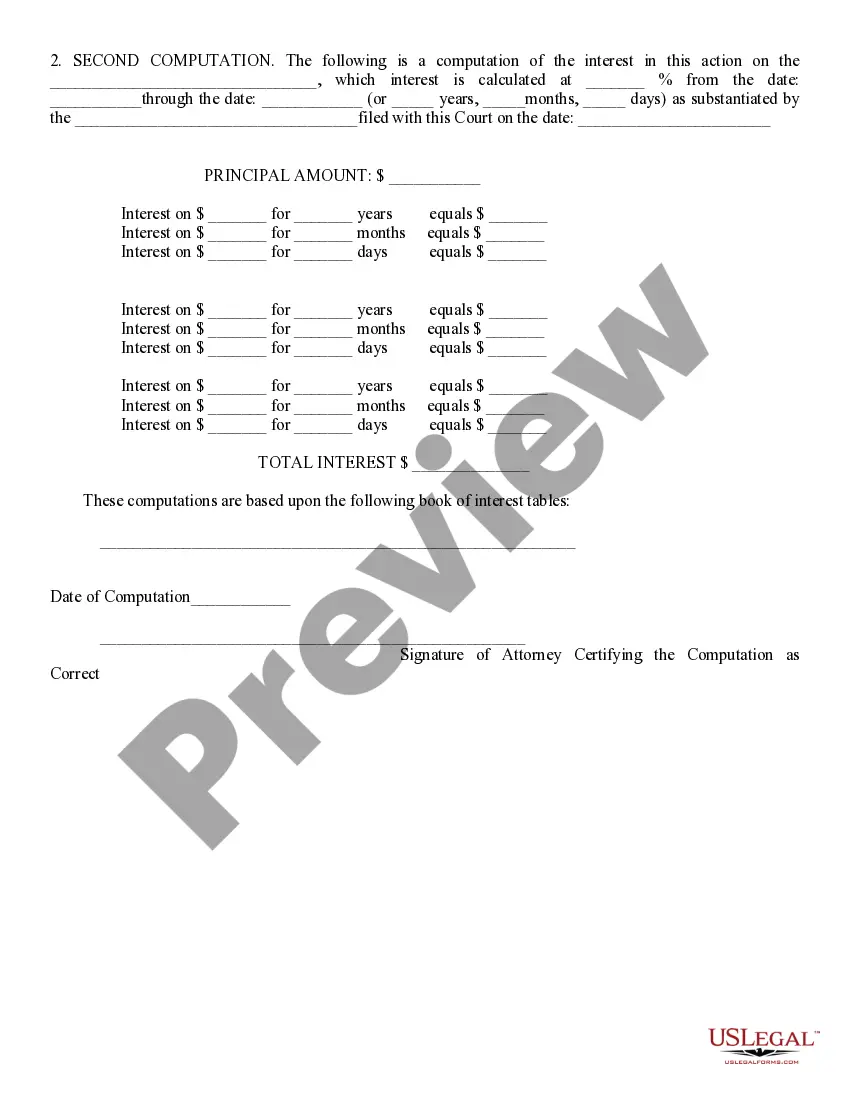

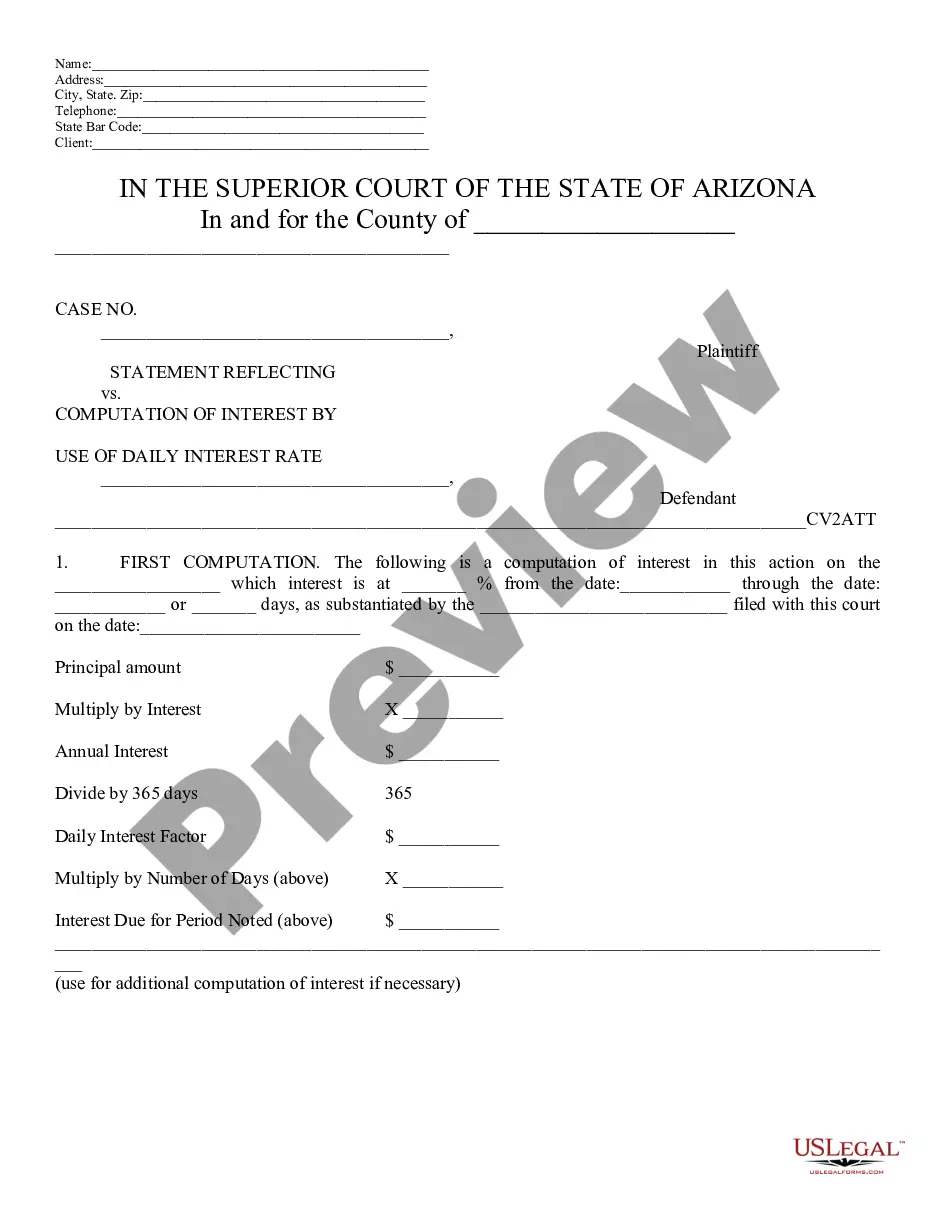

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table

Description

How to fill out Arizona Statement Reflecting Computation Of Interest Using Interest Table?

We continually endeavor to minimize or avert legal complications when addressing intricate legal or financial issues.

To achieve this, we seek legal assistance that is typically quite expensive.

However, not every legal challenge is equally intricate; many can be managed independently.

US Legal Forms is an online repository of current DIY legal documents encompassing a range from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you've lost the form, you can always redownload it from the My documents tab.

- Our library enables you to manage your affairs without the necessity of a lawyer's services.

- We offer access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

- Utilize US Legal Forms whenever you need to obtain and download the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table or any other document swiftly and securely.

Form popularity

FAQ

Late payment penalties for payments on account in Scottsdale, Arizona usually involve a specific percentage levied against the unpaid amount, increasing the longer the payment is delayed. To avoid these penalties, it's important to ensure that all required payments are made on time. Familiarizing yourself with the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table will help you keep track of your obligations and any accrued interest.

The penalty for late payment of Transaction Privilege Tax (TPT) in Arizona typically begins at a specified percentage of the unpaid tax and can increase over time. Timely payment is crucial to avoid escalating penalties. Using tools like the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table can help you keep track of interest on late payments and avoid financial mishaps.

Yes, interest income is taxable in Arizona. Taxpayers must report all interest earnings on their state tax returns. It’s advisable to consider how these interest earnings might affect overall tax liabilities, while the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table can assist in related financial calculations.

To report itemized deductions in Arizona, taxpayers must fill out the appropriate state forms, usually alongside their federal returns. This includes detailing deductions like mortgage interest, charitable contributions, and medical expenses. Accurate reporting will allow taxpayers to benefit from deductions, and leveraging guidelines such as the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table can enhance your understanding of potential interest impacts.

Failing to file taxes in Arizona can result in severe repercussions, including penalties and interest on unpaid taxes. The Arizona Department of Revenue actively pursues individuals who neglect their tax responsibilities. It is wise to consult resources on the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table to understand any interest that may accumulate on outstanding balances.

The penalty for late payment in Scottsdale, Arizona varies depending on the type of tax owed. Generally, late payments incur a percentage of the unpaid tax amount, which increases over time. Knowing the specific penalty structure can help you anticipate costs, especially if you're using the Scottsdale Arizona Statement Reflecting Computation of Interest Using Interest Table for precise calculations.

In Scottsdale, Arizona, a common exception to the late payment penalty occurs when a taxpayer can demonstrate reasonable cause for the delay. If the individual can provide proof that circumstances beyond their control hindered timely payment, the penalty may not apply. It's essential to document these reasons well, as they can support your case during discussions with tax authorities.