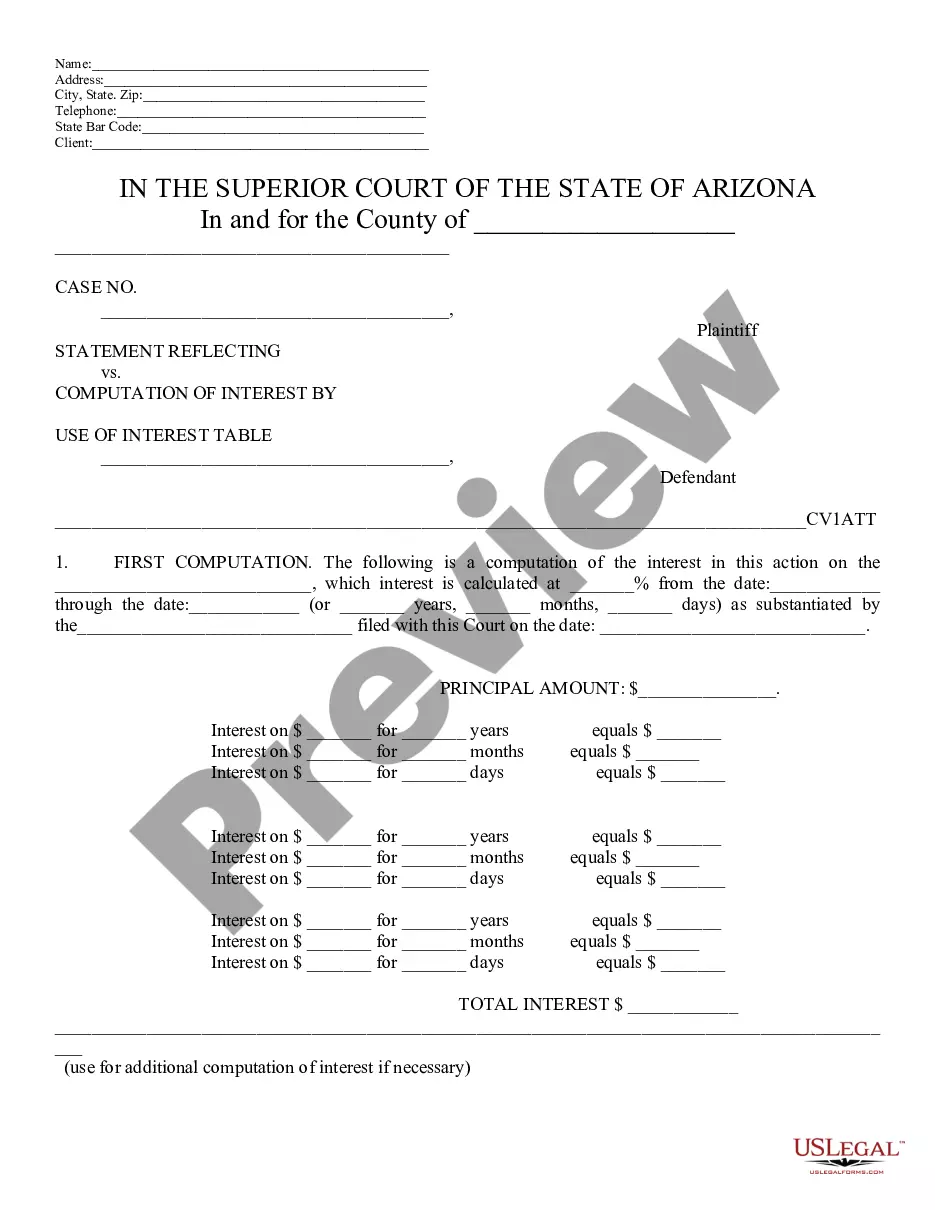

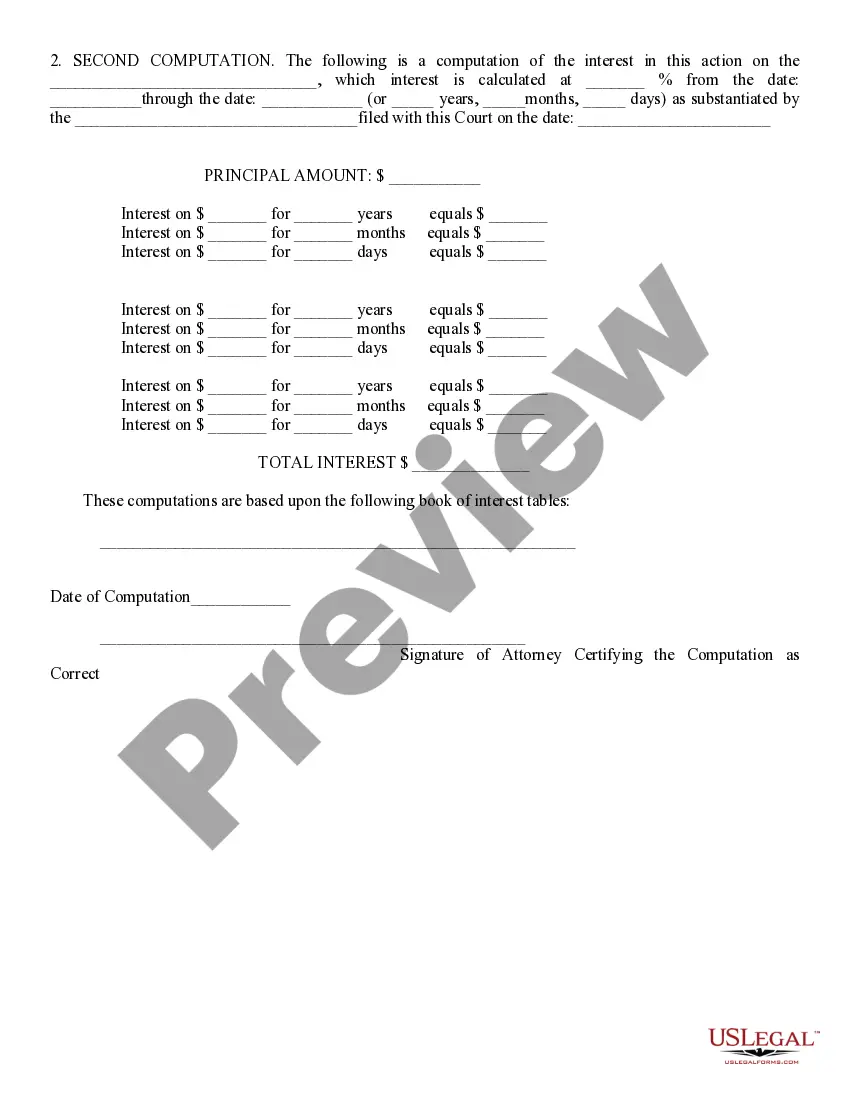

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table is an essential financial document used to calculate and present the interest accrued on various financial transactions. This statement provides a comprehensive breakdown of the interest calculations using an interest table, ensuring transparency and accuracy in the computation process. The Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table plays a crucial role in several financial contexts, including loans, mortgages, investments, and savings accounts. By utilizing an interest table, the statement delivers an itemized summary of the interest earned or paid over a specific period. This statement serves as a reliable reference for both the financial institution and the account holder. It outlines the principal amount, interest rate, and time period involved in the calculation. Additionally, it may include details such as the compounding frequency and any fees or penalties incurred throughout the interest computation. There can be different types of Surprise Arizona Statements Reflecting Computation of Interest Using Interest Table, tailored to specific financial products or purposes. Some of these variations may include: 1. Loan Interest Statement: This specific type of statement focuses on the computation of interest for loans. It provides a clear breakdown of the principal amount, interest rate, and any additional loan costs. It helps borrowers understand the interest charges associated with their loans and facilitates accurate repayment planning. 2. Mortgage Interest Statement: A mortgage interest statement calculates the interest accrued on a mortgage loan. This type of statement is particularly important for homeowners, as it provides insights into the mortgage interest paid and helps in understanding the current outstanding balance and remaining principal. It may also include additional information related to escrow, property taxes, and insurance payments. 3. Investment Interest Statement: An investment interest statement reflects the interest earned on various investments such as bonds, certificates of deposit (CDs), or money market accounts. This statement is useful for investors tracking their investment performance, as it showcases the interest earned and aids in tax reporting. 4. Savings Account Interest Statement: Savings account holders receive a savings account interest statement that outlines the interest earned on their deposits. This statement often includes details like the account balance, interest rate, and the interest credited over a specific period. It is valuable for monitoring and planning personal finances. In summary, the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table is a vital financial tool utilized in various scenarios. Its accuracy and transparency enable individuals and organizations to understand and track the interest calculations, ensuring fair and informed financial decision-making.Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table is an essential financial document used to calculate and present the interest accrued on various financial transactions. This statement provides a comprehensive breakdown of the interest calculations using an interest table, ensuring transparency and accuracy in the computation process. The Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table plays a crucial role in several financial contexts, including loans, mortgages, investments, and savings accounts. By utilizing an interest table, the statement delivers an itemized summary of the interest earned or paid over a specific period. This statement serves as a reliable reference for both the financial institution and the account holder. It outlines the principal amount, interest rate, and time period involved in the calculation. Additionally, it may include details such as the compounding frequency and any fees or penalties incurred throughout the interest computation. There can be different types of Surprise Arizona Statements Reflecting Computation of Interest Using Interest Table, tailored to specific financial products or purposes. Some of these variations may include: 1. Loan Interest Statement: This specific type of statement focuses on the computation of interest for loans. It provides a clear breakdown of the principal amount, interest rate, and any additional loan costs. It helps borrowers understand the interest charges associated with their loans and facilitates accurate repayment planning. 2. Mortgage Interest Statement: A mortgage interest statement calculates the interest accrued on a mortgage loan. This type of statement is particularly important for homeowners, as it provides insights into the mortgage interest paid and helps in understanding the current outstanding balance and remaining principal. It may also include additional information related to escrow, property taxes, and insurance payments. 3. Investment Interest Statement: An investment interest statement reflects the interest earned on various investments such as bonds, certificates of deposit (CDs), or money market accounts. This statement is useful for investors tracking their investment performance, as it showcases the interest earned and aids in tax reporting. 4. Savings Account Interest Statement: Savings account holders receive a savings account interest statement that outlines the interest earned on their deposits. This statement often includes details like the account balance, interest rate, and the interest credited over a specific period. It is valuable for monitoring and planning personal finances. In summary, the Surprise Arizona Statement Reflecting Computation of Interest Using Interest Table is a vital financial tool utilized in various scenarios. Its accuracy and transparency enable individuals and organizations to understand and track the interest calculations, ensuring fair and informed financial decision-making.