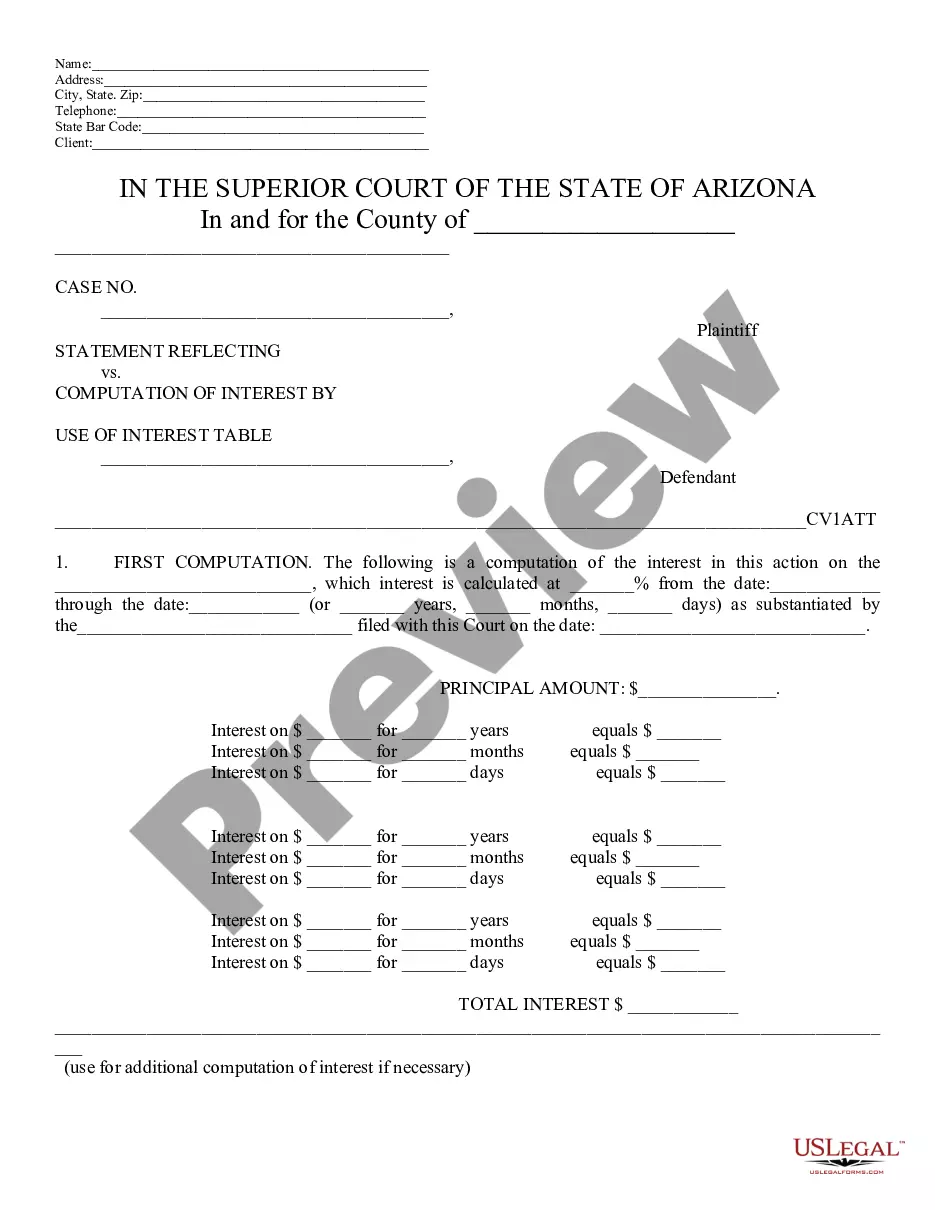

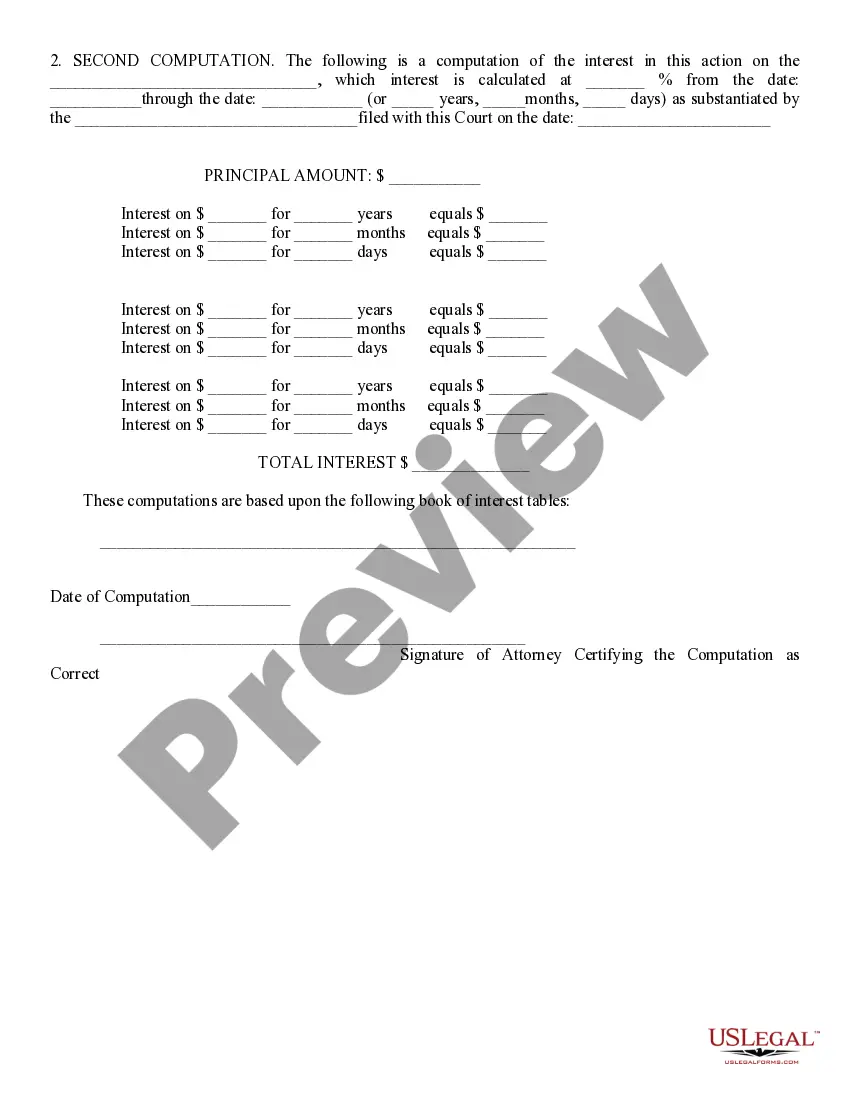

This is a Statement Reflecting Computation of Interest Using Interest Table. It reflects the interest accrued in a particular case. It further displays how the attorney arrived at the computation, by showing the interst table used. It is signed and dated by the presenting attorney.

Tempe, Arizona is a vibrant city known for its diverse community, vibrant culture, and economic growth. In the realm of finance and accounting, a Tempe Arizona Statement Reflecting Computation of Interest Using Interest Table is a powerful tool used by individuals, businesses, and institutions to calculate interest on a loan or investment accurately. The statement reflects a detailed breakdown of the computation process, utilizing an interest table specifically designed for this purpose. It provides a comprehensive view of the interest amounts accumulated over a given period, taking into account various factors such as principal amount, interest rate, and compounding frequency. There are several types of Tempe Arizona Statements Reflecting Computation of Interest Using Interest Table, each catering to different financial scenarios. Here are a few common ones: 1. Personal Loan Interest Statement: This statement is commonly used by individuals seeking to understand the interest accumulation on personal loans, such as mortgages, car loans, or student loans. It provides a breakdown of interest charges over the loan term and helps borrowers make informed financial decisions. 2. Business Loan Interest Statement: Designed for businesses, this statement helps calculate and track interest payments on loans obtained for operational or investment purposes. It allows businesses to budget and forecast their interest expenses accurately, facilitating financial planning and management. 3. Investment Interest Statement: This type of statement is utilized by individuals or institutions who have invested in various financial instruments such as bonds, certificates of deposit (CDs), or savings accounts. It helps assess the interest income generated from investments, enabling investors to evaluate the overall performance of their portfolio. Regardless of the type of Tempe Arizona Statement Reflecting Computation of Interest Using Interest Table, its purpose remains consistent: to provide clarity and transparency in understanding interest calculations. Businesses, individuals, and financial institutions rely on these statements to make informed decisions, monitor financial health, and ensure compliance with regulatory requirements. Overall, Tempe Arizona Statements Reflecting Computation of Interest Using Interest Table play a vital role in the financial landscape of the city, aiding in accurate interest calculations and promoting financial literacy.Tempe, Arizona is a vibrant city known for its diverse community, vibrant culture, and economic growth. In the realm of finance and accounting, a Tempe Arizona Statement Reflecting Computation of Interest Using Interest Table is a powerful tool used by individuals, businesses, and institutions to calculate interest on a loan or investment accurately. The statement reflects a detailed breakdown of the computation process, utilizing an interest table specifically designed for this purpose. It provides a comprehensive view of the interest amounts accumulated over a given period, taking into account various factors such as principal amount, interest rate, and compounding frequency. There are several types of Tempe Arizona Statements Reflecting Computation of Interest Using Interest Table, each catering to different financial scenarios. Here are a few common ones: 1. Personal Loan Interest Statement: This statement is commonly used by individuals seeking to understand the interest accumulation on personal loans, such as mortgages, car loans, or student loans. It provides a breakdown of interest charges over the loan term and helps borrowers make informed financial decisions. 2. Business Loan Interest Statement: Designed for businesses, this statement helps calculate and track interest payments on loans obtained for operational or investment purposes. It allows businesses to budget and forecast their interest expenses accurately, facilitating financial planning and management. 3. Investment Interest Statement: This type of statement is utilized by individuals or institutions who have invested in various financial instruments such as bonds, certificates of deposit (CDs), or savings accounts. It helps assess the interest income generated from investments, enabling investors to evaluate the overall performance of their portfolio. Regardless of the type of Tempe Arizona Statement Reflecting Computation of Interest Using Interest Table, its purpose remains consistent: to provide clarity and transparency in understanding interest calculations. Businesses, individuals, and financial institutions rely on these statements to make informed decisions, monitor financial health, and ensure compliance with regulatory requirements. Overall, Tempe Arizona Statements Reflecting Computation of Interest Using Interest Table play a vital role in the financial landscape of the city, aiding in accurate interest calculations and promoting financial literacy.