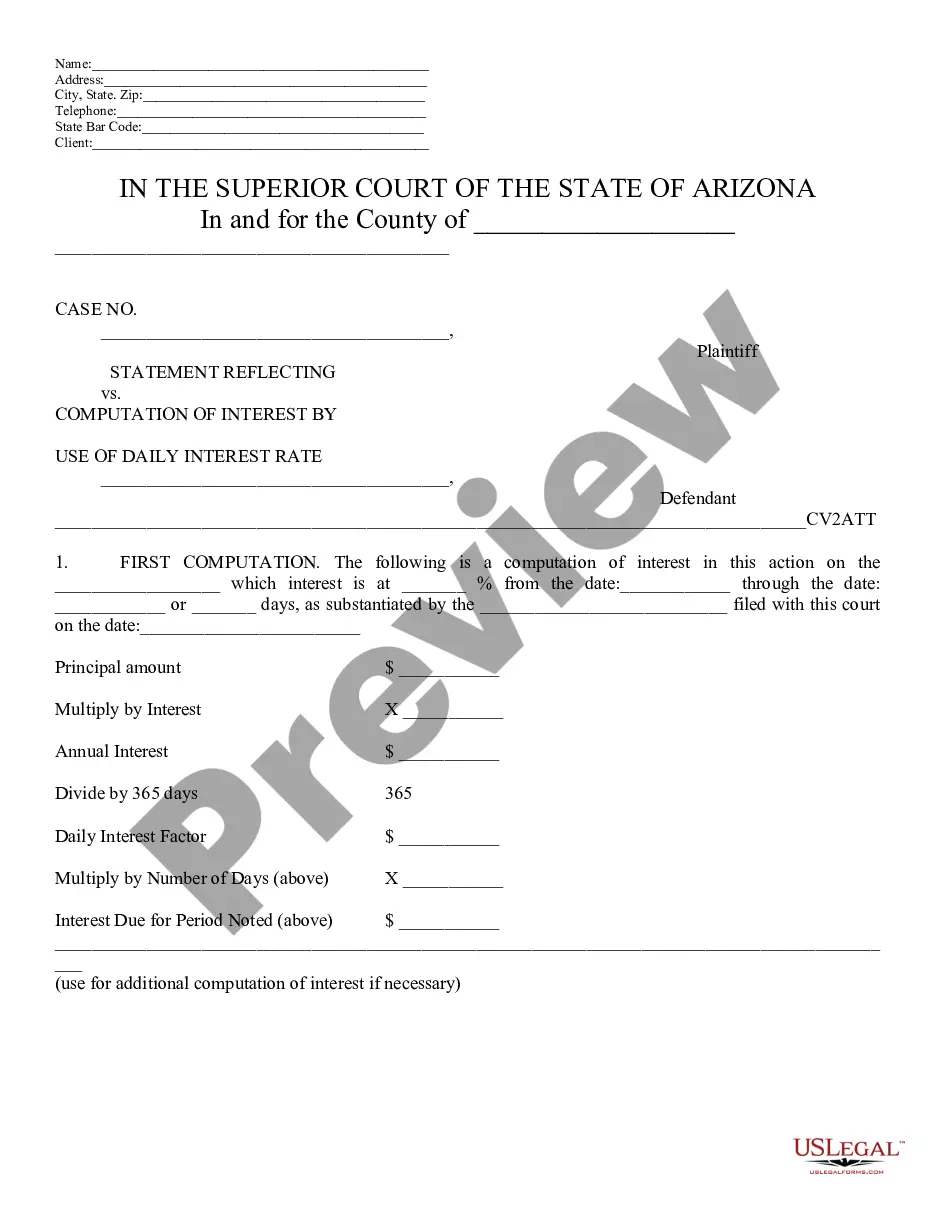

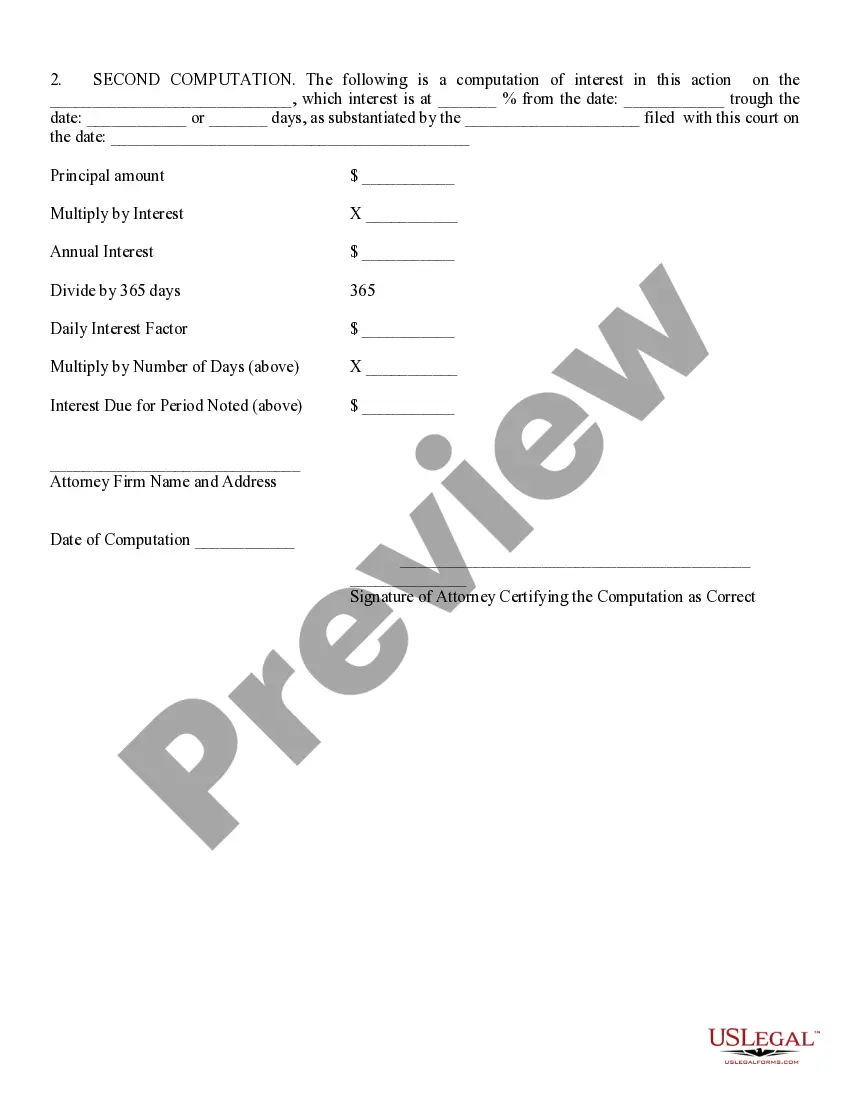

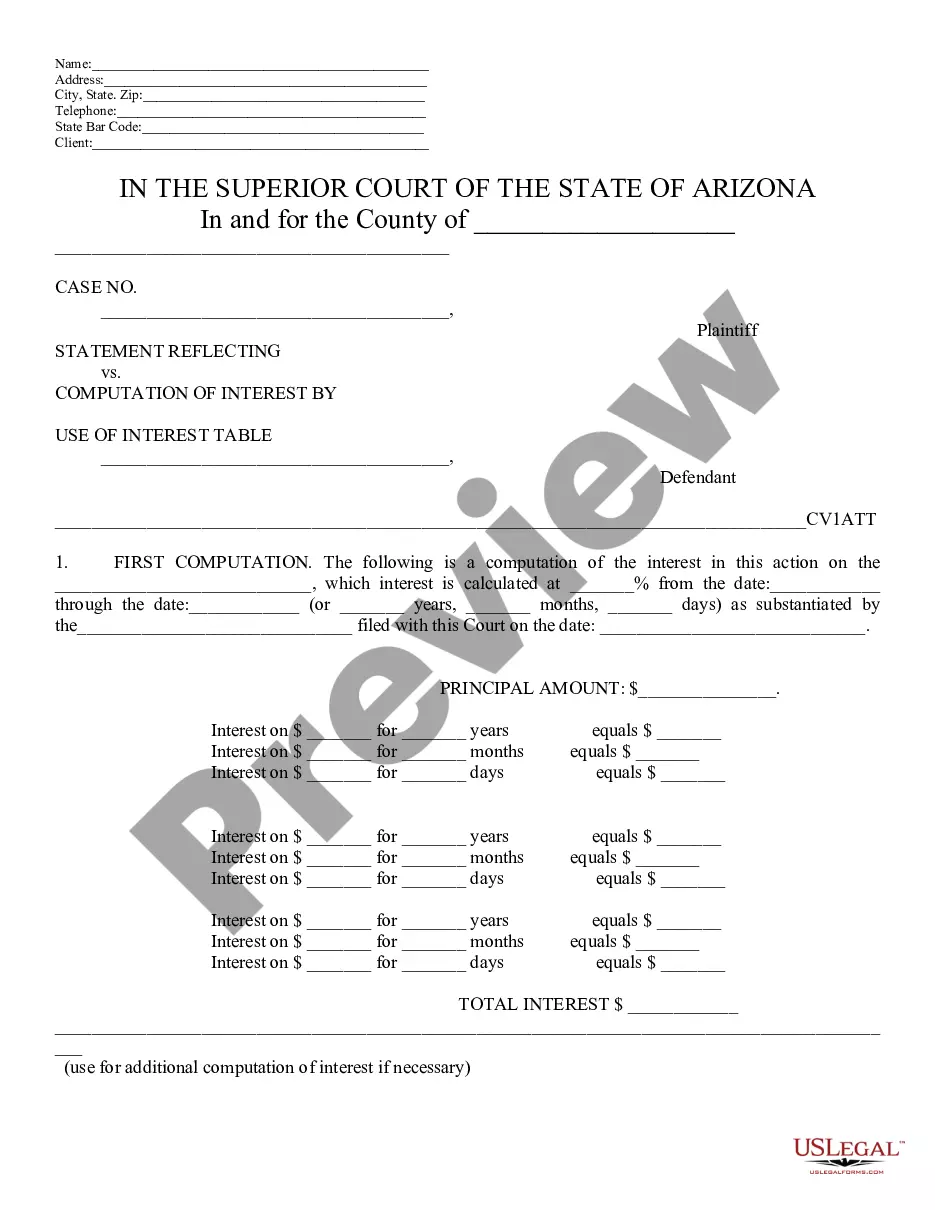

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate

Description

How to fill out Arizona Statement Reflecting Computation Of Interest By Daily Interest Rate?

Take advantage of the US Legal Forms and gain immediate access to any template you need.

Our helpful platform with numerous templates enables you to discover and obtain nearly any document example you desire.

You can download, fill out, and authenticate the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate in only a few minutes rather than searching the internet for hours seeking an appropriate template.

Using our library is an excellent way to enhance the security of your form submissions.

Access the page with the template you need. Confirm that it is the document you were seeking: review its title and description, and utilize the Preview feature when available. If not, use the Search option to locate the correct one.

Initiate the downloading process. Click Buy Now and choose the pricing plan that fits you best. Then, create an account and pay for your order using a credit card or PayPal.

- Our experienced attorneys routinely review all documents to ensure that the templates are suitable for a specific state and adhere to new laws and regulations.

- How can you access the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

- If you are a subscriber, simply Log In to your account. The Download option will be available for all the samples you view.

- Additionally, you can locate all the previously saved documents in the My documents section.

- If you don’t yet have an account, follow the steps below.

Form popularity

FAQ

In Arizona, the maximum legal interest rates are defined by state statutes, often reflecting the type of debt involved. For most consumer loans, the allowable rate generally caps around 10% per annum, although specific cases may differ. Familiarizing yourself with the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can simplify your understanding of applicable rates. For clarity, consult legal resources or forms available through uslegalforms.

Maricopa County property taxes are typically calculated based on the assessed value of the property and the applicable tax rate. The process may involve reviewing a Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate to understand any interest that may apply to unpaid taxes. Additionally, local budgets and voter-approved measures can impact rates each year. It's wise to engage with professionals or platforms like uslegalforms to get accurate assessments.

In Arizona, interest rates are governed by state law, which specifies maximum allowable rates for different types of loans and debts. Understanding the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can help you comply with these regulations. The law aims to protect consumers while allowing lenders to earn reasonable returns. It's essential to stay informed about updates to these laws to ensure compliance.

It's generally more advantageous to overpay rather than underpay your estimated taxes, as this can help you avoid penalties and interest charges accrued on underpayments. However, overpaying means tying up your funds until your tax refund is processed. Understanding the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can clarify the costs associated with each approach, helping you make the most informed decision.

In Arizona, estimated tax payments are typically due quarterly, based on your expected taxable income for the year. You should calculate your payments to avoid penalties, ensuring you adhere to the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate for accuracy. Staying informed about these rules will help you manage your tax obligations effectively.

To have your underpayment penalty waived in Arizona, you must demonstrate reasonable cause for the underpayment, such as unexpected financial hardship or an error on the part of the IRS or state tax authority. It’s advisable to document your situation thoroughly. Consider consulting the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate to ensure compliance and guide you through the process effectively.

In Arizona, taxpayers who underpay their estimated taxes may face a penalty that is calculated based on the underpaid amount and the duration of the underpayment. The state enforces these penalties to encourage timely tax payments. Understanding the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate will help you better navigate these penalties and potential interest.

In the United States, the penalty for underpaid estimated taxes typically involves interest charges and possible penalties based on the amount underpaid. The specifics can vary by state; in Maricopa, Arizona, this is governed by the local tax regulations. It's essential to be aware of how the Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate is calculated, as it can affect your overall tax responsibility significantly.

To calculate interest based on a daily rate, multiply your principal by the daily interest rate. This gives you the interest charged or accrued for each day. For precise calculations tailored to your situation, utilize a Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate.

To calculate daily interest on a mortgage, divide your annual interest rate by 365 to get the daily rate. Multiply this daily rate by the outstanding balance of your mortgage. For clear insights, a Maricopa Arizona Statement Reflecting Computation of Interest By Daily Interest Rate can enhance your understanding of your mortgage interest.