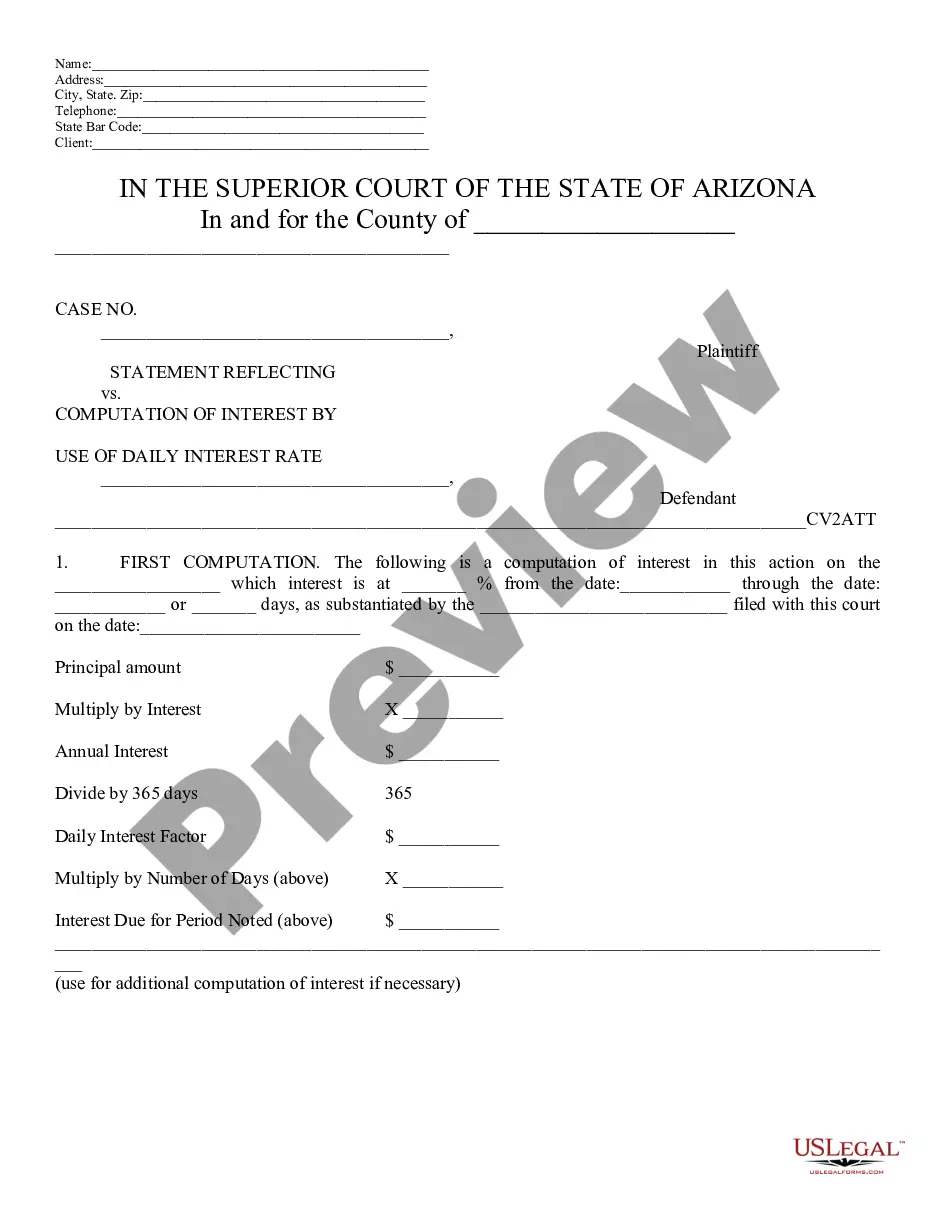

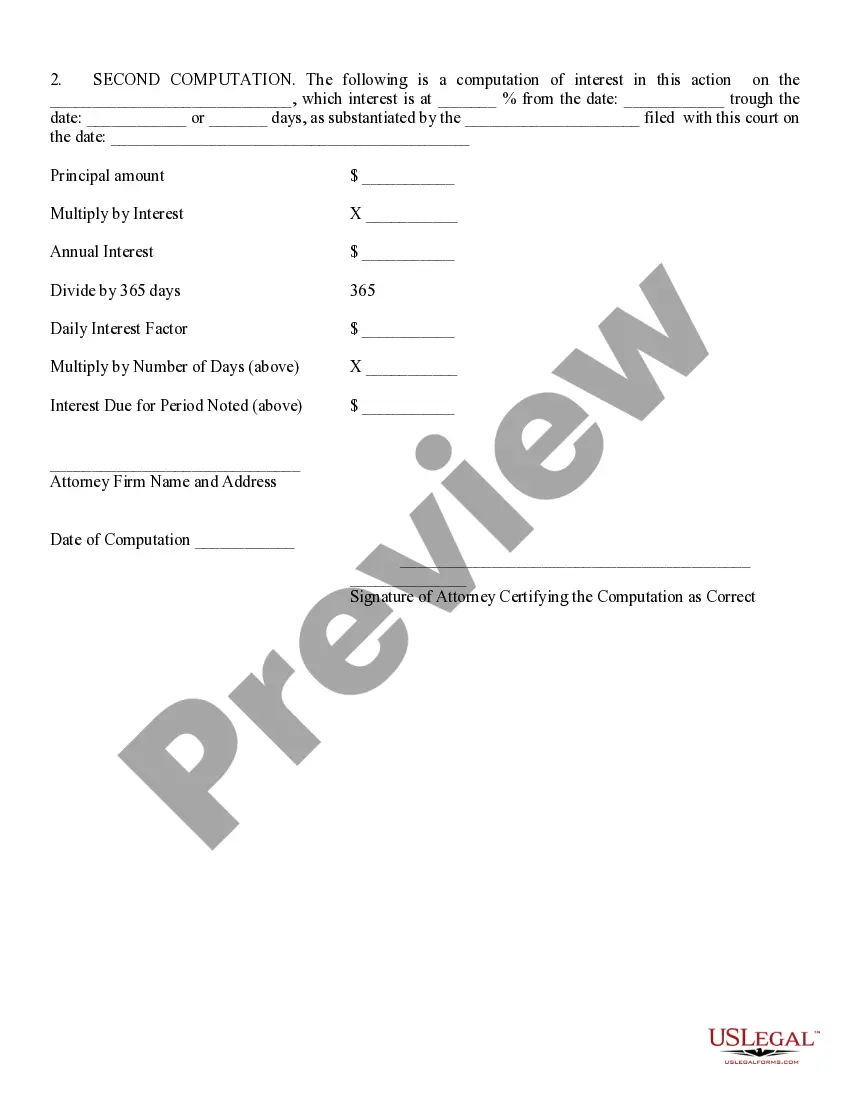

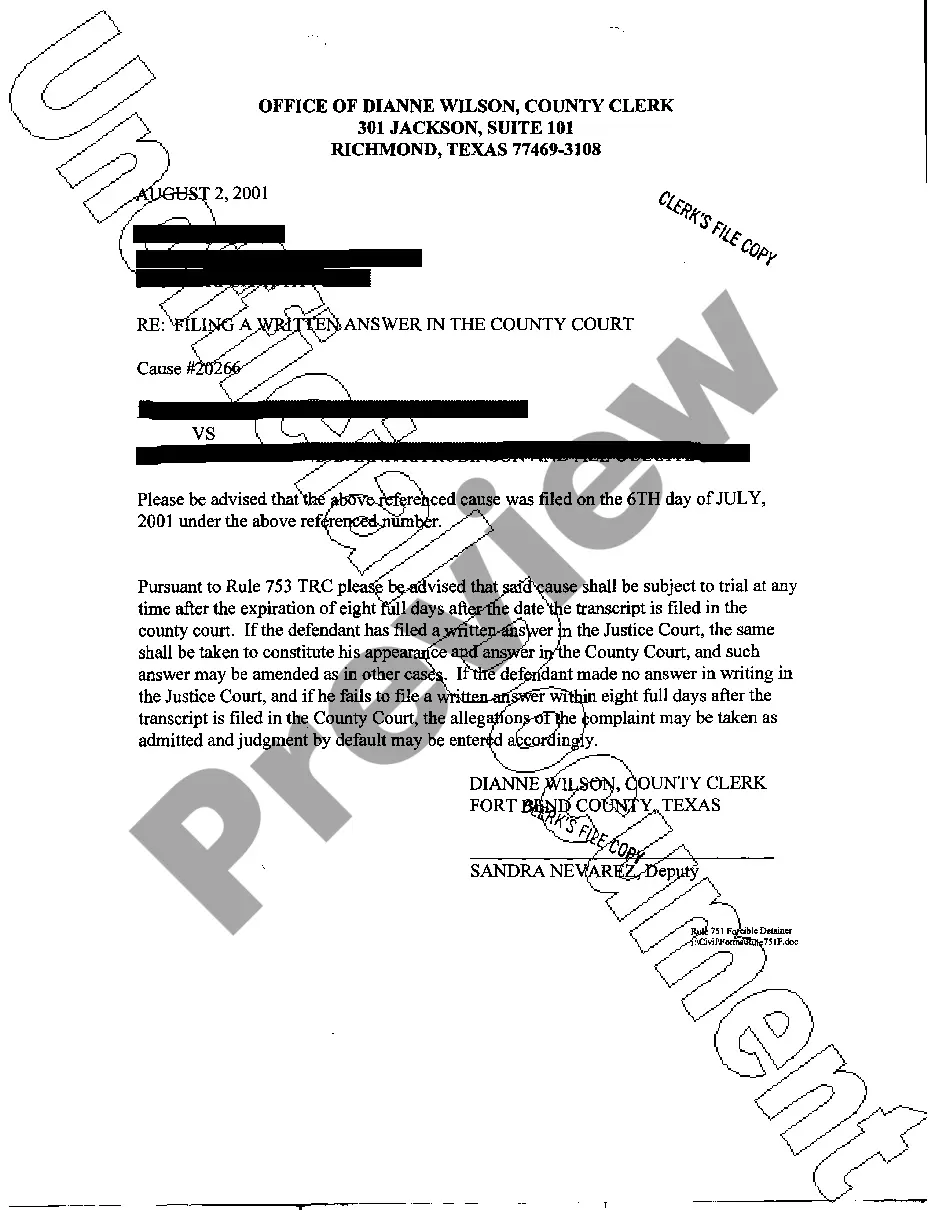

Statement Reflecting Computation of Interest By Daily Interest Rate: This statement reflects the way an attorney arrived at the total amount for damages, attorney's fees,e tc. It displays his/ her mathmatical equation, as well as the exact interest rate he/ she used in their findings. This form is available in both Word and Rich Text formats.

Scottsdale Arizona Statement Reflecting Computation of Interest in Daily Interest Rate is an important document that helps individuals and businesses calculate the interest amount accrued on a daily basis. This statement is used in various financial transactions, such as loans, mortgages, investments, and credit card balances. By accurately computing the interest based on the daily interest rate, individuals can have a clear understanding of their financial obligations and make informed decisions. The Scottsdale Arizona Statement Reflecting Computation of Interest in Daily Interest Rate is typically divided into several sections. The first section includes the basic information, such as the name of the individual or business, account number, and the date when the interest calculation is made. This information ensures that the statement is specific to the intended recipient and serves as a reference for future transactions. The next section provides a detailed breakdown of the principal amount, which is the initial sum of money borrowed or invested. It also includes the interest rate, usually expressed as an annual percentage, and the number of days or periods over which the interest is calculated. The computation section is where the actual interest calculation takes place. It starts with the daily interest rate, which is computed by dividing the annual interest rate by the number of days in a year. For example, if the annual interest rate is 6% and the days in a year are 365, the daily interest rate would be 0.0164% (6% ÷ 365). Using the daily interest rate, the statement reflects the interest accrued each day. This is calculated by multiplying the daily interest rate by the principal amount. For instance, if the principal amount is $10,000, the daily interest accrued would be $1.64 ($10,000 × 0.0164%). To provide a comprehensive overview, the statement usually includes a summary section that shows the total interest accrued over a specific period. This period can range from a few days to a whole month or any other defined timeframe. By summing up the daily accrued interest for the chosen period, the total interest amount can be easily determined. Different types of Scottsdale Arizona Statement Reflecting Computation of Interest in Daily Interest Rate may include statements for various financial instruments, such as personal loans, student loans, mortgages, credit card balances, and investment accounts. Each type of statement may have slight variations in the formatting or specific details included, but the overall purpose remains the same — to calculate and reflect the interest amount based on the daily interest rate. In summary, the Scottsdale Arizona Statement Reflecting Computation of Interest in Daily Interest Rate is a crucial document used for calculating interest on a daily basis. It helps individuals and businesses understand their financial obligations and make informed decisions. Whether it's for personal loans, mortgages, credit card balances, or investment accounts, this statement ensures transparency and accuracy in interest calculations.