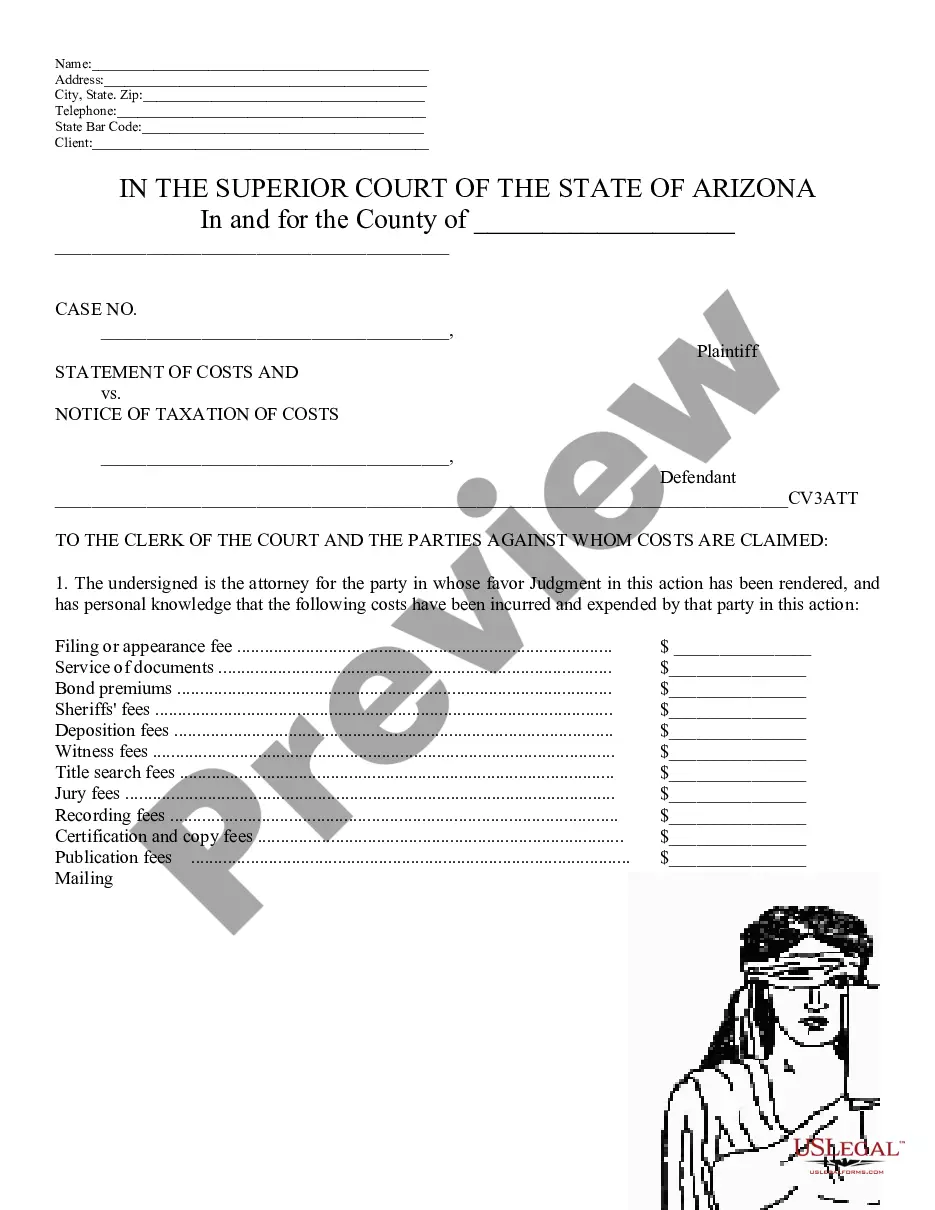

Statement of Costs and Notice of Taxation of Costs: This is a list of all the costs one party has been assessed since the commencement of the suit. He/ She asks the court to demand payment from the opposing party, as a consequence of judgment being rendered against him or her. It should be signed in front of a Notary Public. This form is offered in both Word and Rich Text formats.

Notice Of New Fees In Chandler

Description

How to fill out Chandler Arizona Statement Of Costs And Notice Of Taxation Of Costs?

Do you require a reliable and affordable source for legal forms to obtain the Chandler Arizona Statement of Costs and Notice of Taxation of Costs? US Legal Forms is your ideal option.

Whether you need a straightforward agreement to establish rules for living together with your partner or a collection of forms to facilitate your separation or divorce through the judiciary, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and professional needs. All the templates we provide are not generic and are tailored to comply with the specific regulations of each state and county.

To retrieve the document, you must Log In to your account, locate the desired template, and click the Download button next to it. Please remember that you can access and download your previously acquired document templates anytime in the My documents section.

Is this your first visit to our site? No need to worry. You can easily create an account, but first, ensure you do the following.

Now you can register for your account. Then select the subscription plan and proceed with payment. Once the payment is confirmed, download the Chandler Arizona Statement of Costs and Notice of Taxation of Costs in any available format. You can revisit the website at any point and download the document again without any additional charges.

Finding current legal forms has never been simpler. Give US Legal Forms a try today, and say goodbye to spending hours deciphering legal documents online once and for all.

- Check if the Chandler Arizona Statement of Costs and Notice of Taxation of Costs complies with the rules of your state and local area.

- Review the details of the form (if available) to understand who and what the document is intended for.

- Restart the search if the template does not meet your legal needs.

Form popularity

FAQ

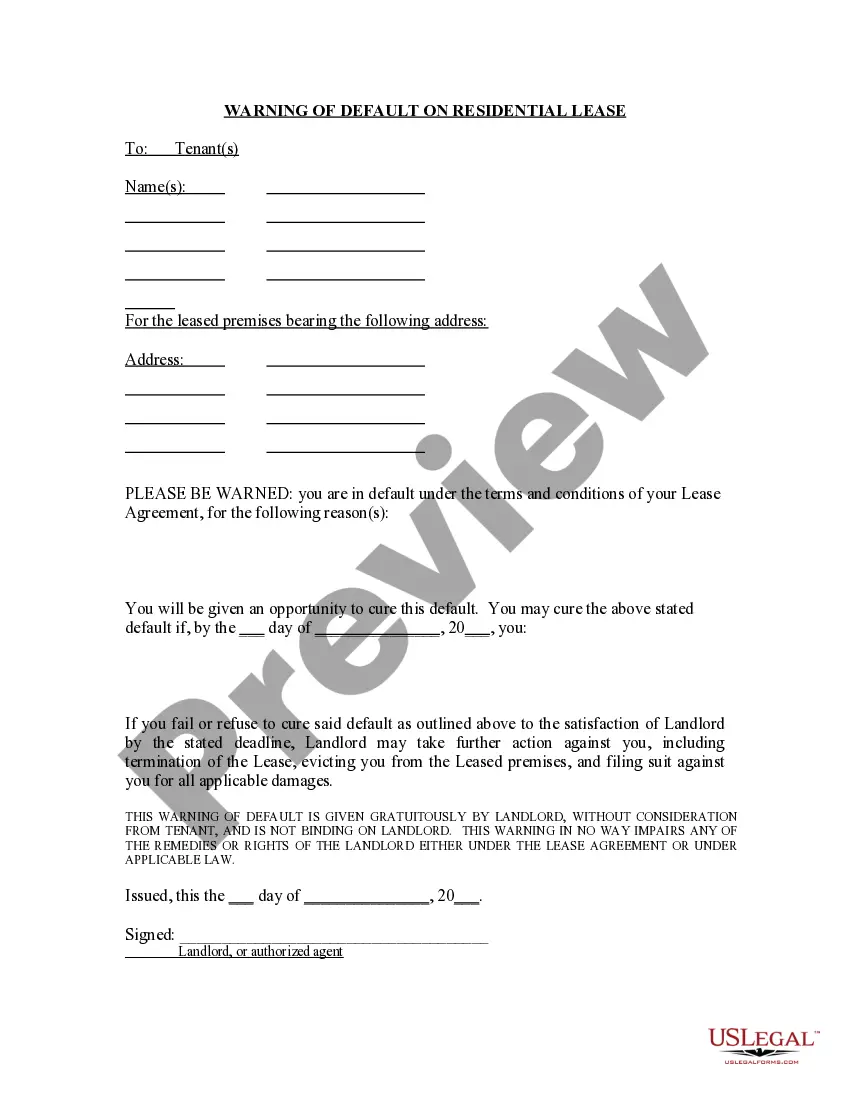

In Arizona, the process of filing for divorce typically takes around 60 to 90 days once you submit your paperwork. This timeline can vary depending on the complexity of your case and whether both parties agree on the terms. It is crucial to be aware of the Chandler Arizona Statement of Costs and Notice of Taxation of Costs, as these documents can influence your divorce proceedings. Using platforms like USLegalForms can help ensure you have the correct paperwork, making the process smoother.

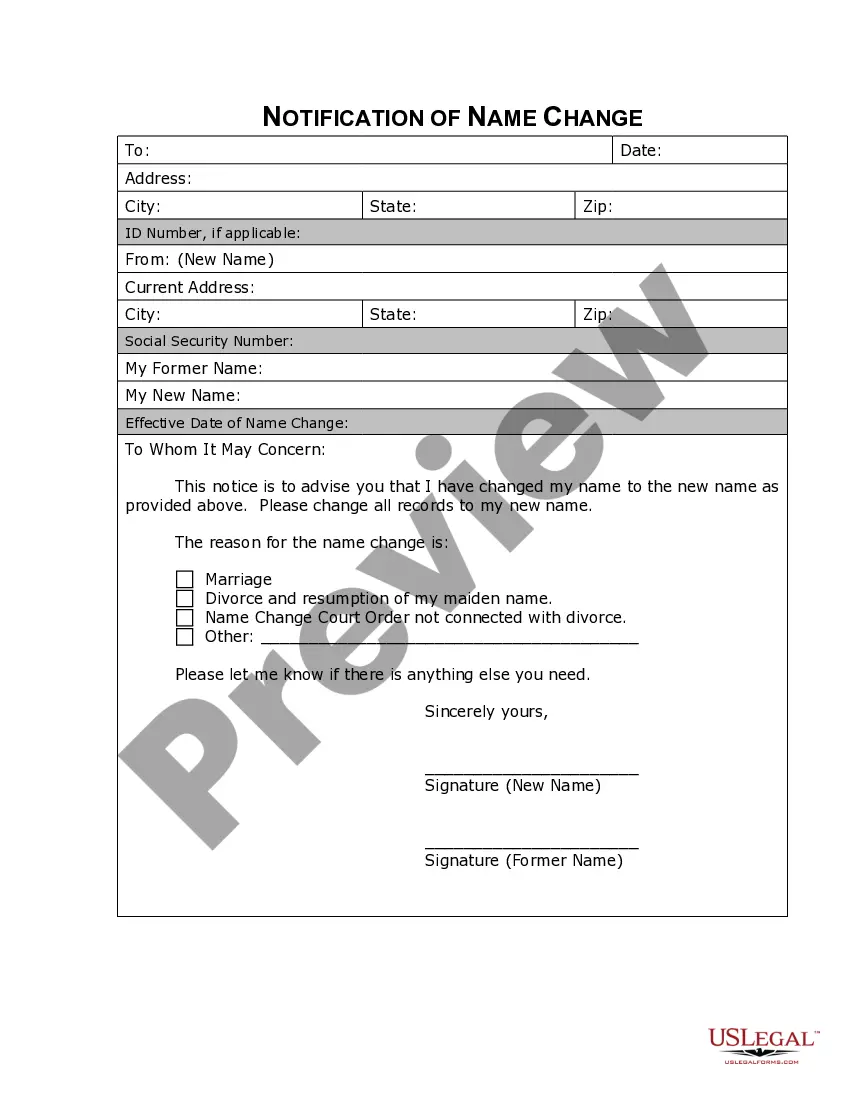

To legally change your name in Arizona, you must file a petition with the court. This process includes completing necessary forms, providing a reason for the change, and sometimes publishing a notice in a local newspaper. After a hearing, the judge will decide on your request. Utilizing the Chandler Arizona Statement of Costs and Notice of Taxation of Costs can help you understand any expenses involved in this process.

Changing a name in Arizona typically takes about two to six weeks. This timeline depends on various factors, such as how quickly the court processes your application and if there are any objections. Once the court grants your request, you will receive a name change order. The Chandler Arizona Statement of Costs and Notice of Taxation of Costs may apply during this process, outlining any associated fees.

Chandler, AZ, has a state tax rate that is combined with County and city taxes. This rate applies to income earned within the state and can impact your overall tax burden. Understanding these rates helps individuals and businesses plan their finances. For a thorough breakdown of your expenses, consider using the Chandler Arizona Statement of Costs and Notice of Taxation of Costs as a helpful reference.

Yes, various cities in Arizona impose local taxes on goods and services sold within their jurisdictions. These taxes contribute to funding essential city services. As a resident or business owner, it's important to be aware of these taxes to ensure compliance and proper budgeting. The Chandler Arizona Statement of Costs and Notice of Taxation of Costs can assist you in tracking your tax-related expenses with ease.

Several states, including Wyoming, Alaska, and Florida, do not have a city or state income tax. This can be attractive for individuals and businesses looking to maximize their financial benefits. However, understanding costs in these regions is still essential. The Chandler Arizona Statement of Costs and Notice of Taxation of Costs can provide insights into how to document and manage costs effectively, even in tax-friendly areas.

The privilege tax in Chandler, AZ, applies to businesses engaging in various activities within the city. This tax is specifically designed for transactions, including property rentals and services offered. Understanding the privilege tax can help you manage your financial obligations better as a business owner or renter. The Chandler Arizona Statement of Costs and Notice of Taxation of Costs serves as an important tool in this context.

In Chandler, AZ, rental properties are subject to a transaction privilege tax, which is akin to a rental tax. The rate can vary, and it largely depends on the type of rental being offered. Knowing about this rental tax will help you budget accurately if you own property in Chandler. For more clarity on property-related expenses, refer to the Chandler Arizona Statement of Costs and Notice of Taxation of Costs.

Yes, Phoenix does impose a city tax on certain goods and services. This tax is collected at the point of sale and contributes to the city's funding for various public services. If you are dealing with costs related to your business or personal expenses in Phoenix, understanding this tax is crucial. You might also want to explore the Chandler Arizona Statement of Costs and Notice of Taxation of Costs to keep track of expenses.

Yes, Arizona has city taxes which are imposed in addition to state taxes. Each city, including Chandler, sets its tax rates that contribute to local funding needs. Being aware of these taxes is important, especially when completing legal forms related to your Chandler Arizona Statement of Costs and Notice of Taxation of Costs, as they may impact your overall financial picture.