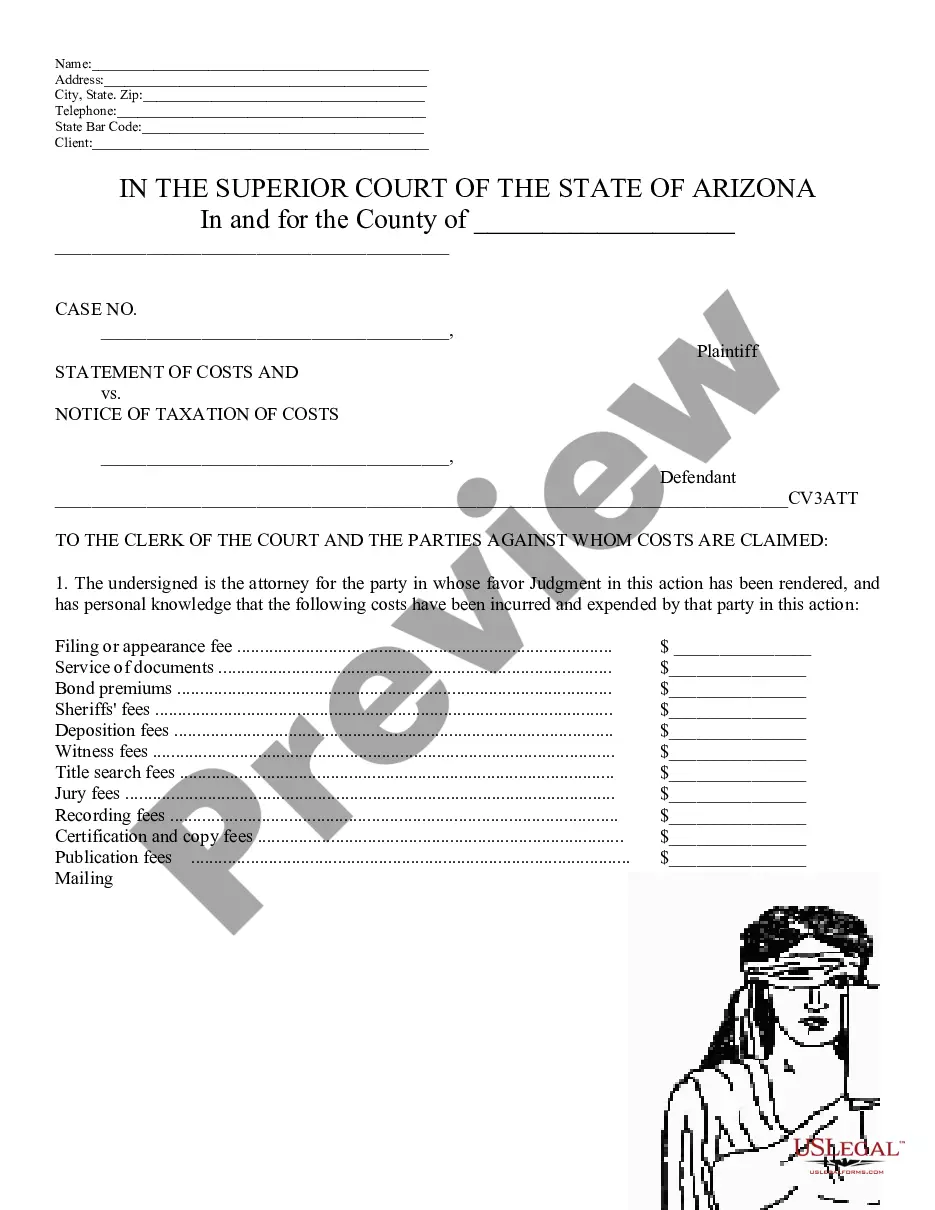

Statement of Costs and Notice of Taxation of Costs: This is a list of all the costs one party has been assessed since the commencement of the suit. He/ She asks the court to demand payment from the opposing party, as a consequence of judgment being rendered against him or her. It should be signed in front of a Notary Public. This form is offered in both Word and Rich Text formats.

The Glendale Arizona Statement of Costs and Notice of Taxation of Costs is a legal document that provides a detailed breakdown of expenses accrued during a legal proceeding or litigation in the Glendale, Arizona jurisdiction. This statement aims to inform all parties involved about the costs associated with the case and the parties responsible for paying those costs. By providing explicit details about the incurred expenses, the Glendale Arizona Statement of Costs and Notice of Taxation of Costs helps ensure transparency and accountability. In Glendale, Arizona, there are two main types of Statement of Costs and Notice of Taxation of Costs: 1. Standard Statement of Costs and Notice of Taxation of Costs: This type of statement is typically used in civil litigation cases and provides a comprehensive list of all costs that have been incurred throughout the legal process. Some common expenses included in this statement may be filing fees, court reporter fees, deposition costs, expert witness fees, photocopying charges, service fees, and other related expenses. Each cost is itemized, specifying the date, service provider, and the amount incurred. 2. Bill of Costs for Taxation: This particular type of statement is used when a party seeks to recover costs after a successful outcome in a legal proceeding or litigation. It outlines the costs that the prevailing party is seeking to be reimbursed by the opposing party. The Bill of Costs for Taxation includes similar expenses as the standard statement, but with the added element of specifically requesting reimbursement from the other party. Both types of Glendale Arizona Statement of Costs and Notice of Taxation of Costs are crucial legal documents that enable transparency in legal proceedings and help in validating the expenses incurred throughout a case. They play a pivotal role in ensuring fair distribution of costs and maintain a clear record of all expenditures related to a legal matter in the Glendale, Arizona jurisdiction.The Glendale Arizona Statement of Costs and Notice of Taxation of Costs is a legal document that provides a detailed breakdown of expenses accrued during a legal proceeding or litigation in the Glendale, Arizona jurisdiction. This statement aims to inform all parties involved about the costs associated with the case and the parties responsible for paying those costs. By providing explicit details about the incurred expenses, the Glendale Arizona Statement of Costs and Notice of Taxation of Costs helps ensure transparency and accountability. In Glendale, Arizona, there are two main types of Statement of Costs and Notice of Taxation of Costs: 1. Standard Statement of Costs and Notice of Taxation of Costs: This type of statement is typically used in civil litigation cases and provides a comprehensive list of all costs that have been incurred throughout the legal process. Some common expenses included in this statement may be filing fees, court reporter fees, deposition costs, expert witness fees, photocopying charges, service fees, and other related expenses. Each cost is itemized, specifying the date, service provider, and the amount incurred. 2. Bill of Costs for Taxation: This particular type of statement is used when a party seeks to recover costs after a successful outcome in a legal proceeding or litigation. It outlines the costs that the prevailing party is seeking to be reimbursed by the opposing party. The Bill of Costs for Taxation includes similar expenses as the standard statement, but with the added element of specifically requesting reimbursement from the other party. Both types of Glendale Arizona Statement of Costs and Notice of Taxation of Costs are crucial legal documents that enable transparency in legal proceedings and help in validating the expenses incurred throughout a case. They play a pivotal role in ensuring fair distribution of costs and maintain a clear record of all expenditures related to a legal matter in the Glendale, Arizona jurisdiction.