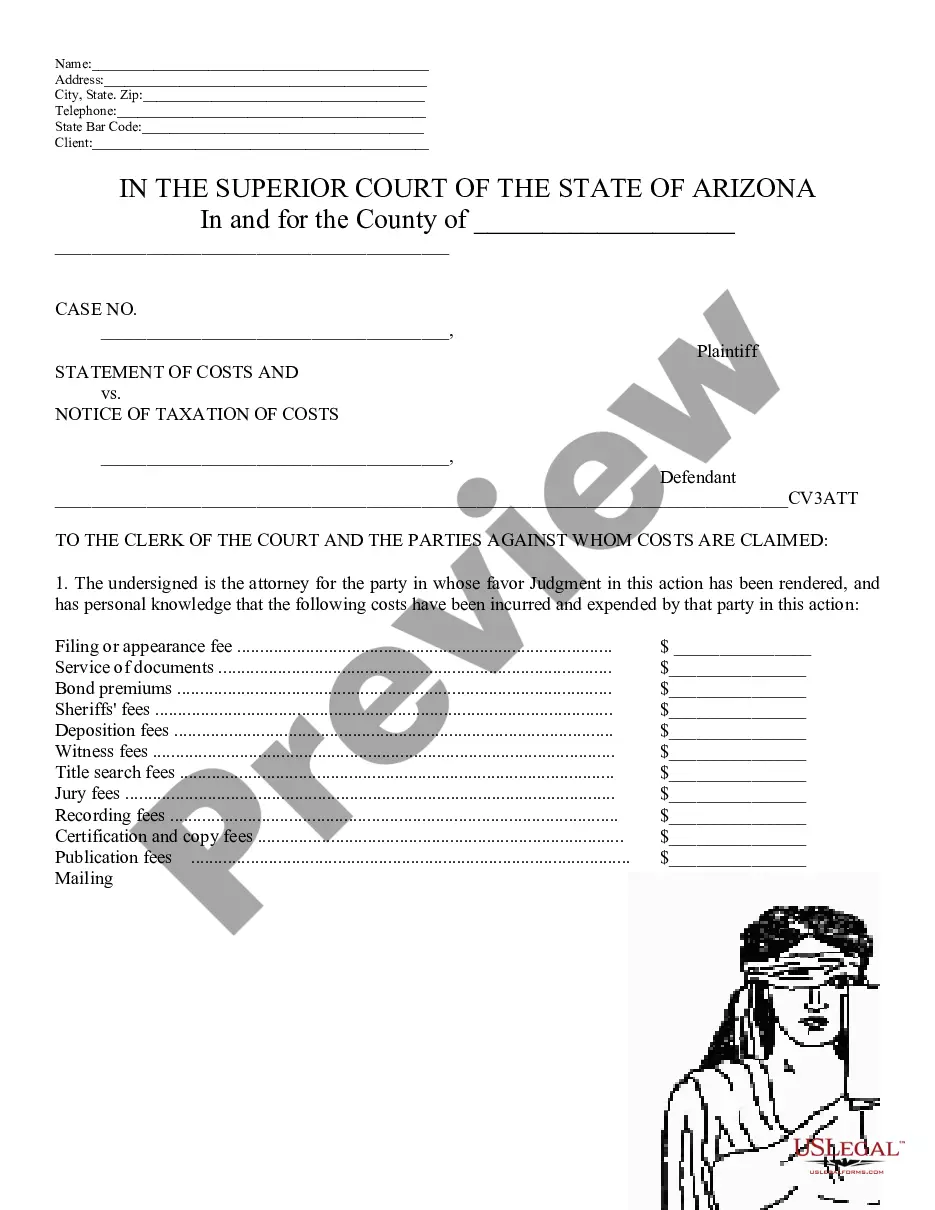

Statement of Costs and Notice of Taxation of Costs: This is a list of all the costs one party has been assessed since the commencement of the suit. He/ She asks the court to demand payment from the opposing party, as a consequence of judgment being rendered against him or her. It should be signed in front of a Notary Public. This form is offered in both Word and Rich Text formats.

The Maricopa Arizona Statement of Costs and Notice of Taxation of Costs is a legal document that provides an itemized breakdown of the costs incurred during a court case or legal matter in Maricopa County, Arizona. This statement serves as a notice to all parties involved, informing them of the expenses associated with the case and the subsequent taxation of costs. In Maricopa County, there are two main types of Statement of Costs and Notice of Taxation of Costs: 1. Maricopa Arizona Statement of Costs: This component of the document outlines the specific expenses that have been accrued throughout the duration of a legal process. It includes charges such as filing fees, service fees, deposition costs, expert witness fees, and other disbursements made by the prevailing party. The statement meticulously lists each cost item and the corresponding amount, providing transparency and accountability. 2. Notice of Taxation of Costs: This portion of the document serves as a notice to all parties involved about the taxation of costs. Taxation of costs refers to the assessment and determination of which party is responsible for paying the incurred expenses. The noticing party, usually the prevailing party, identifies the costs they seek to tax to the opposing party. This allows the opposing party to review the statement of costs, dispute any inaccuracies, and make necessary objections to the taxation. Keywords: Maricopa Arizona, Statement of Costs, Notice of Taxation of Costs, legal document, itemized breakdown, court case, legal matter, Maricopa County, Arizona, notice, expenses, taxation, charges, filing fees, service fees, deposition costs, expert witness fees, disbursements, prevailing party, transparency, accountability, assessment, determination, liable party, inaccuracies, objections.