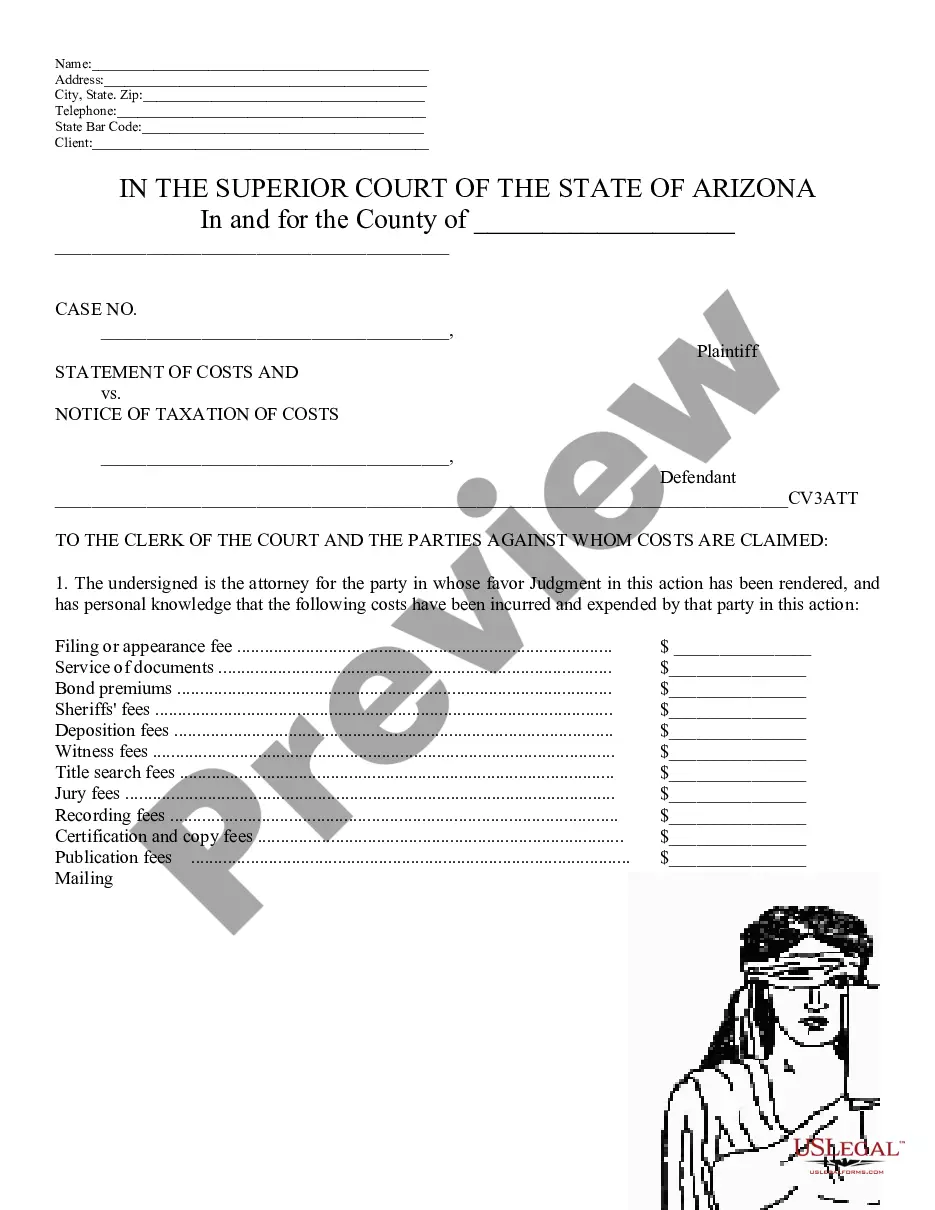

Statement of Costs and Notice of Taxation of Costs: This is a list of all the costs one party has been assessed since the commencement of the suit. He/ She asks the court to demand payment from the opposing party, as a consequence of judgment being rendered against him or her. It should be signed in front of a Notary Public. This form is offered in both Word and Rich Text formats.

Scottsdale Arizona Statement of Costs and Notice of Taxation of Costs is a legal document utilized in the civil court system of Scottsdale, Arizona. It outlines the costs incurred during a legal case and provides notice of the taxation of these costs. This document is crucial for parties involved in a lawsuit as it details the financial obligations associated with the litigation process. There are two primary types of Scottsdale Arizona Statement of Costs and Notice of Taxation of Costs: 1. Initial Statement of Costs: This type of statement is filed by the prevailing party (the party who wins the case) or their attorney. It includes a comprehensive breakdown of all the expenses and disbursements incurred throughout the legal process, such as court filing fees, deposition expenses, witness fees, jury fees, expert witness fees, photocopying charges, and any other relevant costs associated with the case. The initial statement of costs is crucial for the court to assess and verify the reasonable expenses incurred by the prevailing party. 2. Notice of Taxation of Costs: When the initial statement of costs is filed, the opposing party, commonly known as the losing party, has the right to dispute or contest certain costs deemed unreasonable or unnecessary. In such cases, they can file a Notice of Taxation of Costs, which initiates the taxation process. This notice informs the opposing party that they have a specified time frame within which they can object or request a taxation hearing to challenge specific costs. The taxation hearing allows for a detailed review of the claimed costs and provides an opportunity for the court to assess the necessity and reasonableness of each expense. Certain essential keywords associated with this topic include Scottsdale Arizona, statement of costs, notice of taxation, taxation of costs, legal process, prevailing party, expenses, disbursements, court filing fees, deposition expenses, witness fees, jury fees, expert witness fees, photocopying charges, contested costs, taxation hearing. In summary, the Scottsdale Arizona Statement of Costs and Notice of Taxation of Costs is a crucial legal document used to outline and determine the financial responsibilities associated with a legal case. By providing a detailed breakdown of expenses incurred, it ensures transparency and fairness in the taxation of costs.Scottsdale Arizona Statement of Costs and Notice of Taxation of Costs is a legal document utilized in the civil court system of Scottsdale, Arizona. It outlines the costs incurred during a legal case and provides notice of the taxation of these costs. This document is crucial for parties involved in a lawsuit as it details the financial obligations associated with the litigation process. There are two primary types of Scottsdale Arizona Statement of Costs and Notice of Taxation of Costs: 1. Initial Statement of Costs: This type of statement is filed by the prevailing party (the party who wins the case) or their attorney. It includes a comprehensive breakdown of all the expenses and disbursements incurred throughout the legal process, such as court filing fees, deposition expenses, witness fees, jury fees, expert witness fees, photocopying charges, and any other relevant costs associated with the case. The initial statement of costs is crucial for the court to assess and verify the reasonable expenses incurred by the prevailing party. 2. Notice of Taxation of Costs: When the initial statement of costs is filed, the opposing party, commonly known as the losing party, has the right to dispute or contest certain costs deemed unreasonable or unnecessary. In such cases, they can file a Notice of Taxation of Costs, which initiates the taxation process. This notice informs the opposing party that they have a specified time frame within which they can object or request a taxation hearing to challenge specific costs. The taxation hearing allows for a detailed review of the claimed costs and provides an opportunity for the court to assess the necessity and reasonableness of each expense. Certain essential keywords associated with this topic include Scottsdale Arizona, statement of costs, notice of taxation, taxation of costs, legal process, prevailing party, expenses, disbursements, court filing fees, deposition expenses, witness fees, jury fees, expert witness fees, photocopying charges, contested costs, taxation hearing. In summary, the Scottsdale Arizona Statement of Costs and Notice of Taxation of Costs is a crucial legal document used to outline and determine the financial responsibilities associated with a legal case. By providing a detailed breakdown of expenses incurred, it ensures transparency and fairness in the taxation of costs.