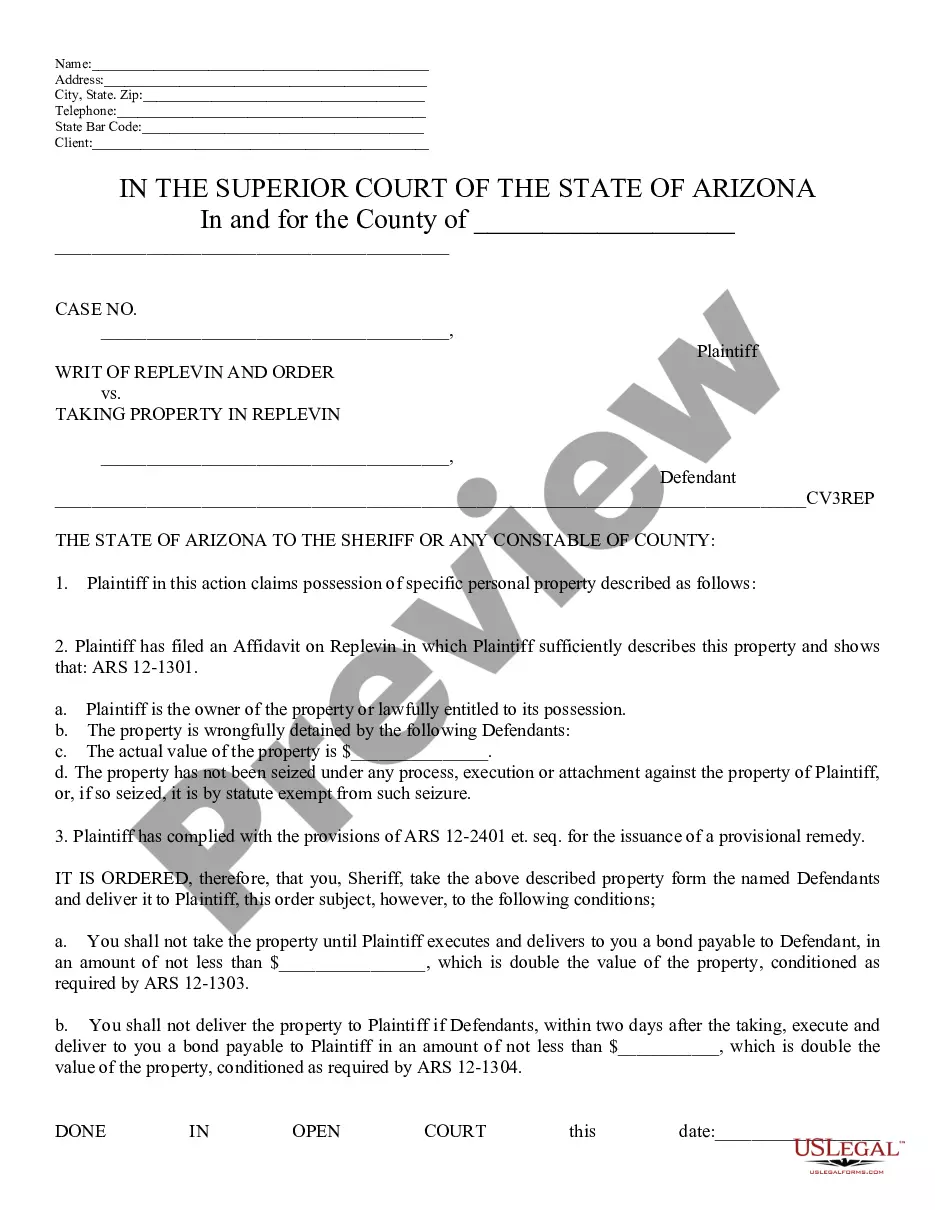

Order Taking Property in Replevin: This order is used when the Plaintiff wants to seize property which is rightly theirs, from the Defendant. The Sheriff is ordered to seize the property and hand it over to the Plaintiff, as long as certain conditions are met. The Plaintiff must issue a bond, payable to the Defendant, to the Sheriff in the amount which is twice the worth of the property to be seized. The Sheriff is not allowed to hand over the seized property to the Plaintiff, if the Defendant gives the Sheriff a bond, payable to the Plaintiff, in the amount of twice the worth of the seized property. This form is offered in both Word and Rich Text formats.

Tempe Arizona Order Taking Property in Repletion or Repossession is a legal process that allows creditors or lenders to recover property that a borrower has failed to make payment for or has defaulted on. This process enables them to regain possession of the property, either through court-ordered repletion or repossession. Repletion is a legal action that creditors can initiate to reclaim specific goods or personal property if the borrower has not fulfilled their financial obligations as agreed upon in a contract. In the case of Tempe, Arizona, a creditor can file a repletion action in the local court system to obtain a court order allowing them to take possession of the property. Repossession, on the other hand, refers to the process of a creditor or lender reclaiming collateralized property (usually a vehicle or real estate) due to loan default or non-payment. Repossession typically involves the creditor physically taking possession of the property without the need for a court order, as the borrower has already granted the lender certain rights and remedies in the loan agreement. In Tempe, Arizona, there are various types of property that can become subject to order taking in repletion or repossession. Some common examples include: 1. Vehicles: This includes cars, trucks, motorcycles, or any other type of motorized vehicle that has been purchased with a loan or used as collateral. 2. Real Estate: If a borrower has taken out a mortgage loan and fails to make timely payments, the lender may initiate repossession proceedings to reclaim the property securing the loan. 3. Business Assets: If a business owner defaults on a commercial loan, the lender may seek to repossess assets such as equipment, machinery, inventory, or office furniture. 4. Personal Property: This category encompasses various items like electronics, jewelry, artwork, or appliances that a borrower has used as collateral for a loan. When initiating the process of order taking property in repletion or repossession in Tempe, Arizona, it is crucial for creditors to follow specific legal procedures and adhere to the guidelines set forth by state law. Hiring an attorney who specializes in these matters can greatly assist in navigating the complex legal landscape and increasing the chances of successful property recovery.Tempe Arizona Order Taking Property in Repletion or Repossession is a legal process that allows creditors or lenders to recover property that a borrower has failed to make payment for or has defaulted on. This process enables them to regain possession of the property, either through court-ordered repletion or repossession. Repletion is a legal action that creditors can initiate to reclaim specific goods or personal property if the borrower has not fulfilled their financial obligations as agreed upon in a contract. In the case of Tempe, Arizona, a creditor can file a repletion action in the local court system to obtain a court order allowing them to take possession of the property. Repossession, on the other hand, refers to the process of a creditor or lender reclaiming collateralized property (usually a vehicle or real estate) due to loan default or non-payment. Repossession typically involves the creditor physically taking possession of the property without the need for a court order, as the borrower has already granted the lender certain rights and remedies in the loan agreement. In Tempe, Arizona, there are various types of property that can become subject to order taking in repletion or repossession. Some common examples include: 1. Vehicles: This includes cars, trucks, motorcycles, or any other type of motorized vehicle that has been purchased with a loan or used as collateral. 2. Real Estate: If a borrower has taken out a mortgage loan and fails to make timely payments, the lender may initiate repossession proceedings to reclaim the property securing the loan. 3. Business Assets: If a business owner defaults on a commercial loan, the lender may seek to repossess assets such as equipment, machinery, inventory, or office furniture. 4. Personal Property: This category encompasses various items like electronics, jewelry, artwork, or appliances that a borrower has used as collateral for a loan. When initiating the process of order taking property in repletion or repossession in Tempe, Arizona, it is crucial for creditors to follow specific legal procedures and adhere to the guidelines set forth by state law. Hiring an attorney who specializes in these matters can greatly assist in navigating the complex legal landscape and increasing the chances of successful property recovery.