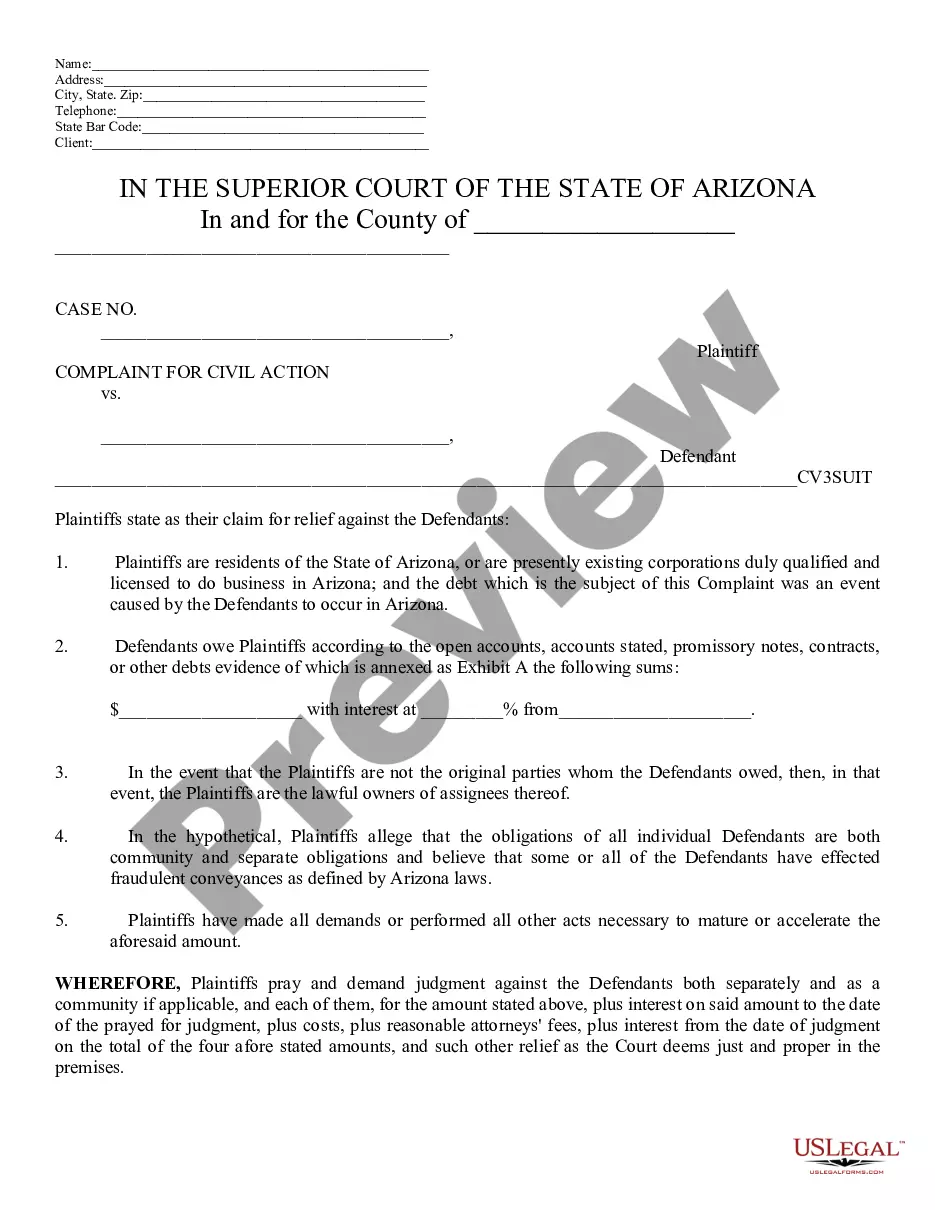

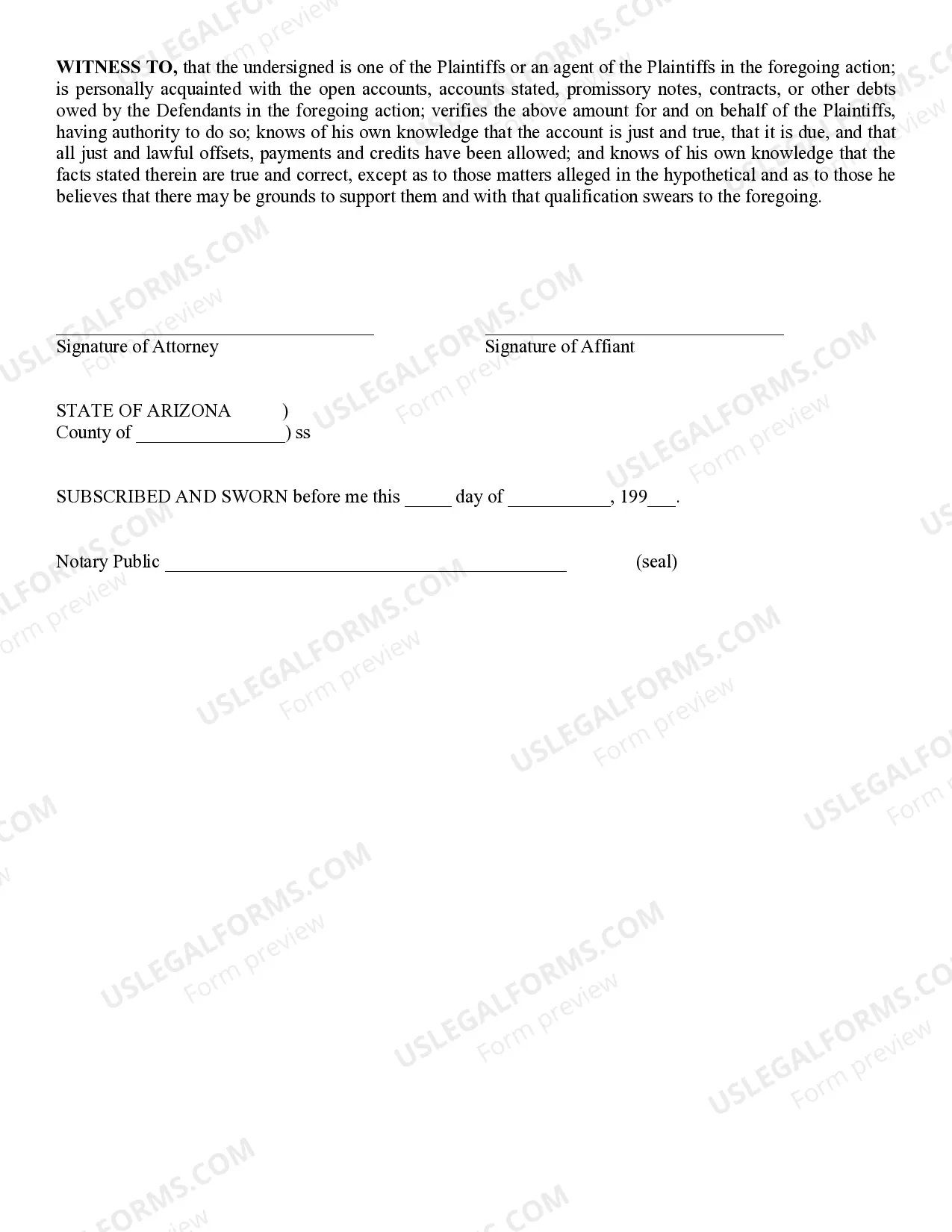

Complaint: This complaint, which begins the action against another party, is used when one party owes money to another on an open account. This form is to be signed in front of a Notary Public. This form is offered in both Word and Rich Text formats.

Title: Understanding Tempe Arizona Complaint for Monies Owed: Types and Process Introduction: When financial obligations go unpaid in Tempe, Arizona, it may result in individuals or businesses filing a complaint for monies owed. This legal action aims to seek reimbursement for outstanding debts, ensuring fairness and resolving financial disputes. In this article, we will delve into the various types of Tempe Arizona Complaints for Monies Owed, the key steps involved in the process, and relevant information on resolving such disputes effectively. Types of Tempe Arizona Complaints for Monies Owed: 1. Personal Loan Defaults: Individuals who fail to repay loans provided by friends, family members, or acquaintances may face a complaint for monies owed. This type typically involves informal agreements or promissory notes related to personal finances. 2. Business Debts: Entrepreneurs or business owners who encounter non-payment issues with clients, suppliers, or partners can file a complaint for outstanding invoices or services rendered. This type often involves formal contracts, purchase orders, or invoices tied to commercial transactions. 3. Rental Arrears: Landlords facing unpaid rental fees or tenants disputing unjust deductions from their security deposit may engage in a complaint for monies owed. This type generally arises from rental agreements or lease contracts. 4. Unpaid Services: Individuals or businesses providing professional services (such as contractors, freelancers, or consultants) can initiate a complaint if their clients do not remunerate for the rendered services. Examples include outstanding invoices for repairs, marketing campaigns, or legal advice. The Complaint Process: 1. Documentation: Gather all relevant documents pertaining to the money owed, such as contracts, invoices, payment receipts, and correspondence related to collection attempts made. 2. Mediation: Before filing a complaint, parties can attempt mediation to reach a mutually agreeable resolution. Mediation involves a neutral third-party assisting in negotiations, aiming to avoid legal proceedings. 3. Filing the Complaint: If mediation fails or is not a viable option, the complainant should draft and file a formal complaint with the Tempe, Arizona court. The complaint should include essential details such as names, addresses, amounts owed, the nature of the debt, and any supporting evidence. 4. Serving the Defendant: Once the complaint is filed, the complainant must serve the defendant with legal notice, ensuring they are aware of the complaint and the legal proceedings initiated against them. 5. Responding to the Complaint: The defendant must file a formal response to the complaint within the specified timeframe. Failure to respond may result in a default judgment against them. 6. Court Process: Following the defendant's response, the court will schedule hearings, allowing both parties to present their case and provide supporting evidence. The court will then make a judgment based on the evidence and applicable laws. Resolving Monies Owed Disputes: 1. Settlement: Throughout the legal process, parties may choose to engage in settlement negotiations, seeking a compromise that satisfies both parties without going through a full trial. 2. Judgment Enforcement: If the court rules in favor of the complainant, the judgment awarded must be enforced. This involves pursuing collection actions against the defendant, possibly including wage garnishment, property liens, or bank account levies to reclaim the owed monies. Conclusion: Tempe, Arizona Complaints for Monies Owed encompass various types of disputes related to unpaid financial obligations. Understanding the process and types of complaints is crucial when seeking reimbursement for debts. By following the proper legal procedures, parties can resolve their disputes and obtain rightful compensation.Title: Understanding Tempe Arizona Complaint for Monies Owed: Types and Process Introduction: When financial obligations go unpaid in Tempe, Arizona, it may result in individuals or businesses filing a complaint for monies owed. This legal action aims to seek reimbursement for outstanding debts, ensuring fairness and resolving financial disputes. In this article, we will delve into the various types of Tempe Arizona Complaints for Monies Owed, the key steps involved in the process, and relevant information on resolving such disputes effectively. Types of Tempe Arizona Complaints for Monies Owed: 1. Personal Loan Defaults: Individuals who fail to repay loans provided by friends, family members, or acquaintances may face a complaint for monies owed. This type typically involves informal agreements or promissory notes related to personal finances. 2. Business Debts: Entrepreneurs or business owners who encounter non-payment issues with clients, suppliers, or partners can file a complaint for outstanding invoices or services rendered. This type often involves formal contracts, purchase orders, or invoices tied to commercial transactions. 3. Rental Arrears: Landlords facing unpaid rental fees or tenants disputing unjust deductions from their security deposit may engage in a complaint for monies owed. This type generally arises from rental agreements or lease contracts. 4. Unpaid Services: Individuals or businesses providing professional services (such as contractors, freelancers, or consultants) can initiate a complaint if their clients do not remunerate for the rendered services. Examples include outstanding invoices for repairs, marketing campaigns, or legal advice. The Complaint Process: 1. Documentation: Gather all relevant documents pertaining to the money owed, such as contracts, invoices, payment receipts, and correspondence related to collection attempts made. 2. Mediation: Before filing a complaint, parties can attempt mediation to reach a mutually agreeable resolution. Mediation involves a neutral third-party assisting in negotiations, aiming to avoid legal proceedings. 3. Filing the Complaint: If mediation fails or is not a viable option, the complainant should draft and file a formal complaint with the Tempe, Arizona court. The complaint should include essential details such as names, addresses, amounts owed, the nature of the debt, and any supporting evidence. 4. Serving the Defendant: Once the complaint is filed, the complainant must serve the defendant with legal notice, ensuring they are aware of the complaint and the legal proceedings initiated against them. 5. Responding to the Complaint: The defendant must file a formal response to the complaint within the specified timeframe. Failure to respond may result in a default judgment against them. 6. Court Process: Following the defendant's response, the court will schedule hearings, allowing both parties to present their case and provide supporting evidence. The court will then make a judgment based on the evidence and applicable laws. Resolving Monies Owed Disputes: 1. Settlement: Throughout the legal process, parties may choose to engage in settlement negotiations, seeking a compromise that satisfies both parties without going through a full trial. 2. Judgment Enforcement: If the court rules in favor of the complainant, the judgment awarded must be enforced. This involves pursuing collection actions against the defendant, possibly including wage garnishment, property liens, or bank account levies to reclaim the owed monies. Conclusion: Tempe, Arizona Complaints for Monies Owed encompass various types of disputes related to unpaid financial obligations. Understanding the process and types of complaints is crucial when seeking reimbursement for debts. By following the proper legal procedures, parties can resolve their disputes and obtain rightful compensation.