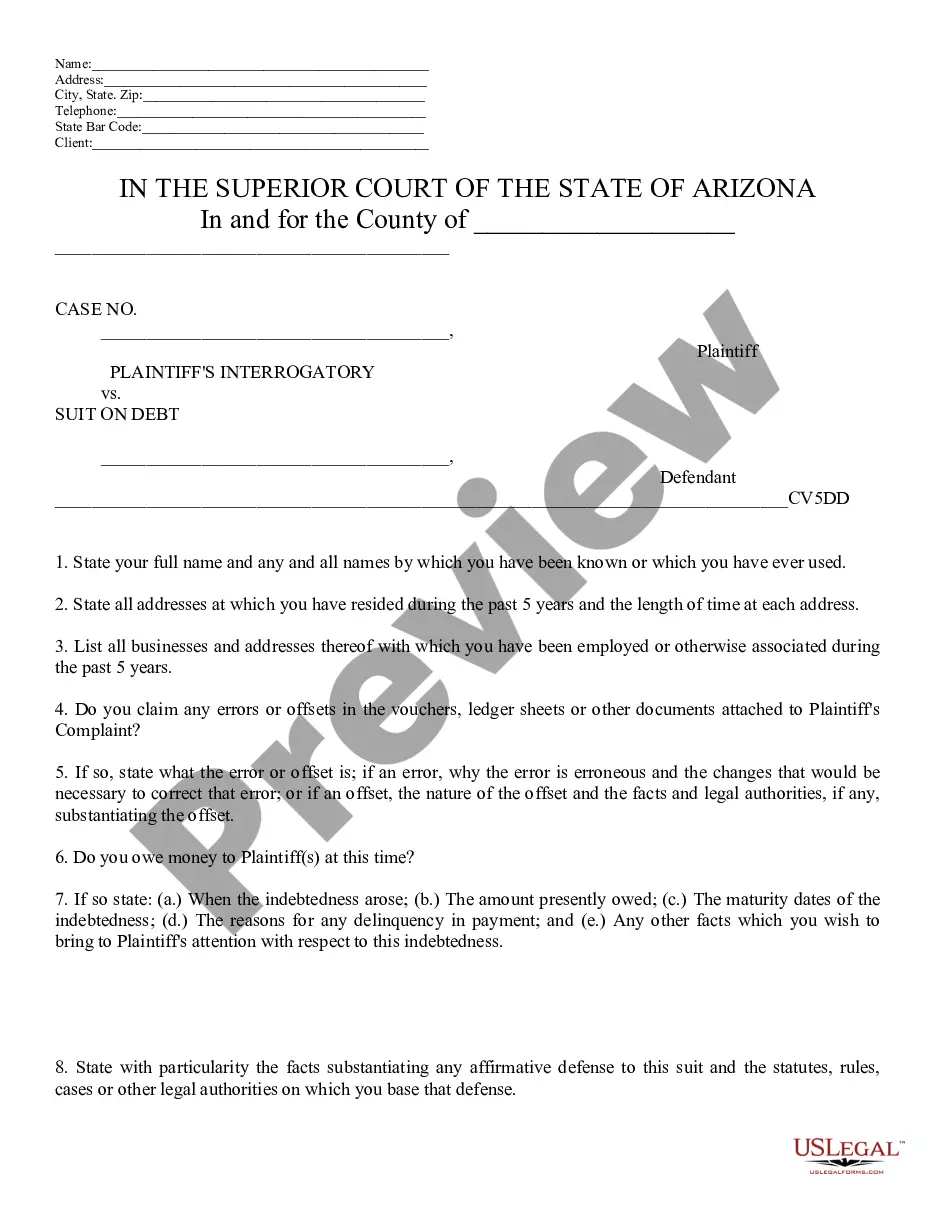

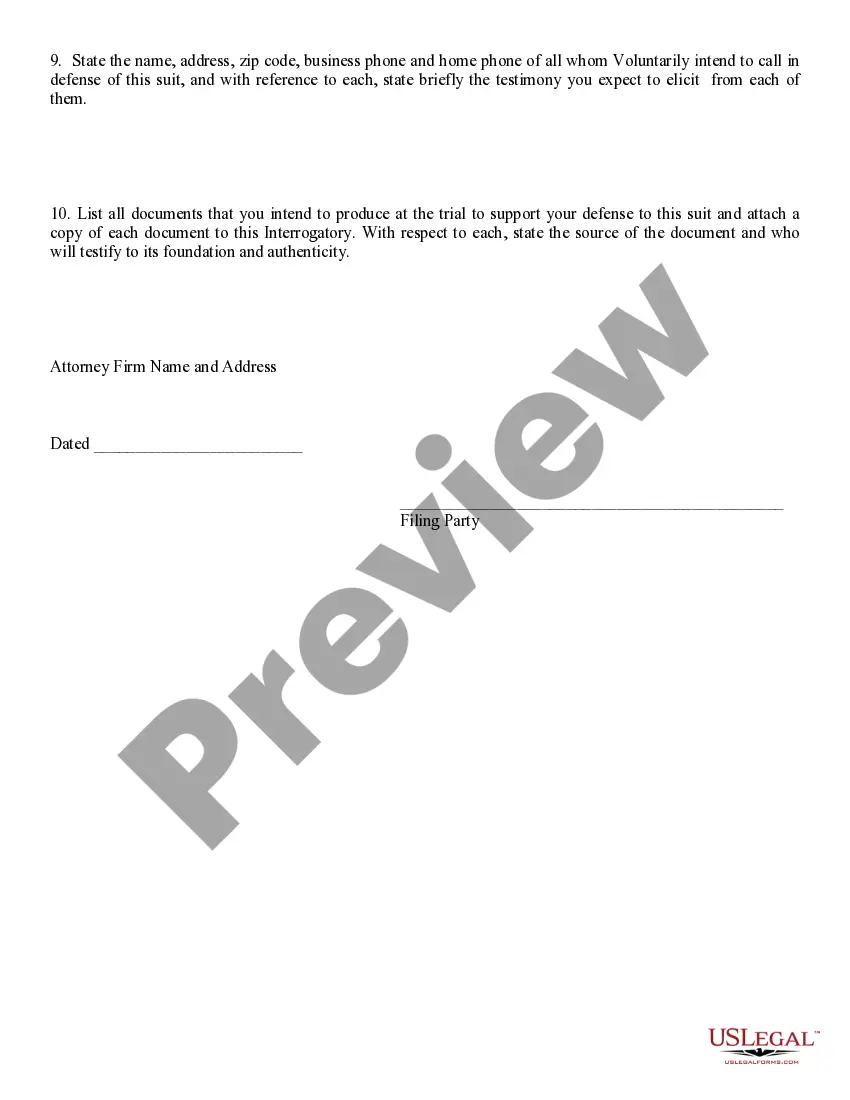

Plaintiffs Interrogatory Suit on Debt: These are sample questions to ask opposing counsel in a suit dealing with an unpaid debt. You should use these as a starting point only, and add or subtract other questions, as would benefit your lawsuit. This form is offered in both Word and Rich Text formats.

Surprise Arizona Plaintiffs Interrogatory Suit on Debt refers to a legal proceeding filed by plaintiffs in Surprise, Arizona, when seeking financial compensation from debtors who have defaulted on their obligations. This legal action utilizes interrogatories, which are written questions posed by one party to another, to gather important information about the debt in question, the debtor's financial situation, and any relevant evidence. In this type of suit, plaintiffs typically serve the debtors with interrogatories, asking specific questions related to the debt and the circumstances of it. The purpose is to obtain detailed and accurate information about the debtor's assets, income, expenses, and any other relevant factors that may aid in recovering the outstanding debt. These interrogatories often cover a broad range of topics, including the debtor's employment history, previous financial transactions, outstanding loans, bank account details, and any other properties or assets they may possess. The specific questions may vary depending on the nature of the debt, the debt agreement, and the individual circumstances of the case. By filing an interrogatory suit on debt, plaintiffs aim to gather all the necessary information to build a strong case and improve their chances of successfully recovering the owed funds. This legal action forces debtors to provide detailed responses under penalty of perjury, ensuring that they cannot evade disclosing important financial information related to the debt. Different types of Surprise Arizona Plaintiffs Interrogatory Suit on Debt may include: 1. Credit card debt interrogatory suit: In this case, the plaintiff is a credit card company or a debt collection agency representing the creditor. The suit seeks to recover outstanding credit card debt, and the interrogatories focus on obtaining information about the debtor's credit card usage, payment history, and financial situation. 2. Mortgage debt interrogatory suit: Here, the plaintiff is typically a bank or a mortgage lender looking to recover unpaid mortgage payments. The interrogatories in such cases aim to uncover details about the mortgage agreement, the debtor's financial viability, and any assets related to the property. 3. Personal loan debt interrogatory suit: This type involves an individual or a business entity filing a suit against a debtor who has defaulted on a personal loan. The interrogatories may seek information about the loan agreement, the debtor's income, employment history, and available assets. In summary, Surprise Arizona Plaintiffs Interrogatory Suit on Debt is a comprehensive legal process through which plaintiffs in Surprise, Arizona, use written interrogatories to gather crucial information from debtors who have defaulted on their financial obligations. This method allows plaintiffs to obtain accurate details about the debt and the debtor's financial situation, increasing their chances of recovering the owed funds.Surprise Arizona Plaintiffs Interrogatory Suit on Debt refers to a legal proceeding filed by plaintiffs in Surprise, Arizona, when seeking financial compensation from debtors who have defaulted on their obligations. This legal action utilizes interrogatories, which are written questions posed by one party to another, to gather important information about the debt in question, the debtor's financial situation, and any relevant evidence. In this type of suit, plaintiffs typically serve the debtors with interrogatories, asking specific questions related to the debt and the circumstances of it. The purpose is to obtain detailed and accurate information about the debtor's assets, income, expenses, and any other relevant factors that may aid in recovering the outstanding debt. These interrogatories often cover a broad range of topics, including the debtor's employment history, previous financial transactions, outstanding loans, bank account details, and any other properties or assets they may possess. The specific questions may vary depending on the nature of the debt, the debt agreement, and the individual circumstances of the case. By filing an interrogatory suit on debt, plaintiffs aim to gather all the necessary information to build a strong case and improve their chances of successfully recovering the owed funds. This legal action forces debtors to provide detailed responses under penalty of perjury, ensuring that they cannot evade disclosing important financial information related to the debt. Different types of Surprise Arizona Plaintiffs Interrogatory Suit on Debt may include: 1. Credit card debt interrogatory suit: In this case, the plaintiff is a credit card company or a debt collection agency representing the creditor. The suit seeks to recover outstanding credit card debt, and the interrogatories focus on obtaining information about the debtor's credit card usage, payment history, and financial situation. 2. Mortgage debt interrogatory suit: Here, the plaintiff is typically a bank or a mortgage lender looking to recover unpaid mortgage payments. The interrogatories in such cases aim to uncover details about the mortgage agreement, the debtor's financial viability, and any assets related to the property. 3. Personal loan debt interrogatory suit: This type involves an individual or a business entity filing a suit against a debtor who has defaulted on a personal loan. The interrogatories may seek information about the loan agreement, the debtor's income, employment history, and available assets. In summary, Surprise Arizona Plaintiffs Interrogatory Suit on Debt is a comprehensive legal process through which plaintiffs in Surprise, Arizona, use written interrogatories to gather crucial information from debtors who have defaulted on their financial obligations. This method allows plaintiffs to obtain accurate details about the debt and the debtor's financial situation, increasing their chances of recovering the owed funds.