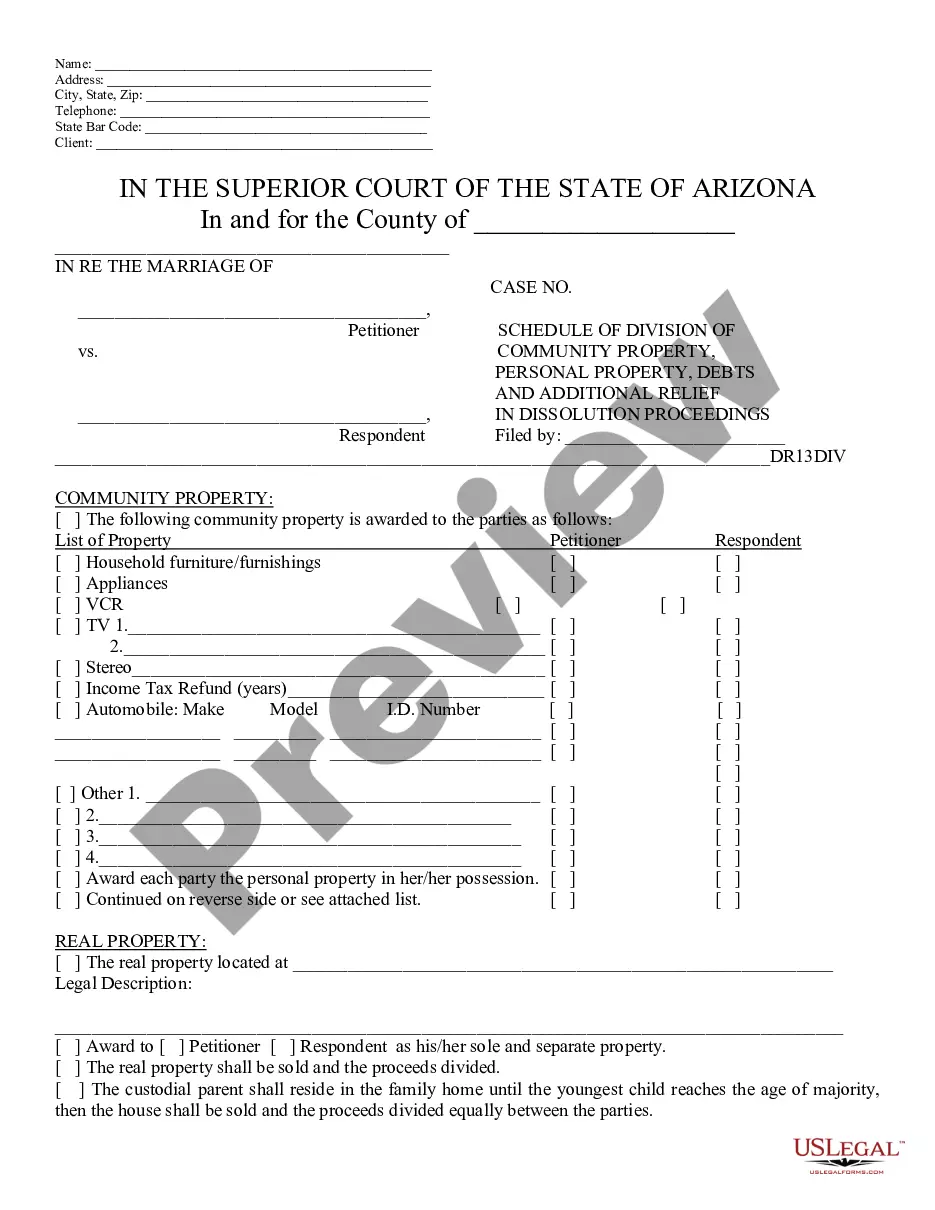

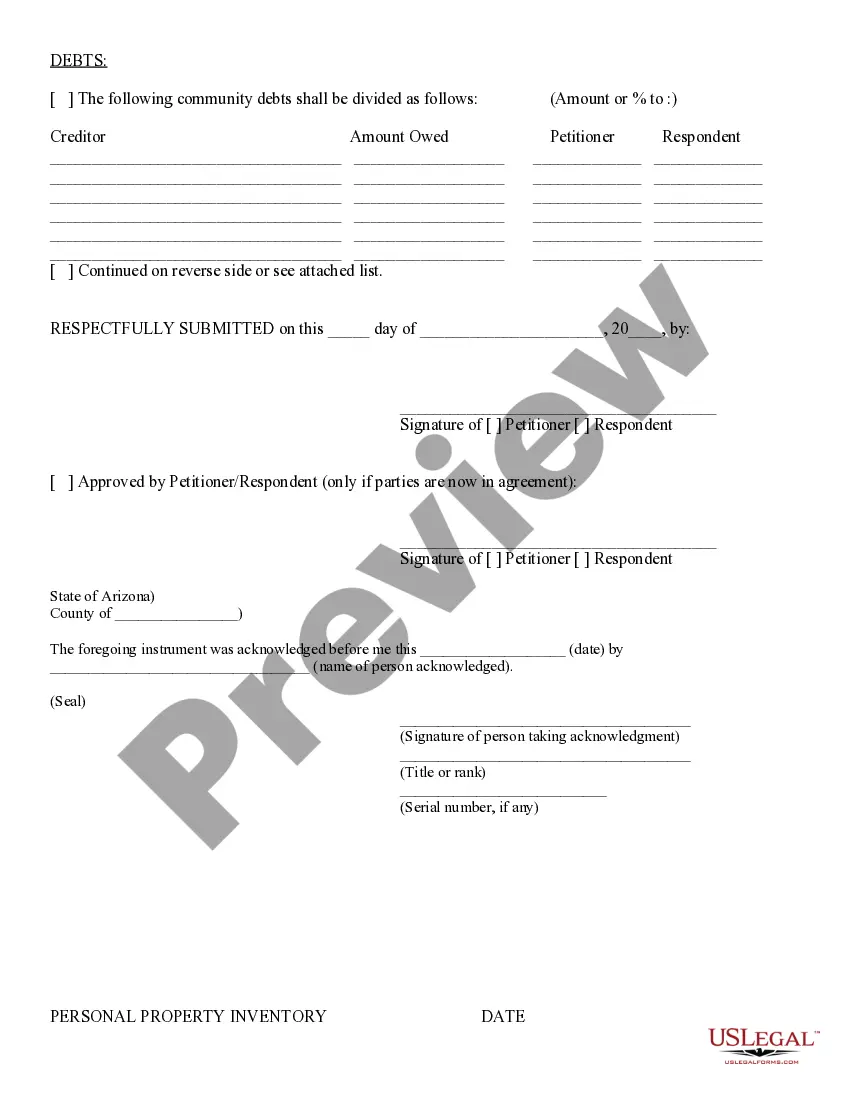

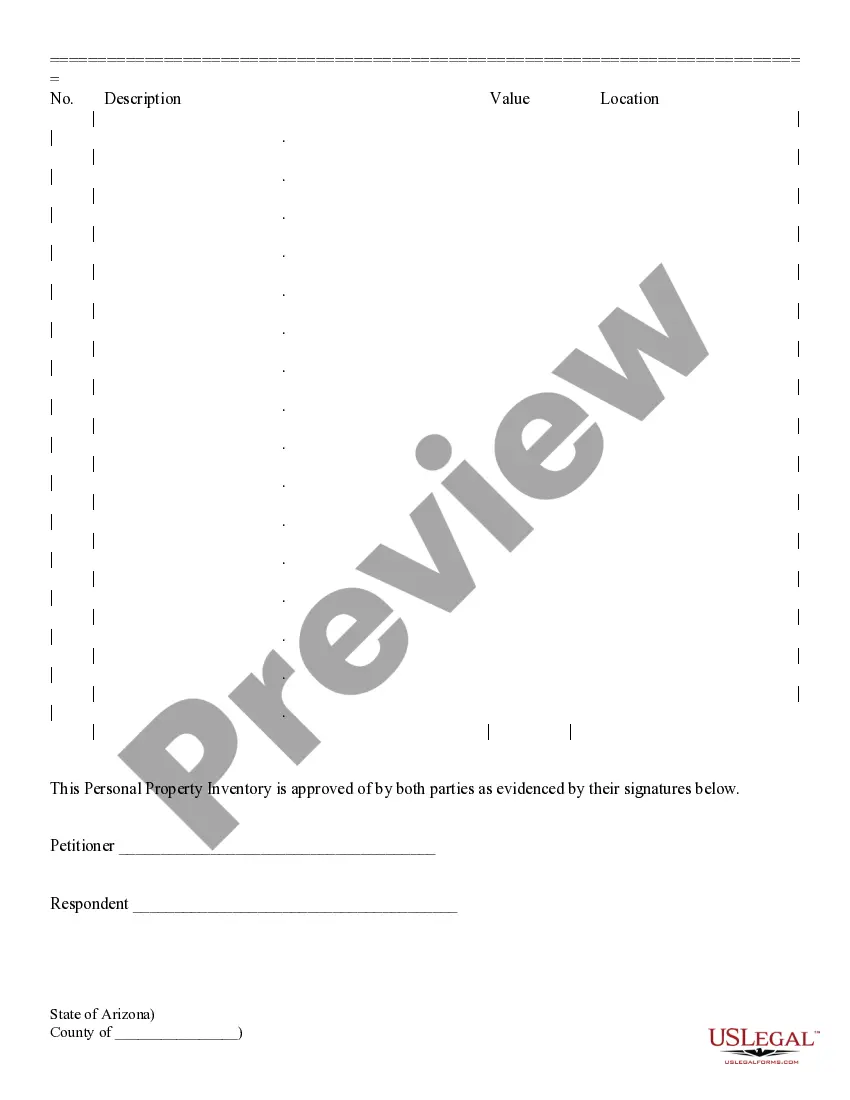

Schedule of Division of Community Property and Additional Relief: The schedule divides all of the assets, debts and property a couple accumulated during their marriage. It further lists exactly what each spouse will be able to take. This form is available in both Word and Rich Text formats.

Surprise Arizona Schedule of Division of Community Property and Additional Relief

Description

How to fill out Arizona Schedule Of Division Of Community Property And Additional Relief?

Do you require a dependable and affordable provider of legal forms to acquire the Surprise Arizona Schedule of Division of Community Property and Additional Relief? US Legal Forms is your ideal answer.

Whether you need a straightforward agreement to set guidelines for living together with your partner or a collection of documents to facilitate your divorce through the court system, we have you covered. Our platform features over 85,000 current legal document templates for personal and business usage. All templates we provide are not generic and tailored according to the regulations of individual states and counties.

To download the form, you must Log In to your account, find the needed form, and click the Download button next to it. Please bear in mind that you can retrieve your previously acquired form templates at any time from the My documents tab.

Are you a newcomer to our platform? No problem. You can set up an account quickly, but first, ensure to do the following.

Now you can create your account. Then choose the subscription option and proceed to the payment stage. Once your payment is processed, download the Surprise Arizona Schedule of Division of Community Property and Additional Relief in any available file format. You can revisit the website whenever needed and redownload the form at no additional charge.

Finding current legal documents has never been simpler. Try US Legal Forms today, and put an end to wasting hours researching legal documents online once and for all.

- Check if the Surprise Arizona Schedule of Division of Community Property and Additional Relief complies with the laws of your state and locality.

- Review the details of the form (if available) to understand who and what the form is appropriate for.

- Re-initialize your search if the form does not align with your legal needs.

Form popularity

FAQ

If you fail to respond to divorce papers in Arizona, the court may proceed with a default judgment against you. This could result in unfavorable terms regarding the division of property and responsibility for debts. It is essential to engage with the process and seek assistance, possibly from a platform like uslegalforms, to ensure your rights are protected under the Surprise Arizona Schedule of Division of Community Property and Additional Relief.

The choice between community property and community property with right of survivorship depends on your specific needs. If you prioritize straightforward transfer of ownership upon death, the latter may be preferable. However, if you wish to maintain flexibility in estate planning, traditional community property may be more suitable. Understanding these options in relation to the Surprise Arizona Schedule of Division of Community Property and Additional Relief can help you make an informed decision.

One key disadvantage of community property with a right of survivorship is that it can limit each spouse’s control over their share of the property. Upon the death of one spouse, the property automatically transfers to the surviving spouse, bypassing the estate process. This can be problematic if a spouse wants to leave their half to someone else, making it vital to consider the implications in the context of the Surprise Arizona Schedule of Division of Community Property and Additional Relief.

For married couples, the best form of tenancy is often community property. This ownership method allows both spouses to share equal rights over the property, which is advantageous when considering the Surprise Arizona Schedule of Division of Community Property and Additional Relief. In this setup, both partners benefit from any appreciation in value, and it supports equitable distribution during divorce proceedings.

In Arizona, one spouse can file for divorce even if the other spouse does not agree. The process will move forward as long as the filing spouse meets the necessary legal requirements. Understanding the implications for property division, particularly through the Surprise Arizona Schedule of Division of Community Property and Additional Relief, can help navigate these circumstances.

The 10-year rule in Arizona refers to the presumption that, after ten years of continuous marriage, assets accumulated during that time are classified as community property. This rule is important when determining property division in divorce cases. For detailed clarification, the Surprise Arizona Schedule of Division of Community Property and Additional Relief is a helpful resource.

In Arizona, property division during a divorce is based on the community property laws, which require an equitable distribution of assets. This means that all marital property will be divided fairly, considering both parties' contributions and needs. Understanding the Surprise Arizona Schedule of Division of Community Property and Additional Relief can guide you through this process effectively.

To terminate community property in Arizona, spouses may agree to divide their shared assets through a written agreement or court order. This process typically occurs during divorce proceedings. Utilizing the Surprise Arizona Schedule of Division of Community Property and Additional Relief can streamline the process and ensure all aspects are addressed.

Community property rules dictate that all property acquired during the marriage is owned equally by both spouses, regardless of whose name is on the title. Any income, debts, or investments made during the marriage fall under this rule. To simplify the complex process of asset division, many couples consult the Surprise Arizona Schedule of Division of Community Property and Additional Relief.

In Arizona, the community property statute establishes that all assets and debts acquired during a marriage are considered joint property. This means that both spouses have equal ownership rights to these assets. When dealing with a divorce, understanding the Surprise Arizona Schedule of Division of Community Property and Additional Relief can help ensure a fair division of these assets.