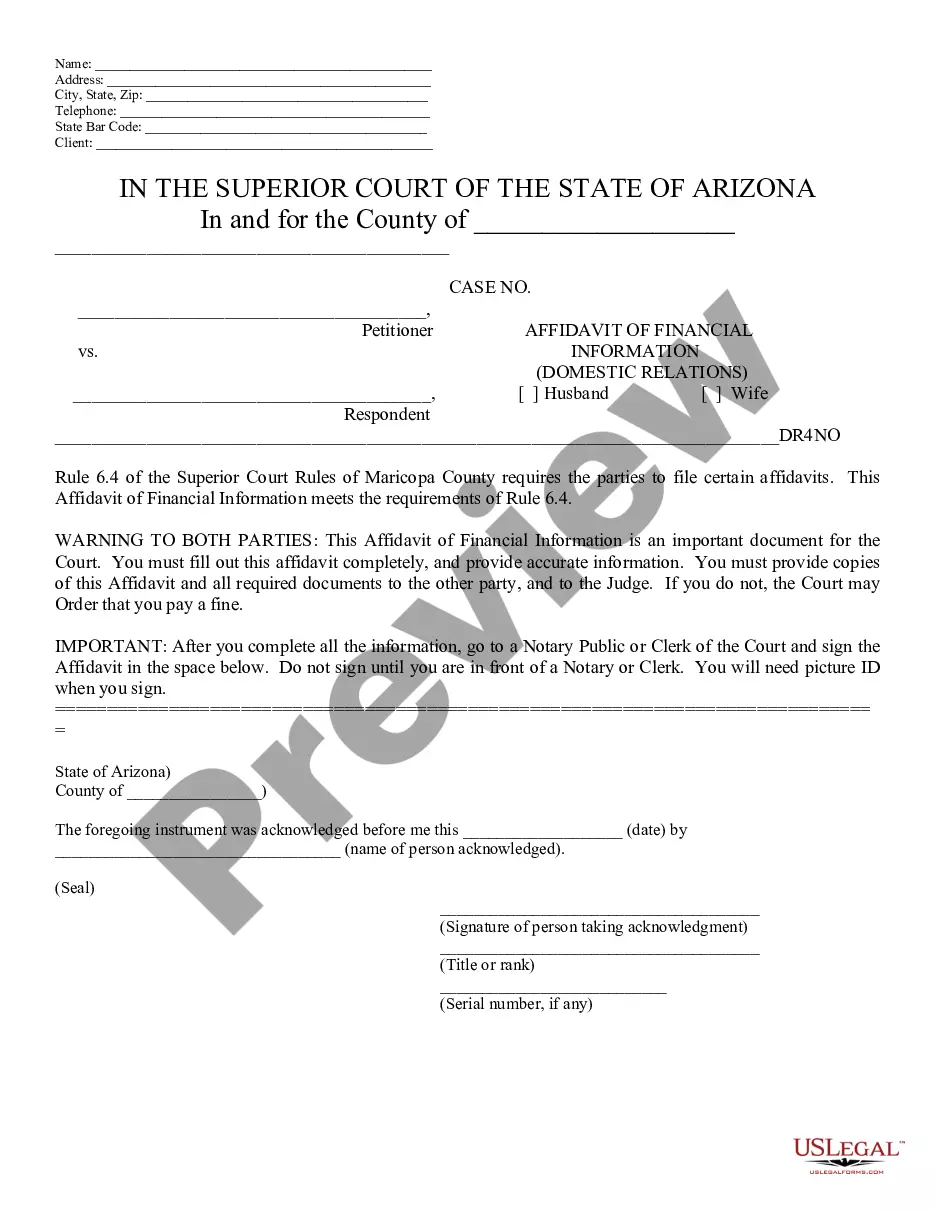

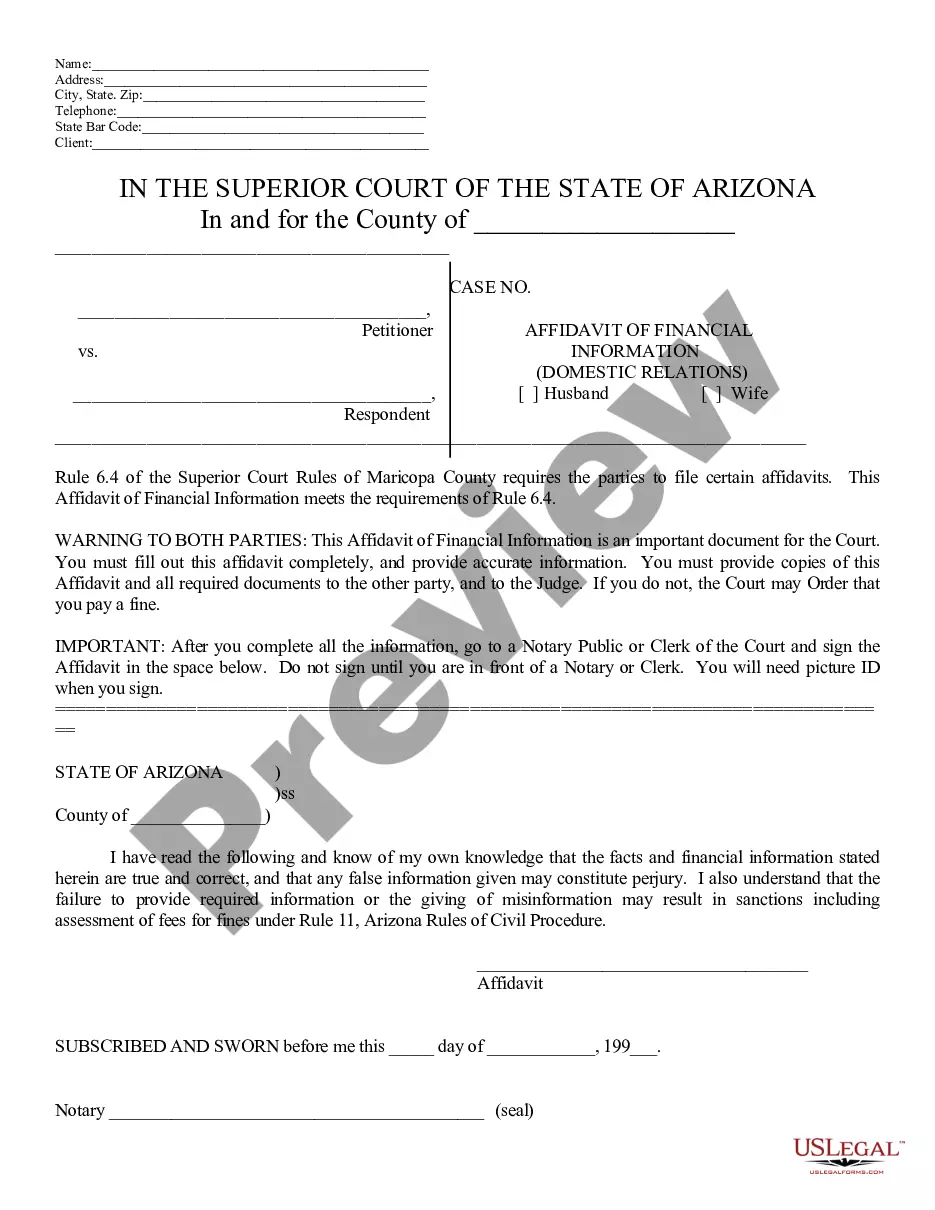

An Affidavit is a sworn, written statement of facts, signed by the 'affiant' (the person making the statement) before a notary public or other official witness. The affiant swears to the truth and accuracy of the statement contained in the affidavit. This document, an Affidavit of Financial Information , is a model affidavit for recording the type of information stated. It must be signed before a notary, who must sign and stamp the document. Adapt the text to fit your facts. Available for download now in standard format(s).

The Phoenix Arizona Affidavit of Financial Information is a legal document that is commonly required in various legal proceedings, including divorces, child custody cases, and spousal support determinations. It serves as a comprehensive financial disclosure tool, allowing individuals to provide detailed information about their income, assets, expenses, and liabilities. This affidavit is essential in determining the financial capability and obligations of the parties involved in a legal proceeding. It helps to ensure that all relevant financial information is provided and considered when making decisions related to support payments, equitable distribution of assets, and other financial matters. The Phoenix Arizona Affidavit of Financial Information typically consists of multiple sections that cover different aspects of an individual's financial situation. These sections may include: 1. Personal Information: This section requires individuals to provide their full legal name, current address, contact details, and relevant identification information. 2. Income: Here, individuals must disclose their sources of income, including employment earnings, self-employment income, rental income, investments, and any other form of regular income they receive. 3. Expenses: This section requires a detailed breakdown of an individual's monthly expenses, such as rent/mortgage payments, utilities, insurance, transportation costs, child care expenses, debt payments, and other regular expenditures. 4. Assets: Individuals are required to list all their assets, including real estate properties, vehicles, bank accounts, investments, retirement accounts, and any other valuable possessions they own. 5. Liabilities: This section covers all debts and financial obligations, such as credit card debts, loans, mortgages, child support or alimony payments, and any other liabilities an individual may have. 6. Financial History: Here, individuals may be asked to provide information about any bankruptcies, foreclosures, or other relevant financial events that have occurred in the past. It is important to note that while the content may vary depending on the specific legal proceeding, the purpose of the Phoenix Arizona Affidavit of Financial Information remains consistent. By completing this document truthfully and comprehensively, individuals can ensure a fair and accurate assessment of their financial status and enable the legal system to make informed decisions. Types of Phoenix Arizona Affidavit of Financial Information may vary depending on the specific legal proceeding. For example, there may be variations for divorce cases, child custody cases, and spousal support cases. Additionally, different courts or jurisdictions may have their own specific forms or formats. Therefore, it is crucial for individuals to consult with an attorney or refer to the specific guidelines provided by the relevant court to ensure accuracy and compliance with the appropriate form.