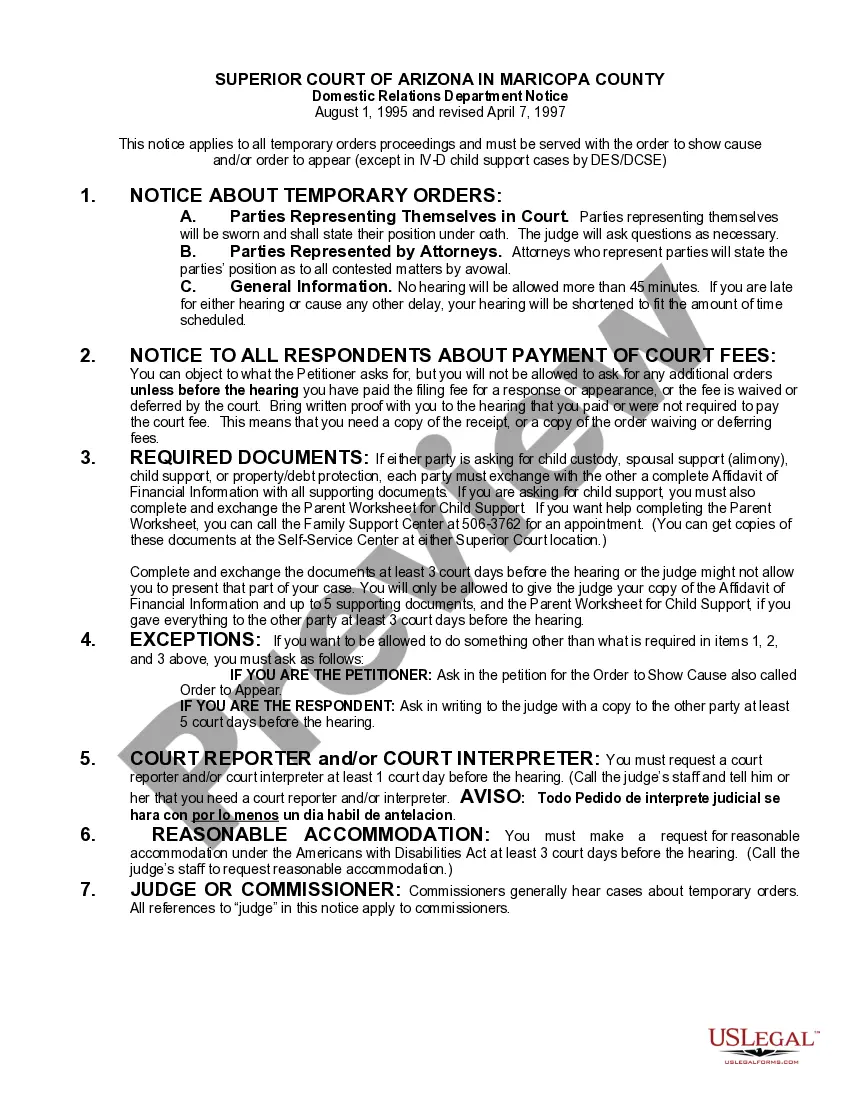

Domestic Relations Department Notice and Return Notice: This Domestic Relations Notice applies to all cases involving Temporary Order proceedings. It is to be served with both the Order to Show Cause and Order to Appear. This form is available in both Word and Rich Text formats.

Maricopa Arizona DR Department Notice and Return Notice, also known as Maricopa County Department of Revenue Notice and Return Notice, is an official correspondence sent by the tax department of Maricopa County, Arizona. These notices typically pertain to various tax-related matters and serve as means of communication between the county's revenue department and taxpayers. The Maricopa County Department of Revenue issues different types of notices and return notices depending on the specific tax issues being addressed. Some common types of DR Department Notice and Return Notice include: 1. Property Tax Notice: This type of notice informs property owners about their assessed property value, applicable tax rates, and the amount of property tax due. It serves as an alert for property owners to make timely tax payments to avoid penalties or legal consequences. 2. Delinquency Notice: A Delinquency Notice is sent to taxpayers who have failed to pay their taxes on time or are behind on their payments. It serves as a reminder for individuals or businesses to settle their outstanding tax balances promptly to avoid further penalties or potential legal actions. 3. Audit Notice: An Audit Notice is sent to notify taxpayers that their tax returns or financial records are being audited to ensure compliance with the tax laws and regulations. This notice will explain the scope of the audit, provide instructions on required documentation, and highlight any potential issues detected during the initial assessment. 4. Overpayment Notice: An Overpayment Notice is issued when an individual or business has paid more than the required amount of tax owed. This notice notifies taxpayers of the excess payment and provides instructions on how to request a refund or apply the overpayment towards future tax obligations. 5. Assessment Notice: An Assessment Notice is sent when the Maricopa County Department of Revenue determines that additional taxes are owed by a taxpayer. This notice specifies the reasons for the assessment, the amount due, and the deadline for payment or filing an appeal. It is important for recipients of Maricopa Arizona DR Department Notice and Return Notice to carefully review the contents of the notice, understand the underlying tax issue being addressed, and take appropriate actions within the given timeframe to avoid further complications or penalties. If an individual or business is uncertain about the notice's content or requirements, seeking professional tax advice from a qualified accountant or tax attorney is recommended.Maricopa Arizona DR Department Notice and Return Notice, also known as Maricopa County Department of Revenue Notice and Return Notice, is an official correspondence sent by the tax department of Maricopa County, Arizona. These notices typically pertain to various tax-related matters and serve as means of communication between the county's revenue department and taxpayers. The Maricopa County Department of Revenue issues different types of notices and return notices depending on the specific tax issues being addressed. Some common types of DR Department Notice and Return Notice include: 1. Property Tax Notice: This type of notice informs property owners about their assessed property value, applicable tax rates, and the amount of property tax due. It serves as an alert for property owners to make timely tax payments to avoid penalties or legal consequences. 2. Delinquency Notice: A Delinquency Notice is sent to taxpayers who have failed to pay their taxes on time or are behind on their payments. It serves as a reminder for individuals or businesses to settle their outstanding tax balances promptly to avoid further penalties or potential legal actions. 3. Audit Notice: An Audit Notice is sent to notify taxpayers that their tax returns or financial records are being audited to ensure compliance with the tax laws and regulations. This notice will explain the scope of the audit, provide instructions on required documentation, and highlight any potential issues detected during the initial assessment. 4. Overpayment Notice: An Overpayment Notice is issued when an individual or business has paid more than the required amount of tax owed. This notice notifies taxpayers of the excess payment and provides instructions on how to request a refund or apply the overpayment towards future tax obligations. 5. Assessment Notice: An Assessment Notice is sent when the Maricopa County Department of Revenue determines that additional taxes are owed by a taxpayer. This notice specifies the reasons for the assessment, the amount due, and the deadline for payment or filing an appeal. It is important for recipients of Maricopa Arizona DR Department Notice and Return Notice to carefully review the contents of the notice, understand the underlying tax issue being addressed, and take appropriate actions within the given timeframe to avoid further complications or penalties. If an individual or business is uncertain about the notice's content or requirements, seeking professional tax advice from a qualified accountant or tax attorney is recommended.