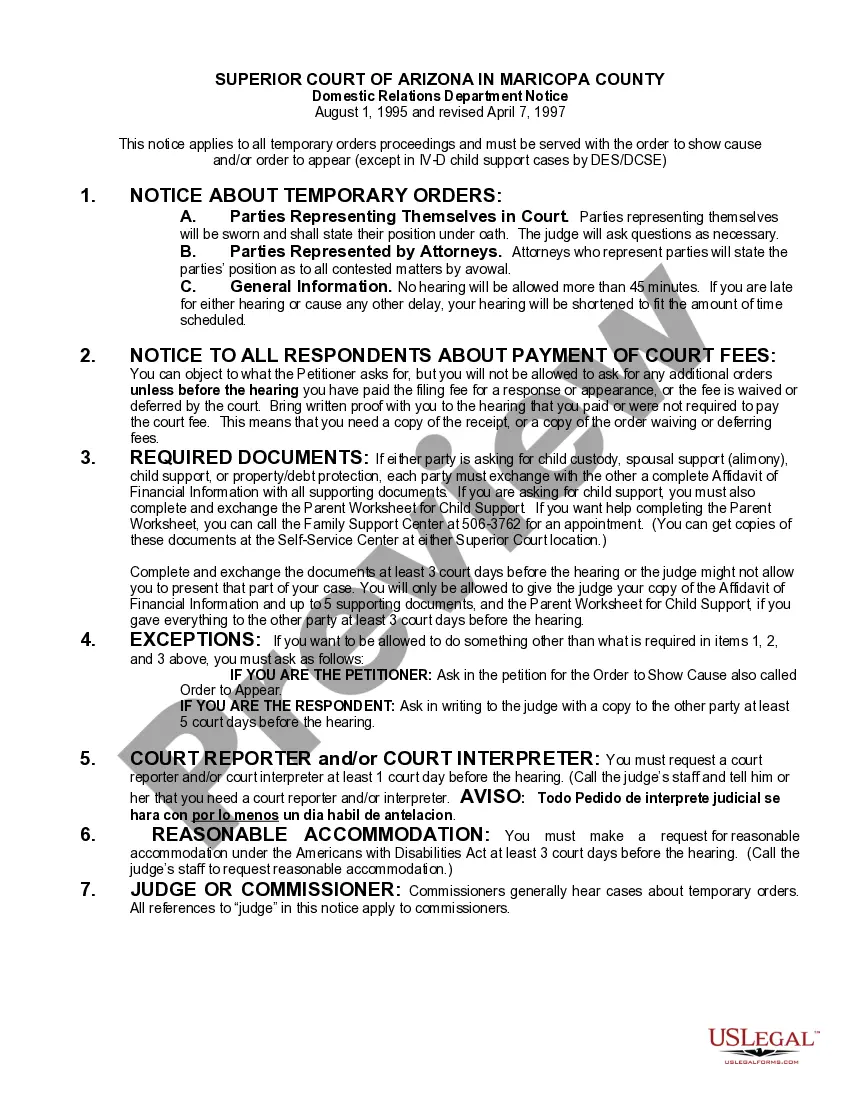

Domestic Relations Department Notice and Return Notice: This Domestic Relations Notice applies to all cases involving Temporary Order proceedings. It is to be served with both the Order to Show Cause and Order to Appear. This form is available in both Word and Rich Text formats.

The Phoenix Arizona DR Department Notice and Return Notice is a formal document issued by the Department of Revenue (DR) in the city of Phoenix, Arizona. It serves as a notice to individuals or businesses regarding any outstanding tax obligations, delinquencies, or non-compliance with tax laws in the city. This notice plays a crucial role in ensuring that individuals and businesses are aware of their tax responsibilities and take necessary actions to rectify any issues. It is typically sent via mail to the address registered with the DR Department, but it can also be delivered electronically or served in person. It contains important information, including the taxpayer's name, identification number, the amount owed, the due date, and instructions on how to address the matter. The Phoenix Arizona DR Department Notice can encompass various specific types depending on the nature of the tax-related concern. These may include: 1. Delinquency Notice: Sent to taxpayers who have failed to pay their taxes on time or have not filed their tax returns by the designated deadline. This notice notifies them about the outstanding balance and provides the opportunity to settle the debt or file the necessary returns. 2. Non-Compliance Notice: Issued to individuals or businesses who have not complied with tax laws, regulations, or reporting requirements. It informs the recipient about the specific areas of non-compliance, the penalties or consequences, and the steps to resolve the issue. 3. Tax Audit Notice: This type of notice is sent when an individual or business is selected for a tax audit. It outlines the specific tax years or periods under review, the documents or information required, and the date by which the requested information must be provided. 4. Collection Notice: Sent to taxpayers who have not responded to previous notices or have failed to make arrangements for payment. It serves as a final warning before taking legal actions, such as wage garnishment, bank levy, or the filing of a tax lien. These different types of notices ensure that taxpayers are well-informed about any outstanding tax matters and provide an opportunity to rectify any issues before more severe actions are taken. It is essential to respond promptly and adequately to these notices to avoid further penalties and potential legal consequences.The Phoenix Arizona DR Department Notice and Return Notice is a formal document issued by the Department of Revenue (DR) in the city of Phoenix, Arizona. It serves as a notice to individuals or businesses regarding any outstanding tax obligations, delinquencies, or non-compliance with tax laws in the city. This notice plays a crucial role in ensuring that individuals and businesses are aware of their tax responsibilities and take necessary actions to rectify any issues. It is typically sent via mail to the address registered with the DR Department, but it can also be delivered electronically or served in person. It contains important information, including the taxpayer's name, identification number, the amount owed, the due date, and instructions on how to address the matter. The Phoenix Arizona DR Department Notice can encompass various specific types depending on the nature of the tax-related concern. These may include: 1. Delinquency Notice: Sent to taxpayers who have failed to pay their taxes on time or have not filed their tax returns by the designated deadline. This notice notifies them about the outstanding balance and provides the opportunity to settle the debt or file the necessary returns. 2. Non-Compliance Notice: Issued to individuals or businesses who have not complied with tax laws, regulations, or reporting requirements. It informs the recipient about the specific areas of non-compliance, the penalties or consequences, and the steps to resolve the issue. 3. Tax Audit Notice: This type of notice is sent when an individual or business is selected for a tax audit. It outlines the specific tax years or periods under review, the documents or information required, and the date by which the requested information must be provided. 4. Collection Notice: Sent to taxpayers who have not responded to previous notices or have failed to make arrangements for payment. It serves as a final warning before taking legal actions, such as wage garnishment, bank levy, or the filing of a tax lien. These different types of notices ensure that taxpayers are well-informed about any outstanding tax matters and provide an opportunity to rectify any issues before more severe actions are taken. It is essential to respond promptly and adequately to these notices to avoid further penalties and potential legal consequences.