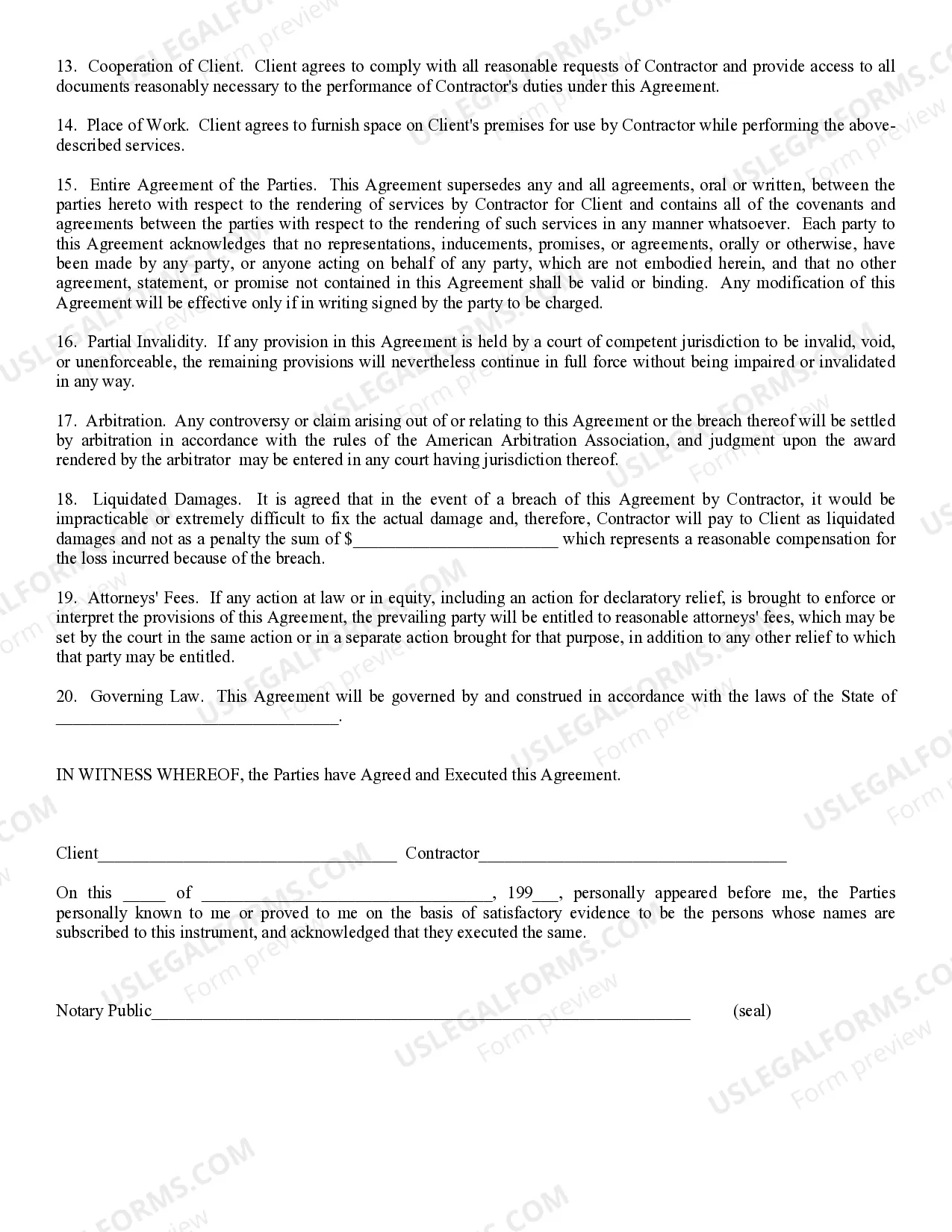

Independent Contractor: This is a contract to be used by an independent contractor. The independent contractor uses this type of contract before beginning a job with either a sub-contractor and/or Owner of a parcel of land. This form is available in both Word and Rich Text formats.

Maricopa Arizona Self-Employed Independent Contractor Agreement

Description

How to fill out Arizona Self-Employed Independent Contractor Agreement?

We consistently seek to lessen or evade legal complications when handling intricate legal or financial issues.

To achieve this, we request legal support that, generally, is exceedingly expensive.

Nevertheless, not all legal matters are equally intricate. The majority can be managed independently.

US Legal Forms is an online repository of current DIY legal documents covering various topics from wills and powers of attorney to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you misplace the document, you can always redownload it from within the My documents section. The procedure is equally straightforward for newcomers! You can set up your account in just a few minutes. Ensure that the Maricopa Arizona Self-Employed Independent Contractor Agreement aligns with your state's and area's laws and regulations. Additionally, it's crucial to review the form's structure (if available), and if you notice any inconsistencies with your initial needs, look for an alternative form. Once you've confirmed that the Maricopa Arizona Self-Employed Independent Contractor Agreement is appropriate for your situation, you can select a subscription plan and process a payment. Then you can download the document in any compatible file format. Having been in the market for over 24 years, we’ve assisted millions by offering ready-to-customize and current legal forms. Utilize US Legal Forms now to conserve time and resources!

- Our library allows you to handle your own issues without needing a lawyer.

- We grant access to legal form templates that aren't always publicly available.

- Our templates are specific to states and regions, simplifying the search.

- Enjoy US Legal Forms whenever you require the Maricopa Arizona Self-Employed Independent Contractor Agreement or any other form promptly and securely.

Form popularity

FAQ

To make your own contract agreement, begin by determining the key terms like the services provided and payment details. Use a clear format, and ensure all necessary clauses are included to protect both parties. Platforms like uslegalforms offer customizable templates to help you create a Maricopa Arizona Self-Employed Independent Contractor Agreement quickly and efficiently.

In Arizona, 1099 employees, or independent contractors, must meet specific criteria to avoid misclassification. The hiring entity should provide a detailed contract that outlines the work arrangement, as outlined in the Maricopa Arizona Self-Employed Independent Contractor Agreement. Keeping accurate records and filing taxes correctly are essential responsibilities for both parties.

An independent contractor agreement should generally start with an introduction that identifies the parties involved. Next, outline the services to be provided, payment structure, and any relevant deadlines. Finally, include sections on confidentiality and dispute resolution to ensure clarity within your Maricopa Arizona Self-Employed Independent Contractor Agreement.

To create an independent contractor agreement, start by outlining the scope of work, payment terms, and deadlines. Include clauses that address confidentiality, ownership of work, and termination conditions. Utilizing templates or resources from platforms like uslegalforms can simplify the process of drafting your Maricopa Arizona Self-Employed Independent Contractor Agreement.

The 2 year contractor rule refers to a guideline under which independent contractors may be classified as employees if they have worked continuously for a client for at least two years. This rule emphasizes the importance of proper classification to avoid tax liabilities. Understanding this rule is essential when drafting a Maricopa Arizona Self-Employed Independent Contractor Agreement.

Typically, an independent contractor agreement is created by the hiring party, often referred to as the client or employer. However, both parties can collaborate to draft this important document. By clearly defining terms and expectations, the Maricopa Arizona Self-Employed Independent Contractor Agreement promotes a successful partnership.

Filing as an independent contractor in Maricopa, Arizona, involves several steps. First, you need to track your income and expenses accurately throughout the year. You will file your taxes using Schedule C along with your Form 1040, detailing your income related to your Maricopa Arizona Self-Employed Independent Contractor Agreement. Additionally, consider using platforms like uslegalforms, which offer tools and templates to streamline your filing process and ensure you meet all necessary requirements.

Generally, independent contractors in Arizona do not need a business license. However, specific local regulations may require you to obtain certain permits or licenses based on the type of work you do. Using a Maricopa Arizona Self-Employed Independent Contractor Agreement allows you to officially set the terms of your work while ensuring you stay informed about any required licenses or permits.

To fill out an independent contractor agreement, start by clearly stating your name and contact information, along with the client's details. Outline the scope of work, payment terms, deadlines, and any additional responsibilities. Using a Maricopa Arizona Self-Employed Independent Contractor Agreement template can streamline this process, ensuring you include all essential terms and conditions for a successful partnership.

As an independent contractor in Maricopa, you will generally need to fill out a W-9 form for tax purposes, providing your Social Security Number or Employer Identification Number. Additionally, you may choose to use a Maricopa Arizona Self-Employed Independent Contractor Agreement to outline the terms of your contract with clients. This agreement helps clarify the services you provide, payment terms, and other important details.