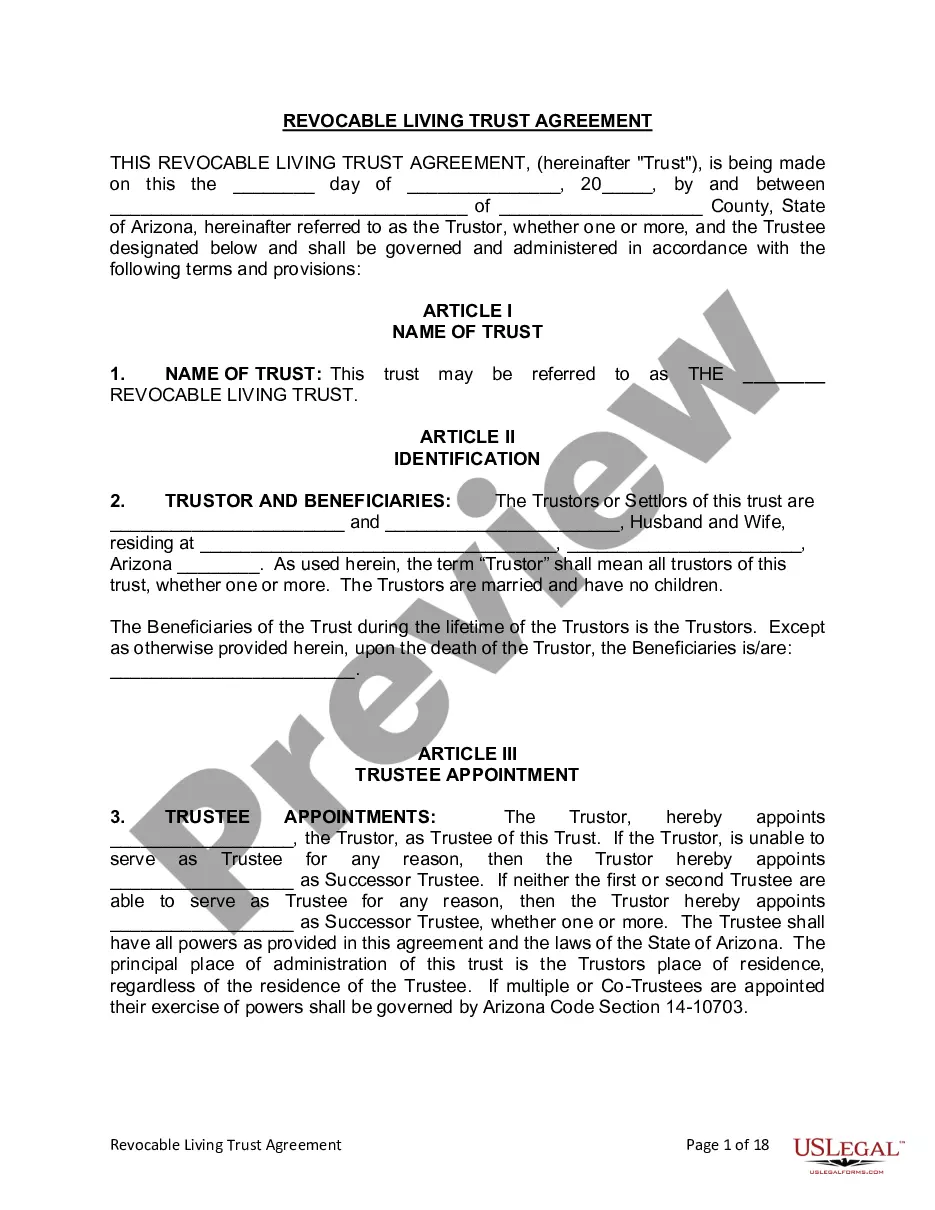

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Maricopa Arizona Living Trust for Husband and Wife with No Children Overview A Maricopa Arizona Living Trust for Husband and Wife with No Children is a legal document that allows a married couple in Maricopa, Arizona, to establish a trust for their assets, ensuring efficient management during their lifetimes and seamless distribution upon death. This estate planning tool offers numerous benefits, including the avoidance of probate, protection of assets, and privacy maintenance. Types of Maricopa Arizona Living Trust for Husband and Wife with No Children 1. Revocable Living Trust: A revocable living trust allows the couple to maintain control over the assets and make amendments or revoke the trust during their lifetimes. It allows them to avoid probate, designate beneficiaries, and appoint a successor trustee to manage the trust after their passing. 2. Testamentary Trust: A testamentary trust is established through a will and only goes into effect upon the death of the last surviving spouse. This type of trust is still subject to probate, but it allows for more flexibility in distributing assets and can be used to avoid potential challenges to the will. 3. Irrevocable Living Trust: An irrevocable living trust cannot be changed or revoked without the consent of both spouses. This type of trust provides more asset protection and may have certain tax benefits. However, it requires careful consideration and professional guidance as it typically involves giving up control over the assets. 4. Charitable Remainder Trust: A charitable remainder trust allows a married couple to donate assets to a charitable organization while still retaining an income stream and receiving certain tax benefits. This type of trust can be an effective tool for philanthropic individuals seeking to leave a charitable legacy. 5. Special Needs Trust: A special needs trust is designed to provide for the ongoing care and support of a disabled beneficiary. It allows a married couple to ensure that their loved one with special needs receives proper care and financial assistance without jeopardizing their eligibility for government benefits. Benefits of a Maricopa Arizona Living Trust for Husband and Wife with No Children — Avoidance of Probate: By establishing a trust, a married couple can bypass the lengthy, costly, and public probate process, ensuring a smooth transition of assets to their chosen beneficiaries. — Asset Protection: A living trust can provide protection against creditors and lawsuits, safeguarding the couple's hard-earned assets. — Privacy: Unlike a will, a living trust remains private. It does not become part of the public record, thereby keeping the couple's estate details confidential. — Incapacity Planning: A living trust allows a couple to plan for potential incapacity by naming a successor trustee who can step in and manage their affairs if they become unable to do so themselves. — Tax Benefits: Depending on the type of trust chosen, certain tax advantages may be available, such as reducing estate taxes or maximizing income tax savings via charitable contributions. It is important for any married couple in Maricopa, Arizona, without children to review their unique circumstances with an experienced estate planning attorney to determine the most suitable type of trust and ensure their assets are protected and distributed according to their wishes.Maricopa Arizona Living Trust for Husband and Wife with No Children Overview A Maricopa Arizona Living Trust for Husband and Wife with No Children is a legal document that allows a married couple in Maricopa, Arizona, to establish a trust for their assets, ensuring efficient management during their lifetimes and seamless distribution upon death. This estate planning tool offers numerous benefits, including the avoidance of probate, protection of assets, and privacy maintenance. Types of Maricopa Arizona Living Trust for Husband and Wife with No Children 1. Revocable Living Trust: A revocable living trust allows the couple to maintain control over the assets and make amendments or revoke the trust during their lifetimes. It allows them to avoid probate, designate beneficiaries, and appoint a successor trustee to manage the trust after their passing. 2. Testamentary Trust: A testamentary trust is established through a will and only goes into effect upon the death of the last surviving spouse. This type of trust is still subject to probate, but it allows for more flexibility in distributing assets and can be used to avoid potential challenges to the will. 3. Irrevocable Living Trust: An irrevocable living trust cannot be changed or revoked without the consent of both spouses. This type of trust provides more asset protection and may have certain tax benefits. However, it requires careful consideration and professional guidance as it typically involves giving up control over the assets. 4. Charitable Remainder Trust: A charitable remainder trust allows a married couple to donate assets to a charitable organization while still retaining an income stream and receiving certain tax benefits. This type of trust can be an effective tool for philanthropic individuals seeking to leave a charitable legacy. 5. Special Needs Trust: A special needs trust is designed to provide for the ongoing care and support of a disabled beneficiary. It allows a married couple to ensure that their loved one with special needs receives proper care and financial assistance without jeopardizing their eligibility for government benefits. Benefits of a Maricopa Arizona Living Trust for Husband and Wife with No Children — Avoidance of Probate: By establishing a trust, a married couple can bypass the lengthy, costly, and public probate process, ensuring a smooth transition of assets to their chosen beneficiaries. — Asset Protection: A living trust can provide protection against creditors and lawsuits, safeguarding the couple's hard-earned assets. — Privacy: Unlike a will, a living trust remains private. It does not become part of the public record, thereby keeping the couple's estate details confidential. — Incapacity Planning: A living trust allows a couple to plan for potential incapacity by naming a successor trustee who can step in and manage their affairs if they become unable to do so themselves. — Tax Benefits: Depending on the type of trust chosen, certain tax advantages may be available, such as reducing estate taxes or maximizing income tax savings via charitable contributions. It is important for any married couple in Maricopa, Arizona, without children to review their unique circumstances with an experienced estate planning attorney to determine the most suitable type of trust and ensure their assets are protected and distributed according to their wishes.