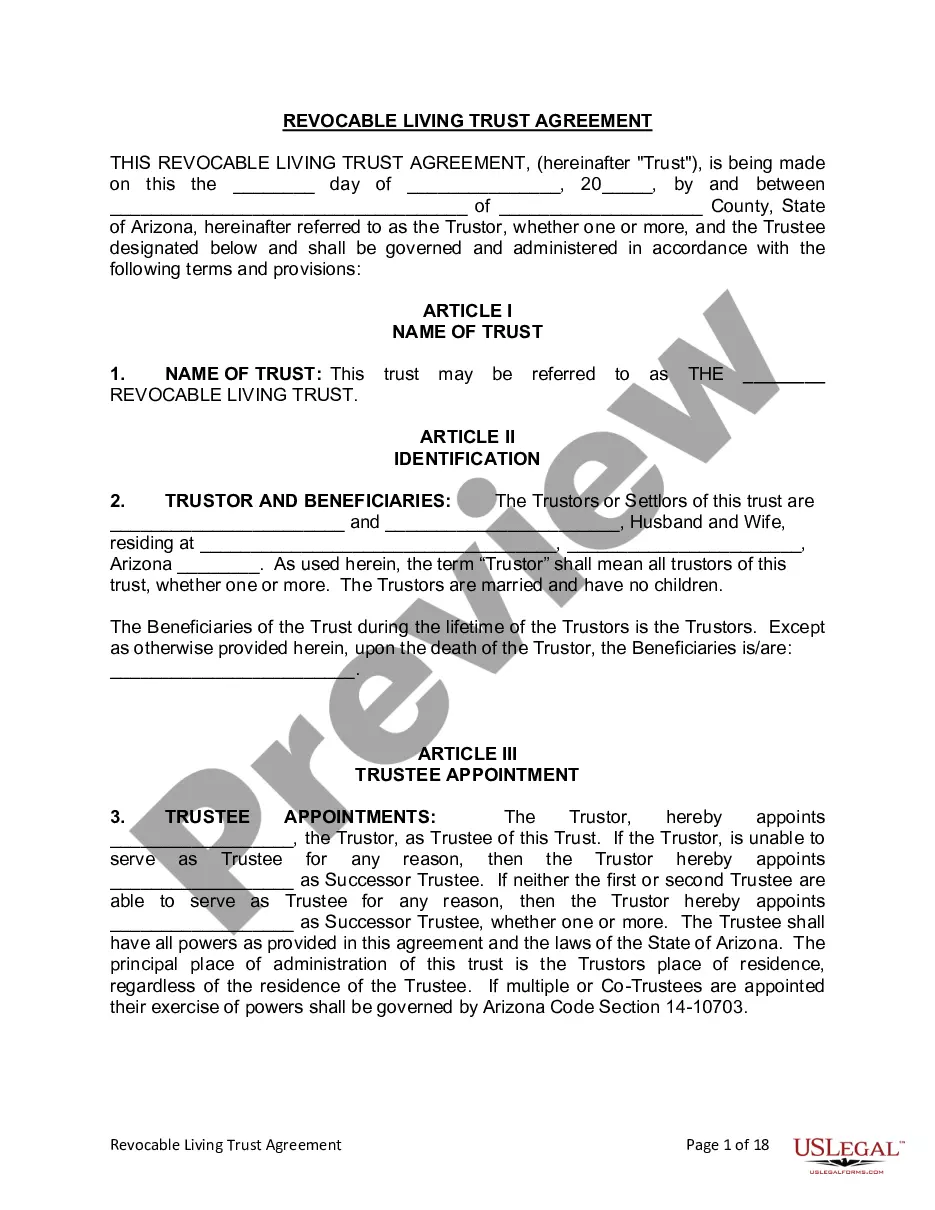

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Phoenix Arizona Living Trust for Husband and Wife with No Children is a legal document that allows a married couple to outline their wishes and distribute their assets upon their death without the need for probate. This type of living trust is specifically tailored for couples who do not have any children. A living trust is established by the couple (trustees) and managed by a trustee, who may be the couple themselves or a third-party individual or institution. The purpose of the living trust is to specify how the couple's assets, such as real estate, investments, bank accounts, and personal property, should be managed and distributed during their lifetime and after their passing. By creating a living trust, the couple can ensure that their assets are protected, their privacy is maintained, and their estate administration is simplified. The trust document delineates how their assets will be distributed upon death, including designating specific beneficiaries or charitable organizations to receive the assets. Phoenix Arizona offers several types of living trusts for husband and wife with no children, including: 1. Revocable Living Trust: This is the most common type of living trust, which allows amendments or revocation during the lifetime of the trustees. The couple retains control over their assets and can make changes as their circumstances require. 2. Irrevocable Living Trust: In this type of trust, the couple permanently transfers their assets into the trust, relinquishing ownership and control. This can provide certain tax advantages and may protect assets from potential creditors or legal claims. 3. Joint Living Trust: This form of living trust combines the assets of the husband and wife into a single trust document. It simplifies administrative tasks and ensures a smooth transition of assets upon the death of one spouse. 4. A-B Trust: Also known as a bypass trust or credit shelter trust, an A-B Trust divides the couple's assets into two separate trusts upon the first spouse's death. This structure can help maximize tax benefits and protect the assets for the surviving spouse while ensuring their ultimate distribution as intended. 5. Testamentary Trust: Although not a living trust, a testamentary trust comes into effect upon the death of one or both spouses, as specified in their will. It allows the couple to determine how their assets will be managed and distributed, ensuring their wishes are carried out. It is important for couples without children in Phoenix, Arizona, to consult with an experienced estate planning attorney to understand the specific legal requirements and implications of each type of living trust. This will enable them to make informed decisions that align with their estate goals and provide peace of mind for the future.A Phoenix Arizona Living Trust for Husband and Wife with No Children is a legal document that allows a married couple to outline their wishes and distribute their assets upon their death without the need for probate. This type of living trust is specifically tailored for couples who do not have any children. A living trust is established by the couple (trustees) and managed by a trustee, who may be the couple themselves or a third-party individual or institution. The purpose of the living trust is to specify how the couple's assets, such as real estate, investments, bank accounts, and personal property, should be managed and distributed during their lifetime and after their passing. By creating a living trust, the couple can ensure that their assets are protected, their privacy is maintained, and their estate administration is simplified. The trust document delineates how their assets will be distributed upon death, including designating specific beneficiaries or charitable organizations to receive the assets. Phoenix Arizona offers several types of living trusts for husband and wife with no children, including: 1. Revocable Living Trust: This is the most common type of living trust, which allows amendments or revocation during the lifetime of the trustees. The couple retains control over their assets and can make changes as their circumstances require. 2. Irrevocable Living Trust: In this type of trust, the couple permanently transfers their assets into the trust, relinquishing ownership and control. This can provide certain tax advantages and may protect assets from potential creditors or legal claims. 3. Joint Living Trust: This form of living trust combines the assets of the husband and wife into a single trust document. It simplifies administrative tasks and ensures a smooth transition of assets upon the death of one spouse. 4. A-B Trust: Also known as a bypass trust or credit shelter trust, an A-B Trust divides the couple's assets into two separate trusts upon the first spouse's death. This structure can help maximize tax benefits and protect the assets for the surviving spouse while ensuring their ultimate distribution as intended. 5. Testamentary Trust: Although not a living trust, a testamentary trust comes into effect upon the death of one or both spouses, as specified in their will. It allows the couple to determine how their assets will be managed and distributed, ensuring their wishes are carried out. It is important for couples without children in Phoenix, Arizona, to consult with an experienced estate planning attorney to understand the specific legal requirements and implications of each type of living trust. This will enable them to make informed decisions that align with their estate goals and provide peace of mind for the future.