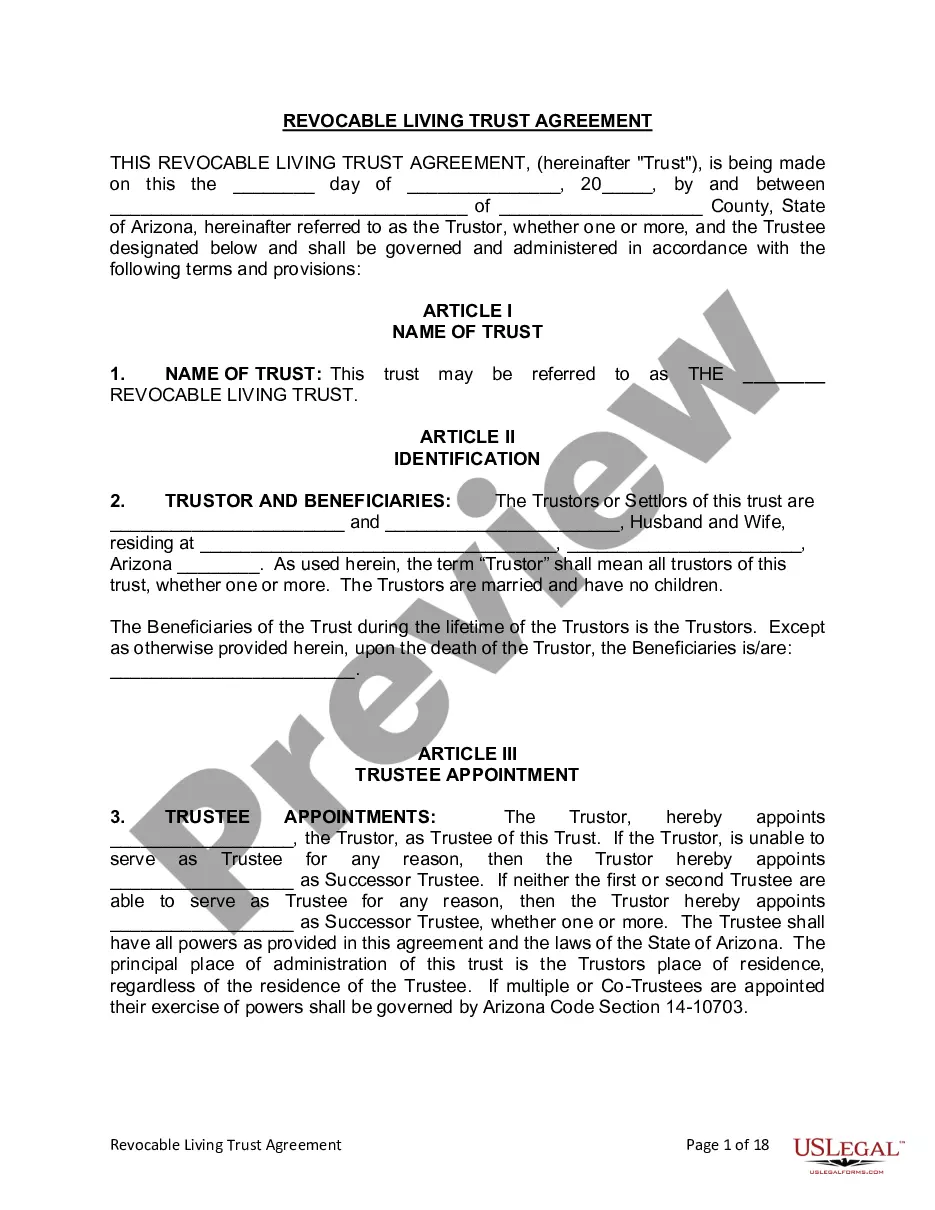

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Lima Arizona Living Trust for Husband and Wife with No Children is a legal document that allows a married couple to protect their assets and determine the management and distribution of their estate upon their death or incapacity. This type of living trust is specifically designed for couples without children, offering unique benefits and considerations. In this trust arrangement, the couple acts as the Trustees (also known as Settler or Granter), placing their assets, such as real estate, bank accounts, investments, and personal property, into the trust. They also act as Trustees, giving them full control and management over the trust assets during their lifetime. The primary objective of a Lima Arizona Living Trust for Husband and Wife with No Children is to ensure a smooth transition of assets and avoid probate, a potentially lengthy and costly legal process. By having a living trust, the couple can effectively bypass probate, preventing their assets from being tied up in court and providing privacy in the distribution of their estate. There are different types of Lima Arizona Living Trusts for Husband and Wife with No Children that couples can consider based on their specific needs and goals: 1. Revocable Living Trust: The most common type of living trust, it allows the couple to maintain full control over the trust assets and make changes or revoke the trust during their lifetime. 2. Irrevocable Living Trust: As the name implies, this type of trust cannot be modified or revoked without the consent of both parties involved. Once assets are placed into the irrevocable trust, they are no longer considered personal possessions of the couple. This type of trust may provide certain tax benefits and asset protection. 3. Joint Living Trust: This trust option allows the couple to create a single trust together, combining their assets and appointing themselves as co-trustees. It simplifies the management and administration process, providing seamless asset management. 4. Testamentary Trust: Unlike a typical living trust, which is created during the lifetime of the couple, a testamentary trust is established within a will. It becomes effective only after the death of both spouses and may include specific instructions on how assets should be distributed or managed for the benefit of surviving family members or other beneficiaries. When establishing a Lima Arizona Living Trust for Husband and Wife with No Children, it is important to consult with an experienced estate planning attorney who is knowledgeable about Arizona laws. They can guide couples through the legal process, customize the trust to their unique circumstances, and ensure their intentions are carried out effectively.A Lima Arizona Living Trust for Husband and Wife with No Children is a legal document that allows a married couple to protect their assets and determine the management and distribution of their estate upon their death or incapacity. This type of living trust is specifically designed for couples without children, offering unique benefits and considerations. In this trust arrangement, the couple acts as the Trustees (also known as Settler or Granter), placing their assets, such as real estate, bank accounts, investments, and personal property, into the trust. They also act as Trustees, giving them full control and management over the trust assets during their lifetime. The primary objective of a Lima Arizona Living Trust for Husband and Wife with No Children is to ensure a smooth transition of assets and avoid probate, a potentially lengthy and costly legal process. By having a living trust, the couple can effectively bypass probate, preventing their assets from being tied up in court and providing privacy in the distribution of their estate. There are different types of Lima Arizona Living Trusts for Husband and Wife with No Children that couples can consider based on their specific needs and goals: 1. Revocable Living Trust: The most common type of living trust, it allows the couple to maintain full control over the trust assets and make changes or revoke the trust during their lifetime. 2. Irrevocable Living Trust: As the name implies, this type of trust cannot be modified or revoked without the consent of both parties involved. Once assets are placed into the irrevocable trust, they are no longer considered personal possessions of the couple. This type of trust may provide certain tax benefits and asset protection. 3. Joint Living Trust: This trust option allows the couple to create a single trust together, combining their assets and appointing themselves as co-trustees. It simplifies the management and administration process, providing seamless asset management. 4. Testamentary Trust: Unlike a typical living trust, which is created during the lifetime of the couple, a testamentary trust is established within a will. It becomes effective only after the death of both spouses and may include specific instructions on how assets should be distributed or managed for the benefit of surviving family members or other beneficiaries. When establishing a Lima Arizona Living Trust for Husband and Wife with No Children, it is important to consult with an experienced estate planning attorney who is knowledgeable about Arizona laws. They can guide couples through the legal process, customize the trust to their unique circumstances, and ensure their intentions are carried out effectively.