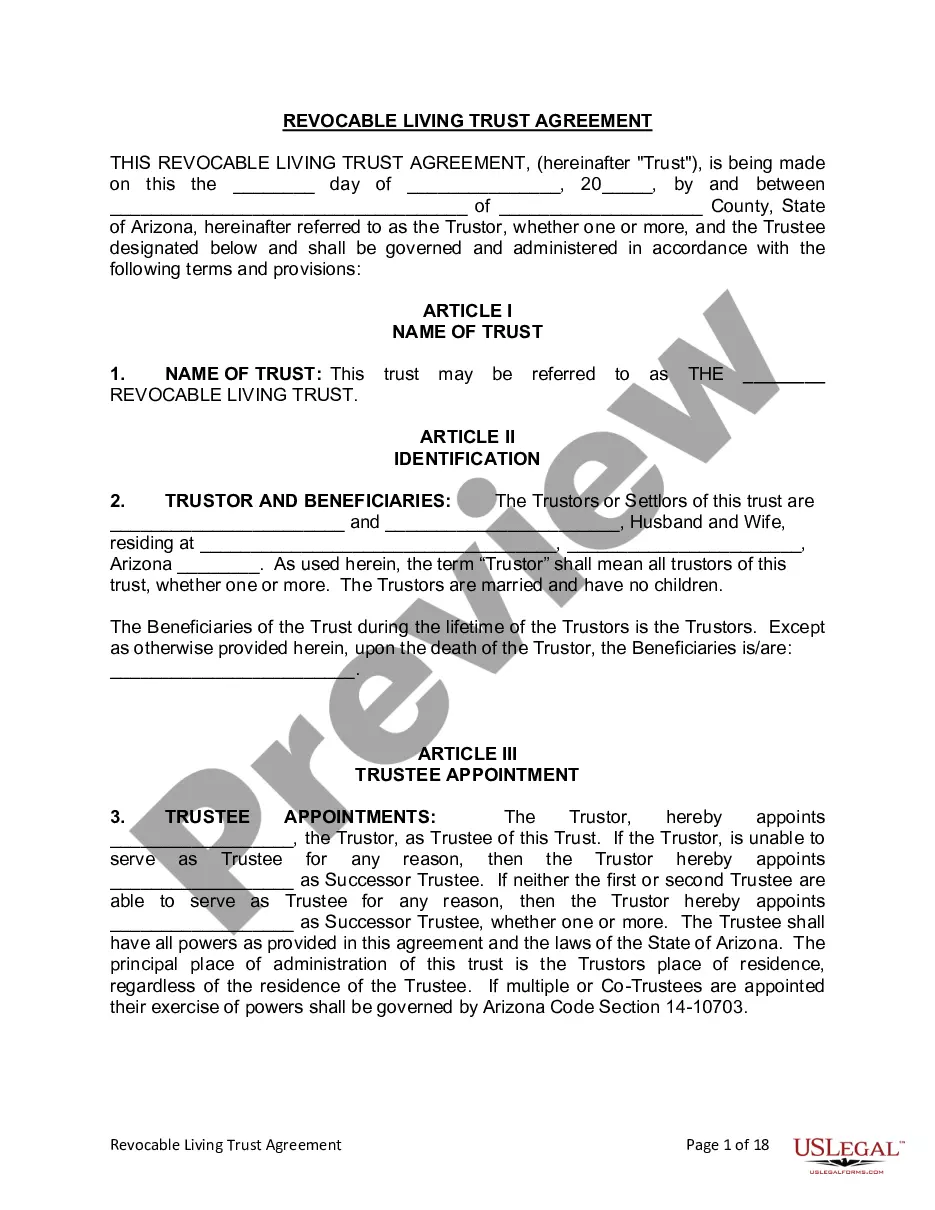

This Living Trust form is a living trust prepared for your state. It is for a Husband and Wife with no children. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Tempe Arizona Living Trust for Husband and Wife with No Children, also known as a joint living trust or a revocable living trust, is a legal document created by a married couple in order to manage their assets and estate during their lifetimes and distribute them after their passing. This trust is specifically designed for couples who do not have any children. The primary purpose of establishing a living trust is to avoid probate, a lengthy and expensive court process necessary for transferring assets after one's death. By creating a living trust, the couple transfers ownership of their assets to the trust, allowing the assets to be managed and distributed according to their wishes upon their demise, without the need for probate. There are a few variations of the Tempe Arizona Living Trust for Husband and Wife with No Children that couples can consider, such as: 1. Revocability: A living trust can either be revocable or irrevocable. A revocable trust allows changes, modifications, or termination during the life of the couple, providing them with flexibility in managing their assets. An irrevocable trust, on the other hand, cannot be altered or revoked once established, but can offer potential tax advantages. 2. Joint vs Separate Trusts: Couples can choose to establish either a joint living trust or separate individual trusts. With a joint trust, the couple's assets are combined into one trust document and managed collectively. In contrast, separate trusts allow individuals to maintain separate control over their assets within the trust. 3. Successor Trustees: When creating a living trust, the couple must appoint a successor trustee(s) who will manage the trust and distribute the assets according to the couple's instructions upon their passing. This can be a family member, friend, or a professional trustee. 4. Asset Distribution: The trust document should include detailed instructions on how the assets should be distributed to beneficiaries, whether family members, friends, charities, or any other desired recipients. Couples can specify the amount or percentage of distributions for each beneficiary, or include specific conditions for receiving the assets. 5. Tax Planning: Depending on the couple's financial situation, tax planning provisions may be incorporated into the living trust. This can include strategies to minimize potential estate taxes, such as setting up a bypass trust or a qualified terminable interest property (TIP) trust. It is important to consult with an experienced estate planning attorney when creating a Tempe Arizona Living Trust for Husband and Wife with No Children. They can guide couples through the process, help them identify their specific goals and wishes, and ensure that the trust is legally valid and tailored to their unique circumstances.A Tempe Arizona Living Trust for Husband and Wife with No Children, also known as a joint living trust or a revocable living trust, is a legal document created by a married couple in order to manage their assets and estate during their lifetimes and distribute them after their passing. This trust is specifically designed for couples who do not have any children. The primary purpose of establishing a living trust is to avoid probate, a lengthy and expensive court process necessary for transferring assets after one's death. By creating a living trust, the couple transfers ownership of their assets to the trust, allowing the assets to be managed and distributed according to their wishes upon their demise, without the need for probate. There are a few variations of the Tempe Arizona Living Trust for Husband and Wife with No Children that couples can consider, such as: 1. Revocability: A living trust can either be revocable or irrevocable. A revocable trust allows changes, modifications, or termination during the life of the couple, providing them with flexibility in managing their assets. An irrevocable trust, on the other hand, cannot be altered or revoked once established, but can offer potential tax advantages. 2. Joint vs Separate Trusts: Couples can choose to establish either a joint living trust or separate individual trusts. With a joint trust, the couple's assets are combined into one trust document and managed collectively. In contrast, separate trusts allow individuals to maintain separate control over their assets within the trust. 3. Successor Trustees: When creating a living trust, the couple must appoint a successor trustee(s) who will manage the trust and distribute the assets according to the couple's instructions upon their passing. This can be a family member, friend, or a professional trustee. 4. Asset Distribution: The trust document should include detailed instructions on how the assets should be distributed to beneficiaries, whether family members, friends, charities, or any other desired recipients. Couples can specify the amount or percentage of distributions for each beneficiary, or include specific conditions for receiving the assets. 5. Tax Planning: Depending on the couple's financial situation, tax planning provisions may be incorporated into the living trust. This can include strategies to minimize potential estate taxes, such as setting up a bypass trust or a qualified terminable interest property (TIP) trust. It is important to consult with an experienced estate planning attorney when creating a Tempe Arizona Living Trust for Husband and Wife with No Children. They can guide couples through the process, help them identify their specific goals and wishes, and ensure that the trust is legally valid and tailored to their unique circumstances.