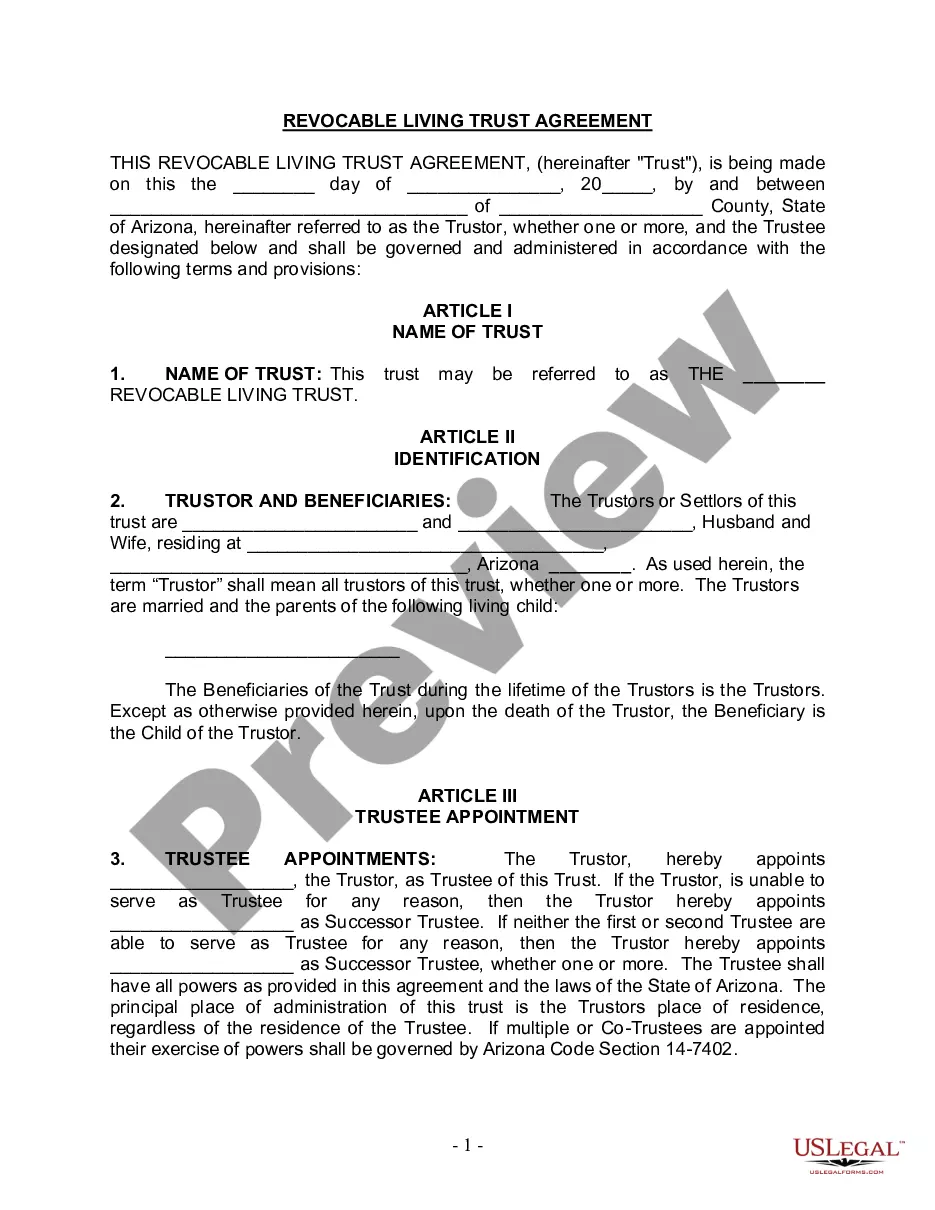

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A living trust is a legal entity established by individuals, called "settlers," to manage their assets during their lifetime and distribute them upon their death. In Maricopa, Arizona, the option of creating a Living Trust for Husband and Wife with One Child ensures that couples can protect and manage their assets while providing for their child's financial future. Here are several types of Maricopa Arizona Living Trusts for Husband and Wife with One Child: 1. Revocable Living Trust: A revocable living trust allows husbands and wives to retain control of their assets, make changes or amendments, and revoke the trust if needed during their lifetime. It provides flexibility and can be adjusted as circumstances change. 2. Irrevocable Living Trust: An irrevocable living trust cannot be changed or revoked once established. This type of trust offers asset protection from creditors and estate taxes. It is crucial to carefully consider the terms and conditions before setting up an irrevocable living trust. 3. Testamentary Trust: A testamentary trust comes into effect only after the death of the husband and wife. It allows for the smooth transfer of assets to the child while ensuring they are managed by a designated trustee until the child reaches a specified age or achieves certain milestones. 4. Special Needs Trust: If the child has special needs or disabilities, a special needs trust can be established within the living trust. It ensures that the child's inheritance does not jeopardize their eligibility for government benefits by providing supplemental support and care. 5. Education Trust: An education trust focuses on providing funds specifically for the child's education. It ensures that the child's educational expenses are covered, regardless of the parents' demise, and can have specific guidelines for how the funds may be used. 6. Spendthrift Trust: A spendthrift trust safeguards the child's inheritance from creditors, lawsuits, or any financial mismanagement. It can be beneficial if the child lacks financial responsibility or if there are concerns about their financial stability. Overall, a Maricopa Arizona Living Trust for Husband and Wife with One Child can be customized to meet specific legal, financial, and familial needs. Engaging with a reputable estate planning attorney is crucial to ensure that the trust is properly structured according to Arizona state laws and your unique circumstances.A living trust is a legal entity established by individuals, called "settlers," to manage their assets during their lifetime and distribute them upon their death. In Maricopa, Arizona, the option of creating a Living Trust for Husband and Wife with One Child ensures that couples can protect and manage their assets while providing for their child's financial future. Here are several types of Maricopa Arizona Living Trusts for Husband and Wife with One Child: 1. Revocable Living Trust: A revocable living trust allows husbands and wives to retain control of their assets, make changes or amendments, and revoke the trust if needed during their lifetime. It provides flexibility and can be adjusted as circumstances change. 2. Irrevocable Living Trust: An irrevocable living trust cannot be changed or revoked once established. This type of trust offers asset protection from creditors and estate taxes. It is crucial to carefully consider the terms and conditions before setting up an irrevocable living trust. 3. Testamentary Trust: A testamentary trust comes into effect only after the death of the husband and wife. It allows for the smooth transfer of assets to the child while ensuring they are managed by a designated trustee until the child reaches a specified age or achieves certain milestones. 4. Special Needs Trust: If the child has special needs or disabilities, a special needs trust can be established within the living trust. It ensures that the child's inheritance does not jeopardize their eligibility for government benefits by providing supplemental support and care. 5. Education Trust: An education trust focuses on providing funds specifically for the child's education. It ensures that the child's educational expenses are covered, regardless of the parents' demise, and can have specific guidelines for how the funds may be used. 6. Spendthrift Trust: A spendthrift trust safeguards the child's inheritance from creditors, lawsuits, or any financial mismanagement. It can be beneficial if the child lacks financial responsibility or if there are concerns about their financial stability. Overall, a Maricopa Arizona Living Trust for Husband and Wife with One Child can be customized to meet specific legal, financial, and familial needs. Engaging with a reputable estate planning attorney is crucial to ensure that the trust is properly structured according to Arizona state laws and your unique circumstances.