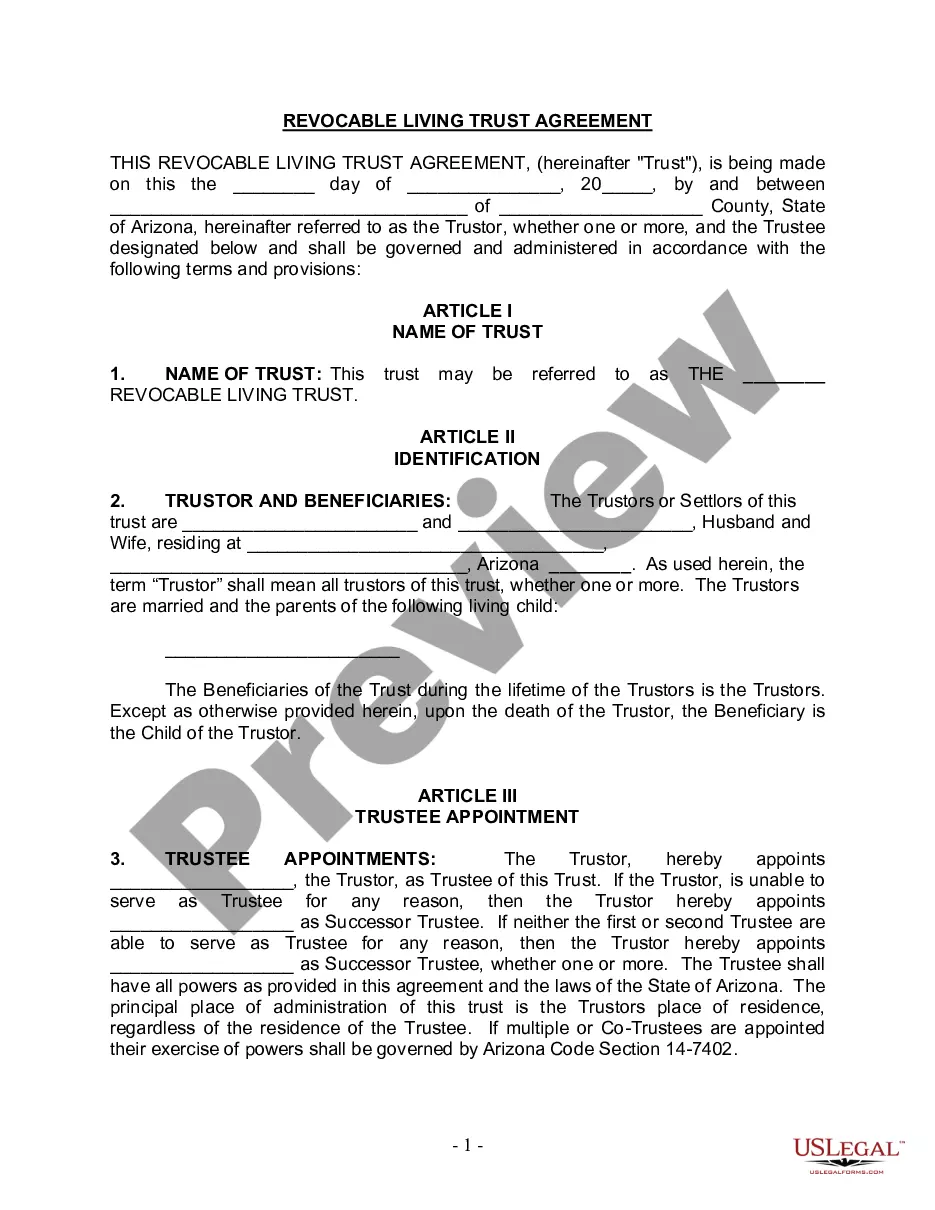

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Title: A Comprehensive Overview of Mesa Arizona Living Trust for Husband and Wife with One Child Introduction: A Mesa Arizona Living Trust for Husband and Wife with One Child is a legal arrangement that allows couples with a child to protect and manage their assets during their lifetime and ensure a seamless transfer of these assets to their child upon their passing. This article aims to provide a detailed description of this trust, including its benefits, types, and key considerations. 1. Understanding Mesa Arizona Living Trust for Husband and Wife with One Child: A Mesa Arizona Living Trust is a legal document created by husband and wife, known as granters, to hold their assets in a separate entity for their benefit during their lifetime. This trust provides flexibility, privacy, and probate avoidance. When the granters pass away, the assets held in the trust are transferred to their child, known as the beneficiary. 2. Benefits of a Mesa Arizona Living Trust for Husband and Wife with One Child: — Probate avoidance: Assets held in a living trust can bypass the probate process, saving time and money. — Privacy: Unlike a will, a living trust is not a public document, enabling the family to keep their affairs private. — Management during incapacity: In the event of incapacity, the trust allows for the seamless management of assets by designated successor trustees. — Asset protection: The trust can include provisions for protecting assets from potential creditors or lawsuits. 3. Different Types of Mesa Arizona Living Trusts for Husband and Wife with One Child: a) Revocable Living Trust: This type of trust is the most common and allows the granters to retain control over the trust assets during their lifetime. It can be modified or revoked as per the granters' wishes. b) Irrevocable Living Trust: Once established, an irrevocable living trust cannot be altered or revoked without beneficiary consent. This type of trust provides greater protection, may reduce estate taxes, and ensures long-term asset management. 4. Key Considerations: — Selection of successor trustees: It's crucial to appoint individuals who will manage the trust in the granters' absence. These individuals should be trustworthy and capable of handling financial matters. — Guardianship for the child: The trust should specify the desired guardianship arrangements for the child in case both granters pass away before the child reaches adulthood. — Regular trust reviewGrantersrs should review and update the trust regularly to ensure it reflects their current wishes, changes in their financial situation, and any legislative amendments that may affect estate planning. Conclusion: A Mesa Arizona Living Trust for Husband and Wife with One Child offers numerous benefits, including probate avoidance, asset protection, and smooth asset transfer for the benefit of the child. Understanding the types and key considerations associated with this trust is vital for couples seeking to secure their assets and protect their child's future. Consulting an experienced estate planning attorney is highly recommended for tailoring the trust to specific needs and ensuring compliance with Arizona state laws.Title: A Comprehensive Overview of Mesa Arizona Living Trust for Husband and Wife with One Child Introduction: A Mesa Arizona Living Trust for Husband and Wife with One Child is a legal arrangement that allows couples with a child to protect and manage their assets during their lifetime and ensure a seamless transfer of these assets to their child upon their passing. This article aims to provide a detailed description of this trust, including its benefits, types, and key considerations. 1. Understanding Mesa Arizona Living Trust for Husband and Wife with One Child: A Mesa Arizona Living Trust is a legal document created by husband and wife, known as granters, to hold their assets in a separate entity for their benefit during their lifetime. This trust provides flexibility, privacy, and probate avoidance. When the granters pass away, the assets held in the trust are transferred to their child, known as the beneficiary. 2. Benefits of a Mesa Arizona Living Trust for Husband and Wife with One Child: — Probate avoidance: Assets held in a living trust can bypass the probate process, saving time and money. — Privacy: Unlike a will, a living trust is not a public document, enabling the family to keep their affairs private. — Management during incapacity: In the event of incapacity, the trust allows for the seamless management of assets by designated successor trustees. — Asset protection: The trust can include provisions for protecting assets from potential creditors or lawsuits. 3. Different Types of Mesa Arizona Living Trusts for Husband and Wife with One Child: a) Revocable Living Trust: This type of trust is the most common and allows the granters to retain control over the trust assets during their lifetime. It can be modified or revoked as per the granters' wishes. b) Irrevocable Living Trust: Once established, an irrevocable living trust cannot be altered or revoked without beneficiary consent. This type of trust provides greater protection, may reduce estate taxes, and ensures long-term asset management. 4. Key Considerations: — Selection of successor trustees: It's crucial to appoint individuals who will manage the trust in the granters' absence. These individuals should be trustworthy and capable of handling financial matters. — Guardianship for the child: The trust should specify the desired guardianship arrangements for the child in case both granters pass away before the child reaches adulthood. — Regular trust reviewGrantersrs should review and update the trust regularly to ensure it reflects their current wishes, changes in their financial situation, and any legislative amendments that may affect estate planning. Conclusion: A Mesa Arizona Living Trust for Husband and Wife with One Child offers numerous benefits, including probate avoidance, asset protection, and smooth asset transfer for the benefit of the child. Understanding the types and key considerations associated with this trust is vital for couples seeking to secure their assets and protect their child's future. Consulting an experienced estate planning attorney is highly recommended for tailoring the trust to specific needs and ensuring compliance with Arizona state laws.