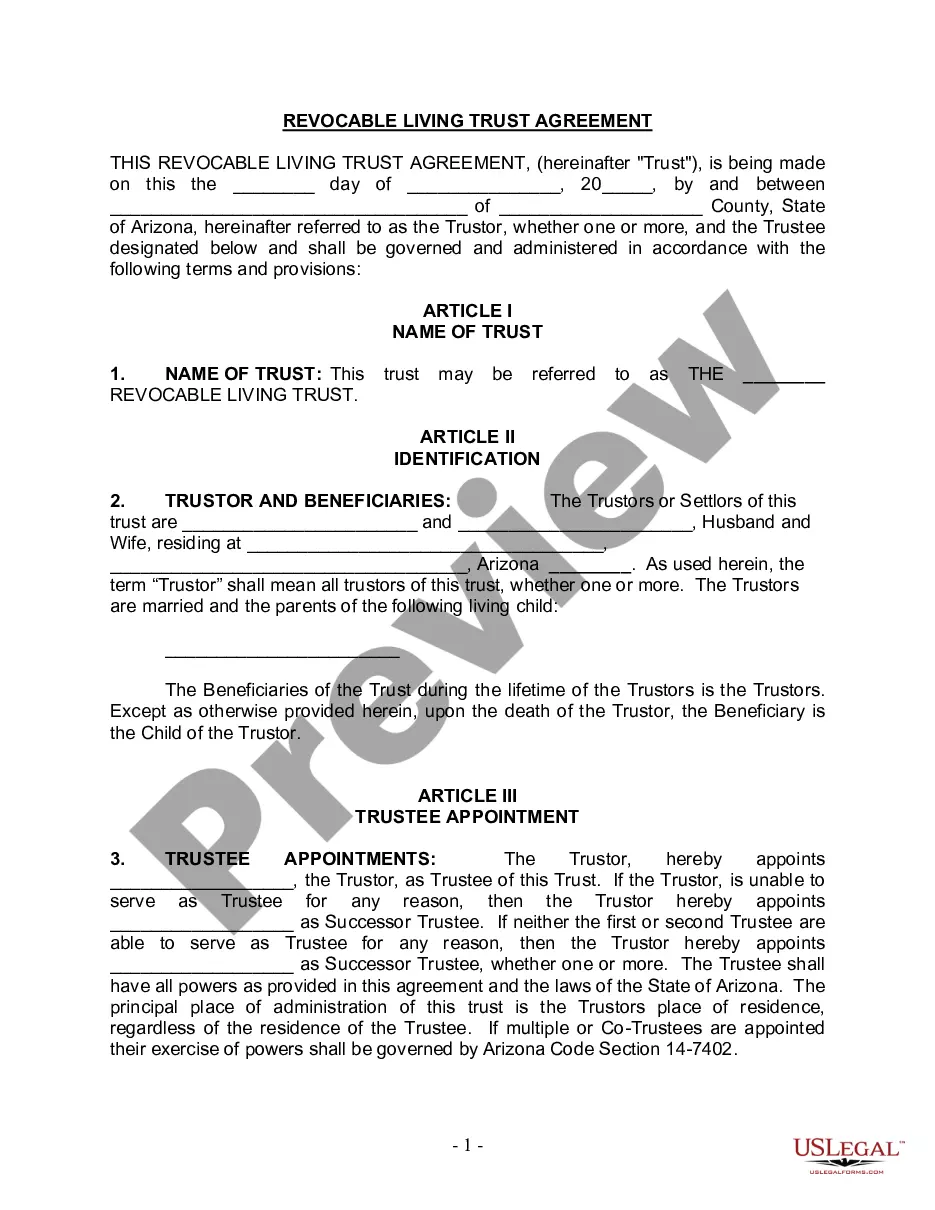

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Scottsdale Arizona Living Trust for Husband and Wife with One Child is a legal document that offers important estate planning benefits for families in the city of Scottsdale, Arizona. This particular trust type ensures that the assets and properties of a couple are properly managed, protected, and distributed to their child in the event of their incapacity or death. Here are a few types of Living Trusts that can be set up by couples residing in Scottsdale, Arizona: 1. Revocable Living Trust: A revocable living trust gives the couple full control over their assets during their lifetime. They can make changes or even revoke the trust if they wish to do so. It allows for seamless management and distribution of assets in case of incapacity or death. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be altered or cancelled without the consent of both spouses and the child. This type of trust arrangement offers various tax benefits and asset protection for the couple and their child. 3. Testamentary Living Trust: This type of trust is created through a Last Will and Testament. It goes into effect upon the death of both spouses and allows for the proper distribution of assets to their child according to the couple's wishes. 4. Special Needs Trust: If the couple has a child with special needs, a special needs trust can be established. Such a trust ensures that the child's eligibility for government benefits is not compromised while still allowing for the utilization of additional resources to enhance their quality of life. 5. Pour-Over Will Living Trust: This trust type is often employed as a safety net. It acts as a backup to a revocable living trust, ensuring that any assets inadvertently left out of the trust are "poured over" and distributed according to the trust's instructions. Establishing a Scottsdale Arizona Living Trust for Husband and Wife with One Child requires the expertise of an experienced estate planning attorney. These legal professionals can guide couples through the process, help them understand the tax implications, and ensure that the trust is tailored to their specific needs and objectives. By preparing a comprehensive living trust, couples in Scottsdale, Arizona can safeguard their assets, maintain control, and provide for the future of their child in a manner that aligns with their wishes and goals.A Scottsdale Arizona Living Trust for Husband and Wife with One Child is a legal document that offers important estate planning benefits for families in the city of Scottsdale, Arizona. This particular trust type ensures that the assets and properties of a couple are properly managed, protected, and distributed to their child in the event of their incapacity or death. Here are a few types of Living Trusts that can be set up by couples residing in Scottsdale, Arizona: 1. Revocable Living Trust: A revocable living trust gives the couple full control over their assets during their lifetime. They can make changes or even revoke the trust if they wish to do so. It allows for seamless management and distribution of assets in case of incapacity or death. 2. Irrevocable Living Trust: Unlike a revocable living trust, an irrevocable living trust cannot be altered or cancelled without the consent of both spouses and the child. This type of trust arrangement offers various tax benefits and asset protection for the couple and their child. 3. Testamentary Living Trust: This type of trust is created through a Last Will and Testament. It goes into effect upon the death of both spouses and allows for the proper distribution of assets to their child according to the couple's wishes. 4. Special Needs Trust: If the couple has a child with special needs, a special needs trust can be established. Such a trust ensures that the child's eligibility for government benefits is not compromised while still allowing for the utilization of additional resources to enhance their quality of life. 5. Pour-Over Will Living Trust: This trust type is often employed as a safety net. It acts as a backup to a revocable living trust, ensuring that any assets inadvertently left out of the trust are "poured over" and distributed according to the trust's instructions. Establishing a Scottsdale Arizona Living Trust for Husband and Wife with One Child requires the expertise of an experienced estate planning attorney. These legal professionals can guide couples through the process, help them understand the tax implications, and ensure that the trust is tailored to their specific needs and objectives. By preparing a comprehensive living trust, couples in Scottsdale, Arizona can safeguard their assets, maintain control, and provide for the future of their child in a manner that aligns with their wishes and goals.