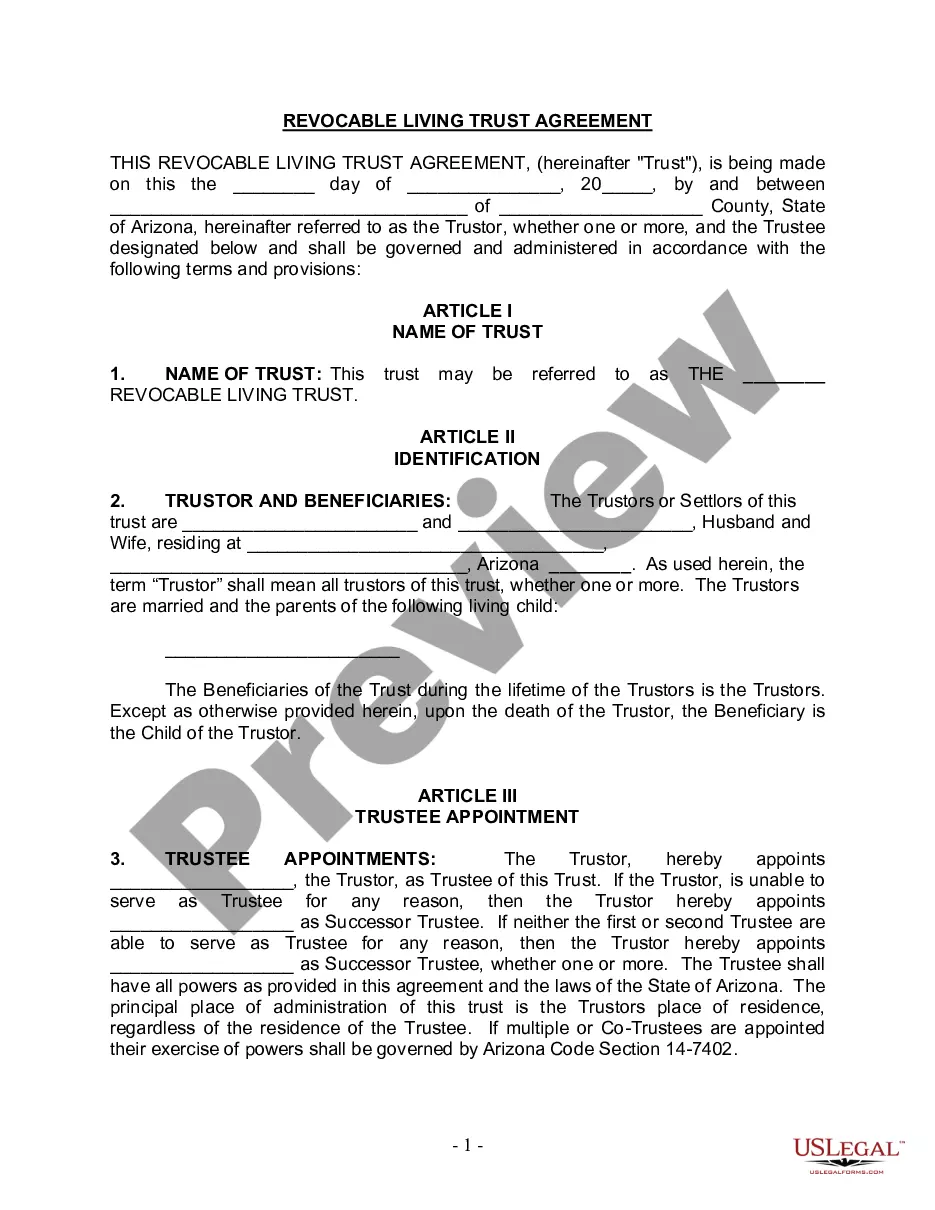

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

A Surprise Arizona Living Trust for Husband and Wife with One Child is a legal document that allows a couple to establish a trust to manage their assets and provide for their child's financial future. This type of living trust is specifically designed for married couples in Surprise, Arizona, who have one child. By creating a living trust, the couple can ensure that their assets are distributed according to their wishes after their passing, while also avoiding the time-consuming and expensive probate process. This ensures their child's needs are met and their financial security is preserved. There are different types of Surprise Arizona Living Trusts for Husband and Wife with One Child, including: 1. Revocable Living Trust: This type of trust allows the couple to retain control over their assets during their lifetime. They can amend or revoke the trust at any time, and they maintain the ability to manage and use the assets for their benefit. 2. Irrevocable Living Trust: In contrast to the revocable trust, an irrevocable living trust cannot be changed or revoked once established. The couple transfers ownership of their assets to the trust, providing both tax advantages and greater asset protection. 3. Testamentary Trust: This type of trust is created through a will and becomes effective after the death of one or both parents. It allows the parents to specify how their assets should be managed and distributed for the benefit of their child. However, it is important to note that a testamentary trust must go through the probate process. 4. Special Needs Trust: If the child has special needs or disabilities, a special needs trust can be established within the living trust. This ensures that any inheritance or assets received by the child do not jeopardize their eligibility for government benefits. Creating a Surprise Arizona Living Trust for Husband and Wife with One Child provides peace of mind for parents, knowing that their child's financial future is secure. It allows for flexibility in managing assets, minimizes estate taxes, avoids probate, and ensures the child's needs are met according to their parents' wishes. Consulting with a qualified estate planning attorney in Surprise, Arizona is recommended to tailor the trust to specific family circumstances and ensure compliance with state laws.A Surprise Arizona Living Trust for Husband and Wife with One Child is a legal document that allows a couple to establish a trust to manage their assets and provide for their child's financial future. This type of living trust is specifically designed for married couples in Surprise, Arizona, who have one child. By creating a living trust, the couple can ensure that their assets are distributed according to their wishes after their passing, while also avoiding the time-consuming and expensive probate process. This ensures their child's needs are met and their financial security is preserved. There are different types of Surprise Arizona Living Trusts for Husband and Wife with One Child, including: 1. Revocable Living Trust: This type of trust allows the couple to retain control over their assets during their lifetime. They can amend or revoke the trust at any time, and they maintain the ability to manage and use the assets for their benefit. 2. Irrevocable Living Trust: In contrast to the revocable trust, an irrevocable living trust cannot be changed or revoked once established. The couple transfers ownership of their assets to the trust, providing both tax advantages and greater asset protection. 3. Testamentary Trust: This type of trust is created through a will and becomes effective after the death of one or both parents. It allows the parents to specify how their assets should be managed and distributed for the benefit of their child. However, it is important to note that a testamentary trust must go through the probate process. 4. Special Needs Trust: If the child has special needs or disabilities, a special needs trust can be established within the living trust. This ensures that any inheritance or assets received by the child do not jeopardize their eligibility for government benefits. Creating a Surprise Arizona Living Trust for Husband and Wife with One Child provides peace of mind for parents, knowing that their child's financial future is secure. It allows for flexibility in managing assets, minimizes estate taxes, avoids probate, and ensures the child's needs are met according to their parents' wishes. Consulting with a qualified estate planning attorney in Surprise, Arizona is recommended to tailor the trust to specific family circumstances and ensure compliance with state laws.