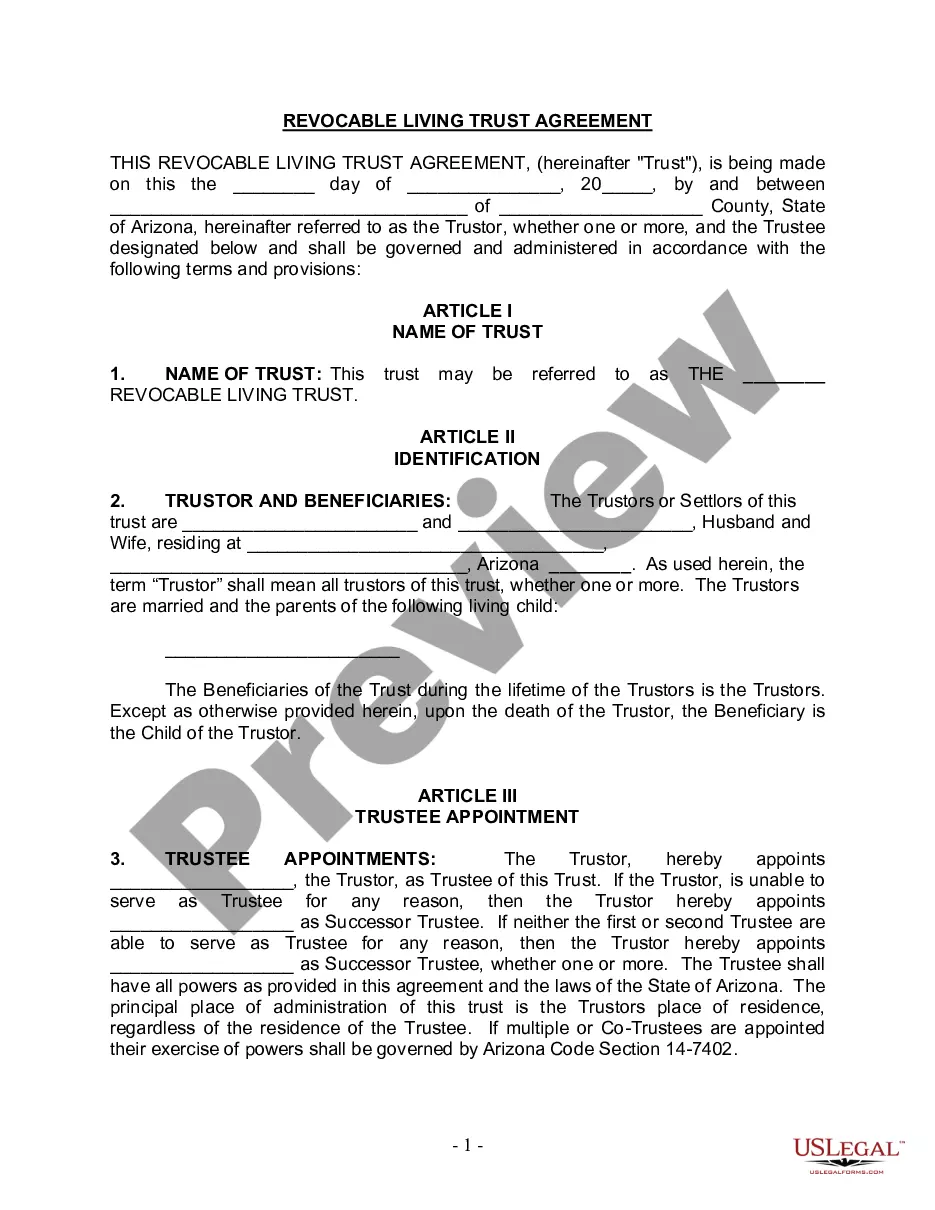

This form is a living trust form prepared for your state. It is for a Husband and Wife with one child. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trust then owns and manages the property held by the trust through a trustee for the benefit of named beneficiary, usually the creator of the trust (settlor). The settlor, trustee and beneficiary may all be the same person. In this way, a person may set up a trust with his or her own assets and maintain complete control and management of the assets by acting as his or her own trustee. Upon the death of the person who created the trust, the property of the trust does not go through probate proceedings, but rather passes according to provisions of the trust as set up by the creator of the trust.

Tempe Arizona Living Trust for Husband and Wife with One Child

Description

How to fill out Arizona Living Trust For Husband And Wife With One Child?

We constantly seek to minimize or evade legal repercussions when managing intricate legal or financial matters.

To achieve this, we seek legal alternatives that are typically quite costly.

Nevertheless, not every legal issue is equally complicated.

Many can be resolved independently.

Utilize US Legal Forms whenever you wish to locate and retrieve the Tempe Arizona Living Trust for Husband and Wife with One Child or any other document quickly and securely. Just Log In to your account and click the Get button next to it. If you misplace the document, you can always download it again in the My documents section. The process is just as simple if you’re a newcomer to the platform! You can sign up for your account in just a few minutes. Ensure to verify whether the Tempe Arizona Living Trust for Husband and Wife with One Child adheres to the laws and regulations of your state and locality. Additionally, it’s essential to review the form’s outline (if available), and if you observe any inconsistencies with what you initially sought, look for an alternative form. Once you’ve confirmed that the Tempe Arizona Living Trust for Husband and Wife with One Child meets your needs, you can select a subscription plan and proceed with the payment. After that, you can download the document in any preferred file format. For over 24 years, we’ve assisted millions by providing readily customizable and current legal forms. Make the most of US Legal Forms now to conserve time and resources!

- US Legal Forms is an online repository of current do-it-yourself legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection enables you to handle your matters autonomously without the assistance of an attorney.

- We offer access to legal templates that aren't always readily accessible.

- Our templates are tailored to specific states and regions, significantly easing the search process.

Form popularity

FAQ

There is no set minimum amount required to start a family trust in Arizona. You can begin a Tempe Arizona Living Trust for Husband and Wife with One Child with any amount of assets you wish to protect. However, it's essential to consider the costs associated with creating and maintaining the trust to ensure its benefits outweigh those expenses.

Yes, it is possible to set up a Tempe Arizona Living Trust for Husband and Wife with One Child without an attorney. Many online platforms provide templates and guidance for creating a trust. However, consulting with a qualified attorney can help you navigate complex legal issues and ensure that all requirements are met.

In many cases, a trust established as a Tempe Arizona Living Trust for Husband and Wife with One Child does become irrevocable upon the death of one spouse. This means that the terms of the trust cannot be changed after that event. However, the specific terms of the trust will dictate its status, so it's vital to review your trust documents carefully.

To create a valid trust in Arizona, you must ensure that the trust has a clear purpose, identifiable beneficiaries, and a trustee who will manage the assets. Additionally, the trust document should be in writing and signed by the creators. A Tempe Arizona Living Trust for Husband and Wife with One Child must also comply with state-specific regulations to ensure its effectiveness.

One of the most significant mistakes parents make when establishing a Tempe Arizona Living Trust for Husband and Wife with One Child is failing to specify how assets will be distributed among beneficiaries. This can lead to confusion or conflict among family members. It's crucial to clearly outline your intentions to prevent misunderstandings and legal disputes in the future.

You are not required to hire an attorney to set up a trust in Arizona, but it is advisable. Setting up a Tempe Arizona Living Trust for Husband and Wife with One Child may seem straightforward, but the nuances of law can be complex. An attorney can help you navigate the intricacies, ensuring your trust is legally sound and fully compliant with state laws. If you wish to simplify the process, platforms like uslegalforms can provide supportive resources and templates to facilitate creating your trust.

Yes, you can write your own trust in Arizona. Many people choose to create their Tempe Arizona Living Trust for Husband and Wife with One Child by themselves, using templates or guidelines available online. However, while this is an option, it can be beneficial to consult with a legal professional to ensure your trust meets all state requirements and accurately reflects your wishes. A small investment in legal advice can save you from costly mistakes down the line.

In Arizona, the law does not require a trust to be notarized to be valid. However, having your Tempe Arizona Living Trust for Husband and Wife with One Child notarized can provide additional legal protection and help avoid future disputes. It's often a good practice to ensure all documents related to the trust are properly executed, which includes notarization. This extra step can give you peace of mind about the legal standing of your trust.

In Arizona, trusts can be considered marital property, especially if both spouses have contributed to the assets within the Tempe Arizona Living Trust for Husband and Wife with One Child. The classification can have implications during divorce or separation. It is important to clearly outline asset ownership and contributions in your trust documents. Consulting with a legal professional can provide clarity and help you structure your trust appropriately.

Yes, you can create your own living trust in Arizona, including a Tempe Arizona Living Trust for Husband and Wife with One Child, if you feel comfortable navigating the process. It involves drafting the trust document and ensuring it meets state requirements. However, it's wise to seek legal guidance to prevent any potential issues down the line. Tools like USLegalForms can help simplify this process by providing the necessary templates and resources.