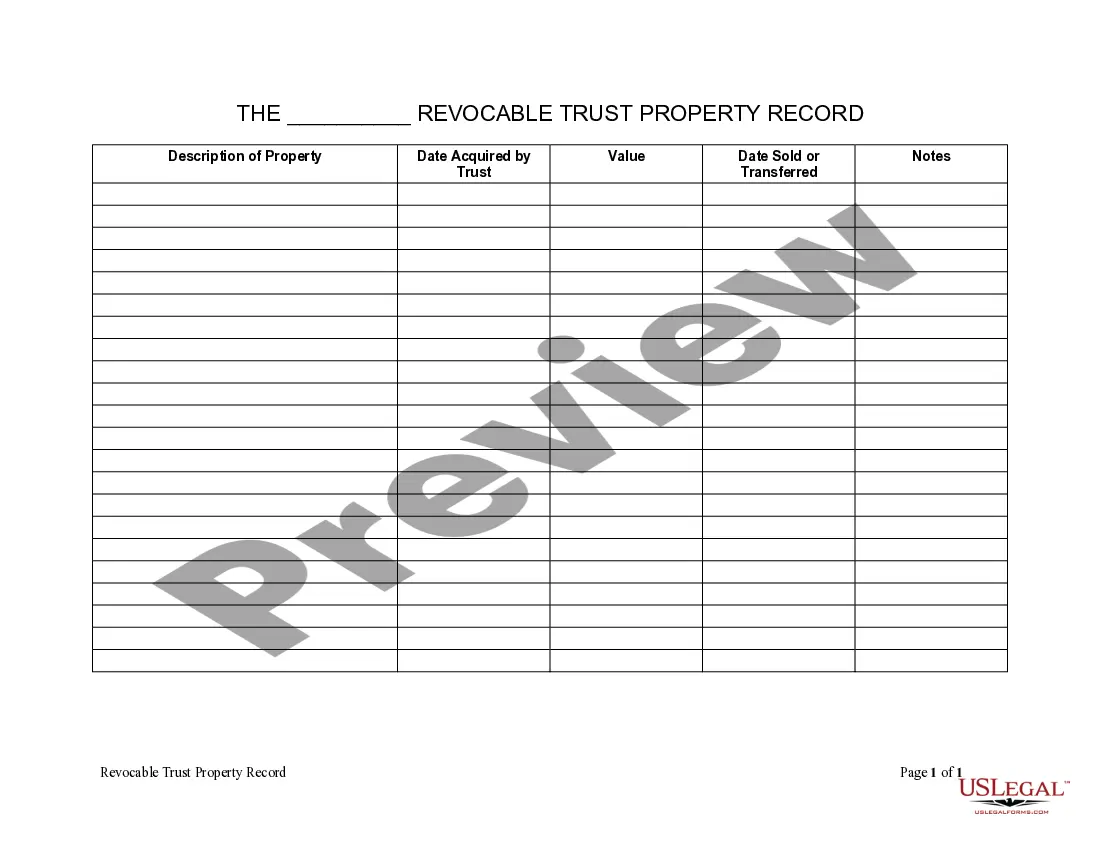

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Glendale Arizona Living Trust Property Record

Description

How to fill out Arizona Living Trust Property Record?

If you are looking for an appropriate form template, it’s hard to find a superior platform than the US Legal Forms website – one of the largest collections on the web.

With this collection, you can locate thousands of form examples for business and personal needs categorized by types and states, or keywords. Using our sophisticated search feature, uncovering the latest Glendale Arizona Living Trust Property Record is as simple as 1-2-3.

Moreover, the accuracy of each document is confirmed by a team of experienced attorneys who regularly review the templates on our site and revise them according to the latest state and county rules.

Receive the form. Select the format and download it to your device.

Make modifications. Fill out, edit, print, and sign the obtained Glendale Arizona Living Trust Property Record.

- If you are already familiar with our platform and possess an account, all you have to do to obtain the Glendale Arizona Living Trust Property Record is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the following instructions.

- Ensure you have located the form you need. Review its description and utilize the Preview option (if available) to check its content. If it does not satisfy your needs, use the Search function at the top of the page to discover the correct record.

- Confirm your selection. Click the Buy now button. Then, choose your desired subscription plan and provide the information to create an account.

- Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

In Arizona, trusts are not typically recorded in the same manner as real estate deeds. However, the Glendale Arizona Living Trust Property Record can help you manage and maintain documentation related to your trust. It’s important to keep your trust documents accessible, even though they may not require formal recording. Utilizing resources like USLegalForms can assist you in creating, organizing, and storing your trust documents effectively.

In Arizona, a trust does not need to be recorded to be valid. However, if the trust holds real property, recording the property deed in the county can protect the beneficiaries. When establishing your Glendale Arizona Living Trust Property Record, it's wise to understand that while recording is not mandatory, it can enhance clarity regarding ownership. Utilizing the uslegalforms platform can guide you through documenting your trust properly, ensuring all necessary paperwork is efficiently handled.

In Arizona, a living trust does not need to be registered with the state. However, for the trust to hold property, you must properly transfer the property titles into the trust's name. Keeping an updated Glendale Arizona Living Trust Property Record is essential to ensure your trust operates smoothly and meets your estate planning goals.

Transferring property to a trust in Arizona involves drafting a deed that transfers the title from your name to the trust. You must then record this deed with the county recorder's office. Utilizing resources like uslegalforms can streamline this process and help you maintain an accurate Glendale Arizona Living Trust Property Record.

Yes, beneficiaries in Arizona typically have the right to view the trust and its terms. This right ensures transparency and allows beneficiaries to understand their entitlements. If you require specific details about a Glendale Arizona Living Trust Property Record, and the trustee is uncooperative, you may need to seek legal assistance. A professional can guide you through the proper channels to access the information.

Trusts themselves are generally not considered public records in Arizona. However, certain details may become public through probate court proceedings if a trust is attached to a will. If you are looking for Glendale Arizona Living Trust Property Record information, it is important to note that you may need to explore alternative routes, such as contacting the trustee directly. Understanding these nuances can help you navigate your search.

Obtaining a copy of a trust in Arizona typically requires the consent of the trustee or an interested party. If you are a beneficiary, you have the right to request this information. For access to Glendale Arizona Living Trust Property Record, you may need to file a request or pursue legal action if the trustee refuses. Consulting with a lawyer can help ensure you follow the appropriate process.

To determine if a trust exists in Arizona, begin by checking with local probate courts to see if any related proceedings have been filed. You can also inquire with banks or financial institutions, as they often hold trust documents. If you are looking for specific Glendale Arizona Living Trust Property Record details, consider consulting a legal professional. They can provide guidance on how to search for such information effectively.

In Arizona, you do not need to register a trust. However, it is essential to establish a Glendale Arizona Living Trust Property Record to ensure proper management and transfer of assets. Keeping detailed records may simplify matters for beneficiaries and can help avoid disputes. Although registration is not required, having organized documents is always beneficial.