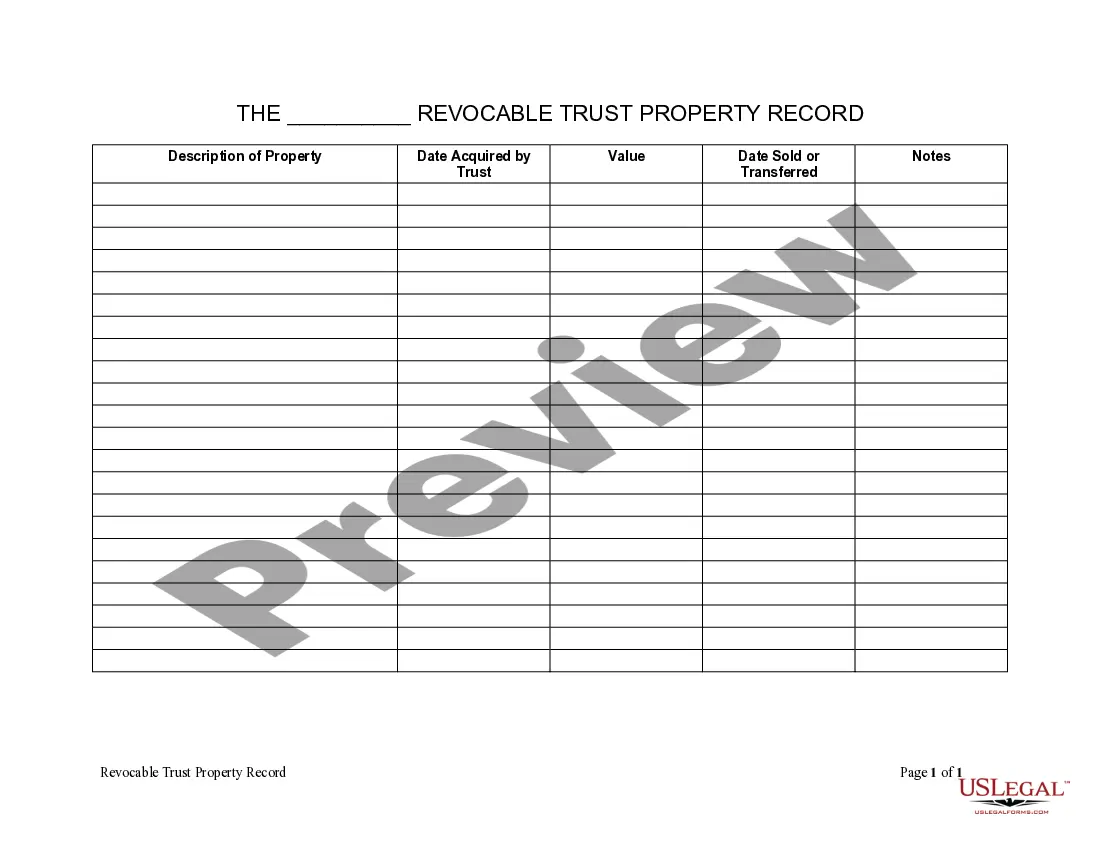

This is a Living Trust Property Inventory form. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form allows the Trustee to record a Description of Property, Date Acquired by Trust, Value, Date Sold or Transferred so that all property held by the trust can be accounted for including the real, personal or intellectual property.

Phoenix Arizona Living Trust Property Record

Description

How to fill out Arizona Living Trust Property Record?

Finding authenticated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms repository.

It serves as an online collection of over 85,000 legal documents for both personal and professional applications and all real-life scenarios.

All forms are appropriately categorized by their area of application and jurisdiction, making the retrieval of the Phoenix Arizona Living Trust Property Record as simple as pie.

Maintaining documentation organized and compliant with legal regulations is crucial. Utilize the US Legal Forms library to have vital document templates for any needs right at your fingertips!

- Review the Preview mode and form description.

- Ensure you have chosen the right one that aligns with your needs and completely meets your local jurisdictional requirements.

- Search for another template, if necessary.

- If any discrepancy is found, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

To create a living trust in Arizona you need to create a trust document that lays out all the details of your trust and names the trustee and beneficiaries. You will sign the document in front of a notary. To complete the process, you fund the trust by transferring the ownership of assets to the trust entity.

As such, Arizona trustees must provide every trust beneficiary with notice, if the trust became irrevocable when the trustor died. Also, where there is a Will, the trustee must file it with the Superior Court in the trustor's home county.

Generally speaking, beneficiaries have a right to see trust documents which set out the terms of the trusts, the identity of the trustees and the assets within the trust as well as the trust deed, any deeds of appointment/retirement and trust accounts.

Arizona law does not allow for a trust to be made in secret. Thus all beneficiaries must be notified if they are included in a trust. In addition to this, Arizona law also requires a trustee to provide a copy of the portions of the trust that the beneficiary is appointed to receive.

Fortunately, Arizona law recognizes the private nature of trusts and helps to protect private information from being exposed to those who do not need it. Under Arizona Revised Statutes (ARS) 14-11013 a trustee of a trust does not have to give a full copy of the trust document to anyone who asks for it.

Once you know that your interest has vested, you can simply write a letter to the Trustee stating that you are legally entitled to a copy of the Trust and asking that the Trustee send it to you.

The new Arizona Trust Code requires the trustee to provide to the trust's beneficiaries an annual report of trust property, including trust liabilities, receipts, disbursements, a list of trust assets and, if feasible, the fair market value of the trust assets.

Arizona trust law allows everybody who may benefit under the trust to request copies of the trust document; and providing notice gives them an opportunity to do so. As such, Arizona trustees must provide every trust beneficiary with notice, if the trust became irrevocable when the trustor died.