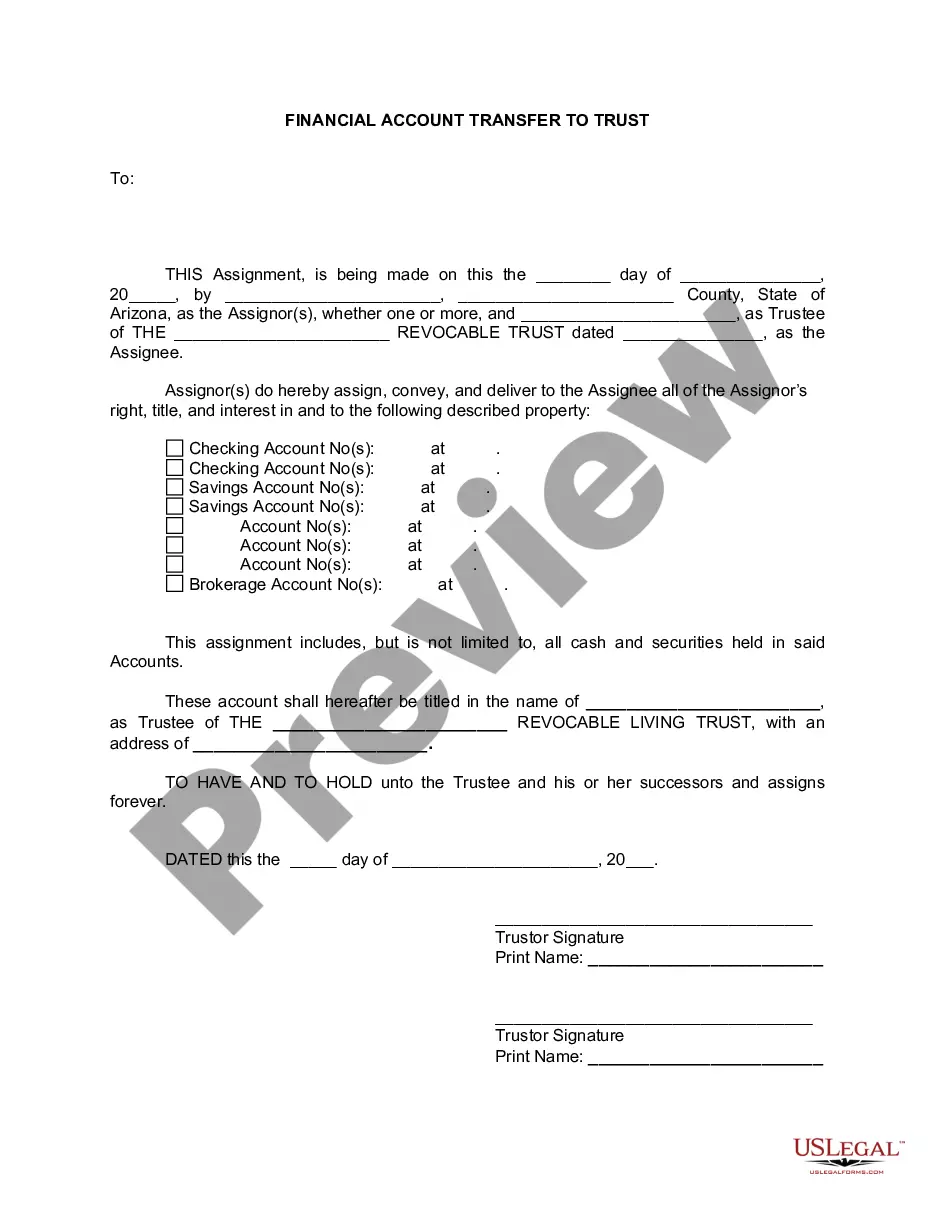

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Glendale Arizona Financial Account Transfer to Living Trust: A financial account transfer to a living trust in Glendale, Arizona is an essential estate planning tool that allows individuals to pass on their assets seamlessly to their beneficiaries upon their passing. By creating a living trust, individuals can ensure that their financial accounts are effectively managed and distributed per their wishes, bypassing the lengthy and costly probate process. There are various types of financial account transfers available when establishing a living trust in Glendale, Arizona. These include: 1. Bank Account Transfer: One of the most common types of financial account transfers is moving funds from traditional checking or savings accounts into the living trust. By re-titling the account to the living trust's name, individuals ensure that these funds are managed and distributed according to the trust's terms. 2. Investment Account Transfer: Individuals can also transfer their investment accounts, such as stocks, bonds, and mutual funds, into their living trust. This transfer provides continuous management and potential growth of investment assets during the owner's lifetime, avoiding the need for a beneficiary to navigate complex investment matters in the event of the owner's incapacitation or passing. 3. Retirement Account Transfer: It is possible to transfer certain types of retirement accounts, like traditional Individual Retirement Accounts (IRAs) or 401(k)s, to a living trust. However, it's important to consult with a qualified financial advisor or estate planning attorney to understand the potential tax implications associated with these transfers. 4. Real Estate Property Transfer: Although not a financial account per se, transferring real estate property into a living trust is an integral part of comprehensive estate planning. By re-titling properties to the trust's name, individuals ensure a smoother and quicker transfer of ownership to their chosen beneficiaries upon their passing, avoiding potential issues of probate or intestate succession. When opting for any of these Glendale Arizona financial account transfers to a living trust, it is crucial to consult with an experienced estate planning attorney who can guide individuals through the legal requirements and necessary paperwork. Establishing a living trust and transferring financial accounts appropriately can provide peace of mind, ensure privacy, and streamline the transfer of assets to loved ones according to individual preferences.Glendale Arizona Financial Account Transfer to Living Trust: A financial account transfer to a living trust in Glendale, Arizona is an essential estate planning tool that allows individuals to pass on their assets seamlessly to their beneficiaries upon their passing. By creating a living trust, individuals can ensure that their financial accounts are effectively managed and distributed per their wishes, bypassing the lengthy and costly probate process. There are various types of financial account transfers available when establishing a living trust in Glendale, Arizona. These include: 1. Bank Account Transfer: One of the most common types of financial account transfers is moving funds from traditional checking or savings accounts into the living trust. By re-titling the account to the living trust's name, individuals ensure that these funds are managed and distributed according to the trust's terms. 2. Investment Account Transfer: Individuals can also transfer their investment accounts, such as stocks, bonds, and mutual funds, into their living trust. This transfer provides continuous management and potential growth of investment assets during the owner's lifetime, avoiding the need for a beneficiary to navigate complex investment matters in the event of the owner's incapacitation or passing. 3. Retirement Account Transfer: It is possible to transfer certain types of retirement accounts, like traditional Individual Retirement Accounts (IRAs) or 401(k)s, to a living trust. However, it's important to consult with a qualified financial advisor or estate planning attorney to understand the potential tax implications associated with these transfers. 4. Real Estate Property Transfer: Although not a financial account per se, transferring real estate property into a living trust is an integral part of comprehensive estate planning. By re-titling properties to the trust's name, individuals ensure a smoother and quicker transfer of ownership to their chosen beneficiaries upon their passing, avoiding potential issues of probate or intestate succession. When opting for any of these Glendale Arizona financial account transfers to a living trust, it is crucial to consult with an experienced estate planning attorney who can guide individuals through the legal requirements and necessary paperwork. Establishing a living trust and transferring financial accounts appropriately can provide peace of mind, ensure privacy, and streamline the transfer of assets to loved ones according to individual preferences.