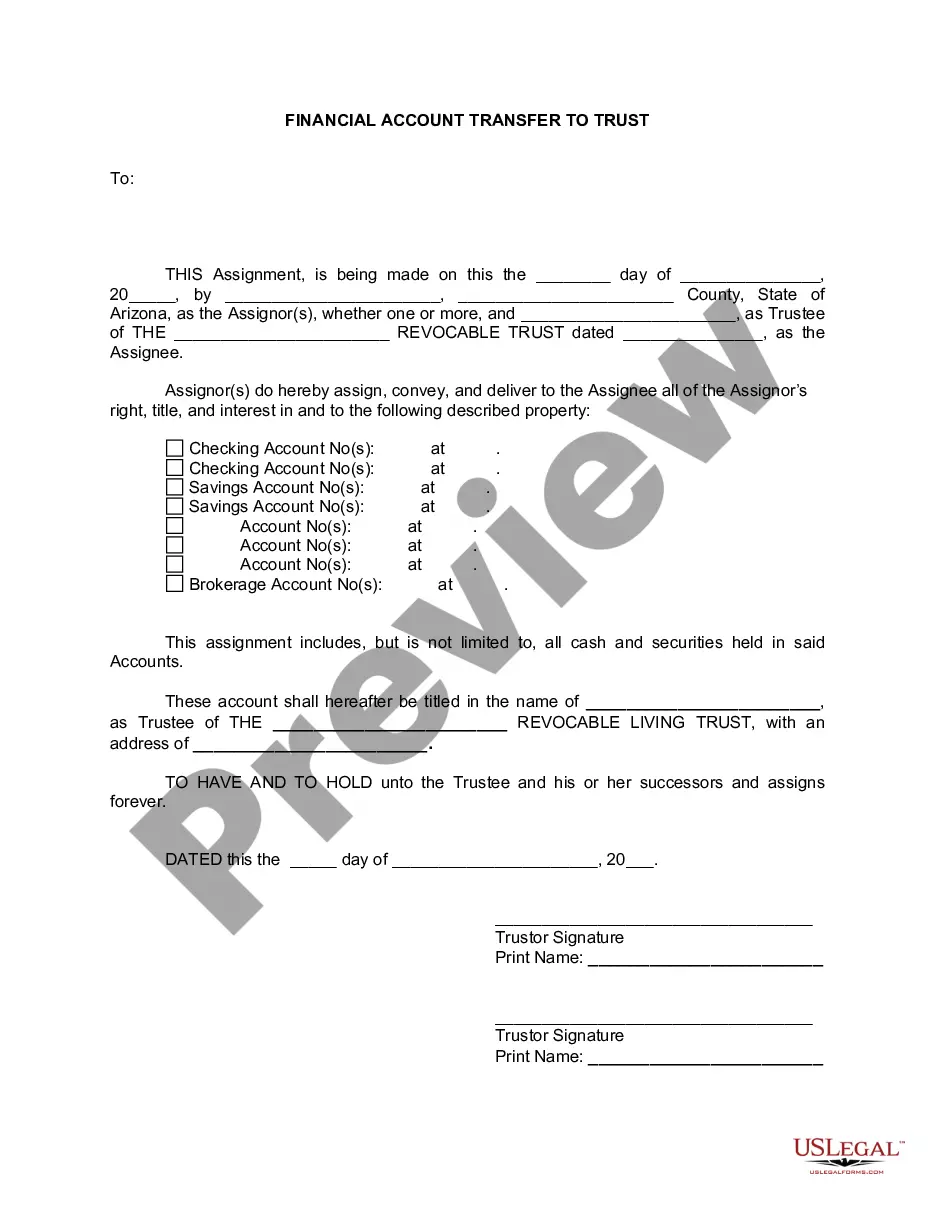

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Mesa Arizona Financial Account Transfer to Living Trust: A Comprehensive Guide to Maintaining Your Financial Legacy In Mesa, Arizona, individuals have the opportunity to secure their financial future and protect their assets through the process of account transfer to a living trust. Establishing a living trust is an effective estate planning strategy that enables you to have control over your assets while providing seamless inheritance for your beneficiaries. What is a Living Trust? A living trust, also known as a revocable trust or inter vivos trust, is a legal entity that holds your assets during your lifetime and transfers them to your designated beneficiaries upon your passing. Unlike a will, which goes through probate, a living trust bypasses this potentially time-consuming and costly process, as it provides immediate distribution according to your wishes. Advantages of Transferring Financial Accounts to a Living Trust: 1. Avoiding Probate: Transferring financial accounts to a living trust allows your loved ones to bypass probate court, which can be a lengthy and expensive process. By avoiding probate, your beneficiaries can access their inheritance promptly, minimizing delays and potential disputes. 2. Privacy and Confidentiality: Unlike a will, a living trust is a private document, offering heightened privacy and confidentiality. It ensures that details regarding your assets and beneficiaries remain confidential, shielding them from public scrutiny. 3. Incapacity Planning: A living trust provides a built-in mechanism for managing your financial affairs in case you become incapacitated. You can designate a successor trustee who will step in and manage your assets for your benefit during such times, ensuring your interests are safeguarded. 4. Professional Asset Management: By establishing a living trust, you gain the ability to appoint a professional trustee, such as a financial institution or an experienced attorney, to manage your assets if needed. Their expertise ensures proper investment and financial management, maintaining the value and growth of your accounts. Types of Financial Account Transfers to a Living Trust: 1. Bank Accounts: All types of bank accounts, like savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), can be transferred to a living trust. Ensuring smooth management and distribution of funds upon your passing. 2. Investment Accounts: Various investment accounts, such as brokerage accounts, individual retirement accounts (IRAs), stocks, bonds, mutual funds, and investment trusts, can be transferred to a living trust. This allows for centralized management of your investments and facilitates seamless transfer to your beneficiaries. 3. Real Estate: If you own real estate properties, such as homes, land, or commercial buildings, in Mesa, Arizona, you can transfer their ownership into your living trust. This avoids potential probate complications and streamlines the transfer process to your chosen beneficiaries. 4. Business Interests: If you're a business owner, you can transfer the ownership of your business or shares in a corporation into your living trust. This ensures the smooth transition of management and ownership to your intended beneficiaries. 5. Retirement Accounts: While retirement accounts, like 401(k)s and IRAs, typically have designated beneficiaries, transferring them to a living trust can provide further flexibility in managing your assets. However, consult with a financial advisor or attorney to evaluate the impact on taxes and potential loss of specific retirement account benefits. In conclusion, transferring your financial accounts to a living trust in Mesa, Arizona, offers you numerous advantages, including avoiding probate, protecting your privacy, managing incapacity, and allowing for professional asset management. Understanding the different types of accounts that can be transferred, such as bank accounts, investment accounts, real estate, business interests, and retirement accounts, will help you make informed decisions about securing your financial legacy. Consult with an experienced estate planning attorney to guide you through the process and ensure your assets are properly protected and distributed according to your wishes.Mesa Arizona Financial Account Transfer to Living Trust: A Comprehensive Guide to Maintaining Your Financial Legacy In Mesa, Arizona, individuals have the opportunity to secure their financial future and protect their assets through the process of account transfer to a living trust. Establishing a living trust is an effective estate planning strategy that enables you to have control over your assets while providing seamless inheritance for your beneficiaries. What is a Living Trust? A living trust, also known as a revocable trust or inter vivos trust, is a legal entity that holds your assets during your lifetime and transfers them to your designated beneficiaries upon your passing. Unlike a will, which goes through probate, a living trust bypasses this potentially time-consuming and costly process, as it provides immediate distribution according to your wishes. Advantages of Transferring Financial Accounts to a Living Trust: 1. Avoiding Probate: Transferring financial accounts to a living trust allows your loved ones to bypass probate court, which can be a lengthy and expensive process. By avoiding probate, your beneficiaries can access their inheritance promptly, minimizing delays and potential disputes. 2. Privacy and Confidentiality: Unlike a will, a living trust is a private document, offering heightened privacy and confidentiality. It ensures that details regarding your assets and beneficiaries remain confidential, shielding them from public scrutiny. 3. Incapacity Planning: A living trust provides a built-in mechanism for managing your financial affairs in case you become incapacitated. You can designate a successor trustee who will step in and manage your assets for your benefit during such times, ensuring your interests are safeguarded. 4. Professional Asset Management: By establishing a living trust, you gain the ability to appoint a professional trustee, such as a financial institution or an experienced attorney, to manage your assets if needed. Their expertise ensures proper investment and financial management, maintaining the value and growth of your accounts. Types of Financial Account Transfers to a Living Trust: 1. Bank Accounts: All types of bank accounts, like savings accounts, checking accounts, money market accounts, and certificates of deposit (CDs), can be transferred to a living trust. Ensuring smooth management and distribution of funds upon your passing. 2. Investment Accounts: Various investment accounts, such as brokerage accounts, individual retirement accounts (IRAs), stocks, bonds, mutual funds, and investment trusts, can be transferred to a living trust. This allows for centralized management of your investments and facilitates seamless transfer to your beneficiaries. 3. Real Estate: If you own real estate properties, such as homes, land, or commercial buildings, in Mesa, Arizona, you can transfer their ownership into your living trust. This avoids potential probate complications and streamlines the transfer process to your chosen beneficiaries. 4. Business Interests: If you're a business owner, you can transfer the ownership of your business or shares in a corporation into your living trust. This ensures the smooth transition of management and ownership to your intended beneficiaries. 5. Retirement Accounts: While retirement accounts, like 401(k)s and IRAs, typically have designated beneficiaries, transferring them to a living trust can provide further flexibility in managing your assets. However, consult with a financial advisor or attorney to evaluate the impact on taxes and potential loss of specific retirement account benefits. In conclusion, transferring your financial accounts to a living trust in Mesa, Arizona, offers you numerous advantages, including avoiding probate, protecting your privacy, managing incapacity, and allowing for professional asset management. Understanding the different types of accounts that can be transferred, such as bank accounts, investment accounts, real estate, business interests, and retirement accounts, will help you make informed decisions about securing your financial legacy. Consult with an experienced estate planning attorney to guide you through the process and ensure your assets are properly protected and distributed according to your wishes.