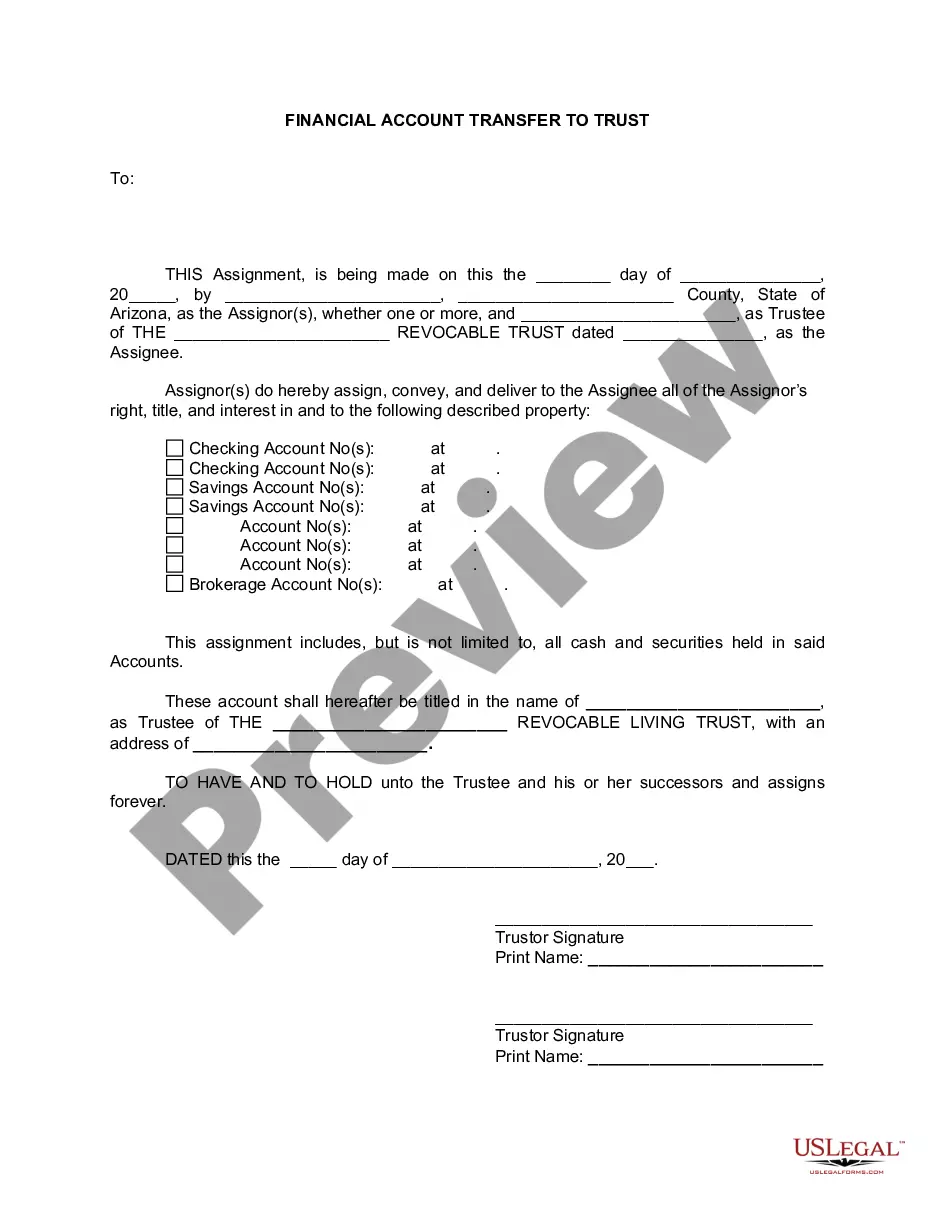

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Phoenix Arizona Financial Account Transfer to Living Trust is a legal process that involves transferring the ownership and control of financial accounts in the city of Phoenix, located in the state of Arizona, to a living trust. This transfer allows individuals to effectively manage their assets and plan for the future, ensuring that their financial affairs are handled according to their wishes even after they pass away. A living trust is a legal entity created by an individual, also known as the granter or trust or, to manage and distribute their assets during their lifetime and upon their death. It is a popular estate planning tool that offers various benefits, including avoiding probate, providing privacy, and allowing for efficient asset distribution. There are different types of Phoenix Arizona Financial Account Transfers to Living Trust that individuals may consider based on their unique circumstances and preferences. These may include: 1. Revocable Living Trust: This type of trust allows individuals to maintain control over their financial accounts while alive and provides flexibility to make changes or revoke the trust if desired. It offers the advantage of avoiding probate and allows for seamless transfer of assets upon the granter's death. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be amended or revoked once established. This type of trust provides certain tax advantages and asset protection benefits. However, it requires careful consideration and consultation with a legal professional due to the permanent nature of the trust. 3. Testamentary Trust: This type of trust is created within a will and only takes effect upon the death of the individual. It allows for the transfer of financial accounts to a trust, thereby avoiding probate. Testamentary trusts are commonly used when individuals have minor children or beneficiaries who may not be ready to manage financial assets independently. The process of Phoenix Arizona Financial Account Transfer to Living Trust involves several steps. Firstly, the individual must create a living trust document that outlines the terms and conditions of the trust. This document should include a comprehensive list of the financial accounts that will be transferred to the trust. Next, the individual must notify the financial institutions where these accounts are held about their intentions to transfer ownership to the trust. This typically involves completing account transfer forms provided by the financial institution and providing necessary documentation, such as a copy of the trust document and proof of the trust's existence. Once the financial accounts have been successfully transferred to the trust, the individual, as the trustee of the trust, assumes control and management of these accounts. They can continue to conduct transactions and make financial decisions as they would have prior to the transfer, with the added benefit of knowing that the assets are now held within the trust. In summary, the Phoenix Arizona Financial Account Transfer to Living Trust process allows individuals in Phoenix, Arizona, to transfer ownership and control of their financial accounts to a living trust. This ensures efficient asset management, protection, and distribution according to their wishes, while also offering various benefits such as avoiding probate and providing privacy. Different types of living trusts, including revocable, irrevocable, and testamentary trusts, cater to different needs and circumstances.Phoenix Arizona Financial Account Transfer to Living Trust is a legal process that involves transferring the ownership and control of financial accounts in the city of Phoenix, located in the state of Arizona, to a living trust. This transfer allows individuals to effectively manage their assets and plan for the future, ensuring that their financial affairs are handled according to their wishes even after they pass away. A living trust is a legal entity created by an individual, also known as the granter or trust or, to manage and distribute their assets during their lifetime and upon their death. It is a popular estate planning tool that offers various benefits, including avoiding probate, providing privacy, and allowing for efficient asset distribution. There are different types of Phoenix Arizona Financial Account Transfers to Living Trust that individuals may consider based on their unique circumstances and preferences. These may include: 1. Revocable Living Trust: This type of trust allows individuals to maintain control over their financial accounts while alive and provides flexibility to make changes or revoke the trust if desired. It offers the advantage of avoiding probate and allows for seamless transfer of assets upon the granter's death. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable trust cannot be amended or revoked once established. This type of trust provides certain tax advantages and asset protection benefits. However, it requires careful consideration and consultation with a legal professional due to the permanent nature of the trust. 3. Testamentary Trust: This type of trust is created within a will and only takes effect upon the death of the individual. It allows for the transfer of financial accounts to a trust, thereby avoiding probate. Testamentary trusts are commonly used when individuals have minor children or beneficiaries who may not be ready to manage financial assets independently. The process of Phoenix Arizona Financial Account Transfer to Living Trust involves several steps. Firstly, the individual must create a living trust document that outlines the terms and conditions of the trust. This document should include a comprehensive list of the financial accounts that will be transferred to the trust. Next, the individual must notify the financial institutions where these accounts are held about their intentions to transfer ownership to the trust. This typically involves completing account transfer forms provided by the financial institution and providing necessary documentation, such as a copy of the trust document and proof of the trust's existence. Once the financial accounts have been successfully transferred to the trust, the individual, as the trustee of the trust, assumes control and management of these accounts. They can continue to conduct transactions and make financial decisions as they would have prior to the transfer, with the added benefit of knowing that the assets are now held within the trust. In summary, the Phoenix Arizona Financial Account Transfer to Living Trust process allows individuals in Phoenix, Arizona, to transfer ownership and control of their financial accounts to a living trust. This ensures efficient asset management, protection, and distribution according to their wishes, while also offering various benefits such as avoiding probate and providing privacy. Different types of living trusts, including revocable, irrevocable, and testamentary trusts, cater to different needs and circumstances.