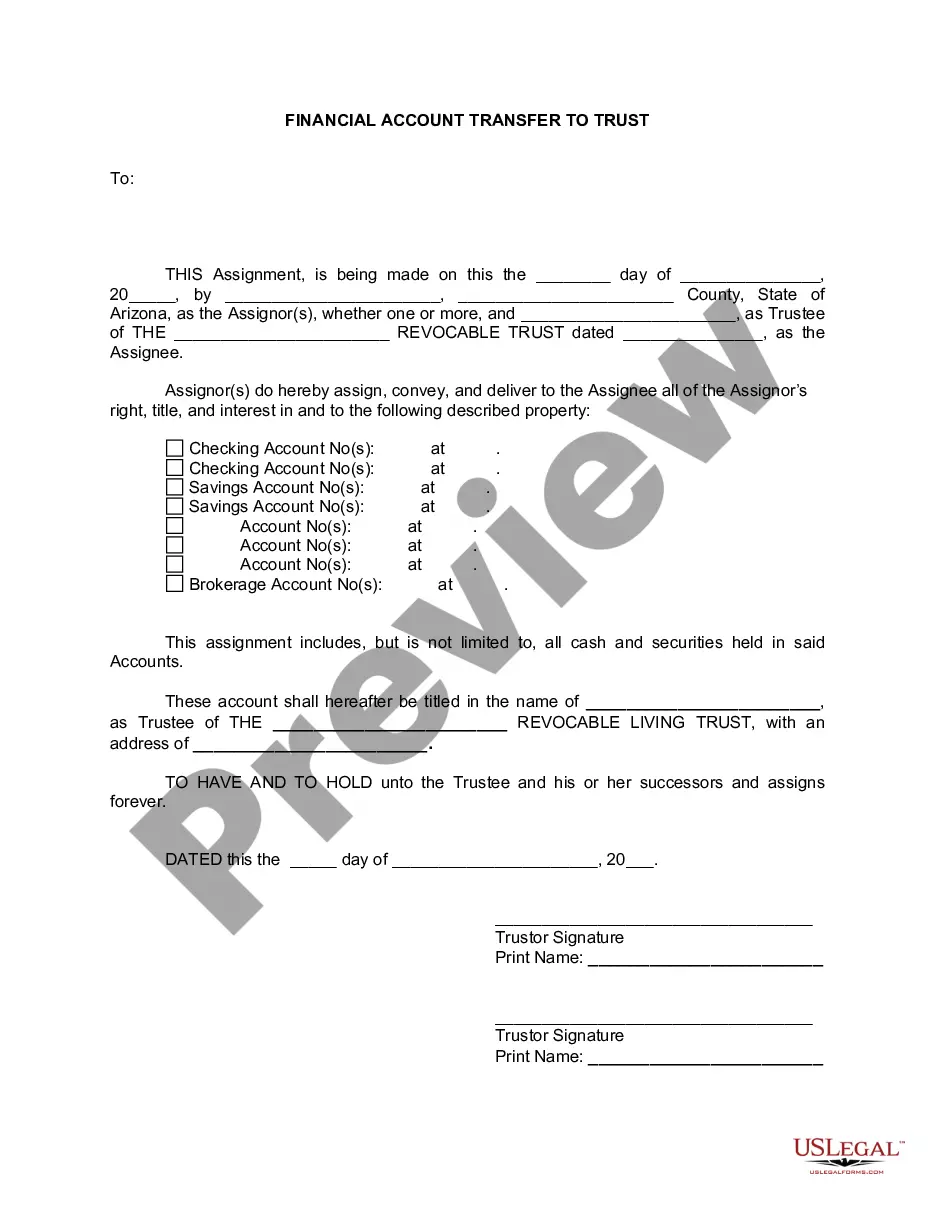

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Lima Arizona Financial Account Transfer to Living Trust includes the process by which an individual transfers their financial accounts, such as bank accounts, investment portfolios, and retirement funds, into a living trust established within the state of Arizona. This legal document appoints a trustee to manage and distribute the assets held in the trust according to the granter's instructions, both during their lifetime and after their passing. One type of financial account transfer to a living trust in Lima, Arizona is the transfer of a regular bank account. By designating the living trust as the new owner of the account, the granter ensures that the funds will be managed within the trust upon their incapacitation or death, offering protection and peace of mind for their beneficiaries. This type of transfer typically requires updating the account information with the financial institution and providing them with the necessary documentation. Another type of transfer involves investment accounts, such as brokerage or mutual fund accounts. By transferring these accounts to a living trust, the granter can benefit from the trust's clear distribution instructions, potential tax advantages, and centralized management. This process generally involves working with the financial institution to update the ownership details while adhering to any specific requirements they may have. Additionally, Lima Arizona Financial Account Transfer to Living Trust encompasses the transfer of retirement accounts, such as IRAs or 401(k)s. By naming the living trust as the beneficiary of these accounts, the granter ensures seamless asset distribution and potential tax advantages for their loved ones. This transfer often involves contacting the retirement account custodian, completing the necessary paperwork, and providing documentation to establish the trust as the named beneficiary. Overall, utilizing Lima Arizona Financial Account Transfer to Living Trust allows individuals to consolidate their various financial accounts within a single entity for ease of management and administration. This process offers numerous benefits, including potential estate tax savings, avoidance of probate, privacy, and efficient asset transfer. It is crucial for individuals considering this strategy to consult with an experienced estate planning attorney to ensure their objectives are achieved in accordance with the relevant laws and regulations.Lima Arizona Financial Account Transfer to Living Trust includes the process by which an individual transfers their financial accounts, such as bank accounts, investment portfolios, and retirement funds, into a living trust established within the state of Arizona. This legal document appoints a trustee to manage and distribute the assets held in the trust according to the granter's instructions, both during their lifetime and after their passing. One type of financial account transfer to a living trust in Lima, Arizona is the transfer of a regular bank account. By designating the living trust as the new owner of the account, the granter ensures that the funds will be managed within the trust upon their incapacitation or death, offering protection and peace of mind for their beneficiaries. This type of transfer typically requires updating the account information with the financial institution and providing them with the necessary documentation. Another type of transfer involves investment accounts, such as brokerage or mutual fund accounts. By transferring these accounts to a living trust, the granter can benefit from the trust's clear distribution instructions, potential tax advantages, and centralized management. This process generally involves working with the financial institution to update the ownership details while adhering to any specific requirements they may have. Additionally, Lima Arizona Financial Account Transfer to Living Trust encompasses the transfer of retirement accounts, such as IRAs or 401(k)s. By naming the living trust as the beneficiary of these accounts, the granter ensures seamless asset distribution and potential tax advantages for their loved ones. This transfer often involves contacting the retirement account custodian, completing the necessary paperwork, and providing documentation to establish the trust as the named beneficiary. Overall, utilizing Lima Arizona Financial Account Transfer to Living Trust allows individuals to consolidate their various financial accounts within a single entity for ease of management and administration. This process offers numerous benefits, including potential estate tax savings, avoidance of probate, privacy, and efficient asset transfer. It is crucial for individuals considering this strategy to consult with an experienced estate planning attorney to ensure their objectives are achieved in accordance with the relevant laws and regulations.