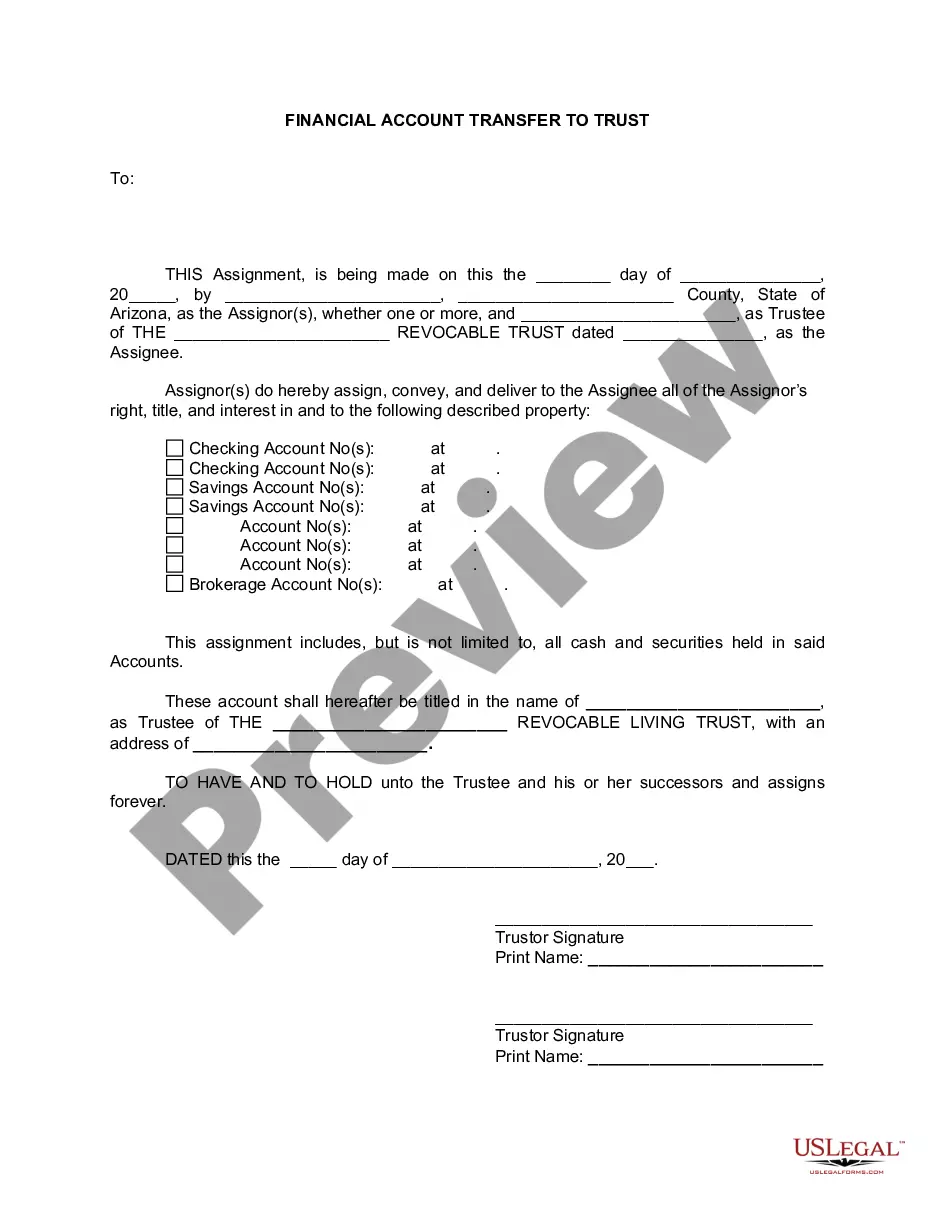

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Tempe Arizona Financial Account Transfer to Living Trust: A Comprehensive Guide Are you a resident of Tempe, Arizona, looking to secure your financial accounts and assets for your loved ones? Consider the Tempe Arizona Financial Account Transfer to Living Trust. With this type of estate planning, you can efficiently transfer your financial accounts to a living trust, ensuring smooth management and distribution of assets while offering numerous benefits for both you and your beneficiaries. What is a Living Trust? A living trust, commonly known as a revocable trust, is an estate planning tool that allows individuals to transfer their assets to a trust, which they can manage during their lifetime. By establishing a living trust, you retain control over your assets while providing a detailed plan for their transfer upon your passing. This legal document helps avoid probate, minimizes potential taxes, protects your privacy, and ensures a seamless transfer of your financial holdings. Advantages of a Tempe Arizona Financial Account Transfer to Living Trust: 1. Avoidance of Probate: Probate is the legal process through which the court transfers a person's assets after their passing. By utilizing a living trust, your financial accounts bypass probate, saving your loved one's time, money, and the emotional stress associated with this often lengthy and public process. 2. Asset Management Continuity: In the event of your incapacitation or death, a living trust ensures that your chosen successor trustee can seamlessly manage and distribute your financial accounts and assets, avoiding potential disruption or confusion. 3. Privacy Protection: Unlike a will, which becomes part of public record during probate proceedings, a living trust keeps your financial affairs private, protecting sensitive information from prying eyes. 4. Flexibility and Control: As the creator of the living trust, you have the power to modify or revoke it during your lifetime, ensuring ongoing control over your financial accounts. Additionally, you can include specific instructions for the distribution of your assets, allowing you to customize your estate plan according to your unique circumstances. 5. Tax Efficiency: While a living trust does not necessarily provide direct tax benefits, it can help minimize estate taxes and streamline the transfer of assets, potentially reducing tax liabilities for your beneficiaries. Types of Tempe Arizona Financial Account Transfer to Living Trust: 1. Banking Accounts: This type of living trust transfer encompasses various financial accounts held at banks, such as checking accounts, savings accounts, certificates of deposit (CDs), money market accounts, and more. 2. Investment Accounts: Transfer securities, stocks, bonds, mutual funds, and other investment products held in brokerage accounts to your living trust. This ensures their efficient management and distribution upon your passing. 3. Retirement Accounts: Though IRAs and 401(k) plans generally have designated beneficiaries, establishing a living trust can provide added protection and flexibility when passing on these assets. It allows you to create specific instructions for the distribution of your retirement funds, ensuring their alignment with your overall estate plan. 4. Insurance Policies: Although life insurance policies typically have named beneficiaries, they can also be transferred to a living trust. Doing so allows you to include them in your comprehensive estate plan, ensuring coordinated distribution with other assets. In conclusion, a Tempe Arizona Financial Account Transfer to Living Trust offers a comprehensive and effective means of securing your financial accounts and assets while providing various advantages for you and your loved ones. By avoiding probate, maintaining control and privacy, and optimizing tax efficiency, this estate planning tool ensures your financial legacy is protected and distributed according to your wishes. Consider consulting a qualified estate planning attorney or financial advisor to help you navigate the specific requirements and intricacies of a living trust transfer in Tempe, Arizona.Tempe Arizona Financial Account Transfer to Living Trust: A Comprehensive Guide Are you a resident of Tempe, Arizona, looking to secure your financial accounts and assets for your loved ones? Consider the Tempe Arizona Financial Account Transfer to Living Trust. With this type of estate planning, you can efficiently transfer your financial accounts to a living trust, ensuring smooth management and distribution of assets while offering numerous benefits for both you and your beneficiaries. What is a Living Trust? A living trust, commonly known as a revocable trust, is an estate planning tool that allows individuals to transfer their assets to a trust, which they can manage during their lifetime. By establishing a living trust, you retain control over your assets while providing a detailed plan for their transfer upon your passing. This legal document helps avoid probate, minimizes potential taxes, protects your privacy, and ensures a seamless transfer of your financial holdings. Advantages of a Tempe Arizona Financial Account Transfer to Living Trust: 1. Avoidance of Probate: Probate is the legal process through which the court transfers a person's assets after their passing. By utilizing a living trust, your financial accounts bypass probate, saving your loved one's time, money, and the emotional stress associated with this often lengthy and public process. 2. Asset Management Continuity: In the event of your incapacitation or death, a living trust ensures that your chosen successor trustee can seamlessly manage and distribute your financial accounts and assets, avoiding potential disruption or confusion. 3. Privacy Protection: Unlike a will, which becomes part of public record during probate proceedings, a living trust keeps your financial affairs private, protecting sensitive information from prying eyes. 4. Flexibility and Control: As the creator of the living trust, you have the power to modify or revoke it during your lifetime, ensuring ongoing control over your financial accounts. Additionally, you can include specific instructions for the distribution of your assets, allowing you to customize your estate plan according to your unique circumstances. 5. Tax Efficiency: While a living trust does not necessarily provide direct tax benefits, it can help minimize estate taxes and streamline the transfer of assets, potentially reducing tax liabilities for your beneficiaries. Types of Tempe Arizona Financial Account Transfer to Living Trust: 1. Banking Accounts: This type of living trust transfer encompasses various financial accounts held at banks, such as checking accounts, savings accounts, certificates of deposit (CDs), money market accounts, and more. 2. Investment Accounts: Transfer securities, stocks, bonds, mutual funds, and other investment products held in brokerage accounts to your living trust. This ensures their efficient management and distribution upon your passing. 3. Retirement Accounts: Though IRAs and 401(k) plans generally have designated beneficiaries, establishing a living trust can provide added protection and flexibility when passing on these assets. It allows you to create specific instructions for the distribution of your retirement funds, ensuring their alignment with your overall estate plan. 4. Insurance Policies: Although life insurance policies typically have named beneficiaries, they can also be transferred to a living trust. Doing so allows you to include them in your comprehensive estate plan, ensuring coordinated distribution with other assets. In conclusion, a Tempe Arizona Financial Account Transfer to Living Trust offers a comprehensive and effective means of securing your financial accounts and assets while providing various advantages for you and your loved ones. By avoiding probate, maintaining control and privacy, and optimizing tax efficiency, this estate planning tool ensures your financial legacy is protected and distributed according to your wishes. Consider consulting a qualified estate planning attorney or financial advisor to help you navigate the specific requirements and intricacies of a living trust transfer in Tempe, Arizona.