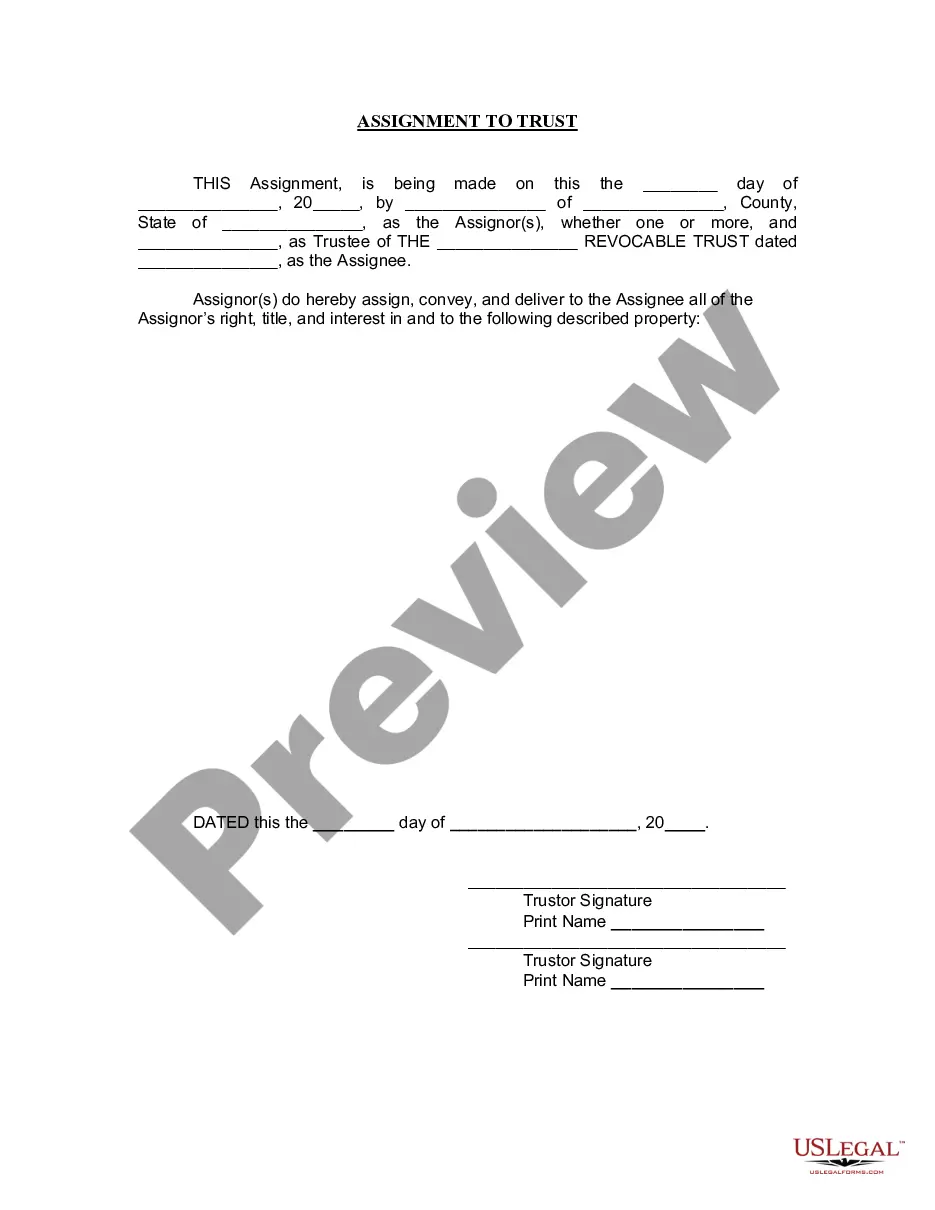

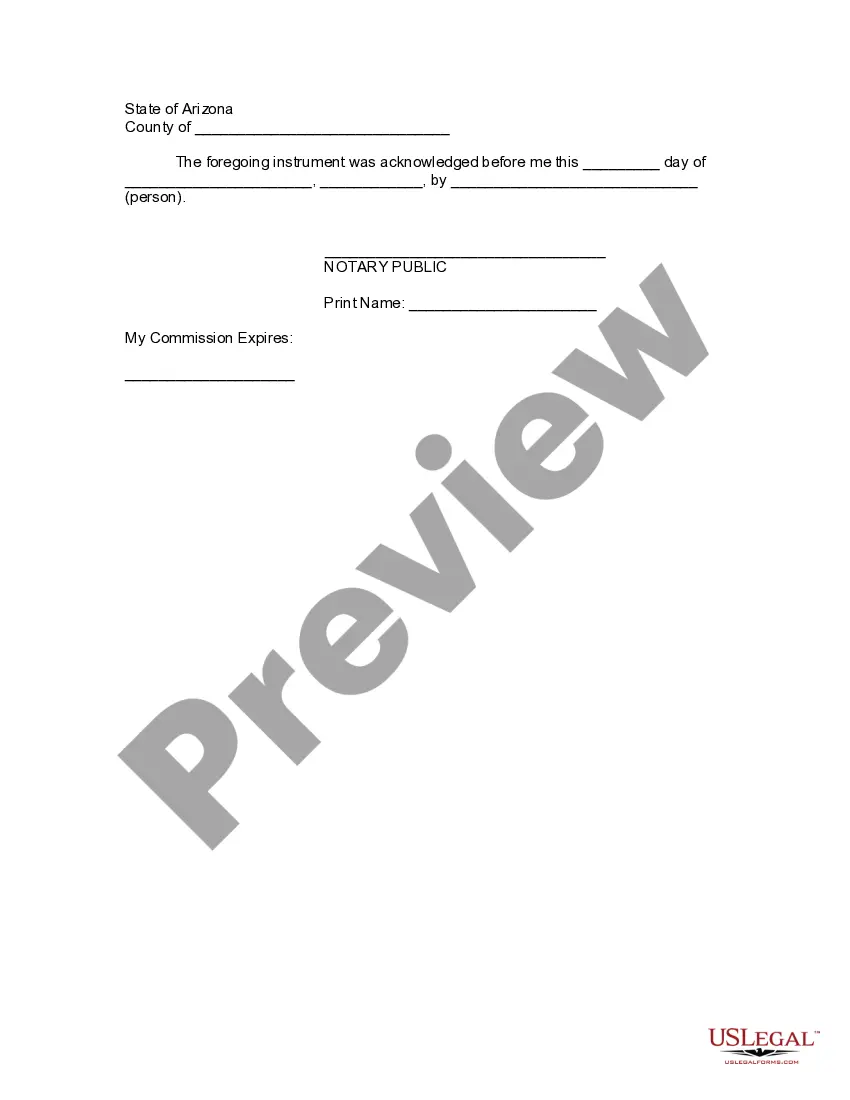

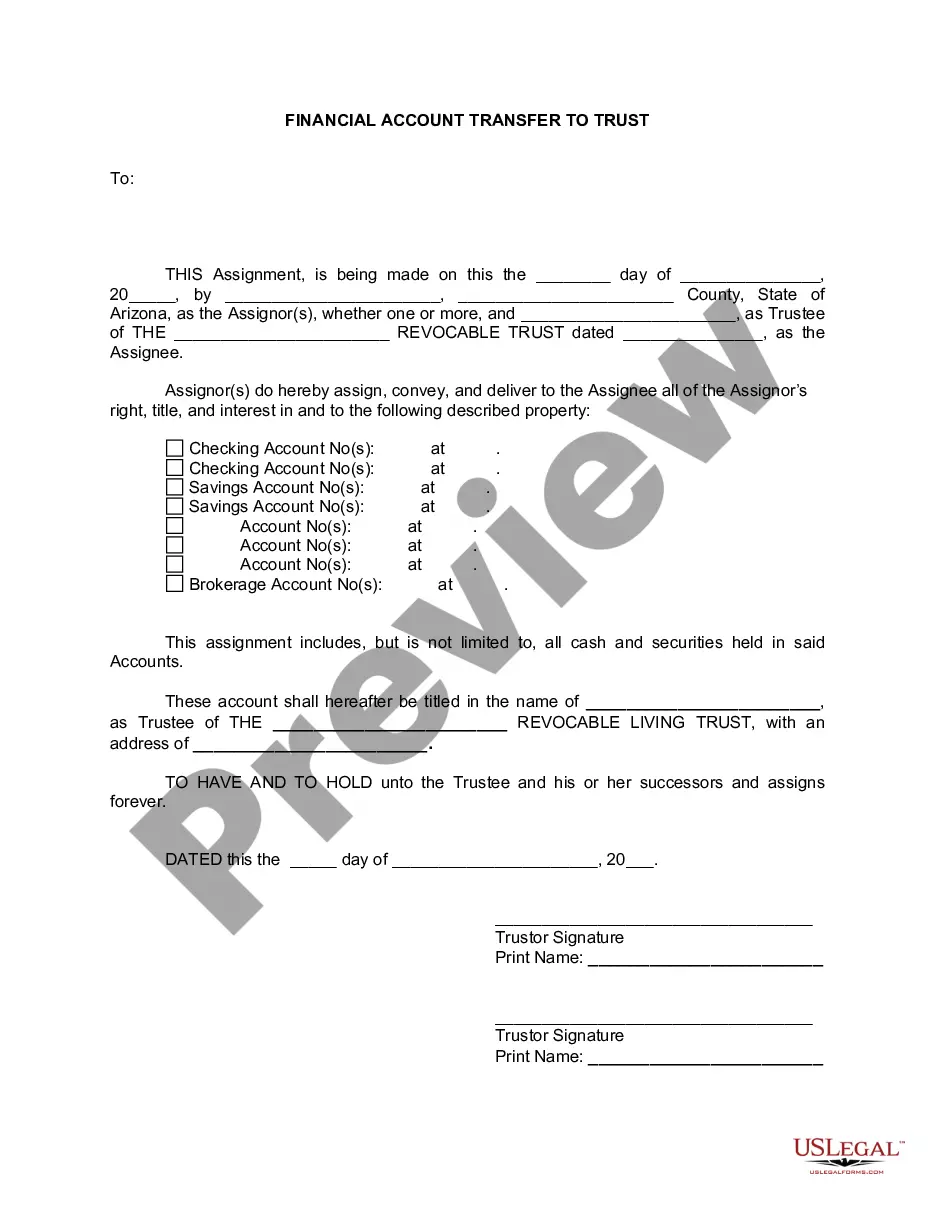

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Gilbert, Arizona Assignment to Living Trust: A Comprehensive Guide In Gilbert, Arizona, an assignment to a living trust is a legal process where an individual transfers their assets into a trust during their lifetime. This assignment to a living trust ensures a smooth transfer of assets to heirs or beneficiaries upon the individual's death, eliminating the need for probate. By utilizing a living trust, individuals in Gilbert, Arizona can maintain control over their assets while enjoying the benefits of their estate being managed efficiently and effectively. The living trust document designates a trustee who will manage the assets in the trust as per the individual's wishes. There are different types of assignments to living trusts in Gilbert, Arizona, based on estate planning goals and specific circumstances. These include: 1. Revocable Living Trust: This type of trust allows the individual, also known as the granter, to maintain control and make changes to the trust at any time during their lifetime. The granter can serve as the trustee and can change beneficiaries, modify instructions, or revoke the trust entirely if desired. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered or revoked by the granter once it has been created. This type of trust is often used for estate tax planning purposes, asset protection, or Medicaid eligibility. It offers increased protection from creditors and can help minimize estate taxes. 3. Testamentary Trust: Unlike revocable and irrevocable trusts, a testamentary trust isn't created during the granter's lifetime. Instead, it is established in the granter's will and takes effect after their death. The assets are then transferred to the trust through the probate process. Testamentary trusts can be beneficial for individuals who want to ensure the appropriate management of assets for minor children or beneficiaries with special needs. 4. Special Needs Trust: Also known as a supplemental needs trust, a special needs trust is designed to provide for the financial well-being of an individual with disabilities without jeopardizing their eligibility for government assistance programs. These trusts are carefully drafted to maintain eligibility for benefits such as Medicaid or Supplemental Security Income while enhancing the quality of life of the disabled individual. 5. Charitable Remainder Trust: For individuals with philanthropic intentions, a charitable remainder trust allows them to contribute assets to the trust, retain an income stream, and donate the remaining assets to a charity upon their death. This type of trust can provide substantial tax benefits while supporting causes close to the granter's heart. In conclusion, a Gilbert, Arizona assignment to a living trust is a crucial estate planning tool that enables individuals to protect and manage their assets during their lifetime and ensure a seamless transfer to their beneficiaries after their passing. By understanding the different types of living trusts available, individuals can choose the one that aligns with their specific needs, goals, and wishes.Gilbert, Arizona Assignment to Living Trust: A Comprehensive Guide In Gilbert, Arizona, an assignment to a living trust is a legal process where an individual transfers their assets into a trust during their lifetime. This assignment to a living trust ensures a smooth transfer of assets to heirs or beneficiaries upon the individual's death, eliminating the need for probate. By utilizing a living trust, individuals in Gilbert, Arizona can maintain control over their assets while enjoying the benefits of their estate being managed efficiently and effectively. The living trust document designates a trustee who will manage the assets in the trust as per the individual's wishes. There are different types of assignments to living trusts in Gilbert, Arizona, based on estate planning goals and specific circumstances. These include: 1. Revocable Living Trust: This type of trust allows the individual, also known as the granter, to maintain control and make changes to the trust at any time during their lifetime. The granter can serve as the trustee and can change beneficiaries, modify instructions, or revoke the trust entirely if desired. 2. Irrevocable Living Trust: Unlike a revocable trust, an irrevocable living trust cannot be altered or revoked by the granter once it has been created. This type of trust is often used for estate tax planning purposes, asset protection, or Medicaid eligibility. It offers increased protection from creditors and can help minimize estate taxes. 3. Testamentary Trust: Unlike revocable and irrevocable trusts, a testamentary trust isn't created during the granter's lifetime. Instead, it is established in the granter's will and takes effect after their death. The assets are then transferred to the trust through the probate process. Testamentary trusts can be beneficial for individuals who want to ensure the appropriate management of assets for minor children or beneficiaries with special needs. 4. Special Needs Trust: Also known as a supplemental needs trust, a special needs trust is designed to provide for the financial well-being of an individual with disabilities without jeopardizing their eligibility for government assistance programs. These trusts are carefully drafted to maintain eligibility for benefits such as Medicaid or Supplemental Security Income while enhancing the quality of life of the disabled individual. 5. Charitable Remainder Trust: For individuals with philanthropic intentions, a charitable remainder trust allows them to contribute assets to the trust, retain an income stream, and donate the remaining assets to a charity upon their death. This type of trust can provide substantial tax benefits while supporting causes close to the granter's heart. In conclusion, a Gilbert, Arizona assignment to a living trust is a crucial estate planning tool that enables individuals to protect and manage their assets during their lifetime and ensure a seamless transfer to their beneficiaries after their passing. By understanding the different types of living trusts available, individuals can choose the one that aligns with their specific needs, goals, and wishes.