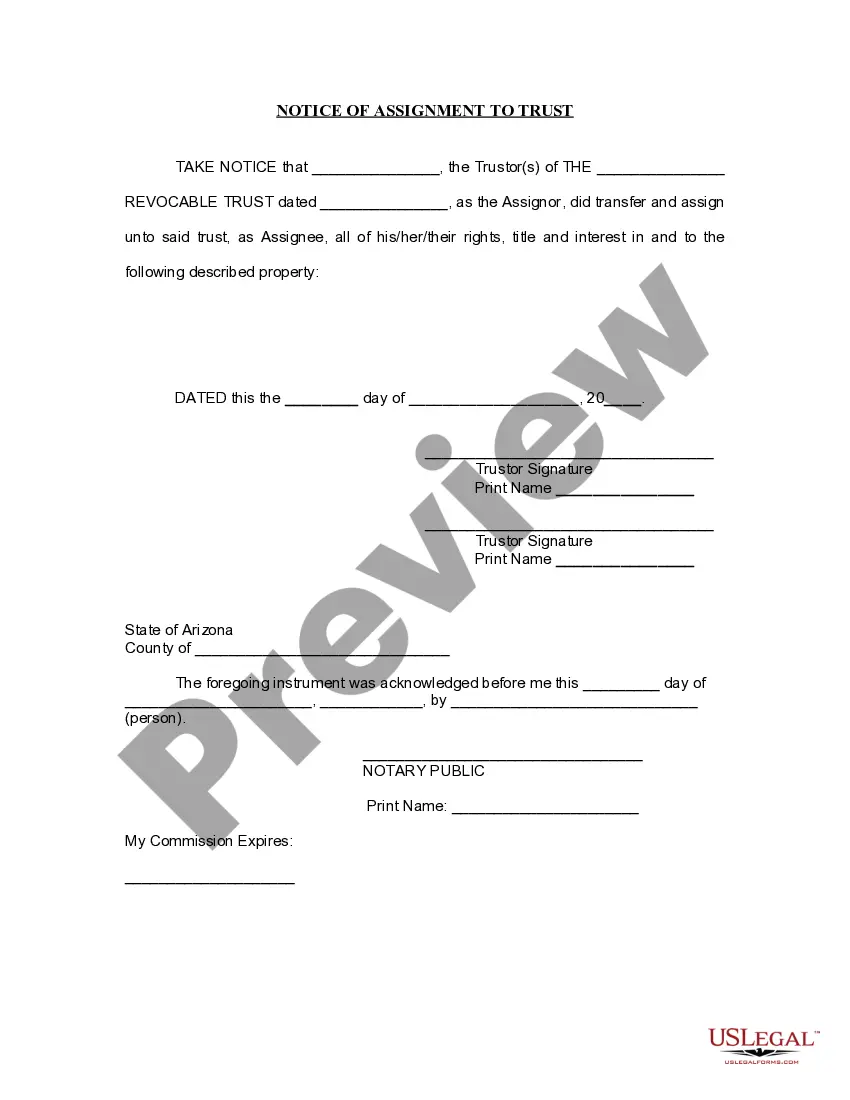

Notice of Assignment to Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form serves as notice that the

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

Surprise Arizona Notice of Assignment to Living Trust

Description

How to fill out Arizona Notice Of Assignment To Living Trust?

Utilize the US Legal Forms and gain instant access to any form sample you desire.

Our user-friendly platform, featuring thousands of documents, simplifies the process of locating and obtaining nearly any document sample you require.

You can download, complete, and validate the Surprise Arizona Notice of Assignment to Living Trust in just a few minutes rather than searching the internet for hours in pursuit of a suitable template.

Leveraging our library is an excellent method to enhance the security of your document filing.

If you haven’t created an account yet, follow the instructions outlined below.

US Legal Forms ranks among the largest and most trusted document libraries online. Our team is always eager to assist you in any legal procedure, even if it’s merely downloading the Surprise Arizona Notice of Assignment to Living Trust.

- Our skilled legal professionals consistently review all records to verify that the forms are suitable for a specific state and comply with current laws and regulations.

- How can you acquire the Surprise Arizona Notice of Assignment to Living Trust.

- If you have an account, simply Log In to your profile.

- The Download option will be available for all the documents you access.

- Additionally, you can retrieve all previously saved documents from the My documents section.

Form popularity

FAQ

You can find out if you are a beneficiary of a trust by requesting information from the trustee or through official documentation, such as a Surprise Arizona Notice of Assignment to Living Trust. If you suspect you have an interest but have not been notified, it may be beneficial to seek legal advice. This will help clarify your situation and ensure your rights are protected.

Yes, it is essential to notify beneficiaries of a trust to comply with legal standards and ensure transparency. This notification often involves issuing a Surprise Arizona Notice of Assignment to Living Trust, which serves as a legal document confirming the beneficiary's rights. Proper notification promotes trust and understanding throughout the estate planning process.

A beneficiary usually receives notice from the trustee or the attorney handling the trust. The notification procedure often includes a Surprise Arizona Notice of Assignment to Living Trust, which details vital information about the trust and the beneficiary's interest in it. This ensures that beneficiaries have access to all essential information regarding their rights and the estate's management.

Beneficiaries are typically notified through formal communication methods, such as written letters or emails, outlining their rights and shares in the trust. This notification process is often accompanied by a Surprise Arizona Notice of Assignment to Living Trust. Such documentation provides clarity and assurance to beneficiaries about their entitlements and the trust's status.

Yes, a trustee is generally required to communicate with beneficiaries regarding the status of the trust and any significant changes. This is particularly important in the context of a Surprise Arizona Notice of Assignment to Living Trust. Keeping beneficiaries informed helps maintain trust and ensures everyone understands the rights and obligations involved.

One of the biggest mistakes parents make is failing to fund their trust after creating it. Without proper funding, a Surprise Arizona Notice of Assignment to Living Trust cannot serve its purpose effectively. It is essential to transfer assets into the trust to ensure it operates as intended and protects your family's future.

To record a living trust in Arizona, you first gather the necessary documents, including the Surprise Arizona Notice of Assignment to Living Trust. You then submit these documents at the county recorder's office where your property is located. This process protects your interests and ensures your assets are distributed according to your wishes.

Generally, a trust does not need to be recorded in Arizona after its creation. Certain assets in the trust, like real estate, may need a Surprise Arizona Notice of Assignment to Living Trust to ensure they are legally recognized. Recording this notice helps establish clear ownership and title for those assets.

In Arizona, trusts do not have to be filed with the court. The Surprise Arizona Notice of Assignment to Living Trust details how assets are assigned to the trust without requiring court approval. This private nature of trusts can help you avoid probate and maintain confidentiality.

A trust is not considered a court document. Instead, it is a private arrangement you create to manage and distribute your assets. Unlike court documents, which must go through legal scrutiny, a trust allows you to maintain control over your assets without intervention unless disputes arise.