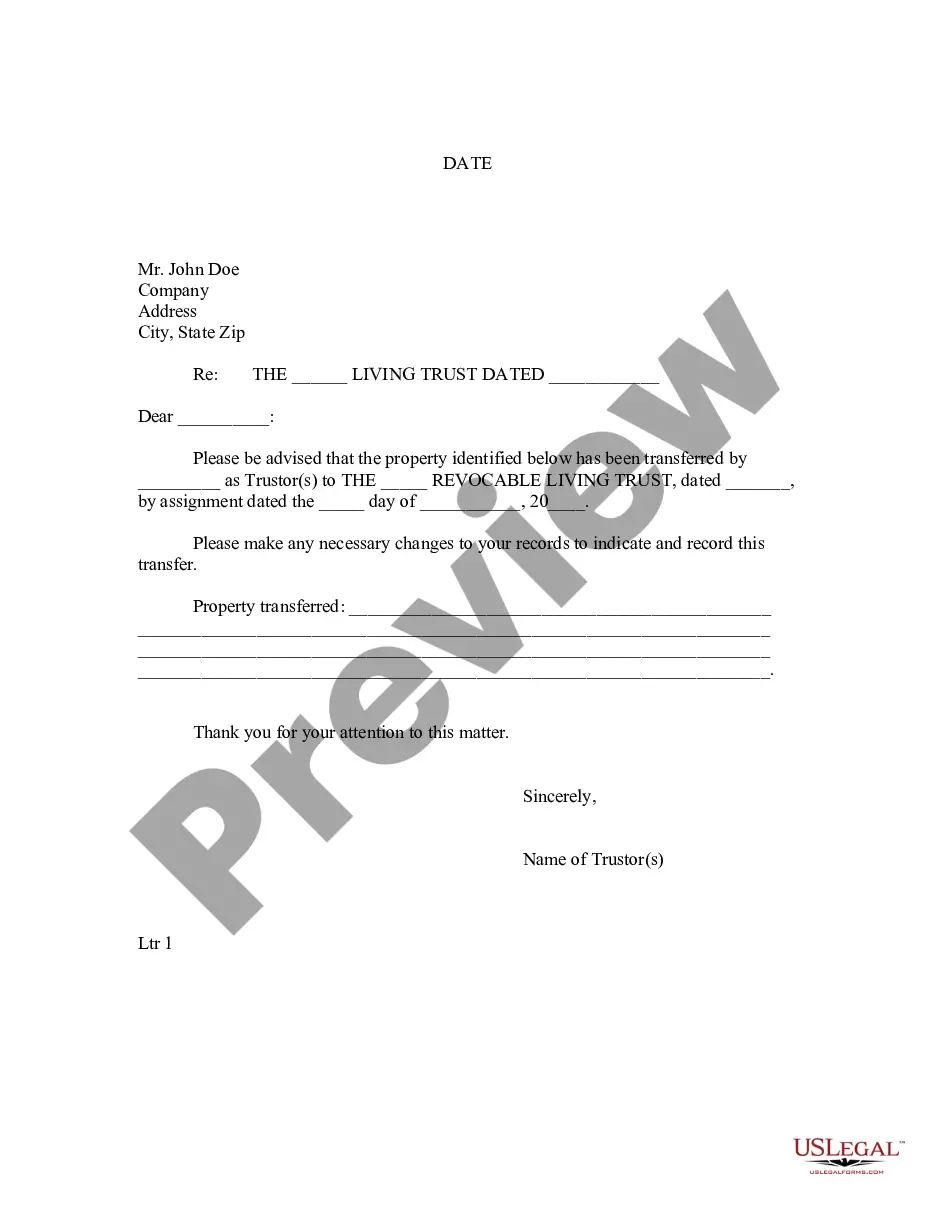

This Letter to Lienholder to Notify of Trust form is a letter notice to a lienholder to notify the lienholder that property has been transferred to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. The trustor would use this form to specify what specific property was being held by the trust.

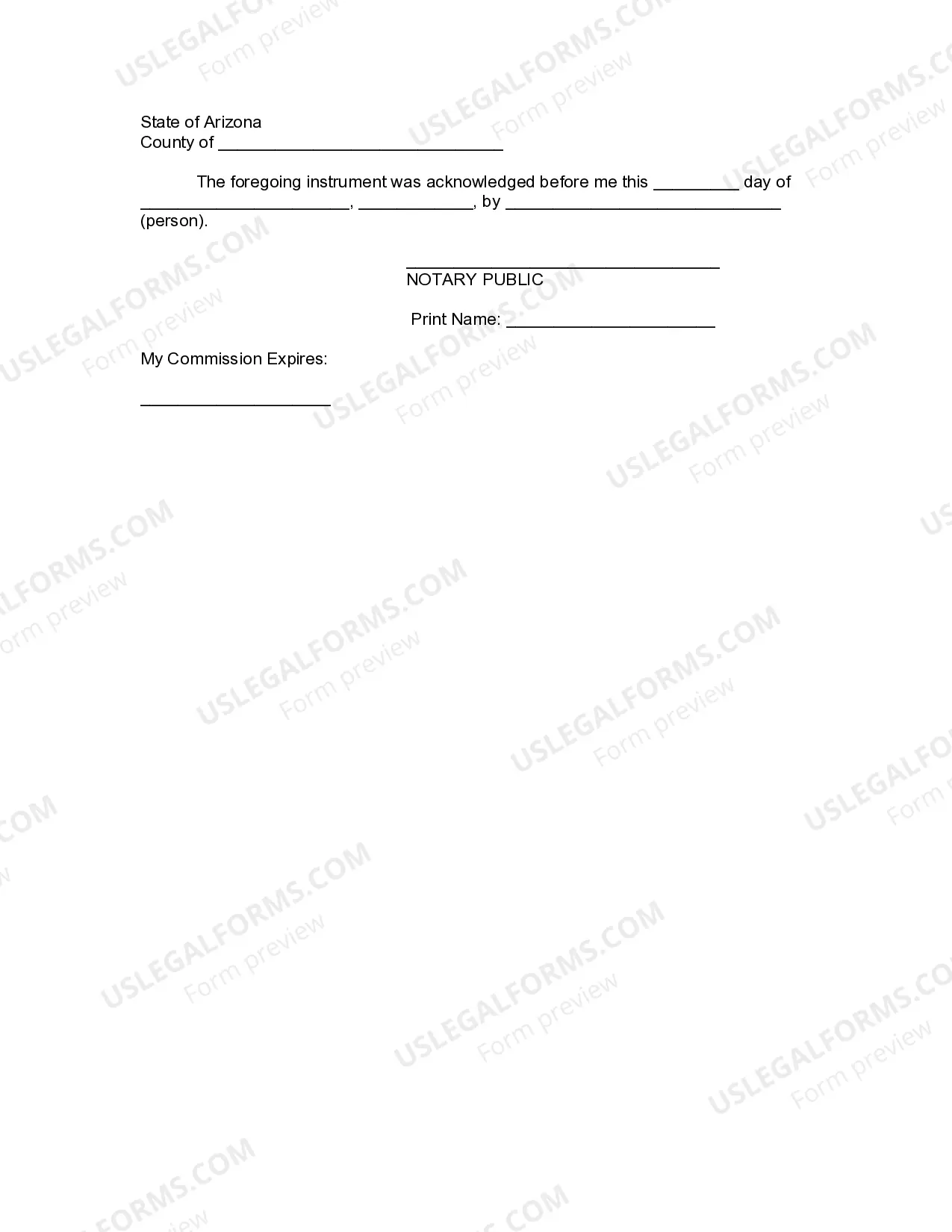

When establishing a trust in Gilbert, Arizona, it is crucial to inform the lien holder to ensure the proper transfer of ownership and management. To notify the lien holder, various types of letters can be used, each serving a specific purpose. Let us delve into the details of each type of Gilbert Arizona letter to lien holder to notify of trust, shedding light on their significance and relevance. 1. Gilbert Arizona Letter to Lien holder to Notify of Living Trust: A living trust allows individuals to transfer their assets into a trust while maintaining control during their lifetime. When notifying the lien holder about a living trust, it is essential to convey the change in ownership and instruct them on how to handle the property's financial matters, such as payment escalations, account updates, and any necessary documentation updates. 2. Gilbert Arizona Letter to Lien holder to Notify of Revocable Trust: A revocable trust offers flexibility as it can be altered or revoked by the granter while they are alive. When a revocable trust is established, notifying the lien holder becomes crucial to communicate the change in ownership and financial management. This letter should also include instructions on updating account information and ensuring a smooth transition of responsibilities. 3. Gilbert Arizona Letter to Lien holder to Notify of Irrevocable Trust: An irrevocable trust provides a more permanent transfer of assets, as it cannot be changed or revoked without the beneficiaries' consent. When creating an irrevocable trust, notifying the lien holder is necessary to inform them about the change in ownership and ensure appropriate correspondence is directed to the trust's designated trustee. This letter should outline the necessary steps for account updates and any specific instructions regarding payments and financial matters. 4. Gilbert Arizona Letter to Lien holder to Notify of Testamentary Trust: A testamentary trust is established through a will and becomes effective upon the granter's death. It ensures proper management and distribution of assets to beneficiaries. While the trust is not in effect during the granter's lifetime, it is still important to inform the lien holder about the existence of the trust. This letter should clarify the upcoming change in ownership and provide instructions for updating lien holder records upon the granter's passing. In conclusion, these various types of Gilbert Arizona letters to lien holder serve as a vital means of notifying financial institutions about the creation or changes in the ownership of trusts. By notifying the lien holder, the appropriate management and financial accounts can be updated, ensuring a smooth transition and proper asset management within the trust.When establishing a trust in Gilbert, Arizona, it is crucial to inform the lien holder to ensure the proper transfer of ownership and management. To notify the lien holder, various types of letters can be used, each serving a specific purpose. Let us delve into the details of each type of Gilbert Arizona letter to lien holder to notify of trust, shedding light on their significance and relevance. 1. Gilbert Arizona Letter to Lien holder to Notify of Living Trust: A living trust allows individuals to transfer their assets into a trust while maintaining control during their lifetime. When notifying the lien holder about a living trust, it is essential to convey the change in ownership and instruct them on how to handle the property's financial matters, such as payment escalations, account updates, and any necessary documentation updates. 2. Gilbert Arizona Letter to Lien holder to Notify of Revocable Trust: A revocable trust offers flexibility as it can be altered or revoked by the granter while they are alive. When a revocable trust is established, notifying the lien holder becomes crucial to communicate the change in ownership and financial management. This letter should also include instructions on updating account information and ensuring a smooth transition of responsibilities. 3. Gilbert Arizona Letter to Lien holder to Notify of Irrevocable Trust: An irrevocable trust provides a more permanent transfer of assets, as it cannot be changed or revoked without the beneficiaries' consent. When creating an irrevocable trust, notifying the lien holder is necessary to inform them about the change in ownership and ensure appropriate correspondence is directed to the trust's designated trustee. This letter should outline the necessary steps for account updates and any specific instructions regarding payments and financial matters. 4. Gilbert Arizona Letter to Lien holder to Notify of Testamentary Trust: A testamentary trust is established through a will and becomes effective upon the granter's death. It ensures proper management and distribution of assets to beneficiaries. While the trust is not in effect during the granter's lifetime, it is still important to inform the lien holder about the existence of the trust. This letter should clarify the upcoming change in ownership and provide instructions for updating lien holder records upon the granter's passing. In conclusion, these various types of Gilbert Arizona letters to lien holder serve as a vital means of notifying financial institutions about the creation or changes in the ownership of trusts. By notifying the lien holder, the appropriate management and financial accounts can be updated, ensuring a smooth transition and proper asset management within the trust.