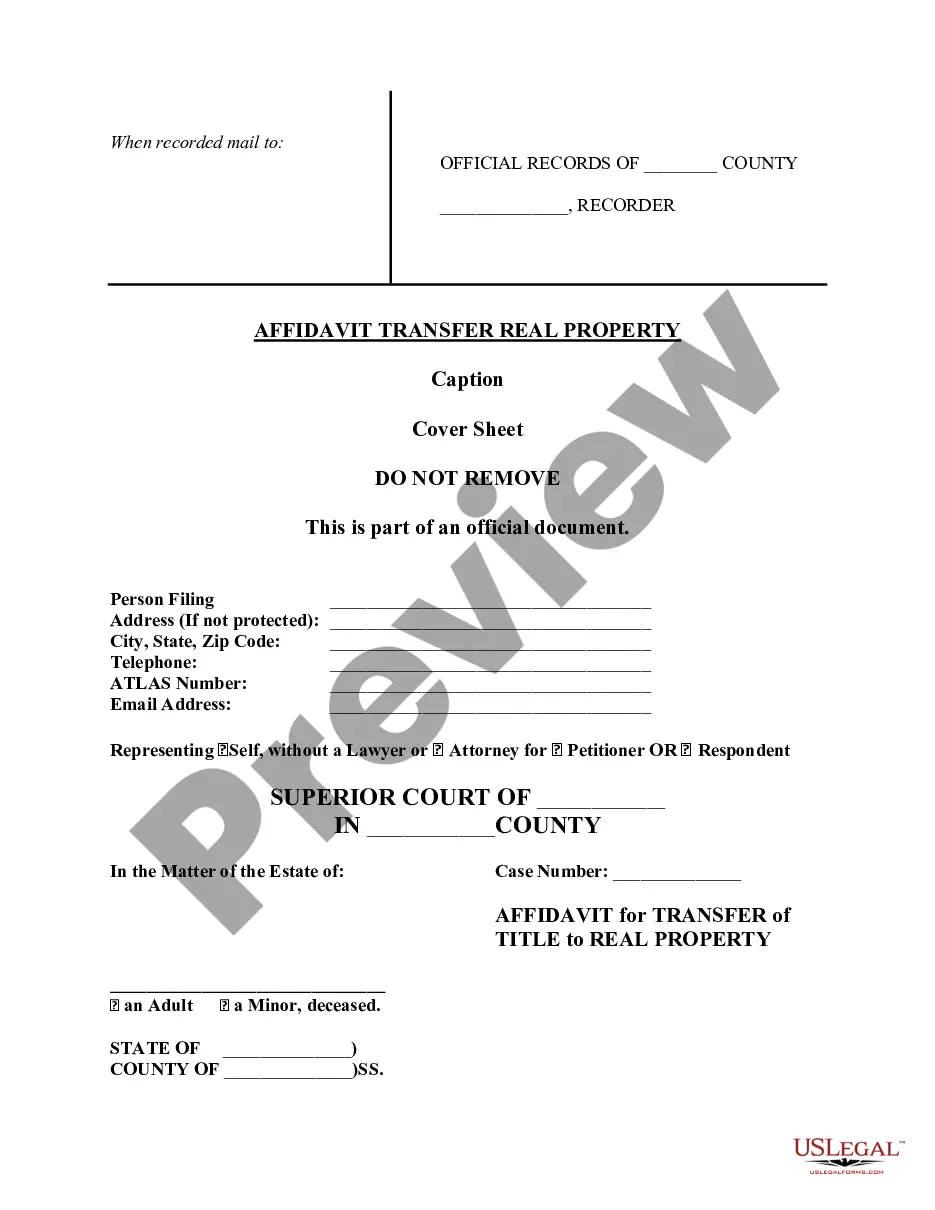

Phoenix Arizona Affidavit for Transfer of Title of Real Property

Description

How to fill out Arizona Affidavit For Transfer Of Title Of Real Property?

If you are in search of a pertinent form template, it’s challenging to select a more suitable location than the US Legal Forms site – likely the most extensive libraries on the internet.

With this collection, you can discover thousands of document samples for commercial and personal intents categorized by types and states, or keywords.

With the enhanced search functionality, locating the most recent Phoenix Arizona Affidavit for Transfer of Title of Real Property is as straightforward as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and save it on your device.

- Moreover, the relevance of each document is validated by a group of skilled attorneys who routinely review the templates on our platform and update them in line with the latest state and county regulations.

- If you are already acquainted with our system and possess an account, all you need to obtain the Phoenix Arizona Affidavit for Transfer of Title of Real Property is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just refer to the guidelines below.

- Ensure you have found the sample you need. Review its description and utilize the Preview function to examine its content. If it doesn’t satisfy your requirements, employ the Search field at the top of the screen to find the necessary document.

- Verify your choice. Click the Buy now button. After that, select the desired pricing plan and provide details to register for an account.

Form popularity

FAQ

Probate is not required to deal with the property but may be needed if the deceased's estate warrants it. Much depends on what the deceased owned and what the beneficiaries intend to do with the property.

Typically, you need the property ownership document and the Will, or the Will with probate or succession certificate. In the absence of a Will, you may also need to prepare an affidavit along with a no-objection certificate from other legal heirs or their successors.

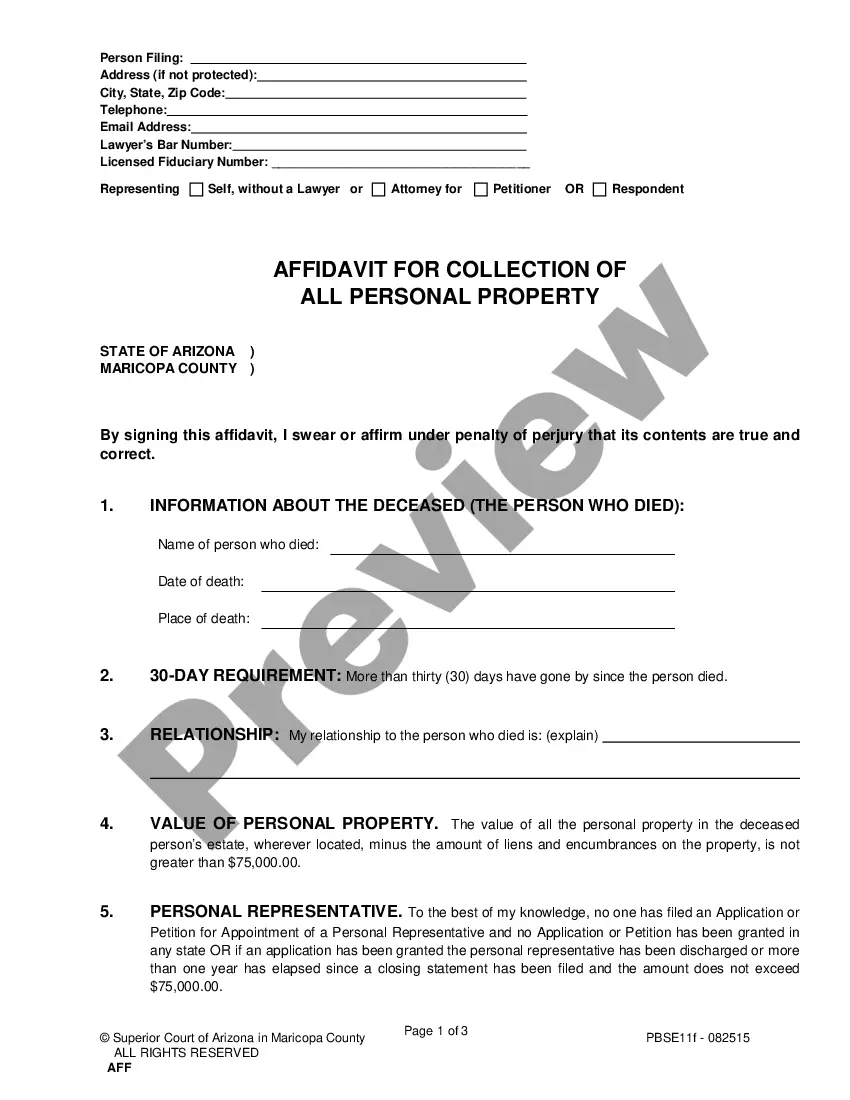

Arizona statutes offer an alternative to avoiding probate by using an Affidavit of Succession to Real Property in cases in which the real property value does not exceed a certain value. The estate value must be less than $100,000 minus all the liens and any other encumbrances when the decedent passed away.

Four Ways to Avoid Probate in Arizona Establish a Trust.Title Property with Rights of Survivorship.Make Accounts Payable on Death or Transfer of Death.Provisions for Small Estates.

estate affidavit is a procedure available under Arizona estate law that allows heirs and beneficiaries to bypass the probate process, which can be lengthy and expensive.

In case a male dies intestate, i.e. without making a will, his assets shall be distributed according to the Hindu Succession Act and the property is transferred to the legal heirs of the deceased. The legal heirs are further classified into two classes- class I and class II.

The Arizona beneficiary deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

A beneficiary deed allows for the avoidance of probate. Arizona allows for the transfer of real estate by affidavit if the equity of all the real property in the estate is not greater than $100,000.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

It is a sworn statement, in which the affiant attests under oath to the inheritance right and certain other facts relating to the estate. The heir or devise files the affidavit with the probate court registrar in the county where the real estate is located.