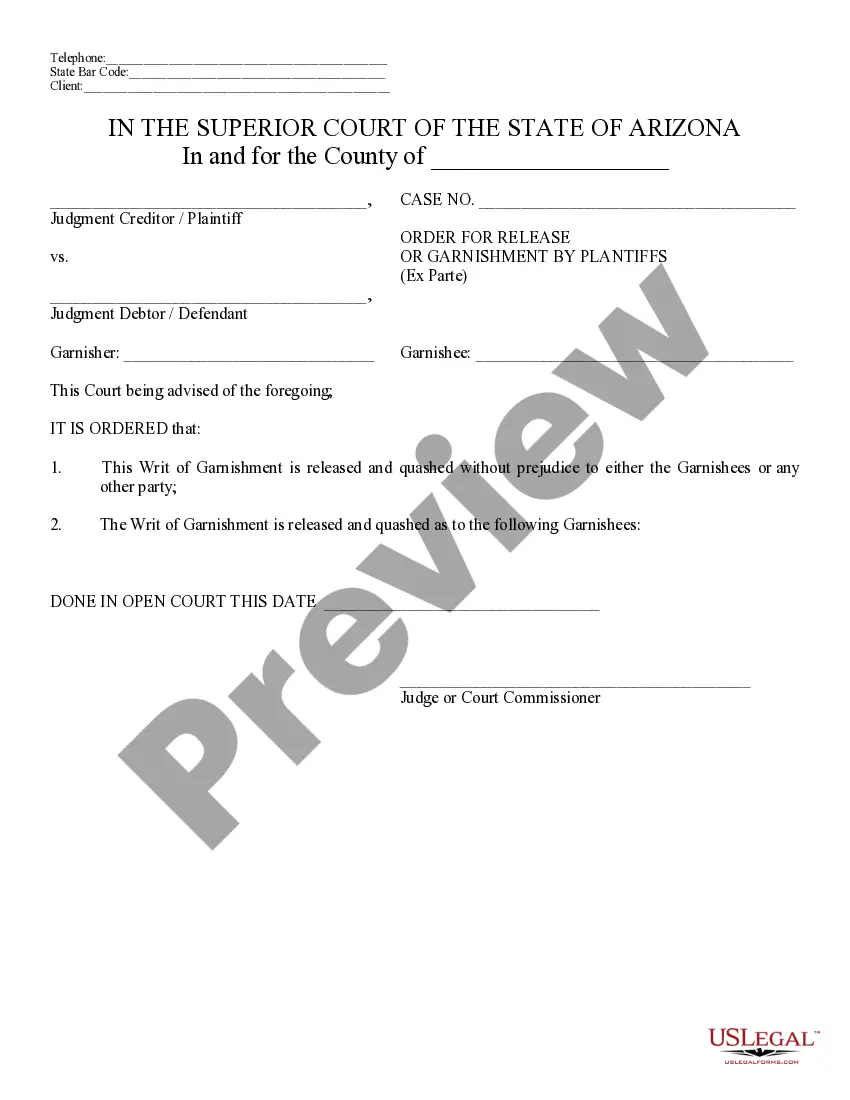

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice of Release of Garnishment & Order, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

A Tucson Arizona Notice of Release of Garnishment and Order is a legal document that signifies the termination of a garnishment order against a debtor's wages or assets. This notification serves as an official release, informing all parties involved that the garnishment has been lifted. This notice holds significant importance for debtors, employers, and entities responsible for executing the garnishment. There are several types of Tucson Arizona Notice of Release of Garnishment and Order, including: 1. Wage Garnishment Release: This notice is issued when a debtor, who has previously been subjected to wage garnishment, fulfills the necessary obligations or reaches an agreement to fulfill the outstanding debt. The wage garnishment release officially declares that the debtor's wages are no longer subject to garnishment. 2. Bank Account Garnishment Release: In cases where a debtor's bank account has been garnished to recover debts owed, this notice is sent to the financial institution involved. It releases any limitations or restrictions on the debtor's bank account, enabling them to access and utilize their funds without interference. 3. Property Garnishment Release: When a debtor's property or assets have been targeted for garnishment, this notice of release is provided to inform the concerned parties that the property is no longer subject to seizure or attachment. It allows the debtor to regain control over their property and prevents any further enforcement actions. The Tucson Arizona Notice of Release of Garnishment and Order is a crucial legal instrument that safeguards debtors' rights and provides clarity to involved parties. Once issued, it ensures that all affected parties are duly informed about the revocation of the garnishment order, preventing any continued interference with the debtor's financial affairs.A Tucson Arizona Notice of Release of Garnishment and Order is a legal document that signifies the termination of a garnishment order against a debtor's wages or assets. This notification serves as an official release, informing all parties involved that the garnishment has been lifted. This notice holds significant importance for debtors, employers, and entities responsible for executing the garnishment. There are several types of Tucson Arizona Notice of Release of Garnishment and Order, including: 1. Wage Garnishment Release: This notice is issued when a debtor, who has previously been subjected to wage garnishment, fulfills the necessary obligations or reaches an agreement to fulfill the outstanding debt. The wage garnishment release officially declares that the debtor's wages are no longer subject to garnishment. 2. Bank Account Garnishment Release: In cases where a debtor's bank account has been garnished to recover debts owed, this notice is sent to the financial institution involved. It releases any limitations or restrictions on the debtor's bank account, enabling them to access and utilize their funds without interference. 3. Property Garnishment Release: When a debtor's property or assets have been targeted for garnishment, this notice of release is provided to inform the concerned parties that the property is no longer subject to seizure or attachment. It allows the debtor to regain control over their property and prevents any further enforcement actions. The Tucson Arizona Notice of Release of Garnishment and Order is a crucial legal instrument that safeguards debtors' rights and provides clarity to involved parties. Once issued, it ensures that all affected parties are duly informed about the revocation of the garnishment order, preventing any continued interference with the debtor's financial affairs.