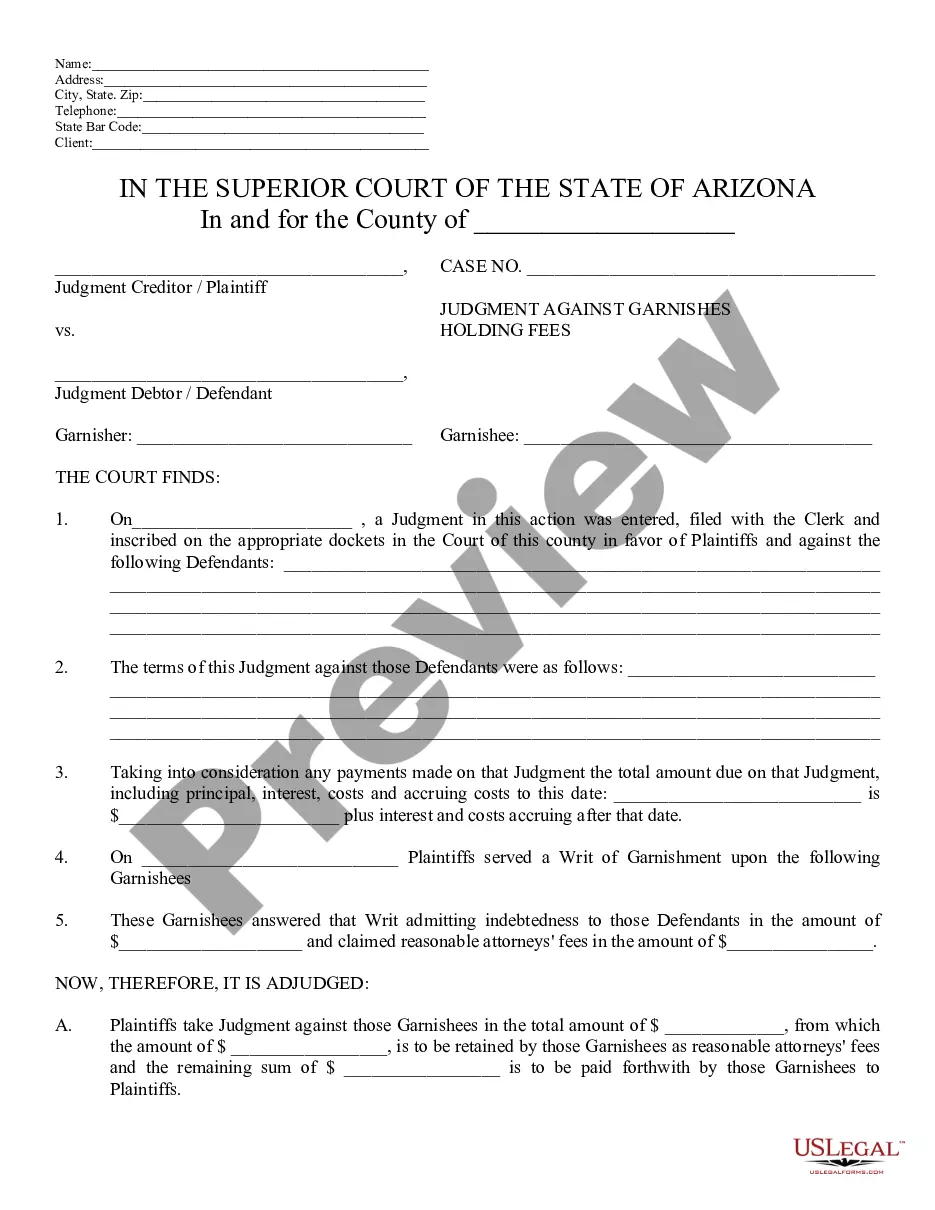

This is a model Judgment form, a Judgment Against Garnishee Holding Funds. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding.

Chandler Arizona Judgment Against Garnishee Holding Funds refers to a legal procedure whereby a judgment creditor seeks to collect their unpaid judgment by placing a hold or attachment on funds in the possession of a garnishee located in Chandler, Arizona. This process involves several steps and involves the court's involvement to ensure the fair distribution of funds. When a judgment creditor successfully obtains a judgment against a debtor in Chandler, Arizona, they may explore the option of garnishing the debtor's assets in order to satisfy the debt. This typically involves identifying a garnishee, which can be an individual, business, or financial institution that holds funds belonging to the debtor. There are various types of Chandler Arizona Judgment Against Garnishee Holding Funds, which are categorized based on the different entities that may be subject to garnishment: 1. Wage Garnishment: If the garnishee is the debtor's employer, the judgment creditor can request a portion of the debtor's wages to be withheld and paid towards the outstanding judgment. 2. Bank Account Garnishment: In some cases, the garnishee may be a bank or financial institution where the debtor holds funds. The judgment creditor can request the court to issue an order freezing the debtor's account and redirecting the funds to satisfy the debt. 3. Third-Party Garnishment: This category refers to garnishment actions against entities other than the debtor's employer or financial institution. For instance, if the debtor is owed money by a third party such as a client or vendor, the judgment creditor can seek a garnishment order to redirect those funds towards the judgment debt. Chandler Arizona Judgment Against Garnishee Holding Funds is a legal tool that allows judgment creditors to recover their unpaid debts. It is essential for judgment creditors to consult with legal professionals to ensure they follow the proper legal procedures while executing garnishment actions to avoid any potential violations or complications in the process.Chandler Arizona Judgment Against Garnishee Holding Funds refers to a legal procedure whereby a judgment creditor seeks to collect their unpaid judgment by placing a hold or attachment on funds in the possession of a garnishee located in Chandler, Arizona. This process involves several steps and involves the court's involvement to ensure the fair distribution of funds. When a judgment creditor successfully obtains a judgment against a debtor in Chandler, Arizona, they may explore the option of garnishing the debtor's assets in order to satisfy the debt. This typically involves identifying a garnishee, which can be an individual, business, or financial institution that holds funds belonging to the debtor. There are various types of Chandler Arizona Judgment Against Garnishee Holding Funds, which are categorized based on the different entities that may be subject to garnishment: 1. Wage Garnishment: If the garnishee is the debtor's employer, the judgment creditor can request a portion of the debtor's wages to be withheld and paid towards the outstanding judgment. 2. Bank Account Garnishment: In some cases, the garnishee may be a bank or financial institution where the debtor holds funds. The judgment creditor can request the court to issue an order freezing the debtor's account and redirecting the funds to satisfy the debt. 3. Third-Party Garnishment: This category refers to garnishment actions against entities other than the debtor's employer or financial institution. For instance, if the debtor is owed money by a third party such as a client or vendor, the judgment creditor can seek a garnishment order to redirect those funds towards the judgment debt. Chandler Arizona Judgment Against Garnishee Holding Funds is a legal tool that allows judgment creditors to recover their unpaid debts. It is essential for judgment creditors to consult with legal professionals to ensure they follow the proper legal procedures while executing garnishment actions to avoid any potential violations or complications in the process.