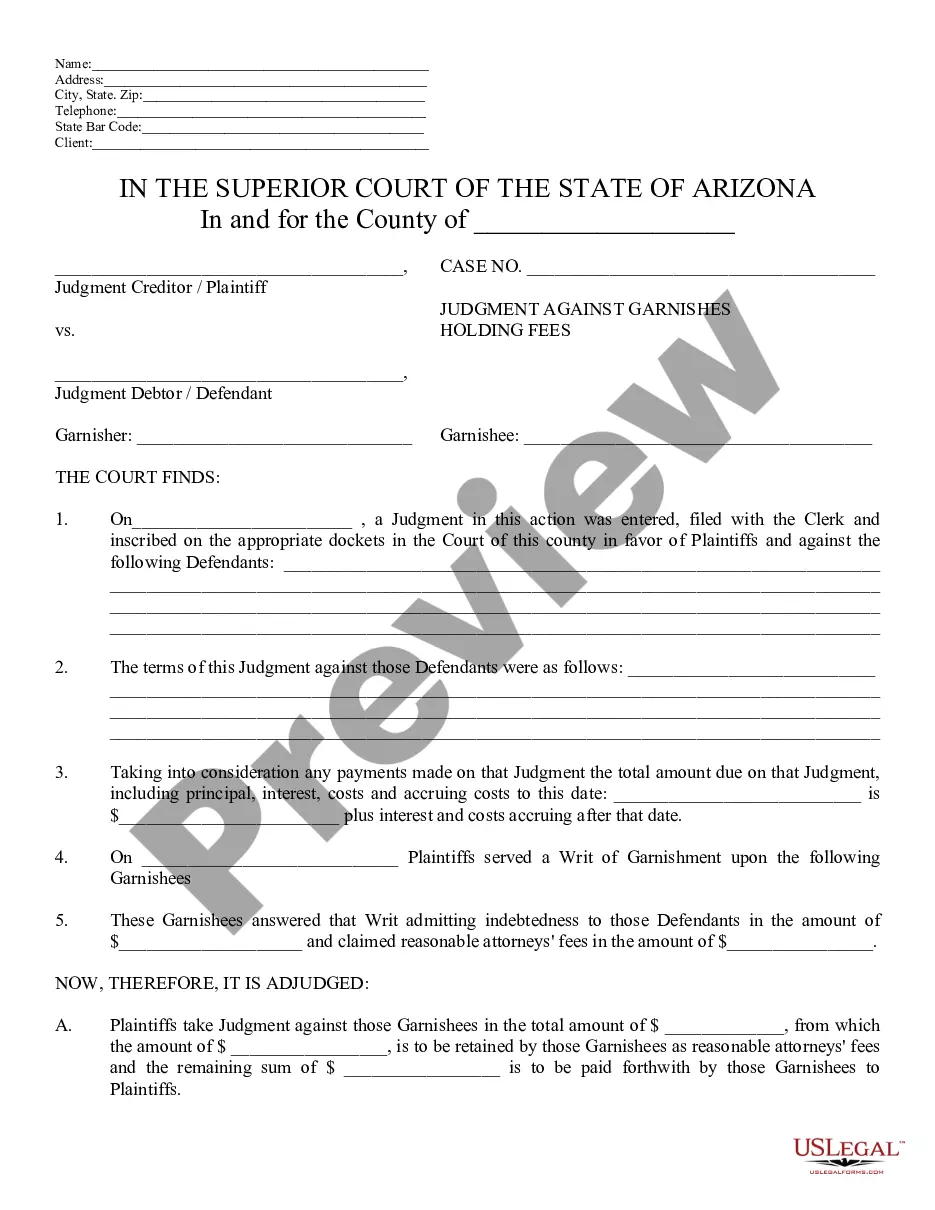

This is a model Judgment form, a Judgment Against Garnishee Holding Funds. The form must be completed to fit the facts and circumstances of whatever judgment the court has rendered. When signed by the Judge, the judgment becomes binding.

Title: Lima, Arizona Judgment Against Garnishee Holding Funds: A Comprehensive Overview Introduction: In Lima, Arizona, a judgment against garnishee holding funds refers to a legal process aimed at collecting outstanding debts owed by an individual or entity. When a judgment creditor (the party owed the debt) successfully obtains a court judgment against a debtor, they may seek to collect the owed funds by garnishing the debtor's assets, including money held by a third-party garnishee. This article will provide a detailed description of Lima's judgment against garnishee holding funds, including its purpose, process, and potential types of garnishments. I. Purpose of Lima Arizona Judgment Against Garnishee Holding Funds: The primary objective of this legal action is to enforce debt collection by seizing funds held by a third-party garnishee, such as a bank, employer, or financial institution. The judgment creditor initiates the process to satisfy the outstanding debt owed to them by the debtor. II. Process of Garnishment: 1. Obtaining a Court Judgment: The judgment creditor must first obtain a court judgment in their favor by winning a lawsuit against the debtor. The court issues an official order or judgment stating the amount owed by the debtor. 2. Issuing a Writ of Garnishment: After obtaining the judgment, the judgment creditor files a writ of garnishment with the court. This document instructs the third-party garnishee to hold or freeze the debtor's funds in their possession. 3. Serving the Writ: The writ of garnishment is served to the garnishee, who then becomes legally obligated to comply with the court order. The garnishee is required to provide an answer to the court regarding the funds they hold for the debtor. 4. Determining Garnishable Funds: The court examines the garnishee's answer to determine the amount of available funds to be garnished. Certain exemptions may apply, protecting specific funds from garnishment, such as those required for necessities. 5. Release of Funds: Once the garnishee's answer is reviewed, the court determines the final garnishable amount. The garnishee transfers the funds to the court, and the court distributes the collected funds to the judgment creditor to satisfy the debt owed. III. Types of Garnishments in Lima, Arizona: 1. Wage Garnishment: If the debtor is employed, the judgment creditor can seek to garnish a portion of the debtor's wages until the debt is resolved. Wage garnishments typically follow specific legal guidelines, ensuring the debtor has enough income to cover basic living expenses. 2. Bank Account Garnishment: If the debtor has funds held in a bank account, the judgment creditor can garnish these funds to satisfy the outstanding debt. Some funds may be exempt from garnishment, such as Social Security benefits or child support payments. 3. Property and Asset Garnishment: In some cases, if the debtor owns valuable assets like real estate, vehicles, or other valuable property, the judgment creditor may seek their garnishment as a means of debt recovery. Conclusion: In Lima, Arizona, a judgment against garnishee holding funds is a legal mechanism used to collect outstanding debts owed to a judgment creditor. By initiating a garnishment process, the judgment creditor seeks to freeze and obtain funds held by a third-party garnishee, ensuring the debt is satisfied. Various types of garnishments, including wage, bank account, and property garnishments, may be employed to enforce debt collection effectively.Title: Lima, Arizona Judgment Against Garnishee Holding Funds: A Comprehensive Overview Introduction: In Lima, Arizona, a judgment against garnishee holding funds refers to a legal process aimed at collecting outstanding debts owed by an individual or entity. When a judgment creditor (the party owed the debt) successfully obtains a court judgment against a debtor, they may seek to collect the owed funds by garnishing the debtor's assets, including money held by a third-party garnishee. This article will provide a detailed description of Lima's judgment against garnishee holding funds, including its purpose, process, and potential types of garnishments. I. Purpose of Lima Arizona Judgment Against Garnishee Holding Funds: The primary objective of this legal action is to enforce debt collection by seizing funds held by a third-party garnishee, such as a bank, employer, or financial institution. The judgment creditor initiates the process to satisfy the outstanding debt owed to them by the debtor. II. Process of Garnishment: 1. Obtaining a Court Judgment: The judgment creditor must first obtain a court judgment in their favor by winning a lawsuit against the debtor. The court issues an official order or judgment stating the amount owed by the debtor. 2. Issuing a Writ of Garnishment: After obtaining the judgment, the judgment creditor files a writ of garnishment with the court. This document instructs the third-party garnishee to hold or freeze the debtor's funds in their possession. 3. Serving the Writ: The writ of garnishment is served to the garnishee, who then becomes legally obligated to comply with the court order. The garnishee is required to provide an answer to the court regarding the funds they hold for the debtor. 4. Determining Garnishable Funds: The court examines the garnishee's answer to determine the amount of available funds to be garnished. Certain exemptions may apply, protecting specific funds from garnishment, such as those required for necessities. 5. Release of Funds: Once the garnishee's answer is reviewed, the court determines the final garnishable amount. The garnishee transfers the funds to the court, and the court distributes the collected funds to the judgment creditor to satisfy the debt owed. III. Types of Garnishments in Lima, Arizona: 1. Wage Garnishment: If the debtor is employed, the judgment creditor can seek to garnish a portion of the debtor's wages until the debt is resolved. Wage garnishments typically follow specific legal guidelines, ensuring the debtor has enough income to cover basic living expenses. 2. Bank Account Garnishment: If the debtor has funds held in a bank account, the judgment creditor can garnish these funds to satisfy the outstanding debt. Some funds may be exempt from garnishment, such as Social Security benefits or child support payments. 3. Property and Asset Garnishment: In some cases, if the debtor owns valuable assets like real estate, vehicles, or other valuable property, the judgment creditor may seek their garnishment as a means of debt recovery. Conclusion: In Lima, Arizona, a judgment against garnishee holding funds is a legal mechanism used to collect outstanding debts owed to a judgment creditor. By initiating a garnishment process, the judgment creditor seeks to freeze and obtain funds held by a third-party garnishee, ensuring the debt is satisfied. Various types of garnishments, including wage, bank account, and property garnishments, may be employed to enforce debt collection effectively.