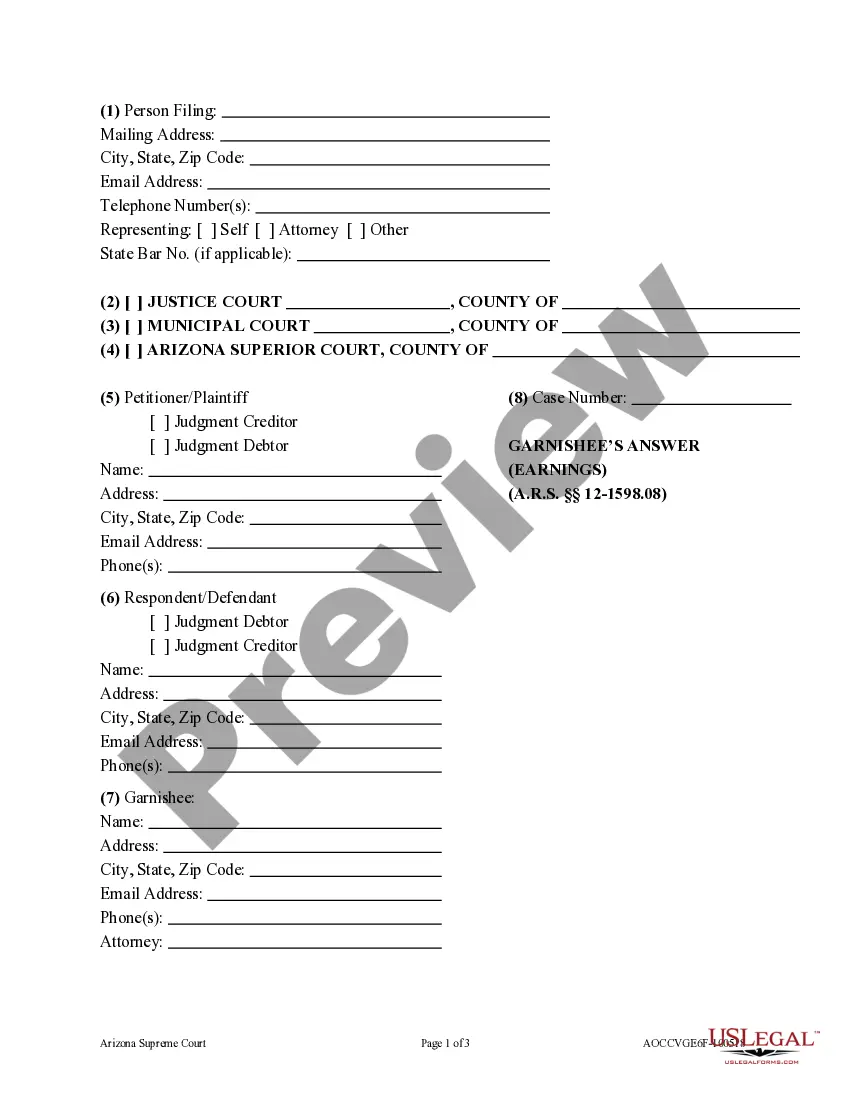

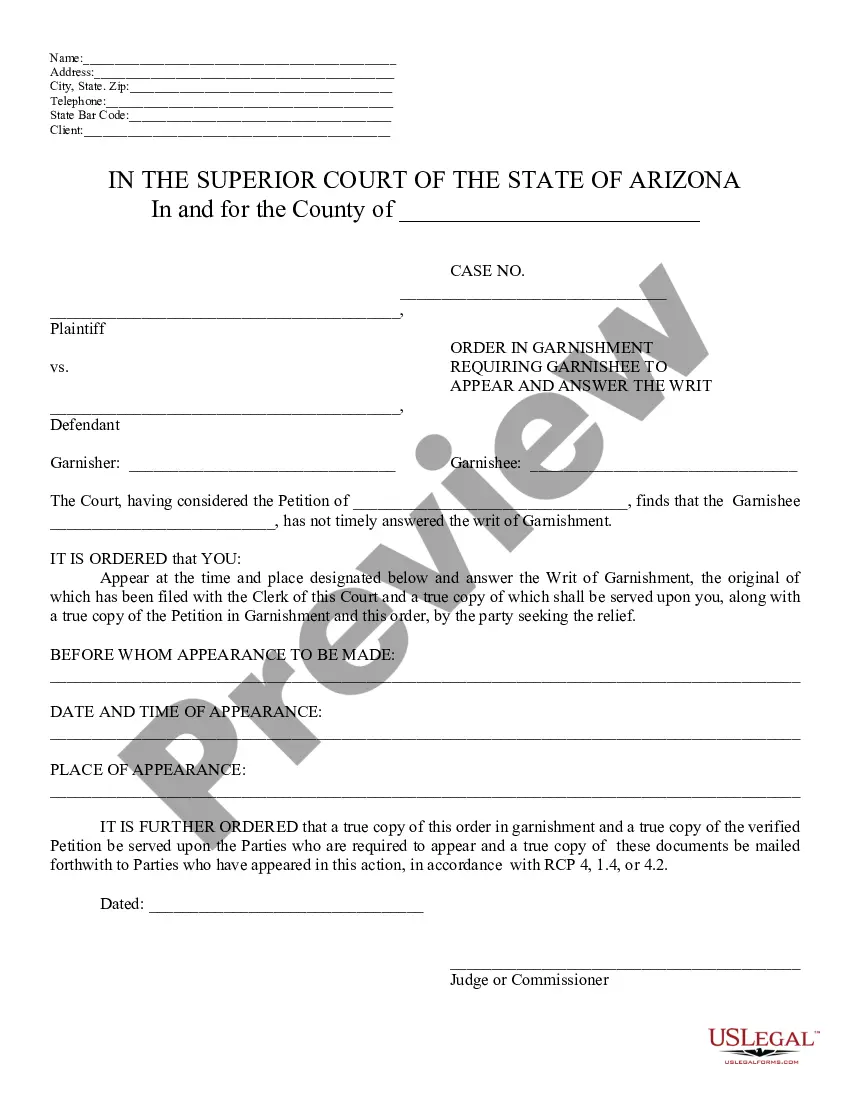

An Order is an official written statement from the court commanding a certain acion, and is signed by the judge. Failure to comply with the order is unlawful and may result in contempt of court charges. This document, a sample Order Requesting Garnishee to Appear and Answer, can be used as a model to draft an order requested for submission by the court (the court often directs a party to draft an order). Adapt the language to the facts and circumstances of your case. Available for download now in standard format(s).

Scottsdale Arizona Order Requesting Garnishee to Appear and Answer

Description

How to fill out Arizona Order Requesting Garnishee To Appear And Answer?

If you are seeking a pertinent form template, it’s remarkably challenging to select a more suitable platform than the US Legal Forms website – likely the most extensive collections available online.

With this collection, you can obtain thousands of templates for corporate and personal uses categorized by types and states, or keywords.

Utilizing our sophisticated search feature, locating the latest Scottsdale Arizona Order Requesting Garnishee to Appear and Answer is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finish the sign-up process.

Obtain the template. Choose the file format and save it on your device.

- Moreover, the relevance of every document is checked by a team of experienced attorneys who routinely assess the templates on our platform and update them according to the latest state and county laws.

- If you are already familiar with our system and possess an account, all you have to do to receive the Scottsdale Arizona Order Requesting Garnishee to Appear and Answer is to Log In to your profile and click the Download button.

- If this is your first time using US Legal Forms, simply follow the guidelines outlined below.

- Ensure you have selected the form you need. Review its description and utilize the Preview option (if available) to examine its content. If it doesn’t fit your requirements, employ the Search field at the top of the screen to find the correct document.

- Verify your selection. Pick the Buy now option. Then, select your desired subscription plan and provide details to create an account.

Form popularity

FAQ

Recently, Arizona has implemented rules that change the way garnishments are calculated and enforced. These changes aim to protect debtors and ensure fair handling of garnishments. Understanding these new rules can be simplified by exploring the Scottsdale Arizona Order Requesting Garnishee to Appear and Answer, which will explain how these updates may impact your situation.

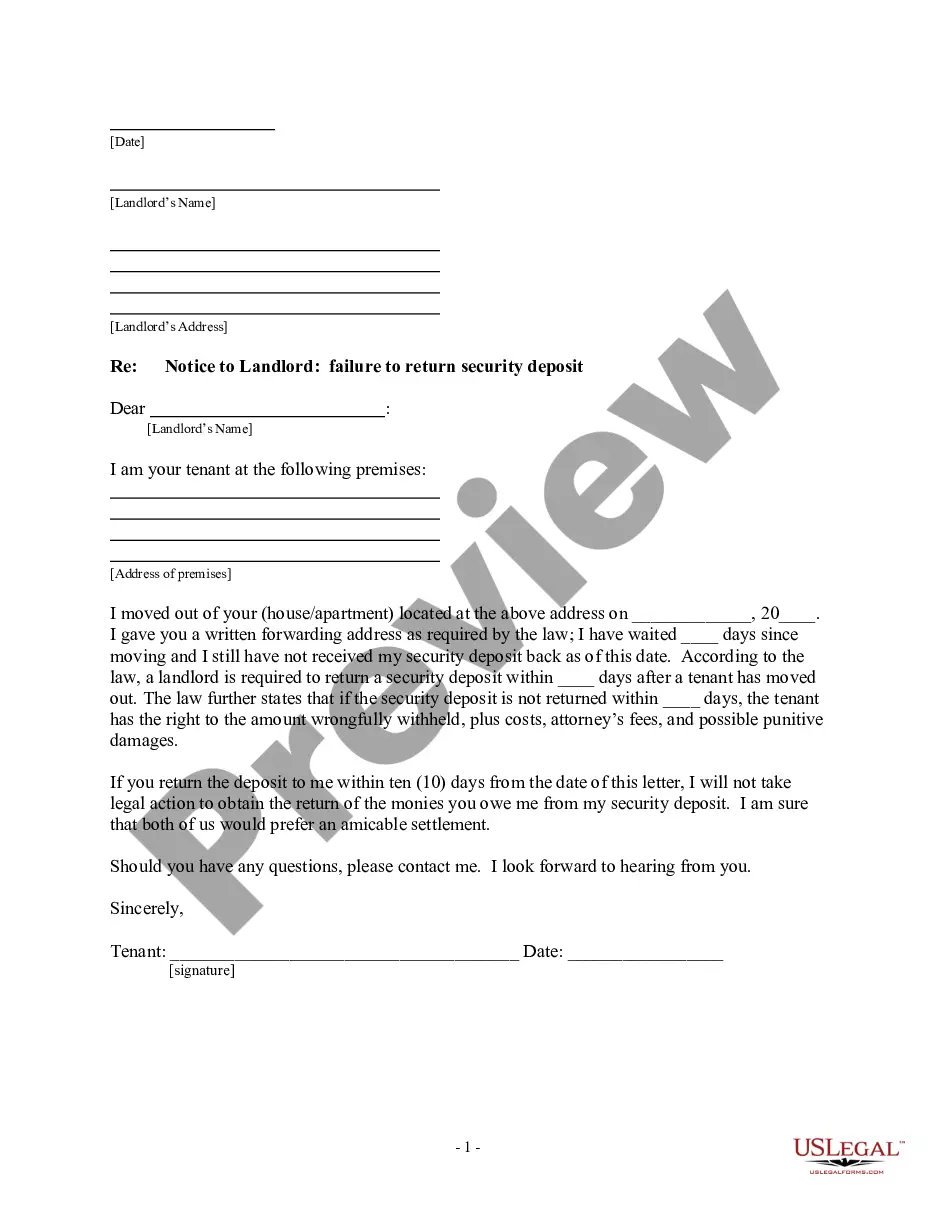

Yes, creditors can garnish your bank account in Arizona, provided they follow the proper legal procedures. This often involves the filing of a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer, which informs both you and your bank of the garnishment. It's important to stay informed and respond to any documentation you receive regarding the process.

To stop a wage garnishment in Arizona, you might file a motion with the court requesting a hearing. You can challenge the validity of the garnishment or prove financial hardship. Utilizing a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer can also be a crucial step in addressing your concerns effectively.

In Arizona, the maximum amount that can be garnished from your paycheck depends on your disposable earnings and federal laws. Typically, creditors can garnishee up to 25% of your disposable income. However, a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer may provide specific insights based on your individual case.

The IRS can garnish up to 75% of your disposable income for unpaid taxes, which is significantly higher than most other creditors. This aggressive garnishment policy underscores the importance of addressing tax debts promptly. If you find yourself in a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer situation, acting quickly can protect your income and financial wellbeing.

The law typically permits up to 25% of your disposable earnings to be garnished from each paycheck, ensuring you can still cover basic living expenses. In some cases, like unpaid taxes, more than this amount may be taken. It's important to be aware of these rules, especially in light of a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer, to safeguard your financial health.

The maximum amount a creditor can garnish varies by state and the type of debt involved. Typically, federal law allows garnishment of wages up to 25% of your disposable earnings. However, certain types of debts, like child support or taxes, may allow for a higher garnishment. Understanding the specifics around a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer can help you navigate the garnishment process effectively.

In Alabama, the general rule allows creditors to garnish up to 25% of your disposable income or the amount by which your weekly earnings exceed 30 times the federal minimum wage, whichever is less. This limitation ensures that you still maintain some income for your essential needs. If you are facing a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer, it is essential to understand these rules, as they may impact your case.

Another term for a garnishment order is a wage attachment or an order of garnishment. These terms refer to the same legal concept where a creditor receives direct payment from a debtor’s wages, similar to a Scottsdale Arizona Order Requesting Garnishee to Appear and Answer. Recognizing the terminology used can clarify conversations with legal professionals. It is beneficial to understand these concepts when dealing with financial obligations.

In Arizona, garnishment laws shape how creditors can collect debts through court orders. The Scottsdale Arizona Order Requesting Garnishee to Appear and Answer outlines specific procedures creditors must follow for wage garnishment. Under state law, certain exemptions exist to protect a portion of your income from these deductions. Familiarizing yourself with these laws can help you understand your rights and obligations in a garnishment situation.