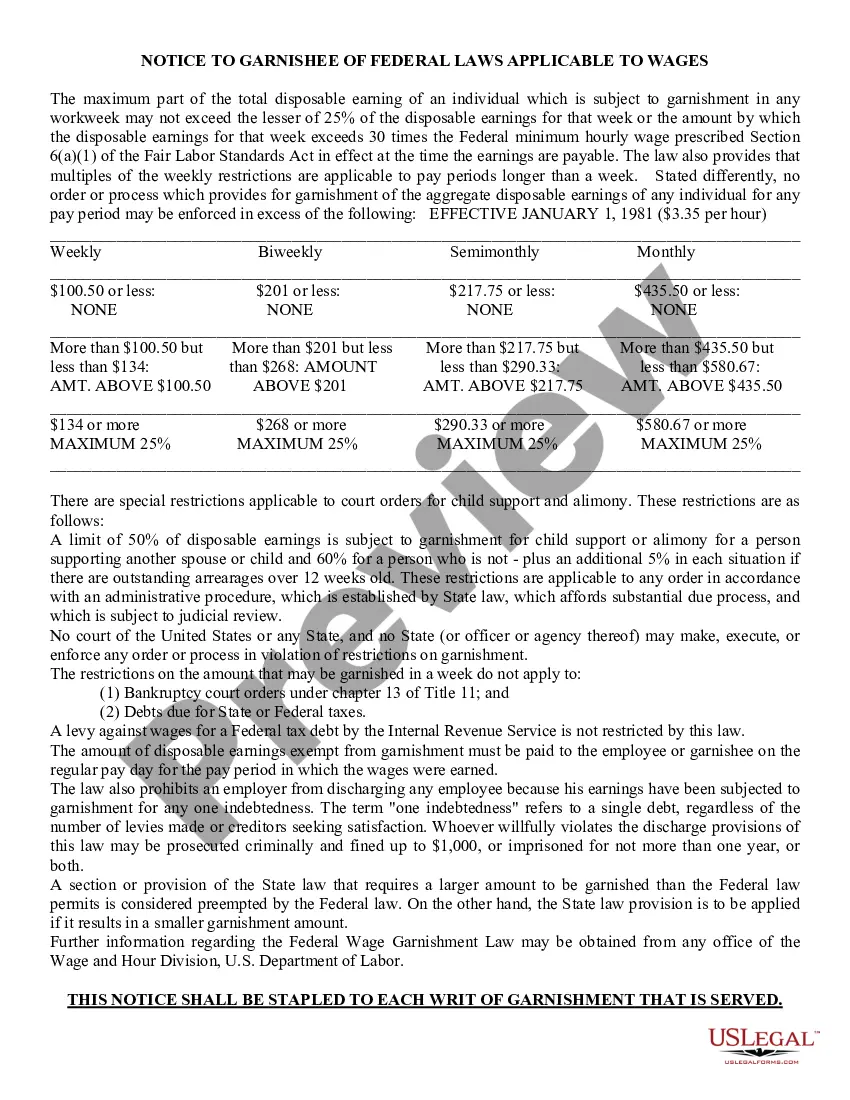

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Chandler Arizona Notice to Garnishee of Federal Law to Wages is a legal document used in the state of Arizona to inform employers about their obligations under federal law when dealing with wage garnishments. This notice serves as an official communication notifying employers that a judgment debtor's wages are subject to garnishment in order to satisfy a debt. Keywords: Chandler Arizona, Notice to Garnishee, Federal Law, Wages, Types. There are two main types of Chandler Arizona Notice to Garnishee of Federal Law to Wages: 1. Regular Chandler Arizona Notice to Garnishee: This type of notice is issued when a creditor has obtained a judgment against a debtor and is legally authorized to garnish the debtor's wages. The notice informs the employer of their responsibility to withhold a specified portion of the employee's wages and remit them to the appropriate authorized entity. 2. Revised Chandler Arizona Notice to Garnishee: In some cases, when changes have been made to federal laws or regulations regarding wage garnishments, a revised notice is issued to inform employers about the updated requirements. Employers must ensure they understand and comply with the revised notice to avoid any legal consequences associated with non-compliance. The content of a Chandler Arizona Notice to Garnishee of Federal Law to Wages typically includes the following information: 1. Title: The notice should clearly state that it is a "Chandler Arizona Notice to Garnishee of Federal Law to Wages." 2. Creditor Information: The notice should mention the name and contact information of the creditor who has obtained a judgment against the debtor. 3. Debtor Information: It is important to provide details about the debtor, including their name, address, and any relevant identification numbers, such as a social security number. 4. Wage Garnishment Details: The notice should specify the amount or percentage of the debtor's wages that the employer is required to withhold. It should also mention the duration of the garnishment, providing a start and end date if available. 5. Employer Obligations: The document must outline the employer's legal obligations and responsibilities when it comes to wage garnishments. This may include the requirement to maintain records, promptly remit garnished wages, and respond to any inquiries or challenges related to the garnishment. 6. Federal Law References: The notice should include references to the relevant federal laws and regulations that support the wage garnishment process under which the notice is issued. This will ensure the employer understands the legal basis for the garnishment. It is essential to consult legal professionals or official resources to obtain the most accurate and up-to-date Chandler Arizona Notice to Garnishee of Federal Law to Wages, as requirements and formats may vary over time.Chandler Arizona Notice to Garnishee of Federal Law to Wages is a legal document used in the state of Arizona to inform employers about their obligations under federal law when dealing with wage garnishments. This notice serves as an official communication notifying employers that a judgment debtor's wages are subject to garnishment in order to satisfy a debt. Keywords: Chandler Arizona, Notice to Garnishee, Federal Law, Wages, Types. There are two main types of Chandler Arizona Notice to Garnishee of Federal Law to Wages: 1. Regular Chandler Arizona Notice to Garnishee: This type of notice is issued when a creditor has obtained a judgment against a debtor and is legally authorized to garnish the debtor's wages. The notice informs the employer of their responsibility to withhold a specified portion of the employee's wages and remit them to the appropriate authorized entity. 2. Revised Chandler Arizona Notice to Garnishee: In some cases, when changes have been made to federal laws or regulations regarding wage garnishments, a revised notice is issued to inform employers about the updated requirements. Employers must ensure they understand and comply with the revised notice to avoid any legal consequences associated with non-compliance. The content of a Chandler Arizona Notice to Garnishee of Federal Law to Wages typically includes the following information: 1. Title: The notice should clearly state that it is a "Chandler Arizona Notice to Garnishee of Federal Law to Wages." 2. Creditor Information: The notice should mention the name and contact information of the creditor who has obtained a judgment against the debtor. 3. Debtor Information: It is important to provide details about the debtor, including their name, address, and any relevant identification numbers, such as a social security number. 4. Wage Garnishment Details: The notice should specify the amount or percentage of the debtor's wages that the employer is required to withhold. It should also mention the duration of the garnishment, providing a start and end date if available. 5. Employer Obligations: The document must outline the employer's legal obligations and responsibilities when it comes to wage garnishments. This may include the requirement to maintain records, promptly remit garnished wages, and respond to any inquiries or challenges related to the garnishment. 6. Federal Law References: The notice should include references to the relevant federal laws and regulations that support the wage garnishment process under which the notice is issued. This will ensure the employer understands the legal basis for the garnishment. It is essential to consult legal professionals or official resources to obtain the most accurate and up-to-date Chandler Arizona Notice to Garnishee of Federal Law to Wages, as requirements and formats may vary over time.