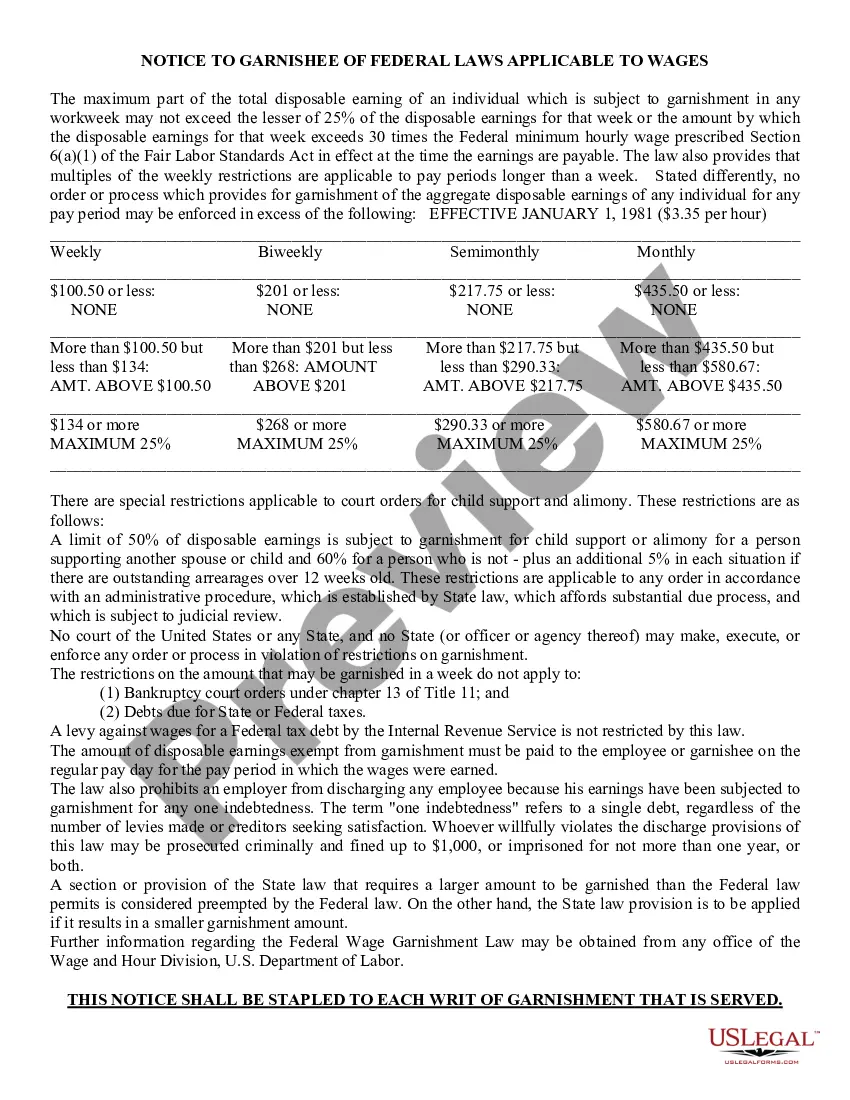

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice to Garnishee of Federal Law to Wages, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Glendale Arizona Notice to Garnishee of Federal Law to Wages is a legal document that informs employers about the federal laws regarding wage garnishments in Glendale, Arizona. It outlines the obligations of the employer in identifying and withholding wages from an employee's salary to satisfy a debt. The notice emphasizes the importance of complying with federal laws and regulations while processing wage garnishments. It serves as a reminder to employers that they must follow specific guidelines to ensure proper remittance of garnished funds to the appropriate creditor or debt collection agency. Different types of Glendale Arizona Notice to Garnishee of Federal Law to Wages may include: 1. Glendale Arizona Notice to Garnishee — Defaulted Federal Loan: This type of notice specifically addresses wage garnishments related to defaulted federal loans, such as student loans or small business loans. It outlines the appropriate actions the employer should take when notified of such garnishments. 2. Glendale Arizona Notice to Garnishee — Child Support: This type of notice pertains to wage garnishments related to unpaid child support. It provides guidance to employers on how to handle wage withholding for employees who owe child support payments. 3. Glendale Arizona Notice to Garnishee — Tax Debt: This notice addresses wage garnishments associated with unpaid federal taxes. It educates employers on their responsibilities in deducting and remitting wages to the Internal Revenue Service (IRS) to satisfy the taxpayer's debt. 4. Glendale Arizona Notice to Garnishee — Judgments and Court Orders: This notice covers wage garnishments resulting from court judgments and orders, such as unpaid fines or penalties. It explains the employer's role in processing wage garnishments as per the specific court directive. 5. Glendale Arizona Notice to Garnishee — Bankruptcy Proceedings: This type of notice is relevant when an employee files for bankruptcy. It informs the employer about the automatic stay provision, which temporarily halts wage garnishments during the bankruptcy process. It's crucial for employers in Glendale, Arizona, to be familiar with the different types of Glendale Arizona Notice to Garnishee of Federal Law to Wages to ensure proper compliance with federal regulations and avoid any potential legal issues.Glendale Arizona Notice to Garnishee of Federal Law to Wages is a legal document that informs employers about the federal laws regarding wage garnishments in Glendale, Arizona. It outlines the obligations of the employer in identifying and withholding wages from an employee's salary to satisfy a debt. The notice emphasizes the importance of complying with federal laws and regulations while processing wage garnishments. It serves as a reminder to employers that they must follow specific guidelines to ensure proper remittance of garnished funds to the appropriate creditor or debt collection agency. Different types of Glendale Arizona Notice to Garnishee of Federal Law to Wages may include: 1. Glendale Arizona Notice to Garnishee — Defaulted Federal Loan: This type of notice specifically addresses wage garnishments related to defaulted federal loans, such as student loans or small business loans. It outlines the appropriate actions the employer should take when notified of such garnishments. 2. Glendale Arizona Notice to Garnishee — Child Support: This type of notice pertains to wage garnishments related to unpaid child support. It provides guidance to employers on how to handle wage withholding for employees who owe child support payments. 3. Glendale Arizona Notice to Garnishee — Tax Debt: This notice addresses wage garnishments associated with unpaid federal taxes. It educates employers on their responsibilities in deducting and remitting wages to the Internal Revenue Service (IRS) to satisfy the taxpayer's debt. 4. Glendale Arizona Notice to Garnishee — Judgments and Court Orders: This notice covers wage garnishments resulting from court judgments and orders, such as unpaid fines or penalties. It explains the employer's role in processing wage garnishments as per the specific court directive. 5. Glendale Arizona Notice to Garnishee — Bankruptcy Proceedings: This type of notice is relevant when an employee files for bankruptcy. It informs the employer about the automatic stay provision, which temporarily halts wage garnishments during the bankruptcy process. It's crucial for employers in Glendale, Arizona, to be familiar with the different types of Glendale Arizona Notice to Garnishee of Federal Law to Wages to ensure proper compliance with federal regulations and avoid any potential legal issues.